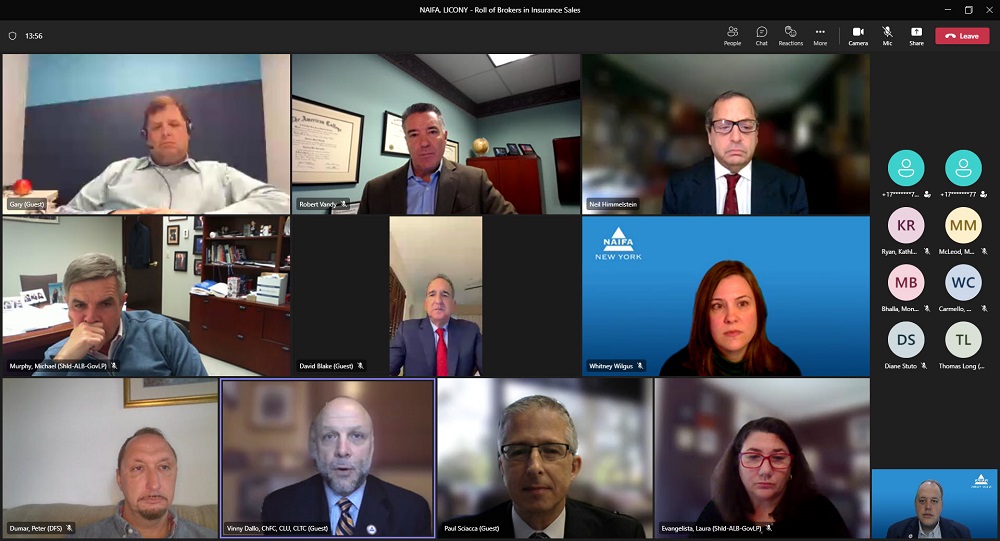

Members of NAIFA’s New York chapter (NAIFA-NY) held a virtual meeting with officials from the state Department of Financial Services (DFS). State President Gary Cappon, CLU, LUTCF, RICP, FSCP, CLTC, provided introductions and a brief rundown of NAIFA’s advocacy work and support for the agent and advisor community and the consumers they serve. He also discussed challenges with financial product availability in the state. President-Elect Vinny Dallo, ChFC, CLU, CLTC, LUTCF, and Vice President of Advocacy Paul Sciacca presented “A Day in the Life of a Financial Professional,” highlighting how NAIFA members serve families and businesses in the state.

NAIFA-NY member Tom Long spoke on how streamlined underwriting processes using electronic applications benefit consumers, and Robert Vandy, CLU, ChFC, LUTCF, presented on the evolution of long-term care planning and products. NAIFA-NY Vice President of Programs Neil Himmelstein covered the availability of fixed-income annuities and pricing of fixed and fixed-income annuity products. NAIFA-NY member David Blake shared his expertise on disability insurance.

DFS officials who participated in the meeting were Chief Insurance Attorney, Life Bureau Peter Dumar; Deputy Superintendent for Life Insurance Mona Bhalla; Acting Deputy Superintendent of Insurance Kate Powers; Chief Life Actuary Bill Carmello; Deputy Chief Examiner Mark McLeod; Supervising Insurance Attorney Kathleen Ryan; and Supervising Insurance Attorney Todd Cafarelli. Also in attendance was Diane Stuto, Managing Director for Legislative and Regulatory Affairs for the Life Insurance Council of New York (LICONY).

“NAIFA-New York’s representatives are pleased by the very productive meeting we had with Department of Financial Services officials, and we look forward to continuing to work with DFS to address some issues financial professionals and our clients face,” said NAIFA-NY President Gary Cappon. “By working with the DFS and other state decision-makers, we are confident we will make New York a more welcoming environment for financial services professionals and products. Consumers rely on us for the products and services that help them achieve financial success and our goal is to work with state officials to provide financial security for all New Yorkers.”

NAIFA members shared their expertise and experiences working with consumers on a broad range of financial issues overseen by the DFS. They offered themselves as resources and laid the groundwork for continued work with the department to ensure strong consumer protections that do not interfere with the ability of Main Street consumers to attain needed products, services, and advice. All parties are looking forward to a series of follow-up discussions to explore solutions to the issues raised and areas of mutual concern.