NAIFA wholeheartedly supports a best interest standard for retirement investment professionals, but believes the Department of Labor's proposal to impose a fiduciary-only regulation goes too far, NAIFA Secretary Chris Gandy wrote in letter submitted to be part of the official record of a recent House Subcommittee on Health, Employment, Labor, & Pensions hearing entitled "Protecting American Savers and Retirees from DOL’s Regulatory Overreach.”

2 min read

NAIFA's Gandy Tells Congress DOL Proposal Is Unnecessary

By NAIFA on 3/1/24 8:41 AM

Topics: Federal Advocacy Congress DOL Supported Legislation

2 min read

NAIFA's Cothron: The SEC's Proposed Limits on Technology Will Harm Consumers

By NAIFA on 2/7/24 5:04 PM

Senators Ted Cruz and Bill Hagerty have introduced legislation, the Protecting Innovation in Investments Act, that would prevent the SEC from moving forward with a proposed rule that would deter technological innovation by financial services companies. The SEC's proposal would also stifle financial professionals' use of technology to benefit clients.

The Senators, in a release entitled "What They're Saying," quoted NAIFA President Tom Cothron, LUTCF, FSCP, on the importance of technology in the financial services industry and NAIFA's opposition to the SEC proposal.

Topics: Technology SEC Federal Advocacy Supported Legislation

1 min read

Senators Call Out NAIFA's Support for Bill to Protect Innovation in Investing

By NAIFA on 2/6/24 11:46 AM

NAIFA strongly supports newly introduced legislation, the Protecting Innovation in Investment Act sponsored by U.S. Senate Commerce Committee Ranking Member Ted Cruz (R-Texas) and U.S. Senator Bill Hagerty (R-Tenn.), that would foster the use of technology and innovation in the financial services industry to benefit consumers.

Topics: Technology Investing Federal Advocacy Supported Legislation

1 min read

NAIFA Favors Maryland Bill to Remove Insurance Pre-Licensing Hurdles

By NAIFA on 2/2/24 5:34 PM

NAIFA supports a bill in Maryland that would eliminate a pre-licensing education requirement for people applying to take the state's insurance license exams. The mandated courses are unnecessary and burdensome and they do a disservice to those pursuing an insurance career in Maryland as well as consumers.

Topics: State Advocacy Maryland Producer Licensing & CE Supported Legislation

2 min read

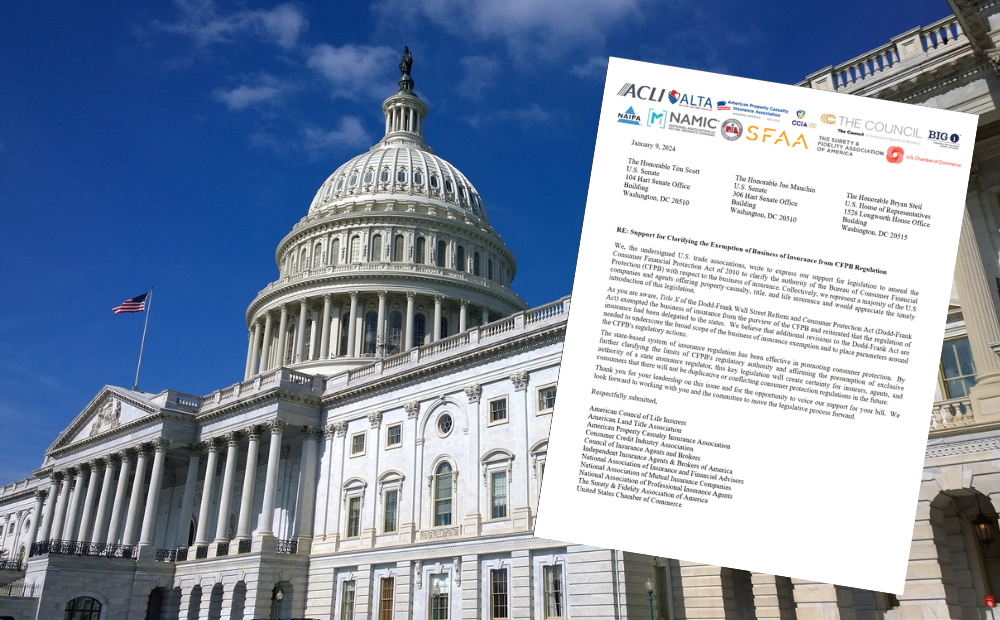

NAIFA Seeks Legislation to Solidify the State-Based Regulation of Insurance

By NAIFA on 1/11/24 4:08 PM

State-based regulation of insurance has been a bedrock of the industry and effectively protects the interests of consumers. Federal law, including Title X of the Dodd-Frank Wall Street Reform and Consumer Protection Act, recognizes this fact and explicitly exempts the business of insurance from regulation by federal Bureau of Consumer Financial Protection (BCFP).

NAIFA and a coalition of groups representing a majority of the U.S. companies and agents offering property-casualty, title, and life insurance have asked Congress for additional legislation that would clarify provisions in Dodd-Frank and solidify the state-based system of insurance regulation.

Topics: Federal Advocacy Congress Insurance & Financial Advisor Regulation Supported Legislation

2 min read

Michigan Enacts NAIFA-Supported Law to Protect Consumers From Financial Fraud

By NAIFA on 12/15/23 9:11 AM

Michigan Governor Gretchen Whitmer has signed a bill NAIFA-MI helped shape and strongly advocated for that will help protect vulnerable adults, specifically seniors, from financial fraud and exploitation. The new law allows broker-dealers or investment advisors to delay disbursements or transactions if they suspect a client is being exploited or defrauded.

Topics: State Advocacy Michigan Supported Legislation Senior Financial Protection

1 min read

NAIFA Supports the Main Street Tax Certainty Act

By NAIFA on 7/19/23 4:37 PM

NAIFA recently signed onto a letter supporting Congressman Lloyd Smucker's (R-PA, 11th District) newly introduced bill that would make the Section 199A deduction permanent. The bill had over 80 co-sponsors from both aisles and received unanimous support from the 25 Republicans on the Ways & Means Committee. The bill is similar to S.1706 introduced by Senator Steve Daines (R-MT) making the support for minimizing tax hikes bipartisan and bicameral.

Topics: Legislation & Regulations Small Business Supported Legislation

1 min read

House Passes Bill to Lower Administrative Burdens on Small Businesses

By Mike Hedge on 6/26/23 3:31 PM

On June 22, The United States House of Representatives passed the NAIFA-supported Employer Reporting Improvement Act (H.R. 3801), which provides employers flexibility about what personal information they have to provide on behalf of their employees and their families. Additionally, it extends the appeal window for any potential violation and establishes a statute of limitations so small businesses operating with limited resources can continue their work with less of a burden.

Topics: Advocacy Legislation & Regulations Supported Legislation

3 min read

New Oregon Law Strengthens Safeguards for Annuity Consumers

By NAIFA on 6/7/23 12:15 PM

American Council of Life Insurers (ACLI) President and CEO Susan Neely and National Association of Insurance and Financial Advisors NAIFA-Oregon President Kym Housley issued the following joint statement on legislation signed into law in Oregon that strengthens safeguards for annuity consumers:

Topics: Legislation & Regulations Press Release Annuity Best Interest Oregon Supported Legislation

1 min read

NAIFA Advocacy Gets Immediate Results

By NAIFA on 5/26/23 12:41 PM

NAIFA Is the One and Only!

We ARE the people making a real difference in achieving financial security for Main Street Americans.

NAIFA’s advocacy efforts are nonstop, working on behalf of agents & advisors, and your clients. No other association represents financial services professionals at the state, interstate, and federal levels. No other association brings 500+ producers to Washington, D.C., year after year for our Congressional Conference to speak with federal lawmakers about issues that impact the financial security of American families and businesses.