April 2021 Issue:

Virtual Congressional Conference is Now Live!

NAIFA's annual Congressional Conference, which will be held virtually on May 25 & 26, is now open for registration! Join your NAIFA colleagues to hear from members of Congress, industry leaders, and NAIFA lobbyists about the federal issues facing your business and your clients.

The conference will begin on May 25th with speakers, optional training sessions, and an IFAPAC event, and culminate on the 26th with a "Day on the Hill" that will include meetings with Senate offices. To give these offices an accurate idea of how many constituents will be attending these virtual meetings, please register ASAP. Your constituent input is vital to a successful defense of the products and programs that underlie middle America's economic security.

NAIFA's Government Relations team says, "NAIFA's annual Congressional Conference is crucial to our grassroots advocacy strategy. The event brings NAIFA members together as a critical mass to advocate on behalf of their businesses, clients, consumers, and the insurance and financial services industry. It provides targeted advocacy training with briefings on specific legislative issues, best practices for conducting congressional meetings, and tips for developing impactful long-term relationships with legislators."

Register today!

Prospects: It is looking like a time of great challenge to NAIFA interests. But your grassroots, constituent-based advocacy means we can and will prevail. Please register for the May 25-26 Congressional Conference ASAP.

NAIFA Staff Contacts: Diane Boyle – Senior Vice President – Government Relations, at dboyle@naifa.org, or Maggie Buneo – Grassroots Director, at mbuneo@naifa.org

President Biden Offers First of Two "Build Back Better" Proposals

The first of two planned "Build Back Better" proposals, the American Jobs Plan (AJP), focuses on traditional infrastructure spending, with proposals to pay for the spending by increasing corporate tax rates. A key offset proposal would raise the corporate tax rate from 21 percent to 28 percent.

The second proposed plan, the American Families Plan (AFP), is expected to be released by the end of April. Early reports suggest that it will focus on what the President is calling "human infrastructure." While we don't know what the pay-fors might be, we are always concerned that offsets may include individual tax increase proposals, including potentially adverse provisions impacting investments, that could impact permanent life insurance as well as such traditional investments such as mutual funds, stocks, and bonds. More on what to expect in this plan—both spending and tax/revenue proposals are discussed below.

On the spending side, the $2.5 trillion AJP is focused on traditional infrastructure projects such as roads, bridges, airports, ports, etc. It also includes provisions on making it easier for unions to organize and operate, many of the PRO Act proposals are reprised in the AJP, as well as care for the aging, and expansion of broadband.

On the revenue side, there is a general expectation that the tax increase proposals included in the package will fully offset the cost of the AJP by the end of 15 years. Something just under half of the revenue increase total would come from the corporate tax rate increase. The rest would come from "guardrails"—provisions to assure that profitable corporations actually do pay tax-- things like a corporate minimum tax and a requirement to use book income to calculate tax liability—and changes to international tax rules applicable to multinational corporations.

The AJP has not yet been put into legislative language and may not be. Instead, it appears likely that the relevant Congressional committees will write the actual legislation, which will reflect the (potentially many) changes to the proposal that lawmakers appear convinced need to be made.

President Biden says the AJP is open to negotiation and that changes to it "are certain." He says he is open to alternative ways to pay for the cost of the infrastructure projects contained in his proposal, but not to making it materially smaller. Initially, virtually every Republican lawmaker opposes the AJP's revenue proposals, and some also object to the size and scope of the infrastructure portion. They say many of the proposal's specifics do not fall within the definition of traditional infrastructure and therefore have no place in an infrastructure bill. Democrats, generally, are supportive of the effort, if not of every specific element of the plan. And, Democrats share President Biden's conviction that a plan similar to, if not exactly like, the AJP is a priority effort that "must" be enacted into law.

Speaker of the House Rep. Nancy Pelosi (D-CA) says she wants the House to complete work on the AJP before the August recess. Senate Majority Leader Sen. Chuck Schumer (D-NY) says the Senate will begin work on the proposal as soon as mid-April. Most Washington insiders agree that it is likely that it will take months to complete work on the bill.

Prospects: The politics of the AJP are difficult. The Biden administration has begun bipartisan meetings, but the Senate parliamentarian has ruled the reconciliation process is available, meaning the bill could pass with a simple majority, but would be subject to the tricky reconciliation rules. NAIFA is watching the offset proposals closely and, if and when necessary, will call on you for grassroots input on important issues.

NAIFA Staff Contacts: Diane Boyle – Senior Vice President – Government Relations, at dboyle@naifa.org, or Judi Carsrud – Assistant Vice President– Government Relations, at jcarsrud@naifa.org

American Families Plan (AFP) Focuses on Education, Health, other "Human Infrastructure" Goals

The second part of the Biden "Build Back Better" plan, the American Families Plan (AFP), is focused on education, health, family support, and other "human infrastructure" goals. Among the expected proposals are a federal paid leave program, proposals to make health insurance more accessible and affordable (including, potentially, a proposal to add a government option to Affordable Care Act (ACA) exchange-based health insurance menus), and possibly another attempt to raise the federal minimum wage.

The package may also include individual tax offsets that could be adverse to permanent life insurance and individual investments.

The AFP proposal is not expected to be released before the end of April, but President Biden has already signaled that he expects to limit his new tax proposals so that they impact only people earning more than $400,000 annually. Tax rates on capital gains, estate tax rules, certain new investment taxes, top individual tax rates, and limits on the value of deductions have all been mentioned as possible sources of new revenue to use to pay for the "human infrastructure" programs to be proposed in the AFP.

Here are some adverse tax proposals that are currently being discussed among Administration and/or Congressional tax writers. Most have not yet been officially proposed, and it is likely that not all of them will be included in the initial AFP. But all are currently in the mix, and under active discussion, as possibilities as Administration and Congressional lawmakers do the initial work of putting together a package of tax rules changes aimed at offsetting the cost of the AFP's "human infrastructure" provisions.

- Timing of Tax Liability: Tax writers are discussing whether to offer rule changes that would make annual gains in investment value taxable each year, rather than waiting until gain is "realized;" e.g., until an asset is sold. Likely, any such proposal would be applied only to "rich" people. This could impact permanent life insurance cash values. To make such a proposal applicable only to "the rich," it could be applied only to cash values that exceeds a set amount, or only to taxpayers above a specified income level. Or, life insurance up to a certain amount could be exempted from the rule. It is possible such a proposal could also impact life insurance held in trusts.

- Estate Tax: Lowering the exemption amount, raising the estate tax rates, and limiting the use of estate planning trusts and other instruments are proposals in the mix currently. In addition, tax writers are discussing changing step-up in basis rules (under which an inherited asset is valued as of the date of the decedent's death rather than the date at which the asset was acquired). This could result in a proposal to use carryover basis (valuing an asset as of the date of the decedent's acquisition of it). There is also some talk among technical tax folks on the Hill and in the Administration about a rule that would deem an asset "sold" when it is inherited, thus subjecting it to tax (income and/or estate) as of the day before the decedent's death.

Bernie Sanders (I-VT) introduced an estate tax bill, S.994, last month that would impose estate tax on estates valued at $3.5 million or more ($7 million for a married couple). It would set new estate tax rates—45 percent for estates of $3.5-$10 million, rising to 65 percent on estates valued at more than $1 billion. It would also change many trust and other estate planning technique rules, modify generation-skipping tax rules, and limit the gift tax exclusion.

- Capital Gains Tax Rate: There is a lot of discussion about whether to tax capital gains at the same rate as ordinary income, or at a higher rate, if not at the same rate as ordinary income, at least for higher-income capital asset owners.

- Wealth Tax: There is interest, particularly among progressive Democrats, in proposals to impose taxes on wealth that exceeds $100 million. The Administration has not come out in support of these wealth tax proposals, but says it is an idea that needs a careful look. An example of a wealth tax bill is the one that Sen. Elizabeth Warren (D-MA) introduced last month, S.510, the Ultra-Millionaire Tax Act.

- Financial Transaction Tax (FTT): Among the proposals under study currently are suggestions to impose a tax of 10 or more basis points on each trade of a stock, bond, derivative, or other security. Last month, Sen. Brian Schatz (D-HI) introduced the Wall Street Tax Act, a bill that would impose a 0.1 percent tax on each trade of a stock, bond, or derivative. It joins a similar bill (H.R.328) introduced this past January in the House by Rep. Peter DeFazio (D-OR).

- Investment Income Tax: Increasing the current net investment tax (imposed by the Affordable Care Act 11 years ago) has its share of supporters.

- Cap on Value of Deductions: Another perennial "tax the rich" proposal that is getting yet another close look now is the years-old idea of limiting the value of deductions and exclusions to a tax rate lower than a wealthy taxpayer's top marginal tax rate. For example, a taxpayer in the 37 percent tax bracket could find the value of his/her deductions limited to 28 percent.

- Income Limits: Yet another "old stand-by" is the proposal to limit certain tax advantages to people at lower income levels. An example of this would be limiting the tax deduction and/or tax exclusion for retirement savings and pension plans to people earning below a specified income level, or to retirement savings accumulated amounts below a set level. For example, it could be proposed that retirement savings plan contributions would no longer be deductible (or perhaps even allowed) once aggregate retirement savings exceed $3 million, or—perhaps—if the saver has taxable (or adjusted gross) income in excess of $400,000.

- Income Tax Surcharge on the Wealthy: An extra tax surcharge could be imposed on individuals whose adjusted gross income exceeds a certain amount. This is a variation on the wealth tax proposals.

A number of these ideas have already been introduced by members of Congress' tax-writing/budget committees—e.g., Sen. Elizabeth Warren (D-MA), Sen. Bernie Sanders (I-VT), Reps. Brendan Boyle (D-IL) and Jimmy Gomez (D-CA) have offered wealth and/or estate tax bills that would make some of these described changes. It is unknown which of these ideas President Biden will offer—but early indications are that adverse capital gains and estate tax changes, applicable to those with incomes in excess of $400,000, are probable.

Prospects: All of these proposals have legs in the current "tax the rich" environment, although we do not yet know which ones will be proposed by President Biden or included in a legislative package put together by Congressional tax writers. Remember, though, the majorities in both chambers are very close, reconciliation has special rules that would limit the viability of some of these ideas, and there are arguments to be made about the necessity to address deficit spending versus the ideological differences in Congress. The exact nature of the threat may become clearer, though, by late spring, Stay tuned.

NAIFA Staff Contacts: Diane Boyle – Senior Vice President – Government Relations, at dboyle@naifa.org; Judi Carsrud – Assistant Vice President– Government Relations, at jcarsrud@naifa.org, or Michael Hedge – Director – Government Relations, at mhedge@naifa.org

PPP Extension Enacted into Law

On March 31, President Biden signed into law H.R.1799, a measure that extended the time for Paycheck Protection Program (PPP) borrowers to submit applications for forgivable loans. The new law gives prospective PPP borrowers until the end of May to submit applications for either first- or second-draw PPP loans. The Small Business Administration (SBA) has until the end of June to approve PPP loan applications.

Absent this legislation, the SBA's authority to approve PPP loans would have expired on March 31. There is still about $87 billion in approved funding remaining for PPP loans.

Prospects: With the economy improving and with vaccines providing hope that the COVID pandemic may be abating, lawmakers think they need for the PPP may be diminishing. Further extensions and/or more funding are possible but appear unlikely at this point.

NAIFA Staff Contacts: Judi Carsrud – Assistant Vice President – Government Relations, at jcarsrud@naifa.org, or Michael Hedge – Director – Government Relations, at mhedge@naifa.org

DOL Proposes to Rescind Worker Classification Reg

On March 11, the Department of Labor (DOL) formally announced its intention to propose a rescission of the Trump Administration DOL's worker classification (independent contractor) final regulation. The announcement came in the form of a Notice of Proposed Rulemaking (NPRM).

In announcing the NPRM, DOL said it is proposing to rescind the Trump era final regulation because it "would significantly weaken protections afforded to American workers under the Fair Labor Standards Act (FLSA)."

DOL said it was proposing to withdraw the final worker classification regulation for the following reasons:

- "The rule adopted a new "economic reality test" to determine whether a worker is an employee or an independent contractor under the FLSA.

- "Courts and the department have not used the economic reality test, and FLSA text or longstanding case law does not support the test.

- "The rule would narrow or minimize other factors considered by the courts traditionally, making the economic test less likely to establish that a worker is an employee under the FLSA."

The NPRM on the worker classification regulation can be found at 29 CFR Parts 780, 788, and 795, or at https://www.dol.gov/agencies/whd/flsa/2021-independent-contractor.

Prospects: It is likely that DOL will follow up on its intention to withdraw the worker classification regulation with a new regulatory initiative. The issue is also part of a pending labor bill (H.R.842, the PRO Act). Washington insiders think the agency (and also the legislation, if it is enacted into law) will go back to a rule closer to California's ABC test, which finds a worker to be an employee when the hiring entity exerts control over the nature of the work being performed. Worker classification could impact many NAIFA members' working relationships with their carriers.

This is and will continue to be a contentious issue, both legislatively and on the regulatory front. But a new proposed worker classification rule is not likely until after the formal process of rescinding the current Trump era final rule is complete.

NAIFA Staff Contact: Michael Hedge – Director – Government Relations, at mhedge@naifa.org

NAIFA Submits Comment Letter to DOL

NAIFA joined with industry partners to submit a comment letter to the Department of Labor (DOL) on the proposed withdrawal of the Independent Contractor Status rule under the Fair Labor Standards Act (FLSA). The rule was published on January 7, 2021.

NAIFA continues to support the final rule published by DOL and has urged the Department not to withdraw it. NAIFA previously submitted comments to DOL explaining that financial professionals choosing to operate as independent contractors help generate economic growth and financial security to the local communities they serve throughout the nation. Independent insurance contractors promote and protect Americans' financial well-being through the insurance, savings, and investment, and other financial services NAIFA members provide.

NAIFA disagrees with the DOL's new perspective that the final rule is inconsistent with the principles established by decades of jurisprudence and that the court system would have difficulty applying it. In fact, it would be a departure from established legal precedents and DOL opinions and would more closely resemble the strict ABC test for determining employee or contractor status. Unlike the economic realities test, or any other worker classification test, the ABC test completely shifts the burden of proof by creating the presumption that a worker is an employee rather than an independent contractor.

NAIFA Staff Contact: Michael Hedge – Director – Government Relations, at mhedge@naifa.org

IRS Extends Certain Tax Deadlines

The Internal Revenue Service (IRS) has extended certain tax deadlines from April 15 to May 17. Announced in Notice 2021-21, the extensions include the date for filing an annual income tax return, for paying 2020 tax liability, and for contributions to IRAs and health savings accounts (HSAs). Also extended are the dates for contributions to Archer medical savings accounts and Coverdell education savings accounts.

However, note that April 15 remains the deadline for making first quarter 2021 estimated tax payments.

Other deadline extensions include the deadline for reporting and paying the 10 percent penalty tax for early withdrawals from IRAs or employer retirement savings plans (new deadline is May 17), and the due date for Form 5498 series returns related to IRAs or workplace retirement savings plans (new deadline is June 20, 2021).

Prospects: There is no expectation that the IRS will further extend any of these deadlines.

NAIFA Staff Contact: Judi Carsrud – Assistant Vice President – Government Relations, at jcarsrud@naifa.org

HHS Extends ACA Open Enrollment to August 15

On March 23, the Department of Health and Human Services (HHS) announced that open enrollment for federal exchange-based Affordable Care Act (ACA) health insurance is now extended from May 15 to August 15. State exchanges are expected to follow suit.

HHS said the extension will give people more time to take advantage of the enhanced premium subsidies enacted earlier this year in the American Rescue Plan (ARP).

Prospects: Expanding and extending affordable health insurance options is a priority for the Biden Administration and many Congressional Democrats. Expect more proposals to make health insurance more accessible and more affordable

NAIFA Staff Contacts: Michael Hedge – Director – Government Relations, at mhedge@naifa.org, or Cody Schoonover – Legislative Liaison, at cschoonover@naifa.org

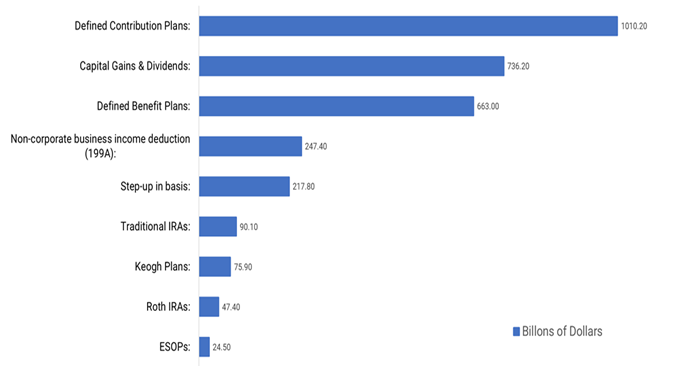

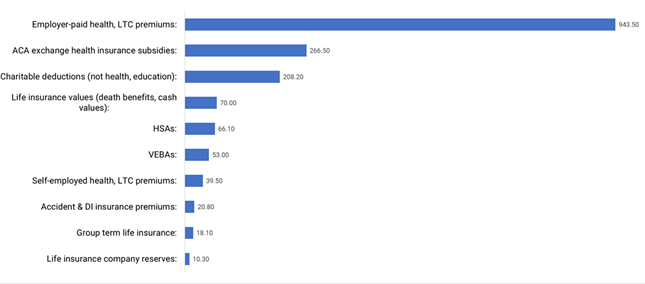

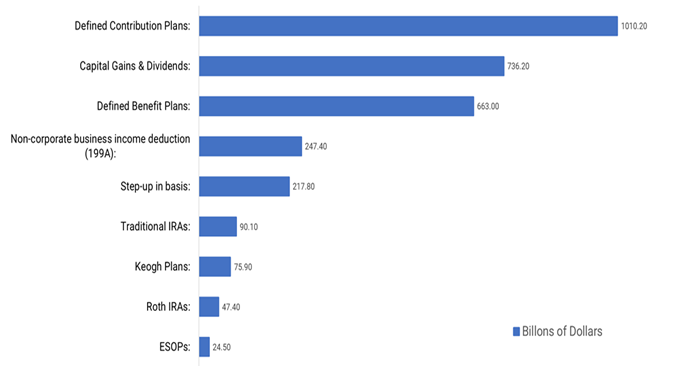

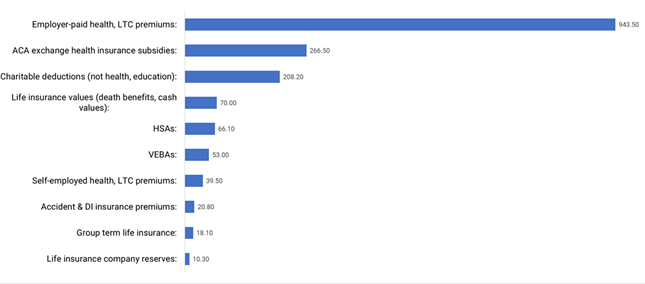

NAIFA Issues Dominate Tax Expenditures List

When lawmakers go hunting for new revenue, they often consult the annual "tax expenditures list"—a list of tax rules that result in the government not collecting tax that it would otherwise collect were it not for those rules. This year's list shows just how many of those rules impact NAIFA issues—they come to 58 percent of the total.

Over $3.2 Trillion from Income & Retirement

Nearly $1.7 Trillion from Insurance Industry

Note: Tax expenditures do not include estate and gift tax rules

Prospects: At this juncture, it appears that Democrats are focusing first on "tax the rich" proposals. If that holds, the pressure on broader, more middle-income-impacting rules (like employer-provided health insurance and retirement savings plans) will be under less pressure. However, "tax the rich" could also include carving back or even eliminating beneficial tax rules governing health insurance and/or retirement savings plans for wealthier individuals. So, this tax expenditure list clearly illustrates the risks facing NAIFA members and their clients as Congress deals with the revenue packages being offered to offset the cost of traditional and human infrastructure proposals.

NAIFA Staff Contacts: Diane Boyle – Senior Vice President – Government Relations, at dboyle@naifa.org, or Judi Carsrud – Assistant Vice President – Government Relations, at jcarsrud@naifa.org

IRS Issues Guidance on Deductibility of Business Meals

The Internal Revenue Service (IRS) has released Notice 2021-25 to provide rules on the temporary 100 percent deduction for business meals. A 100 percent deduction for business meals, available only through 2022, was enacted into law in the coronavirus aid bill enacted into law this past January.

The IRS said in Notice 2021-25 that the deduction is available for eligible expenses paid or incurred after December 31, 2020, and before January 1, 2023. It is applicable only to food or beverages provided by a restaurant at a bona fide business meal, the Notice specifies. The Notice clarifies when the temporary 100 percent deduction as compared to the usual 50 percent deduction rule applies.

Generally, the 100 percent deduction applies to food purchased from takeout and dine-in restaurants and not to pre-packaged food or groceries, the Notice says. It also makes clear that food from third-party facilities operated by an employer is not eligible for the 100 percent deduction.

Prospects: The 100 percent deduction rule was crafted as a way to help restaurants struggling during the pandemic. There's almost no chance it will be extended beyond the end of 2022. It is also possible it will be repealed before then, especially if economic recovery begins to look vigorous later this year.

NAIFA Staff Contacts: Diane Boyle – Senior Vice President – Government Relations, at dboyle@naifa.org, or Judi Carsrud – Assistant Vice President – Government Relations, at jcarsrud@naifa.org

IRS Issues Employee Retention Tax Credit (ERTC) Guidance

On April 2, the Internal Revenue Service (IRS) released Notice 2021-23, guidance on how to implement the employee retention tax credit (ERTC). The guidance covers the first two calendar quarters of 2021.

Notice 2021-23 covers the ERTC for January 1, 2020, through June 30, 2021. In that timeframe, the Notice says, employers can claim a refundable tax credit against the employer's share of Social Security taxes equal to 70 percent of the qualified wages they pay to employees after December 31, 2020, through June 30, 2021. Qualified wages are limited to $10,000 per employee per calendar quarter in 2021. Thus, the maximum ERTC is $7,000 per employee per calendar quarter for the period between January 1, 2020, and June 30, 2020.

Prospects: More guidance on the extension of the ERTC through the end of 2021 (enacted last month) is expected soon, the IRS said.

NAIFA Staff Contact: Judi Carsrud – Assistant Vice President – Government Relations, at jcarsrud@naifa.org

DOL Releases Guidance on COBRA Subsidies

On April 7, the Department of Labor's (DOL's) Employee Benefits Security Administration (EBSA) released guidance on the American Rescue Plan's (ARP's) provision that subsidizes COBRA continuation health insurance coverage from April 1 through September 30, 2021.

The guidance, in the form of frequently-asked questions-and-answers (FAQs), is posted at https://www.dol.gov/sites/dolgov/files/EBSA/about-ebsa/our-activities/resource-center/faqs/cobra-premium-assistance-under-arp.pdf.

Generally, the FAQs restate the ARP's specifics, providing that people who work(ed) for employers with 20 or more workers have a right to choose to continue the employer's health care coverage, at their own expense, after an involuntary job loss, reduction in hours, transition between jobs, death, divorce, birth or other life events. The ARP provides subsidies for the coverage that could result in the coverage being at no cost to the individual for the period between April 1 through September 30, 2021.

The EBSA guidance notes that eligible individuals who initially declined COBRA coverage could get the ARP subsidies if the maximum period allowed for the coverage (generally 18 or 36 months, depending on the qualifying event) has not expired.

Prospects: Expect more proposals to expand accessibility to affordable health insurance coverage. However, whether these COBRA subsidies get expanded past September 30 is still an open question. The answer will largely depend on the state of the economy this fall, and on whether any other health insurance expansions have been enacted (or look like they will be enacted) into law.

NAIFA Staff Contact: Michael Hedge – Director – Government Relations, at mhedge@naifa.org

Supreme Court Issues Ruling on Telephone Consumer Protection Act (TCPA)

On April 1, 2021, the Supreme Court issued its highly anticipated decision in Facebook v. Duguid, resolving a longstanding circuit split on the definition of an automatic telephone dialing system (ATDS or auto-dialer) under the Telephone Consumer Protection Act (TCPA). The Court ruled that to qualify as an ATDS under the TCPA, a device must have the capacity to either (1) store a telephone number using a random or sequential number generator or (2) produce a telephone number using a random or sequential number generator. Reversing the Ninth Circuit, the Court concluded that merely having the capacity to store numbers and dial them automatically is not enough to make a device qualify as an ATDS.

This decision is aligned with NAIFA's prior concerns and positions on the TCPA. Reversing the 9th Circuit decision, the court held that to be a "ATDS" under the TCPA (and thus subject to the prohibition on contacting consumer cell phones without prior express consent), the system must have the capacity to produce or store numbers using a random or sequential number generator. As the Supreme Court notes, this would NOT sweep in modern cell phones/smartphones.

The 9th circuit previously held that an ATDS only needed the capacity to store numbers and automatically dial them (which would sweep in modern phones), which in return created public comment activity from the Federal Communications Commission (FCC). With the new legal opinion handed down from the Supreme Court, it can be expected that the FCC will weigh in with some new guidance.

Prospects: Although the ruling addresses one of NAIFA's primary concerns, the opinion does not address the reality that insurance agents do not enjoy an "established business relationship" with customers after the sale of an insurance policy and are therefore limited in the timeframe in which they can contact those customers.

Previously, NAIFA filed a joint petition with the FCC asking for clarification on the rule of insurance producers contacting clients beyond a certain timeframe of the initial business relationship. This petition has not yet been heard, but NAIFA continues to hope for a positive ruling.

NAIFA Staff Contacts: Diane Boyle – Senior Vice President – Government Relations, at dboyle@naifa.org, or Michael Hedge – Director – Government Relations, at mhedge@naifa.org

Senate Confirms Walsh to Lead DOL, Becerra to Head HHS, Gensler to Chair SEC

On March 18, in a close (50 to 49) partisan vote, the Senate confirmed former California Attorney General and former Rep. Xavier Becerra (D-CA) as Secretary of the Department of Health and Human Services (HHS). On March 22, the Senate confirmed former Boston Mayor Marty Walsh as Secretary of the Department of Labor (DOL). The vote to confirm Walsh was 69 to 29. On April 14, the 53-44 vote confirms Gary Gensler's nomination to lead the Securities and Exchange Commission (SEC).

The Senate also confirmed Isabel Guzman to head the Small Business Administration (SBA). The confirmation came on March 16 by a bipartisan vote of 81 to 17.

Prospects: The SEC, HHS and DOL have jurisdiction over multiple issues of significant import to NAIFA. States are aligning their laws and regulations with the SEC’s new Regulation Best Interest. Under Becerra and Walsh leadership, employees rather than employers are likely to get more sympathetic reaction to health and labor issues.

NAIFA Staff Contact: Judi Carsrud – Assistant Vice President – Government Relations, at jcarsrud@naifa.org

NAIFA-MN Testifies Against Problematic Paid Family Medical Leave Bill

NAIFANAIFA-MN opposes a bill that would create a state-wide paid and family medical leave insurance program in Minnesota, HF 1200, which is under consideration in the state House.

The bill is structured as a contributory social insurance program. Most employers and workers would contribute to a state fund based on wages. Under the plan:

- Employee contributions would amount to approximately $3 each per week for a wage of $50k/year.

- Employers with comparable benefits can provide their own programs.

- Self-employed can choose to join the program.

- Eligibility is based on attachment to the workforce/earnings plus the need for leave.

- Health care providers must certify need for leave, and workers make claims to the state fund.

According to the Minnesota Chamber of Commerce, the bill would place a new payroll tax on every employer to create the state-run insurance program and would collectively cost the Minnesota business community $2.2 billion over its first three years.

Other groups to speak out against the bill include the Minnesota Association of Health Underwriters (MAHU), the Minnesota Chamber of Commerce, the Minnesota Business Partnership, and the Minnesota School Board Association.

Owner and founder of Disability Geek, Corey Anderson, testified on the bill on behalf of NAIFA and MAHU. Anderson has served on state and local NAIFA Boards for the past twenty years.

"The members of this committee need to ask themselves; what problem is this bill solving?" Anderson said. "I say that because, as a specialist in the area, I can tell you that the private sector has products available with very broad coverage for just about every group and individual. The market is competitive, with many providers offering coverage for disability income, so the prices are very affordable. The solutions are out there. This bill puts state government in direct competition with the private sector."

NAIFA Staff Contact: Julie Harrison – State Chapter Director – Government Relations, at jharrison@naifa.org

Idaho Enacts Enhanced Protections for Annuity Consumers

Idaho Governor Brad Little has signed a NAIFA-promoted best interest bill into law. The bill, HR 79, is based on the National Association of Insurance Commissioners (NAIC) Suitability in Annuity Transaction Model Regulation.

Several NAIFA members testified in support of the bill as it moved through the Idaho legislature. After the bill was signed, NAIFA-ID President Guy Stubbs released a joint statement with Susan Neely, president, and CEO of the American Council of Life Insurers:

"Legislation signed today by Gov. Brad Little and championed by Insurance Department Director Dean Cameron enhances protections for consumers in the Gem State seeking lifetime income through annuities. The strict requirements it imposes on financial professionals ensures that they will act in the best interest of the consumers they serve.

"Today's action continues the momentum for enhanced consumer protections nationwide. Idaho is the eighth state to adopt a measure that closely tracks the 'best interest of consumer enhancements' in the National Association of Insurance Commissioners (NAIC) Suitability in Annuity Transactions Model Regulation. The new laws and regulations also align with the SEC's Regulation Best Interest to bolster state and federal protections for low and moderate balance savers without limiting access to information they need for a secure retirement.

"Consumers in Idaho and across the county are anxious about running out of money in retirement. Legislation enacted by Congress in 2019 helped address this concern by making it easier for employers to include lifetime income options through annuities in workplace retirement plans. New laws like Idaho's complement this legislation and give retirement savers the tools they need to secure peace of mind no matter how long they live.

"We hope other states take similar action on behalf of retirement savers."

NAIFA Staff Contact: Julie Harrison – State Chapter Director – Government Relations, at jharrison@naifa.org

NAIFA IA, CA, and TX Each Hold Successful Virtual Legislative Action Days

Three NAIFA State Chapters – Iowa, California, and Texas – recently held virtual legislative action days that connected members to state lawmakers and regulators.

NAIFA-California's event spanned over several days in late March. Attendees received legislative and regulatory updates and heard from speakers who shared insights about building relationships with lawmakers and being an effective political advocate.

NAIFA-Iowa members also received advocacy training, and a policy briefing on its event held on March 23. Insurance and financial professionals from across the state met with their state legislators and discussed legislation of protecting senior citizens from financial fraud and exploitation, financial literacy requirements in the state's high school curriculum, and other important policy issues.

In Maine, NAIFA-members attended a virtual legislative breakfast on March 9 that enabled them to video conference meetings with their state lawmakers. The event also included party-specific small-group meetings and sessions with key members of the Legislature's Committee on Health Coverage, Insurance, and Financial Services and Committee on Taxation.

Meeting with state legislators as part of a coordinated legislative event is an important part of NAIFA's grassroots strategy. These events show the strength of NAIFA's numbers and help members develop relationships with lawmakers. Along with NAIFA's professional lobbying in Augusta and state IFAPAC giving, grassroots are a critical leg of NAIFA's state advocacy strategy in Maine.

NAIFA Staff Contact: Julie Harrison – State Chapter Director – Government Relations, at jharrison@naifa.org

Nebraska Law Enhances Protections for Annuity Consumers

Legislation signed into law today by Nebraska Governor Pete Ricketts provides citizens throughout the Cornhusker state with enhanced consumer protections when buying annuities. Strongly supported by Nebraska Director of Insurance Bruce Ramge and championed in the Nebraska Legislature by State Senator Matt Williams, the new law closely tracks the 'best interest of consumer enhancements' in the National Association of Insurance Commissioners (NAIC) Suitability in Annuity Transactions Model Regulation. It also aligns with the SEC's Regulation Best Interest.

These measures offer strong state and federal protections and, unlike a fiduciary-only approach that limits choices for consumers, make sure savers, particularly financially vulnerable middle-income Americans, are not discriminated against and have information about options for long-term security through retirement.

"Nebraska's new law continues a drive-by policymakers and elected leaders across the country to enhance protections for consumers seeking lifetime income in retirement," said American Council of Life Insurers (ACLI) President and CEO Susan Neely. "At the same time, these new standards safeguard lower and middle-income families access to important information they need for a secure retirement. We hope more states take similar actions, so all consumers are protected no matter where they live."

"Running out of money is one of consumers' biggest retirement fears," said Nebraska Insurance Federation Executive Director Robert M. Bell. "As the only financial product that guarantees lifetime income, annuities can help alleviate this anxiety. Thanks to Senator Williams, Governor Ricketts, and the Nebraska Legislature, Nebraskans planning for a secure retirement will have access to important information about annuities to help them make informed decisions."

"Now more than ever, consumers need to have access to the peace of mind that comes from guaranteed lifetime income," said NAIFA-Nebraska President Mike Hutchinson. "Life insurance companies and agents strongly support this new law because it provides Nebraskans planning for retirement confidence that financial professionals they work with are acting in the best interest of the consumer."

Nebraska joins nine other states that have adopted similar laws and regulations. Several other states are considering similar actions.

NAIFA Staff Contact: Julie Harrison – State Chapter Director – Government Relations, at jharrison@naifa.org