Lawmakers in California, and particularly in the city of Los Angeles, know the importance of life insurance and understand the critical work financial professionals do. NAIFA-Los Angeles has been key to their education. For the past 20 consecutive years, NAIFA-Los Angeles members, including the chapter’s Past President Gilbert Mares, LUTCF, Grassroots Chair Jose Rodriguez, and President Alvin Parra, have worked with Los Angeles Mayors and members of the City Council to have September proclaimed Life Insurance Awareness Month. They have also been instrumental in getting similar proclamations issued by the state Senate and the County of Los Angeles.

2 min read

NAIFA-Los Angeles Builds Long-Term Advocacy Relationships

By NAIFA on 2/7/24 1:39 PM

Topics: Life Insurance & Annuities Life Happens Life Insurance Awareness Month State Advocacy Legislative Day

2 min read

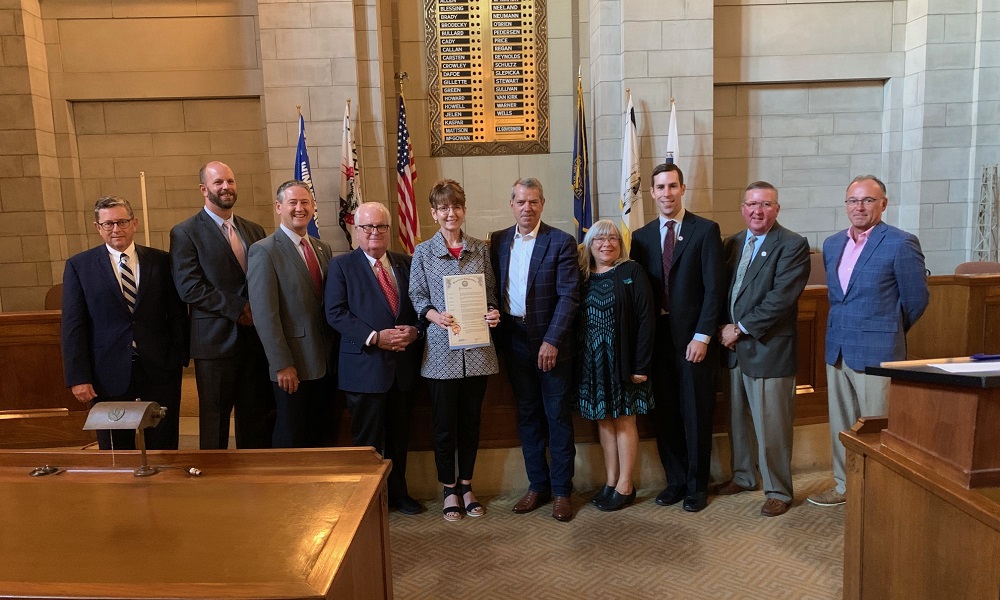

NAIFA-NE Promotes Life Insurance Awareness With Governor Pillen

By NAIFA on 8/8/23 9:07 AM

NAIFA's Nebraska chapter has been a strong advocate for the life insurance industry, working with state officials to proclaim September Life Insurance Awareness Month (LIAM) in the state. Their efforts were successful and several members of the association were on hand at the ceremony when Governor Jim Pillen issued the proclamation.

Topics: Life Insurance & Annuities Life Insurance Awareness Month State Advocacy Nebraska

1 min read

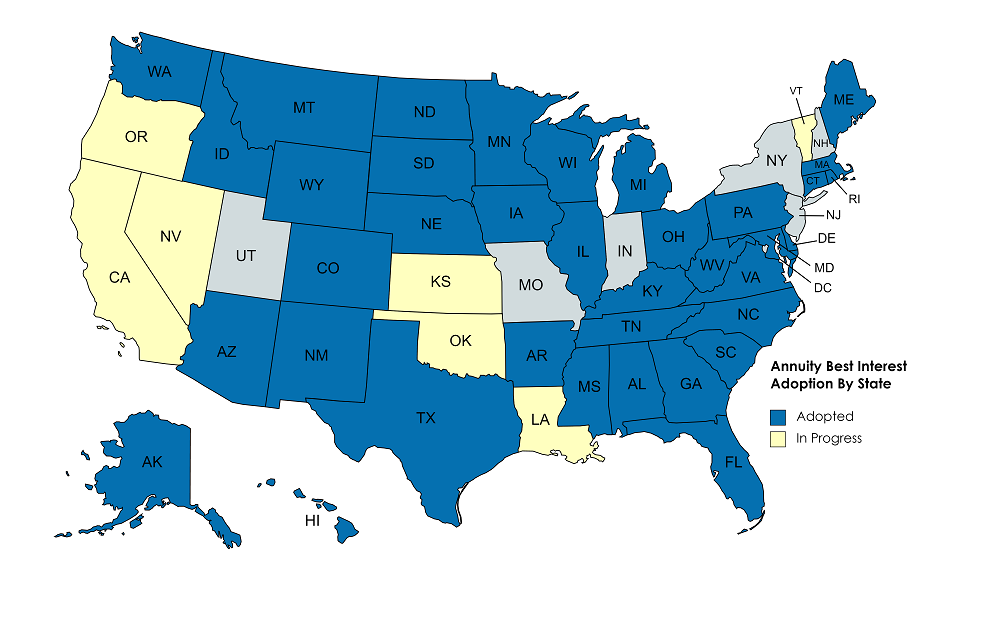

NAIFA's State Advocacy Is Influencing Consumer Protections for Annuity Transactions Around the Country

By NAIFA on 6/1/23 9:07 AM

It's fitting on the first day of National Annuity Awareness Month for us to recognize the great work done by NAIFA leaders, members, and lobbyists in 37 states that have implemented the National Association of Insurance Commissioners (NAIC) model for annuity transactions. NAIFA chapters, along with our partners at ACLI, have worked with lawmakers and regulators in the states to get the measures enacted.

Topics: Life Insurance & Annuities Annuity Awareness Month Annuity Best Interest

2 min read

New Law Enhances Protections for Washington State Annuity Consumers

By NAIFA & ACLI on 4/14/23 5:07 PM

American Council of Life Insurers (ACLI) President and CEO Susan Neely and NAIFA-Washington President Karl Kuntz issued the following joint statement on legislation signed into law in Washington that strengthens protections for annuity consumers:

“The new law sponsored by Representative Kristine Reeves, approved by the legislature, and signed by Governor Jay Inslee strengthens protections for consumers in Washington state seeking lifetime income through annuities.

Topics: Life Insurance & Annuities State Advocacy Interstate Advocacy Press Release NAIC Model Regulation Annuity Best Interest Washington

1 min read

NAIFA-TN Blocks Bill That Would Have Required Agents to Share Clients' Personal Information

By NAIFA on 3/22/23 4:57 PM

Tennessee House Bill 1173 would have permitted funeral directors in some cases to obtain life insurance information – including the names of beneficiaries and policy benefits amounts – from insurance companies or agents. However, thanks to quick action by NAIFA-TN's grassroots and advocacy team, the House Insurance Subcommittee defeated the bill.

Topics: Life Insurance & Annuities State Advocacy Opposed Legislation Tennessee

2 min read

NAIFA-CA Urges Lawmakers to Amend Bill That Would Harm Life Insurance Producers and Consumers

By NAIFA on 3/17/23 4:51 PM

NAIFA's California chapter is holding its annual Legislative Day in Sacramento on March 29. The event will feature visits with lawmakers by NAIFA-CA members, during which they will discuss SB 263, a legislative proposal that in its current form would harm the ability of insurance agents and brokers to serve the public.

Topics: Life Insurance & Annuities Legislation & Regulations State Advocacy Standard of Care & Consumer Protection Press Release California Legislative Day

1 min read

NAIFA Urges the Biden Administration to Fully Enact the NARAB Law on Interstate Insurance Licensing

By NAIFA on 3/16/23 12:19 PM

Congress, with strong bipartisan support, passed the National Association of Registered Agents and Brokers Reform Act more than eight years ago. The law would significantly streamline the process for insurance agents and brokers to be licensed in more than one state. This would obviously benefit producers by reducing red tape and regulatory costs, but it would also be a boon to consumers by promoting choice and fostering economic growth.

Topics: Life Insurance & Annuities Federal Advocacy Licensing

2 min read

Georgia Strengthens Protections for Annuity Consumers

By NAIFA & ACLI on 2/28/23 3:35 PM

American Council of Life Insurers (ACLI) President and CEO Susan Neely and National Association of Insurance and Financial Advisors (NAIFA)-Georgia President Joe Schreck issued the following joint statement on the best interest annuity rule adopted recently by Georgia’s Insurance Department:

“A new rule adopted by Georgia’s Insurance Department and Commissioner John King strengthens protections for Peach State consumers seeking lifetime income from annuities.

Topics: Life Insurance & Annuities Legislation & Regulations Press Release Georgia Annuity Best Interest NAIC

3 min read

NAIFA Hails Passage of SECURE 2.0 and RILA Act to Benefit Consumers Preparing for Retirement

By NAIFA on 12/23/22 2:06 PM

Passage of the Registered Index-Linked Annuities (RILA) Act and the SECURE Act 2.0 as part of the 2023 Omnibus Appropriations bill greatly benefits consumers as well as the insurance financial professionals who help them prepare for retirement and achieve financial security. The National Association of Insurance and Financial Advisors (NAIFA) has strongly advocated on behalf of both pieces of legislation.

“With this bipartisan legislation, Congress makes it easier for Americans to prepare for retirement and gives them greater access to innovative annuity products that guarantee lifetime income while offering some protections from market volatility,” said NAIFA President Lawrence Holzberg, LUTCF, LACP. “SECURE 2.0 will also make it easier for more companies to offer retirement plans for their employees. Preparing for a secure retirement is a vital part of any financial plan and receiving a guaranteed lifetime income can be an important part of that plan for many consumers. It’s great to see strong advocacy efforts by NAIFA, our members, and our advocacy partners pay off with a great win for consumers.”

Topics: Retirement Planning Life Insurance & Annuities Legislation & Regulations Press Release Federal Advocacy SECURE 2.0

2 min read

State Senate Hearing on LTC Features Testimony of NAIFA-WA's Chris Bor

By NAIFA on 12/8/22 5:42 PM

Chris Bor, LUTCF, CLU, ChFC, a loyal NAIFA member since 1998 and Immediate Past President of NAIFA-WA, testified at a hearing of the Washington State Senate Business, Financial Services & Trade Committee on the use of life insurance, annuities, and policy riders in long-term care planning. He gave an overview of a wide variety of LTC planning options and discussed the value of agents and advisors to consumers. Bor also serves as Vice-Chair of NAIFA's National Membership Committee.