Legislation to create a new, tax-favored flexible savings account was introduced in both the House and Senate. The “Universal Savings Account (USA) Act” would qualify USA accounts for Roth treatment (after-tax contributions, tax-free earnings and withdrawals).

1 min read

Bicameral “Universal Savings Account” Bill Introduced

By NAIFA on 5/15/25 10:56 AM

Topics: Legislation & Regulations

2 min read

Worker Classification Bills Introduced in the House

By NAIFA on 5/15/25 10:49 AM

Rep. Kevin Kiley (R-CA) has introduced two worker classification bills. One would clarify what constitutes an independent contractor as compared to an employee. The other would create a safe harbor that would allow an employer to provide benefits to independent contractors without risking a worker’s classification as an employee.

Topics: Legislation & Regulations

2 min read

Bipartisan Federal Paid Family Leave Bill Introduced

By NAIFA on 5/15/25 10:46 AM

On April 30, a bipartisan bill to establish a federal paid family leave program was introduced by Reps. Stephanie Bice (R-OK) and Chrissy Houlahan (D-PA). The bill creates a three-year pilot grant program within the Department of Labor (DOL) aimed at encouraging states to create paid family leave programs using public-private partnerships.

Topics: Legislation & Regulations Paid Family Medical Leave

3 min read

Genworth Financial Hosts Long-Term Care Symposium

By NAIFA on 5/15/25 10:41 AM

Genworth Financial hosted a long-term care (LTC) symposium in Washington, DC on May 7. The symposium focused specifically on the issues surrounding financing long-term care. Also discussed were education, access, caregiver support and other issues.

The symposium on May 7 followed an April 7 conference, also in Washington, hosted by Rep. Tom Suozzi (D-NY). Rep. Suozzi is the principal author of a bipartisan long-term care bill, the WISH Act, H.R.2082, a bill that would create a public-private partnership to make long-term care more accessible and affordable. Rep. Suozzi spoke at the Genworth symposium, emphasizing the need to address the growing problem of affordable long-term care for what is projected to be some 70 million aging baby boomers.

Topics: Long-Term Care

1 min read

Court Grants Administration Request for Delay in Adjudicating Fiduciary Rule Challenge

By NAIFA on 5/15/25 10:37 AM

The Fifth Circuit Court of Appeals has granted the Trump Administration’s request for a 60-day delay in considering the fiduciary rule cases that are currently on appeal before that court. That puts the court’s consideration of the case on track to be considered in mid-June at the soonest.

The request for delay impacts the ACLI/NAIFA case challenging the Department of Labor (DOL) fiduciary rule. This is the second request for a 60-day delay that the court has granted.

Topics: Legislation & Regulations Standard of Care & Consumer Protection DOL

1 min read

DOL Will Not Enforce 2024 Worker Classification Rule

By NAIFA on 5/15/25 10:33 AM

On May 1, the Department of Labor’s (DOL’s) Wage and Hour Division (WHD) issued a field assistance bulletin (FAB No. 2025-1) directing its agency investigators to not use the 2024 worker classification rule when determining whether workers are employees or independent contractors. Instead, agency investigators must rely on “longstanding principles outlined in Fact Sheet #13 and by the reinstated Opinion Letter FLSA2019-6.”

Topics: DOL

1 min read

Democrats Introduce Minimum Wage Hike Bill

By NAIFA on 5/15/25 10:30 AM

Key Democrats in the House and Senate have introduced legislation to phase in a federal minimum wage increase to $17/hour. The five-year phase-in would hike the federal minimum wage, which is currently $7.25/hour, to $17/hour by 2030. The bill would also index the minimum wage for inflation, and would phase out the subminimum wage for youth, tipped, and disabled workers. It would be the first federal minimum wage increase since 2009.

Topics: Congress

1 min read

IRS Sets HDHP/HSA/HRA 2026 Limits

By NAIFA on 5/15/25 10:19 AM

The Internal Revenue Service (IRS) has announced the inflation-adjusted limits for high deductible health plans (HDHPs), Health Savings Accounts (HSAs), and Health Reimbursement Arrangements (HRAs) for 2026. Also announced were 2026 limits for excepted benefits HSAs.

Topics: Taxes IRS

1 min read

Senate Finance Sends Kies Nomination to Senate Floor for Confirmation Vote

By NAIFA on 5/15/25 10:16 AM

On April 29, on a party-line vote, the Senate Finance Committee approved the nomination of Ken Kies to be Treasury Assistant Secretary for Tax Policy. Kies will play a key role in the development of all tax legislation, but especially now in the crafting of the tax portion of the massive reconciliation bill.

Topics: Taxes Congress

1 min read

Nominee for PBGC Director Gets Confirmation Hearing

By NAIFA on 5/15/25 10:13 AM

The Senate Health, Education, Labor and Pensions (HELP) Committee announced it will hold a hearing on the confirmation of Janet Dhillon to serve as Pension Benefits Guaranty Corporation (PBGC) Director. The hearing is set for May 15.

Topics: Congress

1 min read

NAIFA Attends the NCOIL Spring Meeting

By NAIFA on 5/15/25 10:08 AM

Last month, NAIFA attended the National Council of Insurance Legislators (NCOIL) Spring Meeting and received updates on issues impacting the industry.

Topics: NCOIL

3 min read

Congress Approves Budget Resolution that Unlocks Reconciliation Bill

By NAIFA on 4/15/25 9:15 AM

On April 10, after a tense overnight period during which about a dozen House Republicans said they would vote against the compromise Congressional Budget Resolution (CBR) that authorizes a Senate filibuster-proof reconciliation bill, the House narrowly approved the Senate-passed compromise budget. The 216-214 vote opens the way for writing a multi-trillion-dollar budget bill that will contain a huge tax package as well as deep spending cuts. Two Republicans joined all the Democrats in voting against the resolution.

Topics: Congress

2 min read

BOI Rule Narrowed to Apply Only to Foreign Companies

By NAIFA on 4/15/25 9:11 AM

On March 26, the Financial Crimes Enforcement Network (FinCEN) issued an interim final rule (RIN 1506-AB49) narrowing the applicability of the beneficial ownership information (BOI) rule to foreign reporting companies.

Topics: Legislation & Regulations

1 min read

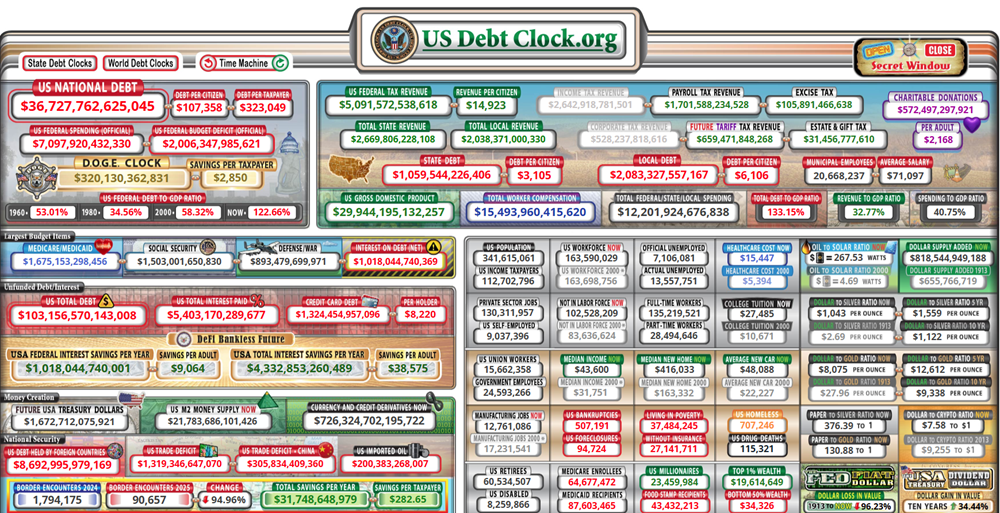

Deficit Projections Could Complicate Tax Cuts Legislation

By NAIFA on 4/15/25 9:07 AM

On March 12, the Treasury Department announced that the federal deficit has grown to $1.15 trillion over the first five months (October through February) of Fiscal Year (FY) 2025. This is 17 percent higher than the deficit level at this time last year. According to the Treasury release, the deficit in February alone grew to $307 billion.

Topics: Taxes Debt

2 min read

Debt Limit Crisis Looms

By NAIFA on 4/15/25 9:05 AM

The U.S. government cannot borrow beyond a statutory limit (the “debt limit”), and when borrowing needs exceed the debt limit either Congress must raise (or suspend) it, or the U.S. will not be able to meet all its obligations on a timely basis. Such a failure to make timely payments would trigger worldwide economic catastrophe, putting at risk the “full faith and credit” of the U.S., economists say. The U.S. is currently at the statutory debt limit and is using certain accounting measures to avoid breaching the cap. Those accounting measures will be exhausted in the coming weeks, setting up a key legislative priority for Congress.

Topics: Debt Congress

2 min read

House Tax-Writer Introduces Long-Term Care Bill

By NAIFA on 4/15/25 8:58 AM

On March 12, Rep. Tom Suozzi (D-NY), a member of the tax-writing House Ways & Means Committee, introduced a bipartisan bill, the WISH Act, that would create a public-private partnership to address the affordability of long-term care. The bill was cosponsored by Rep. John Moolenaar (R-MI).

Topics: Long-Term Care Taxes

1 min read

Lawmakers Reintroduce Bipartisan Legislation Providing Tax Credit for Family Caregivers

By NAIFA on 4/15/25 8:50 AM

On March 11, a group of bipartisan, bicameral legislators, led Rep. Mike Carey (R-OH), Rep. Linda Sanchez (D-CA), Sen. Shelley Moore Capito (R-W.VA.) and Sen. Michael Bennett (D-CO) reintroduced the Credit for Caring Act, which would provide a federal, nonrefundable tax credit of up to $5,000 for working family caregivers. Caregivers with an earned income of at least $7,500 annually would be eligible for the credit if their care recipient meets certain functional or cognitive limitations. The credit would phase out for individual filers earning more than $75,000 in a taxable year and $150,000 for joint filers.

Topics: Extended Care Congress

1 min read

Key House Committee Chair Calls on DOL to Address “Neglected” Regulations

By NAIFA on 4/15/25 8:32 AM

On March 19, House Education & the Workforce Committee Chair Rep. Tim Walberg (R-MI) wrote to Department of Labor (DOL) Secretary Lori Chavez-DeRemer urging her to focus DOL on “neglected” regulatory issues like expansion of access to health care and a range of PBGC issues.

Topics: DOL

1 min read

Senate Majority Leader Touts Estate Tax Repeal

By NAIFA on 4/15/25 8:29 AM

Sen. John Thune (R-SD), the Senate’s Majority Leader and a member of the tax-writing Senate Finance Committee, is pushing for inclusion of complete estate tax repeal in the upcoming tax reconciliation bill. Sen. Thune listed estate tax repeal as among his priorities—another is making permanent the extension of expiring tax rules.

Topics: Estate Planning Taxes

1 min read

House Committee Holds Hearing on AHP Expansion Bill

By NAIFA on 4/15/25 8:16 AM

On April 2, the House Education and the Workforce Committee’s Health Subcommittee held a hearing on “expanding access and affordability” to employer-sponsored health insurance. A key priority the subcommittee discussed was association health plans (AHPs).

.png?width=600&height=90&name=Support%20IFAPAC%20%20(600%20%C3%97%2090%20px).png)