On February 3, the House approved the Senate-passed (by a vote of 71 to 29) government funding minibus, S.7148. The House vote was 217 to 214. The process was full of drama and there still remain knotty immigration enforcement issues to work out by February 13. But with the exception of the Department of Homeland Security (DHS), the federal government is now fully funded through September 30, 2026.

1 min read

Government Reopens after Congress Passes $1.2 Trillion Funding Bill

By NAIFA on 2/13/26 3:41 PM

2 min read

Trump, Congress Target Health Reform as Next Priority Issue

By NAIFA on 2/13/26 3:38 PM

President Trump and Congressional Republicans have offered templates for a broad health reform bill. The proposals do not reinstate the expired enhancements to Affordable Care Act (ACA) premium tax credits (PTCs).

2 min read

NAIFA Comments on CMS 2027 Medicare Rules

By NAIFA on 2/13/26 3:33 PM

On Jan. 26, NAIFA submitted comments on the Centers for Medicare and Medicaid Services’ (CMS’s) “Contract Year 2027 Policy and Technical Changes to the Medicare Advantage Program, Medicare Prescription Drug Benefit Program, and Medicare Cost Plan Program.” NAIFA generally supports the proposed rule but offers suggestions for improvement.

1 min read

House Passes Bill Banning Use of ESG in Retirement Plan Choices

By NAIFA on 2/13/26 3:30 PM

Last month the House approved a bill that bans the use of environmental, social, and governance (ESG) factors in selecting investment choices in retirement plans. HR2988, the Protecting Prudent Investment of Retirement Savings Act, would bar401(k) and pension fund managers from considering ESG factors in making investment decisions.

1 min read

House Committee Examines AI in the Workplace

By NAIFA on 2/13/26 3:28 PM

On Feb. 3, the House Education & the Workforce Committee’s Subcommittee on Health, Employment, Labor, and Pensions held a hearing to explore issues surrounding the readiness of American companies and workers to compete and succeed in an economy driven by artificial intelligence (AI). The issues examined focused on worker protections.

1 min read

SECURE 2.0 Amendment Deadline Extended

By NAIFA on 2/13/26 3:25 PM

In Notice 2026-9, the Internal Revenue Service (IRS) announced an extension of the deadline for required plan amendments needed due to provisions enacted into law in SECURE 2.0. The new December 31, 2027, deadline covers needed amendments to SEPs, SIMPLE IRAs, and IRAs. The old deadline was at the end of 2026.

1 min read

Depreciable Property Guidance Released

By NAIFA on 2/13/26 3:22 PM

On January 14, the Internal Revenue Service (IRS) issued interim guidance on the new depreciable property deductions enacted in last year’s tax and spending cuts law. The guidance is in Notice 2026-11.

1 min read

IRS Releases Guidance on OT Deductibility

By NAIFA on 2/13/26 3:21 PM

The Internal Revenue Service (IRS) has released guidance (FS 2026-01) on the new deduction for qualified overtime (OT) pay. The guidance is in the form of frequently-asked questions (FAQs).

2 min read

DOL’s WHD Issues Opinion Letters on OT, FMLA, Worker Classification

By NAIFA on 2/13/26 3:18 PM

On Jan. 5, the Department of Labor’s (DOL’s) Wage and Hour Division (WHD) issued opinion letters covering specific overtime, worker classification, and Family and Medical Leave Act (FMLA) issues. The agency said the opinion letters, which apply only to the taxpayer requesting them, are designed “to promote clarity, consistency, and transparency in the application of federal labor standards under the Fair Labor Standards Act and Family and Medical Leave Act. The opinion letters provide official written interpretations from the division that address real-world questions and explain how laws apply to specific factual circumstances presented by individuals or organizations that may also have a broader interest to those impacted by the issue presented.”

2 min read

PBM Regulations Require More Transparency for Health Plan Sponsors

By NAIFA on 2/13/26 3:15 PM

Last month the Department of Labor’s (DOL’s) Employee Benefits Security Administration (EBSA) proposed new regulations governing pharmacy benefit managers (PBMs) to provide more transparency to group health plans. The regulation, which applies to PBM services to self-funded ERISA group health plans, derives from ERISA 408(b) welfare benefit plan authority.

1 min read

NAIFA Joins Coalition in Support of Strengthening the Regulatory Flexibility Act

By NAIFA on 2/13/26 3:10 PM

NAIFA continued its fight to reduce red tape in Washington impacting small businesses by partnering with other trades associations to send a letter to U.S. House Majority Leader Steve Scalise (R-LA) urging Congress to pass legislation to strengthen the Regulatory Flexibility Act (RFA) to reduce the impact of burdensome regulations on small businesses.

1 min read

119th Congress Returns to Begin Its Second Session

By NAIFA on 1/16/26 9:04 AM

On January 5, the 119th Congress began what looks to be a contentious second session ahead of the November mid-term elections. Lawmakers face a swath of deadline-driven controversial must-do issues, including the need to fund most of the government for the balance of fiscal year (FY) 2026.

2 min read

House Passes Three-Year Extension of Enhanced Premium Tax Credits

By NAIFA on 1/16/26 9:02 AM

On January 8, with 17 Republicans joining all Democrats, the House passed a bill, H.R.1834, that would reinstate the now-expired enhanced Affordable Care Act (ACA) health insurance premium tax credits (PTCs) that were at the heart of the October-November government shutdown. The vote was 230 to 196.

1 min read

House Passes Health Reform Measure that Excludes PTC Extension

By NAIFA on 1/16/26 9:01 AM

On December 17, the House of Representatives passed a bill, H.R.6703, that would make it easier and/or less expensive for individuals to buy health insurance and/or for employers to offer health insurance to their workers. However, the bill did not include an extension of the now-expired enhanced Affordable Care Act (ACA) health insurance premium tax credits (PTCs). The vote was 216 to 211.

1 min read

Key House Democrat Reintroduces Auto IRA Bill

By NAIFA on 1/16/26 8:59 AM

Rep. Richard Neal (D-MA), ranking member on the House Ways & Means Committee, has reintroduced his automatic IRA legislation. The bill would require employers to enroll their workers (subject to a worker opt-out right) into workers’ individual IRAs.

1 min read

House Subcommittee Holds Hearing on Lifetime Income

By NAIFA on 1/16/26 8:57 AM

On January 7, the House Education and the Workforce’s Subcommittee on Health, Employment, Labor and Pensions held a hearing on the role of lifetime income strategies, including annuities, on retirement savings in the current environment of rapidly-decreasing traditional pension plans.

1 min read

IRS Issues Fact Sheet on PTCs after Enhancements Expiration

By NAIFA on 1/16/26 8:55 AM

On December 22, the Internal Revenue Service (IRS) issued Fact Sheet (FS) 2025-10, guidance on the rules governing Affordable Care Act (ACA) health insurance premium tax credits (PTCs) now that the enhancements to the PTCs enacted in 2020 have expired.

1 min read

Key Lawmakers Introduce Deficit Reduction Resolution

By NAIFA on 1/16/26 8:52 AM

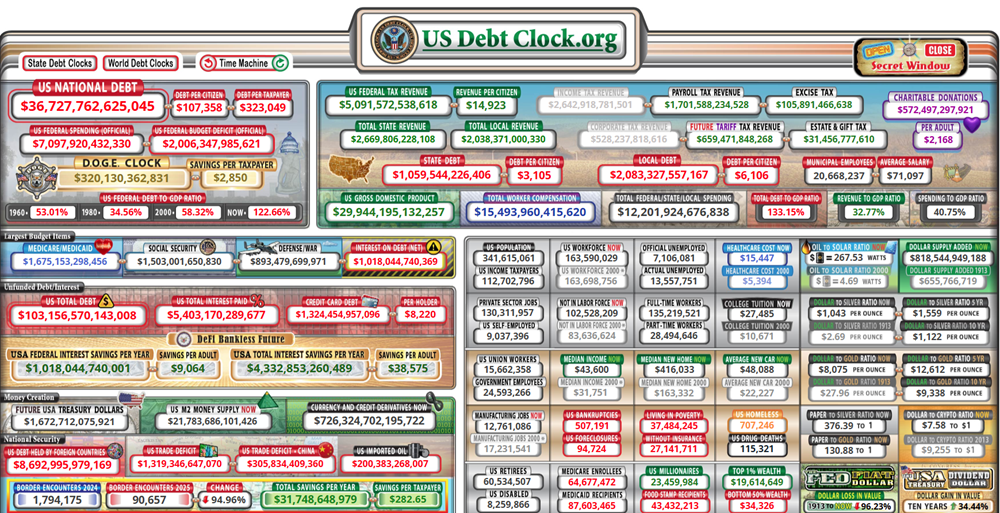

The co-chairs and members of the Congressional Bipartisan Fiscal Forum (BFF) have introduced a resolution calling on Congress to enact legislation to reduce the federal deficit to three percent of gross domestic product (GDP). A deficit that amounts to about three percent of GDP would be about half of its current (six percent of GDP) level.

1 min read

IRS Extends State Paid Family/Medical Leave Transition Relief

By NAIFA on 1/16/26 8:50 AM

In Notice 2026-06, the IRS and Treasury extended for one year the transition relief for employers now obligated to comply with employment tax and reporting obligations related to federal and state paid family and medical leave programs. This means the IRS will treat 2026 as a continued transition period with respect to medical leave benefits paid by a state that are attributable to employer contributions.

2 min read

SEC Issues Bulletin on ABLE Accounts

By NAIFA on 1/16/26 8:48 AM

The Securities and Exchange Commission issued a bulletin this week (Updated Investor Bulletin: An Introduction to ABLE Accounts | Investor.gov) providing information on ABLE accounts including the changes made by H.R. 1. An Achieving a Better Life Experience (ABLE) account provides a tax-advantaged method to save for qualified disability expenses. Contributions are not tax deductible for federal income tax purposes, but investments can grow tax free and remain so when withdrawn and used for qualified disability expenses. Qualified disability expenses are expenses used to maintain or improve the account owner’s “health, independence, or quality of life.” Qualified disability expenses are broadly defined and may include expenses related to education, food, housing, transportation, employment training and support, assistive technology, personal support services, health care expenses, financial management, administrative services and other expenses.

2 min read

Guidance Released on Deductibility of Car Loan Interest

By NAIFA on 1/16/26 8:46 AM

On December 31 the Internal Revenue Service (IRS) and Treasury released guidance on the new law allowing an above-the-line deduction for interest paid on loans to buy new American-made cars. The guidance makes clear that the deduction is not available for cars used for business.

1 min read

White House Considers New Independent Contractor Rule

By NAIFA on 1/16/26 8:44 AM

The U.S. Department of Labor (DOL) has advanced a proposed rule to update its standard for classifying independent contractors under the Fair Labor Standards Act, signaling a potential shift under the Trump administration. While details of the proposal have not yet been released, the move raises the possibility that DOL may return to the “economic reality” test finalized near the end of President Trump’s first term. That approach emphasized two core factors—worker control and opportunity for profit or loss—while considering additional, less-weighted factors such as skill level, permanence of the relationship, and integration into production.

5 min read

Congress, Administration Working on a Health Package

By NAIFA on 12/15/25 2:04 PM

Lawmakers from both parties in both the House and the Senate and the Administration have begun work on a health package for Congress to consider now that the federal government has reopened. At the heart of these efforts are negotiations on whether and if so, how to extend expiring Affordable Care Act (ACA) enhanced premium tax credits (PTCs).

1 min read

DOL Drops Its Appeal of Overturned Fiduciary Rule

By NAIFA on 12/15/25 1:59 PM

The Department of Labor (DOL) has dropped its appeal of the court decision staying implementation of the agency’s fiduciary rule. This is a clear and important win for NAIFA. NAIFA along with four of its Texas chapters, the American Council of Life Insurance, and several other trade associations are plaintiffs in the lawsuit.

3 min read

House Passes NAIFA-Supported INVEST Act

By NAIFA on 12/15/25 1:55 PM

On December 11, the House passed H.R. 3383, The INVEST Act, a bipartisan bill to expand investment options, empower entrepreneurs and small businesses, and provide Americans with the opportunity to more freely invest.

3 min read

IRS Releases Guidance on New Trump Child Savings Accounts

By NAIFA on 12/15/25 1:53 PM

On December 2, the Treasury Department and the Internal Revenue Service (IRS) released initial guidance, Notice 2025-68, on new child savings accounts (Trump accounts, also called 530A accounts).

3 min read

CMS Proposes New Medicare Marketing Rules after NAIFA Meets with CMS

By NAIFA on 12/15/25 1:50 PM

On November 25, the Centers for Medicare and Medicaid Services (CMS) issued a proposed rule for Calendar Year (CY) 2027 that would make significant changes to the marketing rules governing advisors on Medicare coverage. The changes would rescind some of the onerous Biden-era regulations that made working in the Medicare space more difficult. The proposal came after a CMS-NAIFA meeting to outline the value professional advisors provide to those making Medicare purchasing decisions.

1 min read

Treasury/IRS Release Q&A Guidance on HSA Expansion

By NAIFA on 12/15/25 1:48 PM

On December 9, Treasury and the IRS released Notice 2025-119, guidance that summarizes the health savings account (HSA) expansions enacted in last summer’s tax and spending cuts reconciliation law. In Q&A form, the guidance clarifies what the terms mean and how the rules work.

2 min read

CMS Proposes MA, Part D Rules for CY 2027

By NAIFA on 12/15/25 1:47 PM

Just before Thanksgiving, the Centers for Medicare and Medicaid Services (CMS) released its proposed Medicare Advantage (MA) and Medicare Part D (prescription drug) plan rules for calendar year (CY) 2027. Generally, the proposal revises CMS’ star rating system, modifies enrollment rules for individuals whose providers are leaving their current plan, and requests comments on MA program improvements.

2 min read

Retirement Savings Plan Proposals Emerge

By NAIFA on 12/15/25 1:44 PM

In recent weeks a number of new, relatively narrow retirement savings plan proposals have emerged. Among them is a provision in the INVEST Act, H.R.3383, which NAIFA supports. Among other provisions, the INVEST Act would amend securities law to allow 403(b) plan participants to choose to invest in collective investment trusts (CITs) and separate account insurance products. The necessary tax law changes were made in SECURE 2.0. The House approved the bill on December 11. See details in story above.

1 min read

House Committee Advances Bills to Allow Compensatory OT, Self-Audit on Wage Theft

By NAIFA on 12/15/25 1:42 PM

On November 20, the House Education and the Workforce (EWF) Committee favorably reported (sent to the full House for a vote) bills that would allow compensatory overtime (OT), and codify the PAID self-audit program. The 19 to 15 vote to advance the bills was largely party-line.

2 min read

IRS, Experts Offer Tax-Deductible Overtime Pay Clarifications

By NAIFA on 12/15/25 1:40 PM

The Internal Revenue Service (IRS), in Notice 2025-69, has issued more guidance on the tax deduction for qualified overtime (OT). Even with this Notice, though, official guidance—especially for tax year 2025—is still skimpy. In the meantime, experts offer important clarifications that will be helpful to employers with employees who may qualify for the tax deduction.

4 min read

New Tax Expenditure Report Released

By NAIFA on 12/15/25 1:38 PM

On December 3, the Joint Committee on Tax (JCT) released its annual “tax expenditure report.” The report lists tax code provisions that lessen (or decrease) tax revenue paid to the federal government because they are departures from the usual rule, which is the foundation of the current income tax scheme, that all income is subject to tax.

2 min read

IRS Releases Inflation Adjustments for Retirement Plan Limits for 2026

By NAIFA on 12/15/25 1:19 PM

In Notice 2025-67, the IRS announced inflation-adjusted limits for 2026 for retirement savings plans. The adjustments reflect the indexing of these limits that is required by law. They are effective as of January 1, 2026. They are:

2 min read

NCOIL 2025 Annual Meeting Summary

By NAIFA on 12/15/25 1:17 PM

NAIFA’s Policy Director Roger Moore attended the 2025 Annual Meeting of the National Conference of Insurance Legislators (NCOIL) on November 12-15, where he had the opportunity to strengthen NAIFA’s relationships with state legislators, regulators, and industry trade partners as well as advocate for key legislative priorities affecting NAIFA’s members. The meeting drew a record 414 registrations, including 74 legislators from 33 states, 13 first-time legislators from ten states, five insurance commissioners, and representatives from more than a dozen insurance departments.

1 min read

NAIFA President-Elect Gandy Addresses NAIC Senior Issues (B) Task Force

By NAIFA on 12/15/25 1:14 PM

During the 2025 Fall National Association of Insurance Commissioners meeting, President-Elect Christopher Gandy discussed hybrid life insurance policies with long-term care, extended care, and critical care riders, providing his perspective as an agent to the Task Force. Gandy provided insight on what he’s seeing in the market and offered suggestions to regulators to ensure the products remain accessible and easily understandable to consumers.

2 min read

Federal Government Shutdown Ends

By NAIFA on 11/17/25 10:41 AM

On Wednesday November 12 President Trump signed into law a Senate-passed agreement that was approved by the House that reopened the federal government. The agreement guarantees a Senate vote by mid-December on extending the Affordable Care Act enhanced premium tax credits (PTCs), funds about 10 percent of the government for all of FY 2026, funds the remaining 90 percent of federal government discretionary activity at FY 2025 levels until January 30, reverses reductions in force (RIFs) done on or after October 1 and forbids further government layoffs through January 30. The National Flood Insurance Program (NFIP) is reauthorized until January 30, 2026, and is reauthorized retroactively to October 1, 2025.

1 min read

NAIFA’s Medicare Collective Stresses the Value of Agents in CMS Meeting

By NAIFA on 11/17/25 10:39 AM

Representatives of NAIFA’s Medicare Collective, an initiative of the Lifetime Healthcare Center, met with officials from the Centers for Medicare and Medicaid Services (CMS) to discuss the role of brokers and agents in providing vital guidance, services, and protections to consumers in the Medicare space. They presented the Collective’s plan to work with CMS and insurance carriers to ensure Medicare beneficiaries receive the best possible coverage and care in these challenging times. They also addressed rising concerns that the failure to adequately compensate agents for their work would harm consumers by leaving them vulnerable to misinformation or without competent, personalized assistance as they navigate complex coverage options, plans, and regulations.

2 min read

Congressional Republicans Are Working on a Health Package

By NAIFA on 11/17/25 10:37 AM

Republican lawmakers in both the House and the Senate have begun work on a health package for Congress to consider after the federal government reopens. President Trump said the effort should also include Democrats, saying a “much better than Obamacare” law can be developed.

1 min read

Treasury Official Promises Release of Regs Soon, Despite Shutdown

By NAIFA on 11/17/25 10:35 AM

Treasury’s assistant secretary for tax policy, Ken Kies, said agency lawyers are working on the regulations needed to implement the new tax law. Soon to come out will be regs on overtime, tips, car loan interest, seniors, accelerated depreciation, and Trump savings accounts, he said.

1 min read

Deduction for Qualified Overtime Pay Raises Reporting Issues

By NAIFA on 11/17/25 10:33 AM

Workers who receive qualified overtime pay in 2025 are entitled to an up to $12,500/individual tax deduction if they earn less than $150,000. That means employers have to track and report qualified overtime pay. New guidance on how to do that is expected, but current guidance is limited.

1 min read

DOL Releases Opinion Letter on Calculation of Overtime Pay

By NAIFA on 11/17/25 10:31 AM

On September 30, the Department of Labor (DOL) released an opinion letter on how to calculate required overtime pay. Generally, the opinion letter notes that an employee’s overtime pay calculation is not restricted to base hourly wages. Rather, it must include all compensation paid to a worker, including in this case emergency pay premiums.

1 min read

Inflation Adjustments Increase Long-Term Care Premium Tax Deduction

By NAIFA on 11/17/25 10:29 AM

Inflation-adjusted tax deductions for premiums for qualified long-term care insurance have been announced. The deductions vary by age but generally the inflation adjustments increase the deduction by about 3 percent.

For premiums paid for long-term care insurance to be deductible, the insurance has to meet statutory qualification requirements, including consumer protections. Those requirements did not change. The premiums must also exceed 7.5 percent of the taxpayer’s adjusted gross income.

1 min read

ACA Health Insurance Rates Released

By NAIFA on 11/17/25 9:55 AM

On October 29, the federal health insurance marketplace website, healthcare.gov, posted the health insurance rates for exchange-based health (Affordable Care Act, or ACA) coverage in 2026. Open enrollment for exchange-based insurance started November 1. Open enrollment runs through January 15, 2026.

1 min read

IRS Releases Draft Instructions for ACA Reporting

By NAIFA on 11/17/25 9:52 AM

The Internal Revenue Service (IRS) has released draft instructions for Affordable Care Act (ACA)-required reporting of offers of employee health insurance coverage and employee enrollment in health insurance coverage. The instructions will be for Forms 1094-C and 1095-C.

1 min read

IRS Releases Guidance on Reporting Third-Party Transactions

By NAIFA on 11/17/25 9:50 AM

The Internal Revenue Service (IRS) has released guidance on how to report third-party transactions. The reporting thresholds increased via a provision in the spending/tax cuts law enacted this past July. The new transaction thresholds are 200 transactions in a year and/or transactions that exceed $20,000. The previous threshold was any transaction that exceeded $600.

1 min read

IRS Issues FAQs on ERTC Issues

By NAIFA on 11/17/25 9:48 AM

On October 22 the Internal Revenue Service (IRS) released guidance in the form of frequently-asked questions (FAQs) on the new Employee Retention Tax Credit (ERTC) compliance provisions. The new compliance provisions were enacted last summer in the tax/spending cuts reconciliation bill that was signed into law on July 4.

1 min read

Texas Voters Ban Estate/Inheritance, Unrealized Capital Gains Taxes

By NAIFA on 11/17/25 9:46 AM

Ballot initiatives approved by Texas voters on November 4 banned the imposition of state estate and inheritance taxes, and tax on unrealized capital gains. Proposition 8, the measure that bans estate/inheritance taxes, was a constitutional amendment. Proposition 2, also a constitutional amendment, forbids imposition of tax on gains in the value of capital assets when those gains have not been realized (the asset sold).

3 min read

Federal Government Largely Shuts Down

By NAIFA on 10/15/25 11:12 AM

Congress failed to reach an agreement on a short-term patch to fund the government by September 30, the start of the new fiscal year (FY 2026). As a result, as of October 1, large swaths of the federal government are closed. The shutdown impacts federal agencies and programs that are funded through the annual appropriations process (discretionary spending). So, programs and agencies that operate under mandatory spending, or through fees or advance-year appropriations can and will keep operating during the shutdown.

2 min read

Government Shutdown Adversely Impacts NFIP

By NAIFA on 10/15/25 11:09 AM

The ongoing government shutdown has already begun to have an adverse impact on the National Flood Insurance Program (NFIP). Both authorization and funding for the NFIP expired on September 30, the end of fiscal year (FY) 2025.

The currently-pending (and now multiple times defeated) continuing resolutions (CRs) would extend authorization and funding for the NFIP, but until a CR (or, more unlikely, an actual funding bill) is enacted, the NFIP is stopped in its tracks.

2 min read

New Regulations Could be Delayed by Government Funding Disputes

By NAIFA on 10/15/25 11:07 AM

Pending regulatory initiatives on such issues as the fiduciary rule, worker classification, noncompete agreements, and the white-collar exception to overtime rules could be delayed due to the government shutdown, and/or to budget cuts that might be imposed by Congress.

1 min read

IRS Issues Final Rules for Catch-Up Contributions to Retirement Plans

By NAIFA on 10/15/25 11:05 AM

On September 16, the Internal Revenue Service (IRS) and Treasury released final regulations implementing the SECURE 2.0 new rules for catch-up contributions to retirement savings plans. The final regulations (TD 10033/RIN 1545-BR11) implement the SECURE 2.0 rule that requires high-paid retirement savers to make their catch-up contributions on a Roth basis.

1 min read

NAIFA Wins Rescission of Health Broker Time-Out Rule

By NAIFA on 10/15/25 11:02 AM

The Center for Consumer Information and Insurance Oversight (CCIIO) has rescinded its controversial 30-minute time-out rule after an outcry from NAIFA and other agent organizations pointed out how disruptive the rule was. The rule had required advisors helping people sign up for Affordable Care Act (ACA) health insurance to re-sign in with their federally facilitated marketplace account credentials after a 30-minute period of inactivity. And that inactivity was determined by background computer programming rather than by action being taken by the person using the website.

1 min read

House EWF Committee Advances ESOP Valuation Bill

By NAIFA on 10/15/25 11:00 AM

On September 17, the House Education & the Workforce Committee favorably reported H.R.5169, a bill that allows a fiduciary to use publicly-available evaluation methods when valuing ESOP assets. The bipartisan vote was unanimous. The bill is now ready for a vote by the full House of Representatives.

2 min read

DOL To Issue New Worker Classification Rule

By NAIFA on 10/15/25 10:57 AM

The Department of Labor (DOL) has signaled its intention to rescind the 2024 worker classification rule, which uses a six-part economic realities test to determine whether a worker is an employee or an independent contractor. The announcement came via the Trump Administration’s unified agenda.

2 min read

House GOP Tax Writers Introduce New ICHRA Bill

By NAIFA on 10/15/25 10:55 AM

Three senior members of the tax-writing House Ways & Means Committee have introduced legislation aimed at promoting use of Individual Choice Health Reimbursement Arrangements (ICHRAs) by small businesses that want to provide health insurance to their workers. The “Small Business Health Options Awareness Act” (SBHOAA) focuses on enhanced outreach and information about the availability of ICHRAs.

1 min read

DOL Advisory Opinion Greenlights a Lifetime Income Annuity Structure

By NAIFA on 10/15/25 10:53 AM

In Advisory Opinion 202504A, the Department of Labor’s DOL’s Employee Benefits Security Administration (EBSA) approved a lifetime income structure involving a variable annuity. The advisory opinion, issued on Sept. 23, involved a lifetime income strategy (LIS) offered by AllianceBernstein that approved a request by AllianceBerstein that their LIS program qualifies as a qualified default investment alternative (QDIA) under ERISA.

2 min read

Senate Finance Committee Holds Hearing on Crypto Tax Rules

By NAIFA on 10/15/25 10:50 AM

On October 1, the Senate Finance Committee held a hearing on how crypto assets should be taxed. Senators from both parties acknowledged that crafting tax rules for digital assets will be a complicated undertaking.

Based on testimony and questions from committee members at the hearing, a key issue that has yet to be resolved is what to do about small crypto transactions. Witnesses at the hearing argued that some kind of de minimis rule for small crypto transactions is necessary. Committee members questioned that, though. It was clear from the hearing interactions that determining what a “small transaction” is could be a fraught issue.

1 min read

IRS Releases Inflation Adjustments for 2026

By NAIFA on 10/15/25 10:48 AM

A slew of indexed tax limits and benefits adjust each year for inflation. The Internal Revenue Service (IRS) has released Rev.Proc.2025-32, which lists many of these adjustments. Generally, the adjustments amount to about two percent for 2026.

1 min read

Dan Aronowitz Now Heads EBSA

By NAIFA on 10/15/25 10:45 AM

On September 18, on a 51 to 47 vote, the Senate confirmed President Trump’s nominee, Dan Aronowitz, to head the Employee Benefits Security Administration (EBSA). EBSA is the Department of Labor (DOL) agency that oversees the ERISA provisions applicable to retirement savings plans.

1 min read

Senate Confirms Janet Dhillon as Head of PBGC

By NAIFA on 10/15/25 10:43 AM

On October 7, the Senate confirmed Janet Dhillon to head the Pension Benefits Guaranty Corporation (PBGC). The vote was 51 to 47.

The PBGC oversees defined benefit (DB) pension plans’ ERISA rules. (Treasury has jurisdiction over DB plan tax rules.) Some 30 million American workers and retirees are covered by DB plans. The former Republican EEOC chair will lead the PBGC as it is more than halfway through administering a Biden-era bailout of some of the nation’s most severely underfunded multiemployer pension plans.

3 min read

September Brings Sprint to Fund the Government

By NAIFA on 9/15/25 11:14 AM

Chief among a raft of high-profile and controversial issues facing Congress this month is the need to fund the government before the end of fiscal year (FY) 2025 (so, by October 1). Failure means a government shutdown. It is unclear whether a shutdown could benefit either party, but some members on both sides may see some political value in a shutdown.

2 min read

Tax Package Could Include Issues of Importance to NAIFA

By NAIFA on 9/15/25 11:12 AM

Congressional Republicans are working on a new tax package. It could include an increase in the section 199A qualified business interest (QBI) deduction, and improvements to health savings account (HSA) rules. It could happen as part of another bill (government funding), or as a second all-GOP reconciliation bill.

1 min read

House Republicans Offer Bill to Extend ACA Premium Tax Credits

By NAIFA on 9/15/25 11:09 AM

In a nod to the political potency of the risk that enhanced Affordable Care Act (ACA) premium tax credits will expire at the end of 2025, a group of 10 House Republicans—joined by several Democrats—have offered legislation to extend the premium tax credits as they were enhanced in 2021 (during the COVID pandemic) for one year.

1 min read

Senate Democrats Introduce Legislation to Repeal Health Cuts in Recently Enacted New Law

By NAIFA on 9/15/25 11:08 AM

Senate Democrats have introduced legislation, S.2556, that would repeal the health care cuts, including those to Medicaid, that were enacted this past July in the tax and spending cuts reconciliation bill. S.2556 would also permanently extend the enhanced ACA premium tax credits.

1 min read

HHS Releases Guidance on Expanded Eligibility for ACA Catastrophic Plans

By NAIFA on 9/15/25 11:05 AM

On September 4, the Department of Health and Human Services (HHS) issued new guidance on expanded eligibility for Affordable Care Act (ACA) catastrophic health insurance plans. The guidance provides that individuals who cannot get premium tax credits or cost-sharing reductions via a health insurance exchange can now qualify for hardship exemptions under the ACA that allow them to purchase catastrophic health insurance. The expanded eligibility takes effect November 1, according to HHS.

1 min read

ACA Employer Mandate Penalties Increase

By NAIFA on 9/15/25 11:02 AM

In Rev.Proc. 2025-2026, the Internal Revenue Service (IRS) announced inflation adjustment increases in the Affordable Care Act employer mandate penalties. The penalties are based on whether an applicable large employer (ALE) fails to offer affordable health insurance to at least 95 percent of its full-time employees and at least one of those employees receives a premium tax credit to buy individual health insurance. An ALE is an employer with 50 or more full-time equivalent employees. Affordability is measured by employee contributions to the cost of their employer-provided health care—penalties attach if those contributions exceed maximum percentages of their compensation.

1 min read

Government Tells Court It Will Release Short-Term Health Insurance Rules in 2026

By NAIFA on 9/15/25 10:59 AM

Pursuant to a court request for information on timing, three government agencies said their intention is to release new regulations to extend the time permitted to short-term limited duration (STLD) health insurance. STLD health insurance—which currently can be in place for only four months—does not have to comply with most Affordable Care Act (ACA) requirements, including consumer protections and minimum essential benefits.

1 min read

Court Challenges to Rules Allowing Private Equity in 401(k) Plans Expected

By NAIFA on 9/15/25 10:51 AM

Attorneys representing plan participants say they will challenge new Department of Labor (DOL) rules that “facilitate” inclusion of private equity as investment options in 401(k) (and other) participant-directed retirement plans. They say that ERISA preempts agency guidance and the President’s executive order directing DOL to “facilitate” inclusion of “alternative investments” (including private equity) in employer-sponsored retirement plans.

1 min read

White-Collar OT Regs on Long-Term DOL Regulatory Agenda

By NAIFA on 9/15/25 9:57 AM

The Department of Labor’s (DOL’s) “long term action” regulatory agenda includes an update on white-collar overtime pay eligibility. The Spring 2025 regulatory agenda was released on September 4. This came after DOL pulled its spring agenda last month.

1 min read

CMS Implements New Security for Sign-in for ACA Enrollment Activity

By NAIFA on 9/15/25 9:54 AM

As of August 29, the Centers for Medicare and Medicaid Services (CMS) now requires agents and brokers to sign in anew to their Enhanced Direct Enrollment (EDE) accounts on the Enterprise Portal Federally Facilitated Marketplace (FFM) website after 30 minutes of inactivity. This is a new security requirement.

2 min read

President’s EO Directs DOL to Facilitate Inclusion of Alternate Investments in DC Retirement Plans

By NAIFA on 8/15/25 10:02 AM

On August 7, President Trump signed an Executive Order (EO) directing the Department of Labor (DOL), working with other agencies including the Securities and Exchange Commission (SEC) and Treasury, “to facilitate” inclusion of alternative investments in 401(k) plans.

2 min read

Congress Considers Tax-Free Employer-Provided Benefits for Independent Contractors

By NAIFA on 8/15/25 9:58 AM

Lawmakers in both the House and Senate are looking at legislation that would allow employers to provide tax-free benefits to their independent contractors. A House Committee approved legislation that would create a safe harbor that would insulate employers and workers from workers being characterized as employees due to the provision of these “portable” benefits. Separately, a Senate committee held a hearing on similar proposals.

1 min read

Senate HELP Committee Approves ESOP Bills

By NAIFA on 8/15/25 9:55 AM

On July 30, the Senate Health, Education, Labor and Pensions (HELP) Committee approved two largely administrative ESOP bills. However, the committee’s chairman, Sen. Bill Cassidy (R-LA), withdrew from consideration his larger ESOP bill that would substantially increase the amount of employer stock that can be contributed to ESOP participants’ accounts.

1 min read

DOL/HHS/Treasury Announce New Position on STLD Health Insurance

By NAIFA on 8/15/25 9:52 AM

On August 7, the Departments of Labor (DOL), Health & Human Services (HHS) and the Treasury (the tri-agencies) announced the agencies’ intention to initiate a notice-and-comment rulemaking initiative to consider needed amendments to the regulations governing the definition of short-term limited duration (STLD) health insurance.

2 min read

Extension of Enhanced ACA Premium Tax Credits Could Drive New Tax Package

By NAIFA on 8/15/25 9:49 AM

The enhanced Affordable Care Act (ACA) premium tax credits that were enacted during the COVID epidemic lock-down expire at the end of 2025. Efforts to extend them, and other expiring health insurance rules, could drive a new tax bill this fall.

2 min read

Bipartisan Senate Duo Float Social Security Investment Fund

By NAIFA on 8/15/25 9:46 AM

Sens. Bill Cassidy (R-LA) and Tim Kaine (D-VA) have floated a proposal to create a $1.5 trillion investment fund aimed at extending the solvency of Social Security. The five-year fund would grow until it holds enough money to keep Social Security from running out of money by the projected 2033 date, the Senators say.

2 min read

EBSA Releases New PEP Guidance

By NAIFA on 8/15/25 9:43 AM

On July 28, Acting Employee Benefits Security Administration (EBSA) head Janet Dhillon released new interpretive guidance (RIN 1210–AC10), along with a request for information (RFI) on how to lower pooled employer plan (PEP) fees and other administrative costs. The RFI focuses on “market practices associated with PEPs.”

1 min read

IRS Announces Inflation-Adjusted Affordability Standard for ACA Health Insurance

By NAIFA on 8/15/25 9:40 AM

The Internal Revenue Service (IRS) has announced the 2026 inflation adjustment for determining the affordability of employer-provided Affordable Care Act (ACA) health insurance. For 2026, the affordability standard will be 9.96 percent of a worker’s compensation. Failure to adhere to the affordability standard results in a “shared responsibility” penalty imposed on employers.

2 min read

Ways & Means Subcommittees Hold Hearing on Medicare Advantage; NAIFA Comments

By NAIFA on 8/15/25 9:37 AM

The House Ways & Means Committee’s Subcommittees on Health and Oversight held a hearing on July 22 to look into the Medicare Advantage (MA) program. NAIFA submitted comments on the issue.

1 min read

NCOIL Group Focuses on Long-Term Care

By NAIFA on 8/15/25 9:35 AM

The National Conference of Insurance Legislators (NCOIL), at their July 17-18 summer meeting, held a general session on “trends and innovations” in the long-term care insurance marketplace. The session emphasized the urgency for planning ahead for long-term care needs, and highlighted the need for both public and private solutions to the problem of financing the care of aging individuals who need help to remain in their own homes.

3 min read

H.R.1 Signed into Law

By NAIFA on 7/15/25 11:00 AM

On July 4, President Trump signed into law H.R.1, the $3.3 trillion budget reconciliation spending and tax cuts bill. The Senate passed the measure on July 1, by a 50-50 vote with the tie broken by Vice President JD Vance. The Senate made a raft of changes to the version the House passed on May 22. The House approved the Senate-passed measure, without changes, on July 3, by a 218 to 214 vote. Enactment came after multiple all-night, high-drama, tension-filled days as Congress raced to meet their target July 4 date for signing the measure into law.

1 min read

Section 199A Deduction for Noncorporate Business Income Now Permanent

By NAIFA on 7/15/25 10:56 AM

H.R.1, which is now the law of the land, permanently extends the 20 percent deduction for qualifying noncorporate business income (QBI).

The end result came after a rollercoaster of a journey through the legislative process. The House version increased the deduction to 23 percent and added restrictions on eligibility for the deduction. The Senate version dropped the deduction back to 20 percent and ultimately dropped new restrictions on eligibility for the deduction.

1 min read

New Law Makes Permanent Enhanced Business Loan Interest, Depreciation Rules

By NAIFA on 7/15/25 10:53 AM

The new law makes permanent enhanced business loan interest and depreciation rules. The Senate version, which was enacted into law, changed the House version of the bill that enhanced interest deductibility and depreciation rules for only five years.

Tax Package Increases Estate Tax Exemption

By NAIFA on 7/15/25 10:51 AM

H.R.1, the budget reconciliation bill enacted into law on July 3, includes a provision that permanently increases the estate tax exemption to $15 million ($30 million for married couples). The base year for indexing the $15 million exemption amount was changed to 2025.

1 min read

Income-Limited Tax Break for Some Seniors Approved

By NAIFA on 7/15/25 10:49 AM

Now law is a new five-year $6,000 deduction for some seniors. The Senate version of H.R.1, which has been enacted into law, creates a $6,000 special deduction from income, but not Social Security, for taxpayers over age 65 with incomes of $75,000 ($150,000/married) or less. The deduction phases down (but not below zero), at the rate of six percent of the amount by which a single taxpayer’s income exceeds $75,000 ($150,000/married filing jointly). The deduction is good for 2025 through 2028.

1 min read

Reconciliation Bill Restricts Itemized Deduction Values for Wealthy

By NAIFA on 7/15/25 10:47 AM

A “tax-the-rich” provision in the new law reduces the value of itemized deductions for 37 percent taxpayers. The provision would replace current law’s Pease limitation on the value of itemized deductions.

1 min read

Health Savings Accounts Expansion Scaled Back in New Tax Package

By NAIFA on 7/15/25 10:44 AM

The new law excludes a number of enhancements to the rules governing health savings accounts (HSAs) that had been in the House-passed version of H.R.1. Two expansion provisions did make it into the new law, though: qualification of Affordable Care Act (ACA) bronze and catastrophic plans as a high-deductible health plan (HDHP) that allows a person to have an HSA and a provision that permits telehealth without triggering higher copayments or deductibles.

1 min read

New Law Exempts Some Overtime Pay from Income Tax

By NAIFA on 7/15/25 10:42 AM

The new law provides that individuals earning up to $150,000/year ($300,000/married) will not pay income tax on up to $12,500 ($25,000 married) in overtime (OT) pay. This tax break takes effect this year (2025) and expires at the end of 2028.

1 min read

Employer Paid Leave Tax Credit Included in New Law

By NAIFA on 7/15/25 10:40 AM

H.R.1 as enacted into law extends the tax credit for employer-provided paid leave. Plus, the new law expands the tax credit by allowing employers to choose whether to take the deduction based on leave taken, or on the premiums paid for insurance that provides paid leave benefits.

1 min read

H.R.1 Would Create New Tax-Favored Savings Accounts for Children

By NAIFA on 7/15/25 10:38 AM

Included in H.R.1 as enacted into law are provisions that would create new tax-favored savings accounts (Trump accounts) for children. It also includes creation of a pilot program under which there would be a one-time government contribution to Trump accounts.

1 min read

ABLE Account Rules Extended, Modified by New Law

By NAIFA on 7/15/25 10:35 AM

The new law extends and expands ABLE account rules. ABLE accounts are tax-advantaged savings accounts for people with disabilities. Generally, the ABLE accounts are subject to Roth treatment—i.e., contributions are made with after-tax money, but distributions (that comply with specific ABLE account rules) are tax-free.

1 min read

New Law Includes Student Loan, 529 Plan Changes

By NAIFA on 7/15/25 10:33 AM

As enacted into law, H.R.1 expands the ways 529 education savings plans can be used. For example, 529 plan funds can now be used for public or private (including religious) elementary and secondary school expenses. And certain accreditation programs (e.g., trade schools, certificate programs) will now also qualify for tax-free 529 plan payments. On student loans, the new law extends the exclusion from tax liability of employer-paid student loan payments and allows tax-free discharge of student loan debt in the case of death or disability.

1 min read

House Committee Approves Bills to Expand Small Business Access to Health Insurance

By NAIFA on 7/15/25 10:30 AM

On June 25, the House Education & the Workforce Committee approved two health insurance bills that supporters say will increase small business access to affordable health insurance coverage. Committee approval came on party-line votes.

1 min read

CMS Reduces ACA Open Enrollment Period

By NAIFA on 7/15/25 10:27 AM

On June 20, the Centers for Medicare and Medicaid Services (CMS) issued a final rule (RIN 0938-AV61) that reduces by two weeks the time period during which individuals can enroll in Affordable Care Act (ACA) exchange-based health insurance plans. The rule also eliminates the ability of people with incomes of less than 150 percent of the federal poverty level to enroll in monthly ACA coverage.

1 min read

Medicare and Social Security Trust Funds to Run Dry a Year Earlier

By NAIFA on 7/15/25 10:25 AM

The Treasury Department’s annual report, issued June 18, on the state of the Social Security and Medicare trust funds projects that the two safety-net programs will run out of enough money to pay current benefits a year earlier than had been projected last year.

1 min read

Senate Confirms Kies as Assistant Secretary for Tax Policy

By NAIFA on 7/15/25 10:22 AM

On a party-line vote on June 26, the Senate confirmed the nomination of Ken Kies to be assistant secretary for tax policy. The 53 to 45 vote puts Kies in a key position as Treasury must promulgate implementing regulations for a raft of new tax rules signed into law on July 4.

3 min read

House Approves Reconciliation Bill

By NAIFA on 6/13/25 11:21 AM

On May 23, by a narrow 215 to 214 vote after an all-night debate, the House of Representatives passed the $6+ trillion reconciliation bill, H.R.1. The Congressional Budget Office (CBO) projects that the measure as passed by the House would, over 10 years, add $2.42 trillion to the federal deficit. H.R.1 contains a $3.8 trillion tax package. CBO also projected that Trump tariffs would reduce the deficit by $2.5 trillion over 10 years.

2 min read

Senate Contemplates Changes to House-Passed Reconciliation Bill

By NAIFA on 6/13/25 11:19 AM

The Senate is now working on its version of reconciliation (tax) legislation, expecting to make multiple changes to H.R.1, the bill the House passed just before Memorial Day. Here are some of the issues that Republican Senators are considering.

3 min read

H.R.1 Expands and Makes Permanent Section 199A

By NAIFA on 6/13/25 11:16 AM

The House-passed reconciliation bill, H.R.1 contains a provision increasing the Section 199A deduction for qualifying non-corporate business income from 20 percent to 23 percent There is no expiration date on the provision, which also contains modifications to eligibility for use of the deduction.

1 min read

Tax Package Increases Estate Tax Exemption

By NAIFA on 6/13/25 11:13 AM

H.R.1, the budget reconciliation bill approved by the House on May 23, includes a provision that permanently increases the estate tax exemption to $15 million ($30 million for married couples). The $15 million exemption amount is indexed for inflation with a base year of 2025.

1 min read

Reconciliation Bill Restricts Itemized Deduction Values for Wealthy

By NAIFA on 6/13/25 11:11 AM

A “tax-the-rich” provision in the House-passed reconciliation bill would reduce the value of itemized deductions for 37 percent taxpayers. The provision would replace current law’s Pease limitation on the value of itemized deductions.

1 min read

Health Savings Accounts Expanded in House-Passed Tax Package

By NAIFA on 6/13/25 11:09 AM

The House-passed tax package includes a number of enhancements to the rules governing health savings accounts (HSAs). These provisions are not subject to an expiration date—they would take effect in 2026.

1 min read

House Bill Offers New Tax Break for Some Seniors, Enhanced Standard Deduction

By NAIFA on 6/13/25 11:08 AM

The House-passed tax bill provides a temporary additional deduction of $4,000 for those over age 65 who have less than $75,000 ($150,000 for married couples) in taxable income. It also temporarily expands the standard deduction by $2,000 (married)/$1,000 (single taxpayers).

1 min read

H.R.1 Would Create New Tax-Favored Savings Accounts for Children

By NAIFA on 6/13/25 11:06 AM

Included in H.R.1 are provisions that would create new tax-favored savings accounts, Trump Accounts, for children. It also includes creation of a pilot program under which there would be a one-time government contribution to Trump Accounts.

1 min read

House-Passed Reconciliation Bill Includes Bonus Depreciation for Five Years

By NAIFA on 6/13/25 11:04 AM

The House-passed budget reconciliation bill includes a temporary bonus depreciation provision that allows a 100 percent deduction (rather than several years of partial deductions to reflect amortization of the cost of the property) for qualified property acquired and placed in service by a business.

1 min read

Enhanced Deduction for Business Loan Interest Included in H.R.1

By NAIFA on 6/13/25 11:02 AM

H.R.1 modifies the rules for calculating the amount of interest paid on business loans. The result is for many businesses an increase in the amount of business loan interest that is deductible from taxable income.

1 min read

House Reconciliation Bill Makes Some Overtime Pay Income Tax-Free

By NAIFA on 6/13/25 11:00 AM

The House-passed reconciliation budget bill, H.R.1, contains a provision that would make certain overtime (OT) pay free from income tax, but not from payroll (Social Security/Medicare) taxes. This tax relief provision is limited both by income and by the Fair Labor Standards Act’s (FLSA’s) definition of qualified overtime hours.

1 min read

CHOICE Health Arrangements Included in House-Passed Reconciliation Bill

By NAIFA on 6/13/25 10:58 AM

The House-passed budget reconciliation bill includes a new two-year credit for employers that enroll their workers in a new health care program, CHOICE arrangements. The credit would be equal to $100 multiplied by the number of months for which each employee is enrolled in a CHOICE program in the first year, and $50 by the number of months each employee is enrolled in the program in the second year.

1 min read

Reconciliation Bill Includes Enhanced Employer-Provided Paid Leave Credit

By NAIFA on 6/13/25 10:56 AM

The House-passed budget reconciliation bill includes a permanent extension of the tax credit available to employers offering qualified paid family and medical leave programs. It also modifies the tax credit to allow employers to claim the tax credit for the cost of private insurance that covers the cost of paid family and medical leave.

1 min read

DOL Rescinds 2022 Guidance on Crypto in Retirement Plans

By NAIFA on 6/13/25 10:54 AM

On May 28, the Department of Labor’s (DOL’s) Employee Benefits Security Administration (EBSA) announced it has rescinded its 2022 compliance guidance that discouraged retirement plan fiduciaries from including cryptocurrency options in retirement plan investment choices. The EBSA announcement specified that the agency is “neutral” on the issue of recommending inclusion of crypto in retirement plan investment options.

1 min read

Key Senator Introduces Bill to Help ESOPs Contribute Shares to Plans

By NAIFA on 6/13/25 10:52 AM

On May 13, Sen. Bill Cassidy (R-LA), chair of the Senate Health, Education, Labor and Pensions (HELP) Committee, which has jurisdiction over ERISA issues, introduced legislation, S.1727, that would allow ESOPs to contribute company shares to plan participants without having to include the value of the shares in the ESOP’s or the employee’s contribution limits.

1 min read

Senate HELP Advances Dhillon Nomination to Head PBGC

By NAIFA on 6/13/25 10:50 AM

On May 15, the Senate Health, Education, Labor and Pensions (HELP) Committee approved President Trump’s nominee, Janet Dhillon, to head the Pension Benefits Guaranty Corporation (PBGC) by a 12-11 vote. The Senate Finance Committee must also approve her nomination before it can go to the full Senate for a confirmation vote. The Finance Committee held a hearing on her nomination on June 3.

Senate Approves Long Nomination as IRS Commissioner

By NAIFA on 6/13/25 10:48 AM

On June 12, the Senate approved President Trump’s nominee, former Missouri Congressman Billy Long, for Internal Revenue Service Commissioner on a partisan vote of 53-46. The Finance Committee on June 5 approved Long on a partisan 14-13 vote. The Committee held a hearing on his nomination on May 20. The nomination is for a 5-year term.

1 min read

Treasury Secretary Bessent Testifies Before Ways and Means

By NAIFA on 6/13/25 10:46 AM

Treasury Secretary Scott Bessent testified before the House Ways and Means Committee on June 11 in a highly partisan hearing focusing on OBBB tax cut distribution, IRS capabilities in light of Trump staff and budget cuts, budget deficits and trade policy. The hearing was called to discuss the Department’s “priorities”. Secretary Bessent testified that the IRS collected higher than expected receipts in April’s tax filings.

3 min read

House Committees Begin Crafting Massive Reconciliation Bill

By NAIFA on 5/15/25 11:17 AM

During the week of April 29, House committees of jurisdiction began crafting their pieces of the $6 trillion+ reconciliation budget bill that Congress wants to enact by the end of this summer. The process is and will continue to be fraught as lawmakers make tough decisions, on which there is and will be much opposition, on how to cut spending and taxes for the upcoming 10 years.

7 min read

Ways and Means Approves Huge Tax Reconciliation Title

By NAIFA on 5/15/25 11:14 AM

The House Ways and Means Committee approved its reconciliation title on May 14 on a party line vote after a 17-hour mark-up. The tax title of the reconciliation bill contains provisions that would permanently extend (i.e., eliminate an expiration date) a raft of tax rules that are set to expire at the end of this year. A few of these extension provisions also modify the expiring rules, including the Section 199A deduction. In addition, the title includes new tax cuts first proposed by President Trump as well as other tax cuts. Offsets are included to ensure that the cost of the title complies with the Committee’s reconciliation instructions. Significantly and in a major victory for NAIFA, the Committee did not attempt to raise revenue from the products and services NAIFA provides to assist American families in achieving financial security.

2 min read

Debt Limit Sets “Real Deadline” for Reconciliation

By NAIFA on 5/15/25 11:06 AM

The emerging reconciliation bill includes a provision to raise the statutory debt limit—the amount beyond which Treasury may not borrow--to $4 trillion. The Senate version of the budget calls for a $5 trillion increase to the $37.2 trillion federal debt limit. The House budget authorizes a $4 trillion debt limit increase.

1 min read

House Committee Holds Hearing on ESG Rules in Retirement Plans

By NAIFA on 5/15/25 11:03 AM

On April 30, the House Education and the Workforce’s Subcommittee on Health, Employment, Labor, and Pensions (HELP) held a hearing on the impact of ESG rules on retirement plans. The hearing also focused on other security issues, like tariffs, Social Security, and the national debt.

1 min read

Bipartisan, Bicameral Federal Retirement Plan Legislation Introduced

By NAIFA on 5/15/25 10:59 AM

Legislation to create a federal retirement plan for workers whose employers do not offer a retirement plan was introduced last month in both the House and Senate. S.1526 was introduced by Sens. John Hickenlooper (D-CO) and Thom Tillis (R-SC). Reps. Lloyd Smucker (R-PA) and Terri Sewell (D-AL) introduced the companion bill, H.R.2696, in the House.

1 min read

Bicameral “Universal Savings Account” Bill Introduced

By NAIFA on 5/15/25 10:56 AM

Legislation to create a new, tax-favored flexible savings account was introduced in both the House and Senate. The “Universal Savings Account (USA) Act” would qualify USA accounts for Roth treatment (after-tax contributions, tax-free earnings and withdrawals).

2 min read

Worker Classification Bills Introduced in the House

By NAIFA on 5/15/25 10:49 AM

Rep. Kevin Kiley (R-CA) has introduced two worker classification bills. One would clarify what constitutes an independent contractor as compared to an employee. The other would create a safe harbor that would allow an employer to provide benefits to independent contractors without risking a worker’s classification as an employee.

2 min read

Bipartisan Federal Paid Family Leave Bill Introduced

By NAIFA on 5/15/25 10:46 AM

On April 30, a bipartisan bill to establish a federal paid family leave program was introduced by Reps. Stephanie Bice (R-OK) and Chrissy Houlahan (D-PA). The bill creates a three-year pilot grant program within the Department of Labor (DOL) aimed at encouraging states to create paid family leave programs using public-private partnerships.

3 min read

Genworth Financial Hosts Long-Term Care Symposium

By NAIFA on 5/15/25 10:41 AM

Genworth Financial hosted a long-term care (LTC) symposium in Washington, DC on May 7. The symposium focused specifically on the issues surrounding financing long-term care. Also discussed were education, access, caregiver support and other issues.

The symposium on May 7 followed an April 7 conference, also in Washington, hosted by Rep. Tom Suozzi (D-NY). Rep. Suozzi is the principal author of a bipartisan long-term care bill, the WISH Act, H.R.2082, a bill that would create a public-private partnership to make long-term care more accessible and affordable. Rep. Suozzi spoke at the Genworth symposium, emphasizing the need to address the growing problem of affordable long-term care for what is projected to be some 70 million aging baby boomers.

1 min read

Court Grants Administration Request for Delay in Adjudicating Fiduciary Rule Challenge

By NAIFA on 5/15/25 10:37 AM

The Fifth Circuit Court of Appeals has granted the Trump Administration’s request for a 60-day delay in considering the fiduciary rule cases that are currently on appeal before that court. That puts the court’s consideration of the case on track to be considered in mid-June at the soonest.

The request for delay impacts the ACLI/NAIFA case challenging the Department of Labor (DOL) fiduciary rule. This is the second request for a 60-day delay that the court has granted.

1 min read

DOL Will Not Enforce 2024 Worker Classification Rule

By NAIFA on 5/15/25 10:33 AM

On May 1, the Department of Labor’s (DOL’s) Wage and Hour Division (WHD) issued a field assistance bulletin (FAB No. 2025-1) directing its agency investigators to not use the 2024 worker classification rule when determining whether workers are employees or independent contractors. Instead, agency investigators must rely on “longstanding principles outlined in Fact Sheet #13 and by the reinstated Opinion Letter FLSA2019-6.”

1 min read

Democrats Introduce Minimum Wage Hike Bill

By NAIFA on 5/15/25 10:30 AM

Key Democrats in the House and Senate have introduced legislation to phase in a federal minimum wage increase to $17/hour. The five-year phase-in would hike the federal minimum wage, which is currently $7.25/hour, to $17/hour by 2030. The bill would also index the minimum wage for inflation, and would phase out the subminimum wage for youth, tipped, and disabled workers. It would be the first federal minimum wage increase since 2009.

1 min read

IRS Sets HDHP/HSA/HRA 2026 Limits

By NAIFA on 5/15/25 10:19 AM

The Internal Revenue Service (IRS) has announced the inflation-adjusted limits for high deductible health plans (HDHPs), Health Savings Accounts (HSAs), and Health Reimbursement Arrangements (HRAs) for 2026. Also announced were 2026 limits for excepted benefits HSAs.

1 min read

Senate Finance Sends Kies Nomination to Senate Floor for Confirmation Vote

By NAIFA on 5/15/25 10:16 AM

On April 29, on a party-line vote, the Senate Finance Committee approved the nomination of Ken Kies to be Treasury Assistant Secretary for Tax Policy. Kies will play a key role in the development of all tax legislation, but especially now in the crafting of the tax portion of the massive reconciliation bill.

1 min read

Nominee for PBGC Director Gets Confirmation Hearing

By NAIFA on 5/15/25 10:13 AM

The Senate Health, Education, Labor and Pensions (HELP) Committee announced it will hold a hearing on the confirmation of Janet Dhillon to serve as Pension Benefits Guaranty Corporation (PBGC) Director. The hearing is set for May 15.

1 min read

NAIFA Attends the NCOIL Spring Meeting

By NAIFA on 5/15/25 10:08 AM

Last month, NAIFA attended the National Council of Insurance Legislators (NCOIL) Spring Meeting and received updates on issues impacting the industry.

3 min read

Congress Approves Budget Resolution that Unlocks Reconciliation Bill

By NAIFA on 4/15/25 9:15 AM

On April 10, after a tense overnight period during which about a dozen House Republicans said they would vote against the compromise Congressional Budget Resolution (CBR) that authorizes a Senate filibuster-proof reconciliation bill, the House narrowly approved the Senate-passed compromise budget. The 216-214 vote opens the way for writing a multi-trillion-dollar budget bill that will contain a huge tax package as well as deep spending cuts. Two Republicans joined all the Democrats in voting against the resolution.

2 min read

BOI Rule Narrowed to Apply Only to Foreign Companies

By NAIFA on 4/15/25 9:11 AM

On March 26, the Financial Crimes Enforcement Network (FinCEN) issued an interim final rule (RIN 1506-AB49) narrowing the applicability of the beneficial ownership information (BOI) rule to foreign reporting companies.

1 min read

Deficit Projections Could Complicate Tax Cuts Legislation

By NAIFA on 4/15/25 9:07 AM

On March 12, the Treasury Department announced that the federal deficit has grown to $1.15 trillion over the first five months (October through February) of Fiscal Year (FY) 2025. This is 17 percent higher than the deficit level at this time last year. According to the Treasury release, the deficit in February alone grew to $307 billion.

2 min read

Debt Limit Crisis Looms

By NAIFA on 4/15/25 9:05 AM

The U.S. government cannot borrow beyond a statutory limit (the “debt limit”), and when borrowing needs exceed the debt limit either Congress must raise (or suspend) it, or the U.S. will not be able to meet all its obligations on a timely basis. Such a failure to make timely payments would trigger worldwide economic catastrophe, putting at risk the “full faith and credit” of the U.S., economists say. The U.S. is currently at the statutory debt limit and is using certain accounting measures to avoid breaching the cap. Those accounting measures will be exhausted in the coming weeks, setting up a key legislative priority for Congress.

2 min read

House Tax-Writer Introduces Long-Term Care Bill

By NAIFA on 4/15/25 8:58 AM

On March 12, Rep. Tom Suozzi (D-NY), a member of the tax-writing House Ways & Means Committee, introduced a bipartisan bill, the WISH Act, that would create a public-private partnership to address the affordability of long-term care. The bill was cosponsored by Rep. John Moolenaar (R-MI).

1 min read

Lawmakers Reintroduce Bipartisan Legislation Providing Tax Credit for Family Caregivers

By NAIFA on 4/15/25 8:50 AM

On March 11, a group of bipartisan, bicameral legislators, led Rep. Mike Carey (R-OH), Rep. Linda Sanchez (D-CA), Sen. Shelley Moore Capito (R-W.VA.) and Sen. Michael Bennett (D-CO) reintroduced the Credit for Caring Act, which would provide a federal, nonrefundable tax credit of up to $5,000 for working family caregivers. Caregivers with an earned income of at least $7,500 annually would be eligible for the credit if their care recipient meets certain functional or cognitive limitations. The credit would phase out for individual filers earning more than $75,000 in a taxable year and $150,000 for joint filers.

1 min read

Key House Committee Chair Calls on DOL to Address “Neglected” Regulations

By NAIFA on 4/15/25 8:32 AM

On March 19, House Education & the Workforce Committee Chair Rep. Tim Walberg (R-MI) wrote to Department of Labor (DOL) Secretary Lori Chavez-DeRemer urging her to focus DOL on “neglected” regulatory issues like expansion of access to health care and a range of PBGC issues.

1 min read

Senate Majority Leader Touts Estate Tax Repeal

By NAIFA on 4/15/25 8:29 AM

Sen. John Thune (R-SD), the Senate’s Majority Leader and a member of the tax-writing Senate Finance Committee, is pushing for inclusion of complete estate tax repeal in the upcoming tax reconciliation bill. Sen. Thune listed estate tax repeal as among his priorities—another is making permanent the extension of expiring tax rules.

1 min read

House Committee Holds Hearing on AHP Expansion Bill

By NAIFA on 4/15/25 8:16 AM

On April 2, the House Education and the Workforce Committee’s Health Subcommittee held a hearing on “expanding access and affordability” to employer-sponsored health insurance. A key priority the subcommittee discussed was association health plans (AHPs).

1 min read

DOL Issues Guidance on Annual Funding Notice Requirements

By NAIFA on 4/15/25 8:12 AM

An April 3 Department of Labor (DOL) Field Assistance Bulletin (FAB 2025-02) provides guidance on the annual funding notice requirements applicable to defined benefit (DB) plans. The Bulletin also provides updated model notices for single-employer and multiemployer DB pension plans.

2 min read

CMS Proposes Rule Shortening ACA Open Enrollment, Modifying Premium Subsidies

By NAIFA on 4/15/25 8:09 AM

On March 10, the Centers for Medicare and Medicaid Services (CMS) issued a proposed new rule, CMS-9884-P/RIN 0938-AV61, that would, among other things, shorten the Affordable Care Act (ACA) enrollment period by a month and reduce ACA subsidies by $5/month until those claiming the subsidies confirm information about their income. Under the new rule, the enrollment period would end on December 15 rather than January 15.

1 min read

Democrats Introduce Minimum Wage Hike Bill

By NAIFA on 4/15/25 8:07 AM

Key Democrats in the House and Senate have introduced legislation to phase in a federal minimum wage increase to $17/hour. The five-year phase-in would hike the federal minimum wage, which is currently $7.25/hour, to $17/hour by 2030. The bill would also index the minimum wage for inflation, and would phase out the subminimum wage for youth, tipped and disabled workers. It would be the first federal minimum wage increase since 2009.

2 min read

States Reacting to Potential Cuts to Medicaid, ACA Premium Subsidy Rollback

By NAIFA on 4/15/25 8:04 AM

As Congress grapples with whether and how to cut Medicaid and also whether to allow current ACA premium tax credit levels to revert to 2016 levels, States are looking at ways to fill the gap.

1 min read

Senate Confirms Atkins to Head SEC

By NAIFA on 4/15/25 8:00 AM

On April 9, the Senate confirmed Paul Atkins to lead the Securities and Exchange Commission (SEC). The vote was 52 to 44.

1 min read

Sonderling Confirmed as Number Two at DOL

By NAIFA on 4/15/25 7:57 AM

On March 12, the Senate confirmed Keith Sonderling as deputy secretary of labor, the number two job at the Department of Labor (DOL). The vote was 53 to 46.

1 min read

Senate Confirms Dr. Oz as Head CMS

By NAIFA on 4/15/25 7:55 AM

On April 3, the Senate confirmed President Trump’s nominee to head the Centers for Medicare and Medicaid Services (CMS), Dr. Mehmet Oz. The party-line vote was 53 to 45.

2 min read

NAIFA’s Roger Moore Attends NAIC Spring National Meeting

By NAIFA on 4/15/25 7:52 AM

NAIFA’s Policy Director Roger Moore attended NAIC’s Spring 2025 National Meeting on March 23-26, where he had the opportunity to strengthen NAIFA’s relationships with state regulators and industry trade partners as well as advocate for key priorities affecting NAIFA’s members. Before regulators convened for the meeting, they announced their 2025 federal legislative and regulatory priorities, which include 1) preserving and respecting states’ primary role as insurance regulators by eliminating the Federal Insurance Office (FIO); 2) ensuring natural catastrophe resilience; 3) promoting and preserving state flexibility to manage their health insurance markets; 4) providing consistent funding for crucial programs; and 5) producing guidance for key issues, including Section 1557 nondiscrimination rules, copay accumulator rules, and mental health parity grants.

2 min read

Congress Funds the Government Through September 30, 2025

By NAIFA on 3/17/25 1:43 PM

On March 14, Congress enacted a continuing resolution (CR) to fund the government’s discretionary spending through September 30, 2025, the end of the current fiscal year.

Enactment of the law prevented a government shut-down that, absent this measure, would have kicked in at midnight March 15.

2 min read

Congress Moves Forward on Massive Budget Bill

By NAIFA on 3/17/25 1:39 PM

The House and Senate have passed different Congressional Budget Resolutions (CBRs). Now, the two chambers must reconcile the differences to pass identical CBRs to unlock the budget process (reconciliation) that could bring deep mandatory and discretionary spending cuts, a huge tax package, and possibly an increase in the debt limit.

1 min read

NAIFA Calls for Extension of Tax Rules Important to Small Business

By NAIFA on 3/17/25 1:34 PM

NAIFA, in conjunction with a coalition of pass-through business employers, has weighed in with Congressional leadership on the importance of extending expiring tax rules important to pass-through (S corps, partnership, sole proprietorship) businesses.

On February 24, the Main Street Employers Coalition sent a letter to Speaker of the House Rep. Mike Johnson (R-LA) and Democratic Leader Rep. Hakeem Jeffries (D-NY) urging Congress “to act quickly to prevent a massive tax hike on Main Street businesses.”

2 min read

BOI Enforcement Back on Track

By NAIFA on 3/17/25 1:30 PM

The Financial Crimes Enforcement Network (FinCEN) announced that it is again going to enforce the beneficial ownership interest (BOI) rule that was enacted as part of the Corporate Transparency Act (CTA). But, FinCEN said on February 27 that it will not impose fines or penalties until after it finalizes new reporting rules that would narrow the BOI reporting rule to foreign reporting companies. The new reporting deadline is March 21, 2025.

1 min read

Trump Calls for Tax Cuts in Address to Joint Session of Congress

By NAIFA on 3/17/25 1:23 PM

President Trump’s March 4 address to a joint session of Congress included a call for tax cuts along with most of his other campaign promises and priorities. The speech (technically not a State of the Union speech due to its occurrence at the beginning of his term) was well-received by President Trump’s GOP base, but characterized as divisive by those who do not support him.

1 min read

HHS Secretary Limits Comments on Proposed Regulations

By NAIFA on 3/17/25 1:21 PM

On February 28, Department of Health and Human Services (HHS) Secretary Robert F. Kennedy Jr. announced the agency will no longer accept public comments on many of its rulemaking initiatives. This could impact rules important to NAIFA members, such as many Affordable Care Act (ACA) rules, including compensation for advisors on ACA insurance purchases.

1 min read

Trump Orders Reordering of Federal Bureaucracy

By NAIFA on 3/17/25 1:15 PM

Staffing cuts, federal agency and program relocation, and contract review (and potential cancellation) have started across the federal government. In conjunction with the Administration's “Department of Government Efficiency” (DOGE) (it is not a formal Cabinet department as it has not been established by law), all federal agencies have been ordered to put together a plan to reduce the federal workforce (starting with last month’s termination of thousands of probationary employees) by mid-March. The agencies must also draw up plans, by mid-April, to move agencies and programs out of Washington, DC to less expensive parts of the country. Agencies are also reviewing contracts they have with private sector service providers, with an eye to cancelling those that are not required by law or are otherwise not “mission critical.”

1 min read

House, Senate Democrats Introduce Social Security Expansion Bill

By NAIFA on 3/17/25 1:09 PM

On Feb. 27, House and Senate Democrats introduced the Social Security Expansion Act, a bill that would increase Social Security (SS) benefits by $2,400/year, fully fund the program for 75 years, and apply the SS payroll tax to all income above $250,000/year.

1 min read

Lawmakers Introduce Bicameral Bipartisan Bill to Extend ABLE Account Tax Rules

By NAIFA on 3/17/25 1:02 PM

On Feb. 19, bipartisan bicameral legislation was introduced that would make permanent several provisions of tax-favored ABLE accounts. The bill’s sponsors say that ABLE accounts help people with disabilities save for their future and ease the burden on those who support them.

1 min read

NLRB Acting GC Rescinds Memos on Non-Compete Agreements

By NAIFA on 3/17/25 12:54 PM

On Feb. 14, the National Labor Relations Board’s (NLRB’s) Acting General Counsel, William Cowen, rescinded two general counsel (GC) memos opining that virtually all non-compete and stay-or-pay agreements would violate the National Labor Relations Act (NLRA). This action does not resolve all the non-compete agreement issues currently in play, but it does signal a shift in NLRB thinking on the issues.

1 min read

House Education & the Workforce Committee Examines Over-Regulation

By NAIFA on 3/17/25 11:59 AM

On Feb. 26, the House Education & the Workforce Committee held a hearing focused on over-regulation of business. Titled “Unleashing America’s Workforce and Strengthening Our Economy,” the hearing focused on the adverse impact of a slew of recent regulations, including overtime pay (the white-collar exemption) and worker classification.

1 min read

Senate HELP Grills Sonderling During His Confirmation Hearing

By NAIFA on 3/17/25 11:56 AM

Senators closely questioned Department of Labor (DOL) Deputy Secretary nominee Keith Sonderling during his February 27 confirmation hearing before the Senate’s Health, Education, Labor and Pensions (HELP) Committee. Sonderling has been nominated to serve in the number 2 spot at DOL. He vowed to undertake a wholesale review of every DOL enforcement division, and to make sure that DOL has the resources it needs to carry out its mission.

1 min read

Senate Confirms Chavez-DeRemer as DOL Secretary

By NAIFA on 3/17/25 11:53 AM

On March 10, the Senate voted to confirm former Rep. Lori Chavez-DeRemer (R-OR) to be Secretary of the Department of Labor (DOL). The 67 to 32 vote was bipartisan and included some GOP opposition as well as some Democratic support.

1 min read

Trump Nominates Insurance Executive to Head EBSA

By NAIFA on 3/17/25 11:49 AM

President Trump has nominated Daniel Aronowitz to lead the Department of Labor’s (DOL’s) Employee Benefits Security Administration (EBSA). Aronowitz is currently the president of ENCORE Fiduciary, an underwriter of insurance designed to protect employee benefits plans and trustees from fiduciary liability.

1 min read

Lawmakers Introduce Bicameral Legislation Targeting Agents and Brokers in the ACA Marketplace

By NAIFA on 3/17/25 11:43 AM

On March 12, Senate Finance Committee Ranking Member Ron Wyden (D-OR) along with Representatives Kathey Castor (D-FL) and Deborah Ross (D-NC) introduced the Insurance Fraud Accountability Act, which would impose civil and criminal penalties on agents and brokers engaging in misleading or fraudulent activities in the ACA marketplace, including enrolling individuals in plans without their consent and using deceptive marketing to target vulnerable groups.

6 min read

Congress Begins Work on GOP Agenda

By NAIFA on 2/17/25 9:34 AM