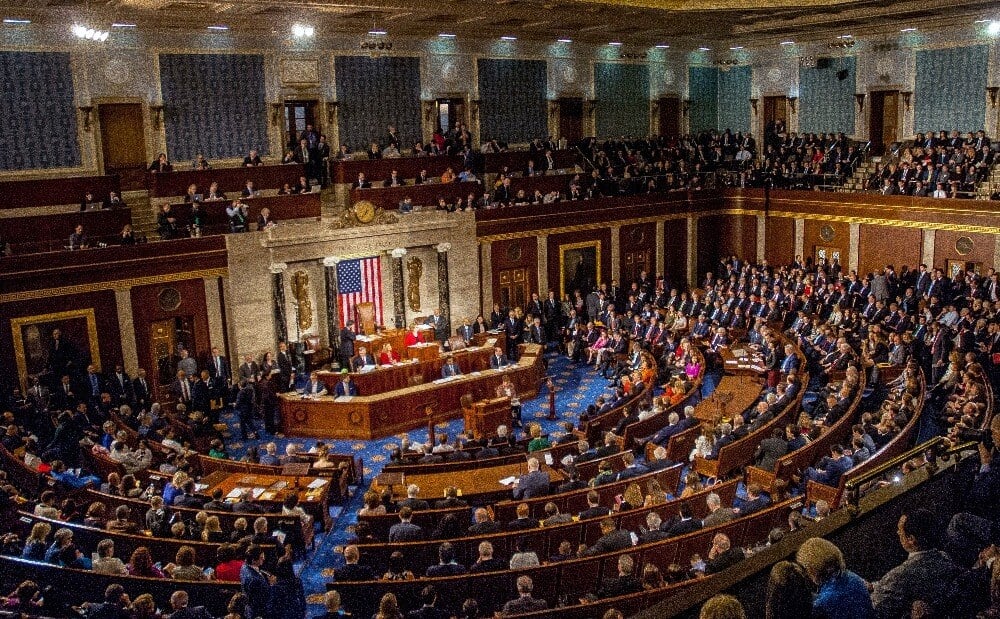

On January 5, the 119th Congress began what looks to be a contentious second session ahead of the November mid-term elections. Lawmakers face a swath of deadline-driven controversial must-do issues, including the need to fund most of the government for the balance of fiscal year (FY) 2026.

1 min read

119th Congress Returns to Begin Its Second Session

By NAIFA on 1/16/26 9:04 AM

Topics: Congress

1 min read

House Subcommittee Holds Hearing on Lifetime Income

By NAIFA on 1/16/26 8:57 AM

On January 7, the House Education and the Workforce’s Subcommittee on Health, Employment, Labor and Pensions held a hearing on the role of lifetime income strategies, including annuities, on retirement savings in the current environment of rapidly-decreasing traditional pension plans.

Topics: Congress

1 min read

Key Lawmakers Introduce Deficit Reduction Resolution

By NAIFA on 1/16/26 8:52 AM

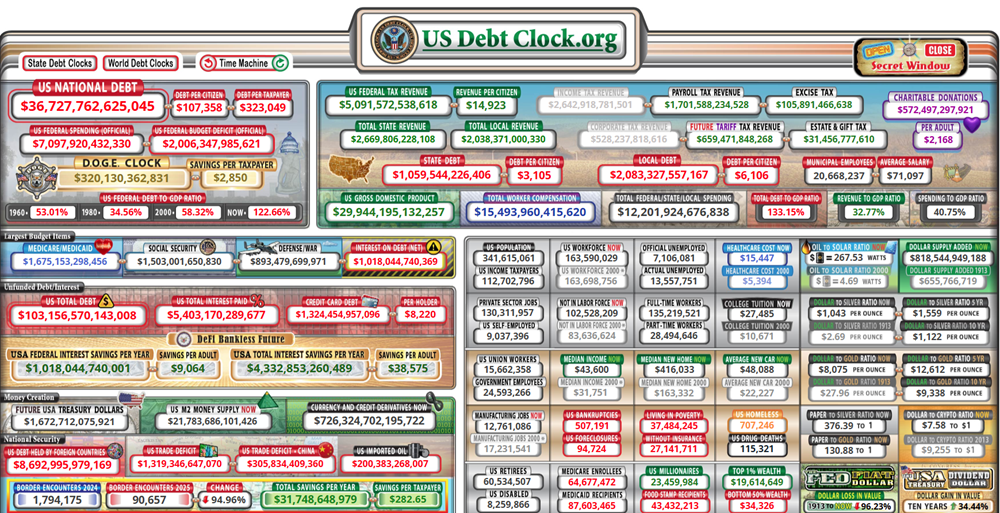

The co-chairs and members of the Congressional Bipartisan Fiscal Forum (BFF) have introduced a resolution calling on Congress to enact legislation to reduce the federal deficit to three percent of gross domestic product (GDP). A deficit that amounts to about three percent of GDP would be about half of its current (six percent of GDP) level.

Topics: Legislation & Regulations Congress

3 min read

September Brings Sprint to Fund the Government

By NAIFA on 9/15/25 11:14 AM

Chief among a raft of high-profile and controversial issues facing Congress this month is the need to fund the government before the end of fiscal year (FY) 2025 (so, by October 1). Failure means a government shutdown. It is unclear whether a shutdown could benefit either party, but some members on both sides may see some political value in a shutdown.

Topics: Congress

2 min read

Congress Considers Tax-Free Employer-Provided Benefits for Independent Contractors

By NAIFA on 8/15/25 9:58 AM

Lawmakers in both the House and Senate are looking at legislation that would allow employers to provide tax-free benefits to their independent contractors. A House Committee approved legislation that would create a safe harbor that would insulate employers and workers from workers being characterized as employees due to the provision of these “portable” benefits. Separately, a Senate committee held a hearing on similar proposals.

Topics: Group & Employee Benefits Taxes Congress

2 min read

Ways & Means Subcommittees Hold Hearing on Medicare Advantage; NAIFA Comments

By NAIFA on 8/15/25 9:37 AM

The House Ways & Means Committee’s Subcommittees on Health and Oversight held a hearing on July 22 to look into the Medicare Advantage (MA) program. NAIFA submitted comments on the issue.

Topics: Medicare Congress

3 min read

House Approves Reconciliation Bill

By NAIFA on 6/13/25 11:21 AM

On May 23, by a narrow 215 to 214 vote after an all-night debate, the House of Representatives passed the $6+ trillion reconciliation bill, H.R.1. The Congressional Budget Office (CBO) projects that the measure as passed by the House would, over 10 years, add $2.42 trillion to the federal deficit. H.R.1 contains a $3.8 trillion tax package. CBO also projected that Trump tariffs would reduce the deficit by $2.5 trillion over 10 years.

Topics: Legislation & Regulations Congress Tax Reform

2 min read

Senate Contemplates Changes to House-Passed Reconciliation Bill

By NAIFA on 6/13/25 11:19 AM

The Senate is now working on its version of reconciliation (tax) legislation, expecting to make multiple changes to H.R.1, the bill the House passed just before Memorial Day. Here are some of the issues that Republican Senators are considering.

Topics: Legislation & Regulations Congress Tax Reform

1 min read

Treasury Secretary Bessent Testifies Before Ways and Means

By NAIFA on 6/13/25 10:46 AM

Treasury Secretary Scott Bessent testified before the House Ways and Means Committee on June 11 in a highly partisan hearing focusing on OBBB tax cut distribution, IRS capabilities in light of Trump staff and budget cuts, budget deficits and trade policy. The hearing was called to discuss the Department’s “priorities”. Secretary Bessent testified that the IRS collected higher than expected receipts in April’s tax filings.

Topics: Congress

3 min read

House Committees Begin Crafting Massive Reconciliation Bill

By NAIFA on 5/15/25 11:17 AM

During the week of April 29, House committees of jurisdiction began crafting their pieces of the $6 trillion+ reconciliation budget bill that Congress wants to enact by the end of this summer. The process is and will continue to be fraught as lawmakers make tough decisions, on which there is and will be much opposition, on how to cut spending and taxes for the upcoming 10 years.

Topics: Legislation & Regulations Taxes Congress

2 min read

Debt Limit Sets “Real Deadline” for Reconciliation

By NAIFA on 5/15/25 11:06 AM

The emerging reconciliation bill includes a provision to raise the statutory debt limit—the amount beyond which Treasury may not borrow--to $4 trillion. The Senate version of the budget calls for a $5 trillion increase to the $37.2 trillion federal debt limit. The House budget authorizes a $4 trillion debt limit increase.

Topics: Legislation & Regulations Debt Congress

1 min read

House Committee Holds Hearing on ESG Rules in Retirement Plans

By NAIFA on 5/15/25 11:03 AM

On April 30, the House Education and the Workforce’s Subcommittee on Health, Employment, Labor, and Pensions (HELP) held a hearing on the impact of ESG rules on retirement plans. The hearing also focused on other security issues, like tariffs, Social Security, and the national debt.

Topics: Retirement Congress

1 min read

Democrats Introduce Minimum Wage Hike Bill

By NAIFA on 5/15/25 10:30 AM

Key Democrats in the House and Senate have introduced legislation to phase in a federal minimum wage increase to $17/hour. The five-year phase-in would hike the federal minimum wage, which is currently $7.25/hour, to $17/hour by 2030. The bill would also index the minimum wage for inflation, and would phase out the subminimum wage for youth, tipped, and disabled workers. It would be the first federal minimum wage increase since 2009.

Topics: Congress

1 min read

Senate Finance Sends Kies Nomination to Senate Floor for Confirmation Vote

By NAIFA on 5/15/25 10:16 AM

On April 29, on a party-line vote, the Senate Finance Committee approved the nomination of Ken Kies to be Treasury Assistant Secretary for Tax Policy. Kies will play a key role in the development of all tax legislation, but especially now in the crafting of the tax portion of the massive reconciliation bill.

Topics: Taxes Congress

1 min read

Nominee for PBGC Director Gets Confirmation Hearing

By NAIFA on 5/15/25 10:13 AM

The Senate Health, Education, Labor and Pensions (HELP) Committee announced it will hold a hearing on the confirmation of Janet Dhillon to serve as Pension Benefits Guaranty Corporation (PBGC) Director. The hearing is set for May 15.

Topics: Congress

3 min read

Congress Approves Budget Resolution that Unlocks Reconciliation Bill

By NAIFA on 4/15/25 9:15 AM

On April 10, after a tense overnight period during which about a dozen House Republicans said they would vote against the compromise Congressional Budget Resolution (CBR) that authorizes a Senate filibuster-proof reconciliation bill, the House narrowly approved the Senate-passed compromise budget. The 216-214 vote opens the way for writing a multi-trillion-dollar budget bill that will contain a huge tax package as well as deep spending cuts. Two Republicans joined all the Democrats in voting against the resolution.

Topics: Congress

2 min read

Debt Limit Crisis Looms

By NAIFA on 4/15/25 9:05 AM

The U.S. government cannot borrow beyond a statutory limit (the “debt limit”), and when borrowing needs exceed the debt limit either Congress must raise (or suspend) it, or the U.S. will not be able to meet all its obligations on a timely basis. Such a failure to make timely payments would trigger worldwide economic catastrophe, putting at risk the “full faith and credit” of the U.S., economists say. The U.S. is currently at the statutory debt limit and is using certain accounting measures to avoid breaching the cap. Those accounting measures will be exhausted in the coming weeks, setting up a key legislative priority for Congress.

Topics: Debt Congress

1 min read

Lawmakers Reintroduce Bipartisan Legislation Providing Tax Credit for Family Caregivers

By NAIFA on 4/15/25 8:50 AM

On March 11, a group of bipartisan, bicameral legislators, led Rep. Mike Carey (R-OH), Rep. Linda Sanchez (D-CA), Sen. Shelley Moore Capito (R-W.VA.) and Sen. Michael Bennett (D-CO) reintroduced the Credit for Caring Act, which would provide a federal, nonrefundable tax credit of up to $5,000 for working family caregivers. Caregivers with an earned income of at least $7,500 annually would be eligible for the credit if their care recipient meets certain functional or cognitive limitations. The credit would phase out for individual filers earning more than $75,000 in a taxable year and $150,000 for joint filers.

Topics: Extended Care Congress

1 min read

House Committee Holds Hearing on AHP Expansion Bill

By NAIFA on 4/15/25 8:16 AM

On April 2, the House Education and the Workforce Committee’s Health Subcommittee held a hearing on “expanding access and affordability” to employer-sponsored health insurance. A key priority the subcommittee discussed was association health plans (AHPs).

Topics: Health Care Congress

2 min read

Congress Funds the Government Through September 30, 2025

By NAIFA on 3/17/25 1:43 PM

On March 14, Congress enacted a continuing resolution (CR) to fund the government’s discretionary spending through September 30, 2025, the end of the current fiscal year.

Enactment of the law prevented a government shut-down that, absent this measure, would have kicked in at midnight March 15.

.png?width=600&height=90&name=Support%20IFAPAC%20%20(600%20%C3%97%2090%20px).png)