Two federal district courts in Texas have blocked enforcement of the Department of Labor’s (DOL’s) fiduciary-only rule. The rule’s September 23 effective date was enjoined (blocked) by the Texas Eastern District Court on July 26, and then one day later stayed (stopped) by the Texas Northern District Court. NAIFA and several of its chapters are among the plaintiffs in the Northern District court case.

2 min read

Texas District Courts Stay Fiduciary Rule Effective Date

By NAIFA on 8/15/24 10:29 AM

Topics: DOL Fiduciary

2 min read

September Will Likely Lead to Fraught Lame-Duck Session

By NAIFA on 8/15/24 10:21 AM

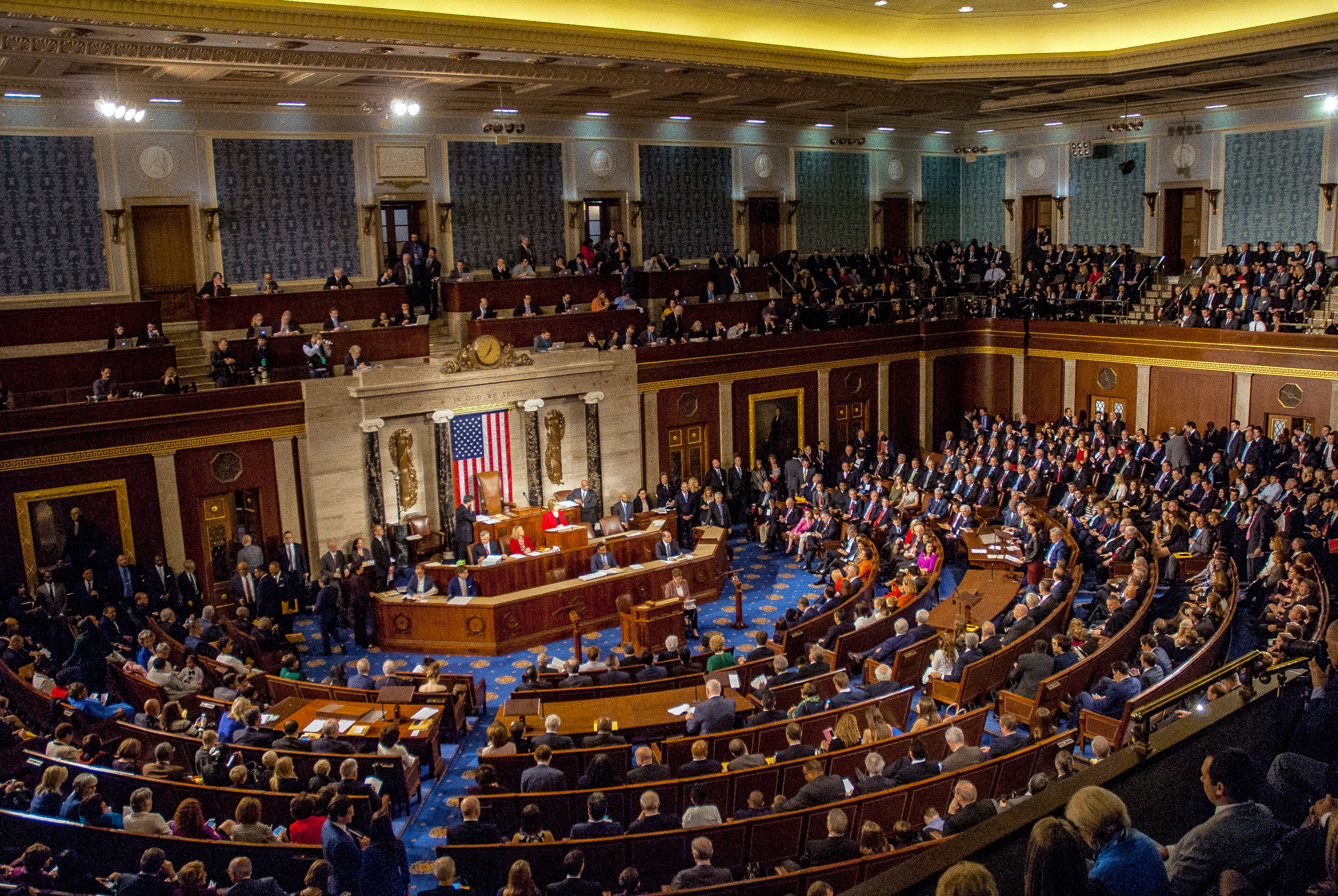

When Congress returns to Washington on September 9, lawmakers will have less than three weeks to fund the government (and consider any other pre-election pending legislation). Plus, Representatives and Senators will be focused on the November 5 election, when partisan control of the House, Senate, and Presidency are all in play. So, most Washington insiders believe that Congress will punt on most, if not all, major decisions, leading to a fraught post-election lame-duck session.

Topics: Legislation & Regulations Debt CMS Congress DOL

1 min read

House Committee Approves, Sends to House Floor, Resolution to Block Fiduciary Rule

By NAIFA on 7/15/24 4:38 PM

On July 10, the House Education and Workforce Committee approved a Congressional Review Act (CRA) resolution to block the Department of Labor’s (DOL’s) new fiduciary-only rule. The CRA resolution, H.J.Res.142, would “disapprove the rule submitted by the Department of Labor relating to “Retirement Security by Rule: Definition of an Investment Advice Fiduciary (89 Fed. Reg. 32122 (April 25, 2024)), and such rule shall have no force or effect.”

Topics: Legislation & Regulations Congress DOL Fiduciary

2 min read

Supreme Court Decision Curtails Agency Power

By NAIFA on 7/15/24 4:37 PM

The Supreme Court decision to overturn the Chevron Doctrine—a 40+-year-old rule that required courts to defer to federal agencies’ “reasonable” interpretations of “ambiguous” statutes—may mean that a sea change in regulatory activity—and possibly legislation—is likely.

Topics: DOL Federal Trade Commission SCOTUS

1 min read

Bicameral Motions to Block White-Collar Exemption to the OT Rule Introduced

By NAIFA on 7/15/24 4:34 PM

Last month Republican lawmakers introduced motions to block the new rule raising the salary threshold for the white-collar exemption to the Fair Labor Standards Act (FLSA) overtime (OT) rule. Rep. Tim Walberg (R-MI) introduced the Congressional Review Act (CRA) motion in the House; Sen. Mike Braun (R-IN) introduced it in the Senate.

Topics: Legislation & Regulations Congress DOL SCOTUS

2 min read

NAIFA, ACLI Sue to Overturn New Fiduciary Rule

By NAIFA on 6/14/24 2:45 PM

On May 24, a group of nine industry organizations, including NAIFA and the American Council of Life Insurers (ACLI), filed a lawsuit seeking to overturn the Department of Labor’s (DOL’s) newly finalized fiduciary rule. Joining NAIFA and ACLI in the lawsuit are NAIFA-Texas, NAIFA-Fort Worth, NAIFA-Dallas, NAIFA-Piney Woods of East Texas, the National Association of Fixed Annuities (NAFA), the Insured Retirement Institute (IRI), and Finseca.

Topics: SEC DOL Fiduciary NAIFA

1 min read

Legislation to Block Fiduciary Rule Introduced in both House and Senate

By NAIFA on 6/14/24 2:45 PM

Congressional Review Act (CRA) resolutions to block the Department of Labor’s (DOL’s) newly finalized fiduciary rule have been introduced in both the House and Senate. It appears the motion may pass, but President Biden is virtually certain to veto it if it does pass.

Topics: Congress DOL Fiduciary

2 min read

Business Groups Sue to Overturn DOL’s Overtime Rule

By NAIFA on 6/14/24 2:38 PM

A coalition of business groups has filed a lawsuit seeking to overturn the Department of Labor’s (DOL’s) new and now-final white-collar exemption to Fair Labor Standards Act (FLSA) overtime (OT) rules. A court ruling on the lawsuit could result in a delay in the July 1 effective date of the new rule.

Topics: Legislation & Regulations DOL

1 min read

LIMRA Study Shows Pension Risk Transfers Skyrocket

By NAIFA on 6/14/24 2:37 PM

A study released on June 6 by the Life Insurance Marketing and Research Association (LIMRA) shows a 25 percent increase in pension risk transfer contracts in the first quarter of this year. A LIMRA statement discussing the study pointed to a record $14.6 billion in 146 contracts in companies shifting their lifetime pension obligations to annuities.

Topics: LIMRA Congress DOL Fiduciary

4 min read

Final Fiduciary Rule Heads to Court

By NAIFA on 5/15/24 2:01 PM

On April 23, the Department of Labor (DOL) finalized its new fiduciary rule and its accompanying amendments to prohibited transaction exemptions (PTEs) 2020-02 and 84-24. The new rules would take effect September 23, but they have already triggered the first of what are likely to be multiple court challenges to them. Those court decisions could impact the effective date. And Congress is likely to vote on a Congressional Review Act (CRA) motion to block the rules, although even if a CRA motion passes both the House and Senate, President Biden will surely veto it.

Topics: Retirement 401(k) SEC Congress DOL Fiduciary

1 min read

DOL Finalizes White-Collar Exemption to Overtime Rules

By NAIFA on 5/15/24 1:45 PM

The long-awaited final rule on the white-collar exception from the Fair Labor Standards Act’s (FLSA’s) overtime rules was released last month. The new rule significantly increases the salary threshold below which the white-collar exception does not apply and provides for automatic adjustments to the salary threshold every three years.

Topics: Legislation & Regulations Congress DOL

3 min read

FY 2024 Government Funding Complete without Fiduciary Rider

By NAIFA on 4/15/24 3:57 PM

In the wee morning hours of March 23—just two hours after the midnight March 22 deadline—Congress completed the fraught process of funding the federal government’s discretionary spending for fiscal year (FY) 2024—six months after FY 2024 began this past October 1. President Biden signed the measure into law the same day. Despite hard lobbying, the final funding package excluded a rider that would have stopped the Department of Labor’s (DOL) work on its fiduciary rule.

Topics: Legislation & Regulations Congress DOL Fiduciary

2 min read

NAIFA Meets with OIRA on DOL’s Proposed Fiduciary Rule; OIRA Returns Rule to DOL

By NAIFA on 4/15/24 3:44 PM

On April 10, NAIFA met with the White House’s Office of Information and Regulatory Affairs (OIRA) to express the association’s concerns about the Department of Labor’s (DOL’s) proposed fiduciary rule. NAIFA reiterated its long-standing opposition to the rule, citing its probable impact on the accessibility and affordability of professional investment advice for middle-American retirement savers. Late that afternoon, OIRA sent the proposed rule back to DOL for finalization, canceling at least two subsequent previously scheduled stakeholder meetings.

Topics: Legislation & Regulations Retirement Plans DOL Fiduciary

2 min read

CMS/DOL/Treasury Finalize Short-Term Limited Duration Health Insurance Rule

By NAIFA on 4/15/24 3:35 PM

On March 28, the Departments of Labor (DOL), Health and Human Services’ (HHS’) Centers for Medicare and Medicaid Services (CMS), and Treasury released a final short-term limited-duration (STLD) health insurance rule. It retains the proposed rule’s new limits of three months duration, with a four-month renewal option for this kind of insurance.

Topics: Legislation & Regulations Affordable Care Act CMS Congress DOL

2 min read

House Advances Effort to Block the Final Worker Classification Rule

By NAIFA on 4/15/24 3:10 PM

A bicameral GOP resolution to block the Department of Labor’s (DOL’s) now-final worker classification rule has been introduced. On March 21, the House Education and the Workforce Committee approved a Congressional Review Act (CRA) motion to block the rule.

Topics: Legislation & Regulations CMS Congress DOL

2 min read

DOL Issues Final QPAM Rule

By NAIFA on 4/15/24 2:24 PM

On April 2, the Department of Labor (DOL) finalized its qualified plan asset manager (QPAM) rule. The rule is an amendment to prohibited transaction exemption (PTE) 84-14. The rule, which imposes broad disqualifying provisions on retirement plan asset managers who have been convicted of financial crime, takes effect June 17, 2024.

Topics: Retirement Plans Congress DOL

1 min read

DOL Extends Comment Period for SECURE 2.0 Reporting/Disclosure Rules

By NAIFA on 4/15/24 2:14 PM

The Department of Labor’s (DOL’s) Employee Benefits Security Administration (EBSA) and the Treasury Department have announced an extension, from April 22 to May 22, 2024, of the deadline for responses to its request for information (RFI) on the effectiveness of SECURE 2.0’s notice and disclosure requirements.

Topics: Congress DOL SECURE 2.0

1 min read

Proposed Fiduciary Rule Goes to White House for Final Review

By NAIFA on 3/15/24 5:01 PM

On March 8, the Department of Labor (DOL) sent to the Office of Information and Regulatory Affairs (OIRA) for review its proposed new fiduciary rule. This is the last step in the regulatory process prior to finalization of a rule. OIRA is an agency within the Office of Management and Budget (OMB), a White House agency.

Topics: Legislation & Regulations Congress DOL

1 min read

Six of 12 Government Funding Bills Now Law-Partial Shutdown Averted

By NAIFA on 3/15/24 4:42 PM

Congress has passed, and President Biden has signed into law a “minibus” government funding bill that provides discretionary funding for six of the 12 required appropriations bills for fiscal year (FY) 2024. The new funding law, H.R.4366, does not include the industry-sought rider to prevent the Department of Labor (DOL) from further work on its proposed new fiduciary rule.

Topics: Legislation & Regulations Congress DOL

2 min read

Congressional Action to Stop Worker Classification Rule on Tap

By NAIFA on 3/15/24 4:06 PM

A bicameral GOP resolution to block the Department of Labor’s (DOL’s) now-final worker classification rule has been introduced. Votes on it in both the House and Senate are expected later this month.

.png?width=600&height=90&name=Support%20IFAPAC%20%20(600%20%C3%97%2090%20px).png)