On April 30, the House Education and the Workforce’s Subcommittee on Health, Employment, Labor, and Pensions (HELP) held a hearing on the impact of ESG rules on retirement plans. The hearing also focused on other security issues, like tariffs, Social Security, and the national debt.

1 min read

House Committee Holds Hearing on ESG Rules in Retirement Plans

By NAIFA on 5/15/25 11:03 AM

Topics: Retirement Congress

1 min read

Bipartisan, Bicameral Bill Allows CIT Investment by 403(b)s

By NAIFA on 2/17/25 9:12 AM

Bipartisan legislation to allow 403(b) retirement savings plans to invest in collective investment trusts (CITs) has been introduced in both the House and Senate. The legislation would amend securities laws to allow for 403(b) CIT investments. Retirement law was amended to allow these CIT investments in SECURE 2.0, but efforts to expand the CIT investment authority to include securities laws fell short at the time.

Topics: Retirement Congress

1 min read

IRS Extends Deadline for SECURE 2.0 RMD Rules

By NAIFA on 1/14/25 1:23 PM

Last month the Internal Revenue Service (IRS) announced an extension, to January 1, 2026, for rules to accommodate the SECURE 2.0 required minimum distribution (RMD) rules. The December 18 announcement came in IRA Announcement 2025-2.

Topics: Retirement IRS SECURE 2.0

2 min read

Retirement Savings, Death Benefits on Most Recent JCT Tax Expenditure List

By NAIFA on 1/14/25 1:06 PM

The Joint Committee on Tax’s (JCT’s) most recent “tax expenditure list” includes trillions in foregone federal revenue as a result of the tax rules governing retirement savings, life insurance death benefits and cash values, and employer provided health insurance.

Topics: Retirement Tax Reform

1 min read

Treasury Issues 403(b) Guidance on Long-Term Part-Time Employees

By NAIFA on 10/15/24 10:48 AM

On October 3, the Internal Revenue Service (IRS) and Treasury issued new guidance, Notice 2024-73, on coverage requirements for long-term part-time employees (LTPTE), beginning in 2025. SECURE 2.0, enacted late in 2022, includes a provision requiring employer-sponsored retirement plans to allow long-term (those with service of two years or more) part-time (those who work at least 500 hours/year) to participate in the employer-sponsored retirement savings plan.

Topics: Retirement Legislation & Regulations 401(k) Congress IRS SECURE 2.0

1 min read

RISE Act Introduced in the Senate

By NAIFA on 6/14/24 2:42 PM

A companion Senate bill (S.4398) to the RISE Act introduced last fall in the House (H.R.6007) has been introduced. The RISE Act expands the tax credit available for starting retirement savings plans for very small businesses.

Topics: Retirement Legislation & Regulations Congress SECURE 2.0

2 min read

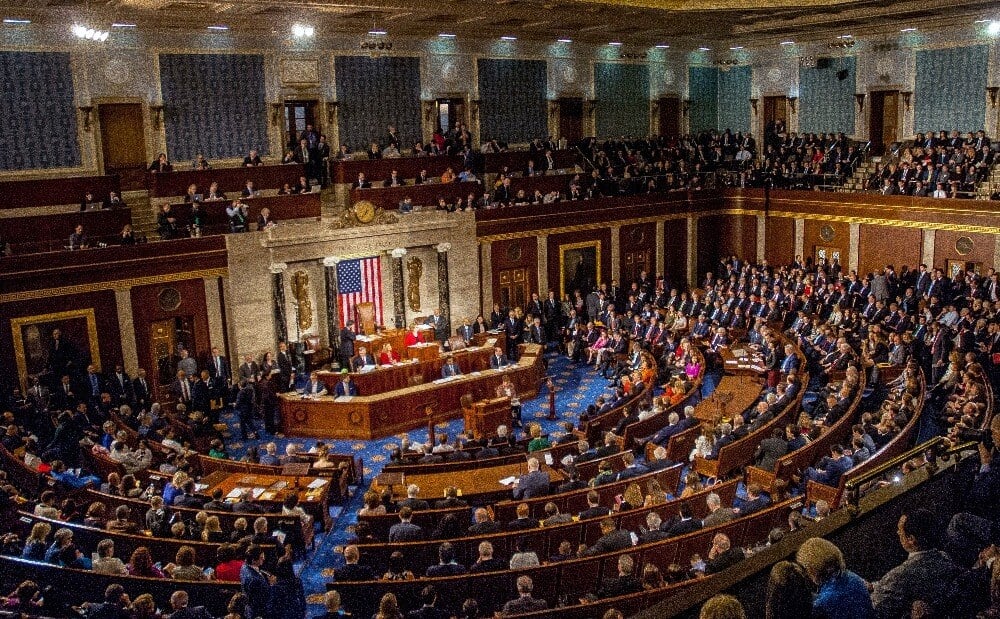

NAIFA Congressional Conference Participants Educate Lawmakers

By NAIFA on 5/15/24 2:02 PM

NAIFA’s May 20-21 Congressional Conference participants will fan out over Capitol Hill to educate lawmakers on key issues impacting NAIFA members and their clients. Several hundred participants from almost every state and Congressional District will also establish and grow the constituent-lawmaker relationships that are so key to favorable legislative outcomes.

Topics: Education Retirement Taxes Financial Literacy Congress Congressional Conference

4 min read

Final Fiduciary Rule Heads to Court

By NAIFA on 5/15/24 2:01 PM

On April 23, the Department of Labor (DOL) finalized its new fiduciary rule and its accompanying amendments to prohibited transaction exemptions (PTEs) 2020-02 and 84-24. The new rules would take effect September 23, but they have already triggered the first of what are likely to be multiple court challenges to them. Those court decisions could impact the effective date. And Congress is likely to vote on a Congressional Review Act (CRA) motion to block the rules, although even if a CRA motion passes both the House and Senate, President Biden will surely veto it.

Topics: Retirement 401(k) SEC Congress DOL Fiduciary

1 min read

Senate HELP Committee Looks at Retirement Plans, Social Security

By NAIFA on 3/15/24 2:48 PM

The Senate Health, Education, Labor, and Pensions (HELP) Committee held a hearing on February 28 to examine how to increase retirement financial security through defined benefit (DB) plans, defined contribution (DC) plans, and Social Security. There was considerable focus on whether the Social Security wage base disproportionately taxes income that makes up the base of Social Security benefits. For example, one witness noted that when Social Security started, the wage base for lower income workers captured 2 percent of income whereas now it now captures 12.4 percent.

Topics: Retirement Federal Advocacy Congress DOL

6 min read

Government JCT Releases Latest Tax Expenditure Report

By NAIFA on 1/16/24 3:25 PM

Last month, Congress’ Joint Committee on Taxation (JCT) released its annual “tax expenditure report.” This is a list of many tax code rules that result in the government not collecting tax on what would otherwise be taxable income. Many of these rules directly benefit life and health insurance, retirement savings, employer-provided benefits, and general investments.

Topics: Retirement Legislation & Regulations Taxes Debt Insurance Congress

2 min read

Treasury Issues Guidance on New Retirement Savings Provisions

By NAIFA on 1/16/24 12:51 PM

On December 20, the Treasury Department issued a “grab bag” of guidance on the new retirement savings rules and opportunities in the SECURE 2.0 retirement savings law enacted late in 2022. Notice 2024-02 covers a dozen of the law’s provisions, in a question-and-answer format.

Topics: Retirement 401(k) SECURE 2.0

1 min read

SECURE 2.0 Technical Corrections Draft Released

By NAIFA on 12/15/23 2:01 PM

On December 6, professional staff to Congress’ retirement savings committees released a draft of their proposed SECURE 2.0 technical corrections package. The committee staff are requesting input from stakeholders to be sure the proposed fixes work, and to provide one last opportunity to add any newly identified errors that need correcting.

Topics: Retirement 401(k) Congress Individual Retirement Accounts SECURE 2.0

2 min read

Treasury Releases Proposed Regulations on Long-Term Part-Time Employees

By NAIFA on 12/15/23 1:29 PM

On November 24, the Treasury Department and the IRS issued proposed regulations implementing the rules of the provision in the SECURE retirement laws that qualifies long-term (those who have worked two years or more for an employer), part-time (those who work at least 500 hours/year) employees to participate in an employer-sponsored retirement savings plan.

Topics: Retirement 401(k) Congress IRS

1 min read

New Retirement Savings Proposals Proliferate

By NAIFA on 12/15/23 1:02 PM

Ideas for the emerging “SECURE 3.0” retirement savings bill—which is still early in the development phase—are beginning to proliferate. Here is a summary of some of the idea's lawmakers are considering for the next-generation retirement savings legislation.

Topics: Retirement

2 min read

IRS Releases Retirement and Benefit Plan Inflation Adjustments

By NAIFA on 11/15/23 12:20 PM

On November 1, the Internal Revenue Service (IRS) released inflation-adjusted retirement and benefits plan contribution limits for 2024. Next year, 401(k) savers will be allowed to contribute $500 more than they can in 2023.

Topics: Retirement 401(k) IRS

4 min read

Pending Regulations Impact NAIFA

By NAIFA on 10/16/23 12:19 PM

There is a slew of pending regulations on such issues as the fiduciary rule, retirement savings, and health insurance nearing release. Below is a summary of some of the ones that will have the most impact.

Topics: Retirement Legislation & Regulations DOL

1 min read

ESG Rules Trigger Congressional, Judicial Attention

By NAIFA on 10/16/23 11:49 AM

A Texas judge has ruled against a challenge to Biden Administration environmental, social, and governance (ESG) rules that allow fiduciaries to consider ESG factors in selecting retirement plan investment choices. House action to roll back the rules is pending.

Topics: Retirement Planning Retirement Legislation & Regulations Investing

2 min read

Roth Rule Catch-Up Contribution Notice Resolves Some Effective Date Issues

By NAIFA on 9/15/23 2:08 PM

In Notice 2023-62, the IRS and Treasury clarified that many catch-up contributions for 2024-2025 will not have to be Roth contributions for taxpayers earning $145,00/year or more.

Topics: Retirement Legislation & Regulations Federal Advocacy IRS SECURE 2.0

2 min read

EBSA Sends New Fiduciary Proposal to White House for Review

By NAIFA on 9/15/23 2:06 PM

On September 8, the Department of Labor’s (DOL’s) Employee Benefits Security Administration (EBSA) sent to the White House’s Office of Information and Regulatory Affairs (OIRA) a notice of proposed rulemaking (NPRM) on new fiduciary duty rules applicable to advisors on retirement savings. Details of what the agency is proposing are as yet unknown, but speculation suggests its focus is on insurance-related advice, and on rollovers from retirement plans to individual IRAs.

Topics: Retirement Legislation & Regulations Federal Advocacy DOL

2 min read

Retirement Plan Sponsors Seek Delay in Catch-Up Contribution Rule

By NAIFA on 7/14/23 5:30 AM

A coalition of more than 150 retirement savings plan sponsors and their allies in the retirement savings community is asking both Congress and the Treasury Department for a delay in the 2024 effective date of the SECURE 2.0 rule that requires individuals earning more than $145,000/year to make their retirement plan catch-up contributions on a Roth basis.

.png?width=600&height=90&name=Support%20IFAPAC%20%20(600%20%C3%97%2090%20px).png)