In the wee morning hours of March 23—just two hours after the midnight March 22 deadline—Congress completed the fraught process of funding the federal government’s discretionary spending for fiscal year (FY) 2024—six months after FY 2024 began this past October 1. President Biden signed the measure into law the same day. Despite hard lobbying, the final funding package excluded a rider that would have stopped the Department of Labor’s (DOL) work on its fiduciary rule.

3 min read

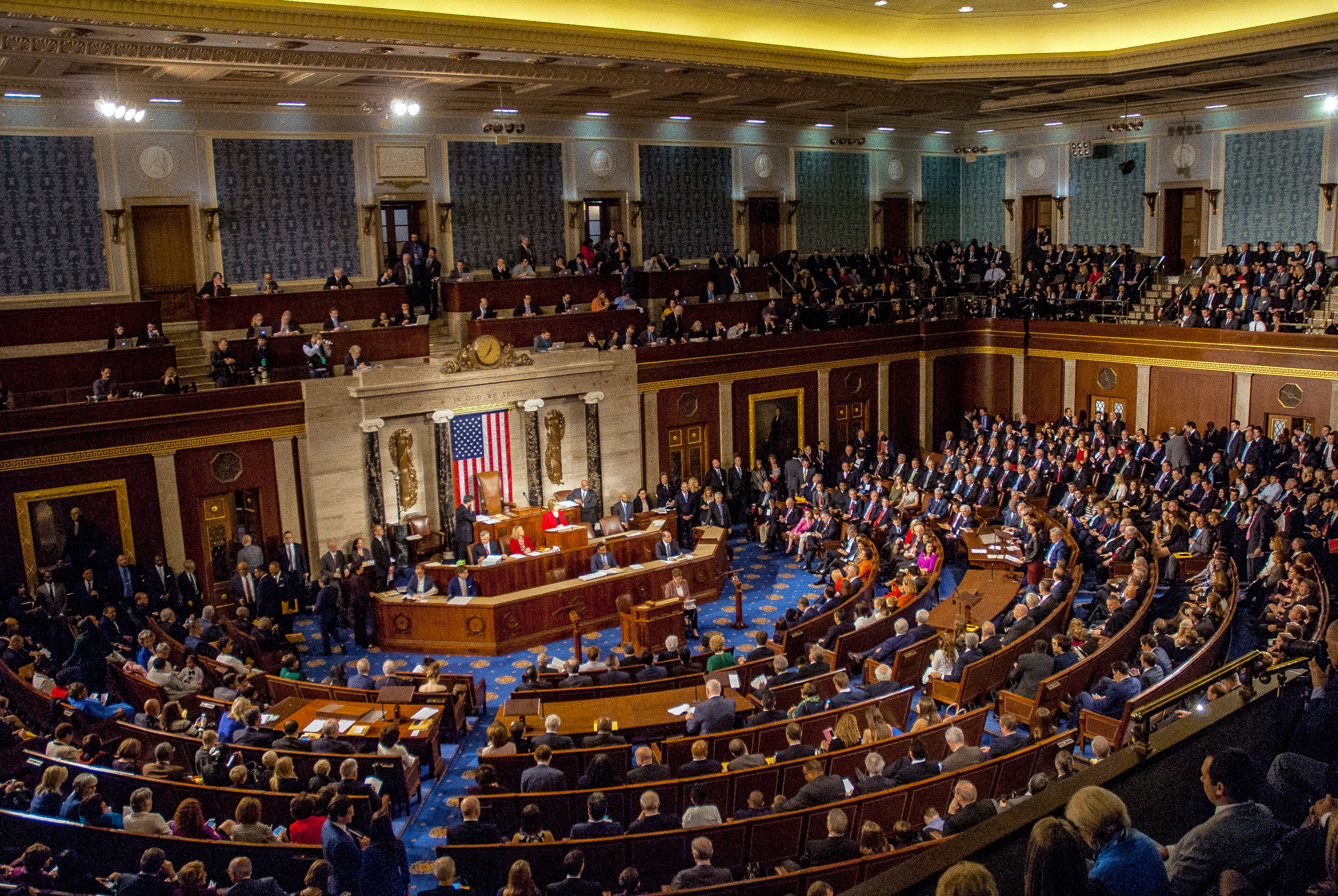

FY 2024 Government Funding Complete without Fiduciary Rider

By NAIFA on 4/15/24 3:57 PM

Topics: Legislation & Regulations Congress DOL Fiduciary

2 min read

CMS/DOL/Treasury Finalize Short-Term Limited Duration Health Insurance Rule

By NAIFA on 4/15/24 3:35 PM

On March 28, the Departments of Labor (DOL), Health and Human Services’ (HHS’) Centers for Medicare and Medicaid Services (CMS), and Treasury released a final short-term limited-duration (STLD) health insurance rule. It retains the proposed rule’s new limits of three months duration, with a four-month renewal option for this kind of insurance.

Topics: Legislation & Regulations Affordable Care Act CMS Congress DOL

2 min read

Ways & Means Holds Hearing on TCJA and Its Expiring Tax Cuts

By NAIFA on 4/15/24 3:29 PM

The tax-writing House Ways & Means Committee held a hearing on April 11 on the TCJA and its expiring individual and estate tax provisions. Predictably, the hearing showcased GOP support for extending the TCJA’s individual and estate tax rules that expire at the end of 2025. Democrats, on the other hand, called for more taxes to be paid by corporations and “the rich.”

Topics: Legislation & Regulations Taxes Congress

2 min read

Senate Opposition Grows to Quick Vote on House-Passed Tax Bill

By NAIFA on 4/15/24 3:17 PM

Republican Senators are growing increasingly reluctant to vote any time soon on the House-passed bill that would, among other things, allow for more generous business equipment depreciation and business loan interest deductibility. The bill would need 60 votes, and therefore at least ten Republicans, to pass the Senate. However, some key GOP Senators are demanding changes, while others urge waiting until next year when they think they will be in a stronger position.

Topics: Legislation & Regulations Taxes Congress

2 min read

House Advances Effort to Block the Final Worker Classification Rule

By NAIFA on 4/15/24 3:10 PM

A bicameral GOP resolution to block the Department of Labor’s (DOL’s) now-final worker classification rule has been introduced. On March 21, the House Education and the Workforce Committee approved a Congressional Review Act (CRA) motion to block the rule.

Topics: Legislation & Regulations CMS Congress DOL

1 min read

CMS Releases ACA Marketplace Rules for 2025

By NAIFA on 4/15/24 3:05 PM

On April 2, the Centers for Medicare, and Medicaid Services (CMS) released its final rules for Affordable Care Act (ACA) marketplaces for 2025. The rules include the requirements applicable to advisors who work with participants in ACA marketplace insurance.

Topics: Legislation & Regulations CMS Congress

1 min read

Senate and House Democrats Reintroduce Bicameral Wealth Tax Bill

By NAIFA on 4/15/24 2:54 PM

Sen. Elizabeth Warren (D-MA) and Reps. Pramila Jayapal (D-WA) and Brendan Boyle (D-PA) have reintroduced their wealth tax legislation that would impose increased tax liability on the ultra-wealthy. The bill would impact taxpayers with household income in excess of $50 million.

Topics: Legislation & Regulations Taxes Congress

2 min read

Bicameral, Bipartisan National Privacy Proposal Released

By NAIFA on 4/15/24 2:47 PM

On April 7, Sen. Maria Cantwell (D-WA) and Rep. Cathy McMorris Rodgers (R-WA) released a proposed national privacy standard. Sen. Cantwell and Rep. McMorris Rodgers chair the committees with jurisdiction over the proposal and so, although its enactment is a long shot this year, it is a proposal that privacy rights interests are taking very seriously.

Topics: Legislation & Regulations Congress Privacy

2 min read

Democrats Offer Federal Paid Leave, Shortened Workweek Bills

By NAIFA on 4/15/24 2:39 PM

Democrats have offered one bill to create a federal paid leave program and another to shorten the standard workweek to 32 hours.

Topics: Legislation & Regulations Congress

2 min read

DOL Issues Final QPAM Rule

By NAIFA on 4/15/24 2:24 PM

On April 2, the Department of Labor (DOL) finalized its qualified plan asset manager (QPAM) rule. The rule is an amendment to prohibited transaction exemption (PTE) 84-14. The rule, which imposes broad disqualifying provisions on retirement plan asset managers who have been convicted of financial crime, takes effect June 17, 2024.

Topics: Retirement Plans Congress DOL

1 min read

DOL Extends Comment Period for SECURE 2.0 Reporting/Disclosure Rules

By NAIFA on 4/15/24 2:14 PM

The Department of Labor’s (DOL’s) Employee Benefits Security Administration (EBSA) and the Treasury Department have announced an extension, from April 22 to May 22, 2024, of the deadline for responses to its request for information (RFI) on the effectiveness of SECURE 2.0’s notice and disclosure requirements.

Topics: Congress DOL SECURE 2.0

1 min read

Proposed Fiduciary Rule Goes to White House for Final Review

By NAIFA on 3/15/24 5:01 PM

On March 8, the Department of Labor (DOL) sent to the Office of Information and Regulatory Affairs (OIRA) for review its proposed new fiduciary rule. This is the last step in the regulatory process prior to finalization of a rule. OIRA is an agency within the Office of Management and Budget (OMB), a White House agency.

Topics: Legislation & Regulations Congress DOL

1 min read

Six of 12 Government Funding Bills Now Law-Partial Shutdown Averted

By NAIFA on 3/15/24 4:42 PM

Congress has passed, and President Biden has signed into law a “minibus” government funding bill that provides discretionary funding for six of the 12 required appropriations bills for fiscal year (FY) 2024. The new funding law, H.R.4366, does not include the industry-sought rider to prevent the Department of Labor (DOL) from further work on its proposed new fiduciary rule.

Topics: Legislation & Regulations Congress DOL

6 min read

Biden Budget: $4.9 Trillion in Tax Increases, Some Hit Life Insurance

By NAIFA on 3/15/24 4:27 PM

The $7.3 trillion Fiscal Year (FY) 2025 Biden budget proposal, released March 11, includes $4.9 trillion in new taxes—mostly in corporate and “tax the rich” proposals—with $3 trillion of that allocated to deficit reduction. The budget spending proposals for FY 2025 are in line with the spending targets set in last year’s Fiscal Responsibility Act (FRA). According to the budget documents, it would reduce the deficit by some $3 trillion over ten years.

Topics: Legislation & Regulations Taxes Congress

3 min read

House-Passed Tax Bill Stalls in the Senate

By NAIFA on 3/15/24 4:15 PM

The House passed H.R.7024, a tax bill that would enhance several key business tax rules as well as the child tax credit, has hit a hurdle in the Senate. A key Senator (GOP leader of the Finance Committee) and a number of his colleagues want changes to the bill before they will support it.

Topics: Legislation & Regulations Congress

2 min read

Congressional Action to Stop Worker Classification Rule on Tap

By NAIFA on 3/15/24 4:06 PM

A bicameral GOP resolution to block the Department of Labor’s (DOL’s) now-final worker classification rule has been introduced. Votes on it in both the House and Senate are expected later this month.

Topics: Legislation & Regulations Congress DOL

2 min read

Senate Finance Committee Chair Vows to Stop Private Placement Life Insurance

By NAIFA on 3/15/24 3:50 PM

Sen. Ron Wyden (D-OR), chair of the tax-writing Senate Finance Committee, has vowed to stop use of private placement life insurance (PPLI) as a tax shelter. He calls PPLI a “$40 billion tax shelter.” Sen. Wyden conducted an 18-month investigation into PPLI and said the results of the investigation prove that PPLI is used only by the ultra-wealthy and serves little to no true-life insurance purpose. Instead, he said, it is no more than a tax shelter for the ultra-wealthy that is not generally available.

Topics: Legislation & Regulations Congress

1 min read

Key House Tax Writers Introduce Bill to Expand HSA, FSA Fund Uses

By NAIFA on 3/15/24 3:42 PM

On February 5, Reps. Vern Buchanan (R-FL) and Mike Thompson (D-CA), both senior members of the tax-writing House Ways & Means Committee, introduced legislation that would allow use of health savings account (HSA) and flexible spending arrangement (FSA) funds to pay parents’ medical expenses. The Lowering Costs for Caregivers Act, H.R.7222, removes the requirement that parents be dependents for tax purposes before HSA/FSA money can be used to pay their medical expenses on a tax-free basis.

Topics: Legislation & Regulations Congress

2 min read

House Hearing Lambasts DOL’s Proposed Fiduciary Rule

By NAIFA on 3/15/24 3:35 PM

On February 14, a subcommittee of the House Education & the Workforce Committee held a hearing on the Department of Labor’s (DOL’s) proposed new fiduciary rule. Generally, most witnesses and the subcommittee’s Republicans lambasted the proposed rule, saying it would adversely impact retirement savers.

Topics: Legislation & Regulations SEC Congress DOL NAIC Regulation Best Interest

1 min read

Bill to Block DOL’s Proposed Overtime Rule Introduced

By NAIFA on 3/15/24 2:59 PM

A House Republican has introduced legislation to prevent the Department of Labor (DOL) from finalizing its proposed rule modifying the white-collar exemption to Fair Labor Standards Act’s (FLSA’s) minimum wage and overtime (OT) rules. On February 15, Rep. Eric Burlison (R-MO) introduced H.R.7367, the Overtime Pay Flexibility Act.

.png?width=600&height=90&name=Support%20IFAPAC%20%20(600%20%C3%97%2090%20px).png)