In Moore v. United States, the Supreme Court (SCOTUS) sidestepped the question of whether it is constitutional to tax unrealized income—but four opinions (two concurring and two dissenting) suggest that at least four of the current SCOTUS justices might in another case find it is unconstitutional to tax income until it is realized.

2 min read

Supreme Court Decision Casts Doubt on Wealth Tax Proposals

By NAIFA on 7/15/24 4:35 PM

Topics: Legislation & Regulations Taxes Congress SCOTUS

2 min read

Tax Bill Preparation Continues

By NAIFA on 7/15/24 4:34 PM

Both House and Senate tax writers continue their preparations for the 2025 tax bill. More potential targets for revenue-raising tax provisions have emerged.

Topics: Legislation & Regulations Taxes Congress

1 min read

Bicameral Motions to Block White-Collar Exemption to the OT Rule Introduced

By NAIFA on 7/15/24 4:34 PM

Last month Republican lawmakers introduced motions to block the new rule raising the salary threshold for the white-collar exemption to the Fair Labor Standards Act (FLSA) overtime (OT) rule. Rep. Tim Walberg (R-MI) introduced the Congressional Review Act (CRA) motion in the House; Sen. Mike Braun (R-IN) introduced it in the Senate.

Topics: Legislation & Regulations Congress DOL SCOTUS

2 min read

IRS Says Most ERTC Claims Show Risk of Being Improper

By NAIFA on 7/15/24 4:33 PM

On June 20, the Internal Revenue Service (IRS) said the 1.4 million pending employee retention tax credit (ERTC) claims are getting continued heightened scrutiny, with “the vast majority” of them showing risk of being improper. The agency announced it had completed a detailed review of the pending claims in order to protect taxpayers and small businesses, and said it resulted in plans to deny tens of thousands of improper high-risk ERTC claims. Now, the IRS has started a new round of processing lower-risk claims to help eligible taxpayers.

Topics: Legislation & Regulations Congress IRS

2 min read

House Committee Approves Bill to Expand 529 Plans

By NAIFA on 7/15/24 4:32 PM

On July 9, the House Ways & Means Committee approved legislation, H.R.8915, to expand the kinds of education-related expenses that can be paid tax-free from a 529 plan. Among the bill’s provisions is one that would allow NAIFA members to use 529 funds for professional certifications or programs connected with obtaining a postsecondary credential, including those required to obtain a state license.

Topics: Legislation & Regulations Congress

1 min read

Legislation to Block Fiduciary Rule Introduced in both House and Senate

By NAIFA on 6/14/24 2:45 PM

Congressional Review Act (CRA) resolutions to block the Department of Labor’s (DOL’s) newly finalized fiduciary rule have been introduced in both the House and Senate. It appears the motion may pass, but President Biden is virtually certain to veto it if it does pass.

Topics: Congress DOL Fiduciary

3 min read

House, Senate GOP Tax Writers Begin Focused Work on Major 2025 Tax Bill

By NAIFA on 6/14/24 2:44 PM

House Ways & Means Committee Republicans have formed ten issue-specific “tax teams” to work on what to include in the looming 2025 major tax bill. Senate Finance Committee Republicans will tackle these issues in six “working groups.” Both say they “may” include Democrats in their deliberations at some point, but for now, it is an all-GOP effort.

Topics: Education Legislation & Regulations Taxes Debt Congress

2 min read

Revenue Looks to Become a Major Element of 2025 Tax Bill

By NAIFA on 6/14/24 2:43 PM

Recurring revenue estimates of the cost of extending the expiring 2017 tax cuts suggest that revenue will play a major role in the debate over the upcoming tax bill in 2025. After at least five revenue estimates, all covering a 10-year period that includes 2028, projections of the revenue lost due to current tax rules keep going up.

Topics: Legislation & Regulations Taxes Debt Congress NAIFA

1 min read

RISE Act Introduced in the Senate

By NAIFA on 6/14/24 2:42 PM

A companion Senate bill (S.4398) to the RISE Act introduced last fall in the House (H.R.6007) has been introduced. The RISE Act expands the tax credit available for starting retirement savings plans for very small businesses.

Topics: Retirement Legislation & Regulations Congress SECURE 2.0

1 min read

House-Passed Tax Bill Remains Stalled in the Senate

By NAIFA on 6/14/24 2:40 PM

The House-passed tax bill, H.R.7024, remains stalled in the Senate. However, its chief Senate sponsor, Sen. Ron Wyden (D-OR), says the bill is not dead. Sen. Wyden says he continues to work with Senate leadership to schedule Senate floor time on the bill.

Topics: Legislation & Regulations Taxes Congress

2 min read

GOP Senator Seeks Input on Providing Benefits for Independent Contractors

By NAIFA on 6/14/24 2:39 PM

Sen. Bill Cassidy (R-LA) has asked for public comments on how to amend current law to allow companies to provide benefits to their independent contractor workers who are not employees. Sen. Cassidy is ranking member of the Senate Health, Education, Labor, and Pensions (HELP) Committee, the committee with jurisdiction over ERISA’s non-tax pension/retirement savings issues. He also serves on the Senate Finance Committee, which has jurisdiction over ERISA’s and other retirement savings tax issues.

Topics: Legislation & Regulations Congress

1 min read

LIMRA Study Shows Pension Risk Transfers Skyrocket

By NAIFA on 6/14/24 2:37 PM

A study released on June 6 by the Life Insurance Marketing and Research Association (LIMRA) shows a 25 percent increase in pension risk transfer contracts in the first quarter of this year. A LIMRA statement discussing the study pointed to a record $14.6 billion in 146 contracts in companies shifting their lifetime pension obligations to annuities.

Topics: LIMRA Congress DOL Fiduciary

2 min read

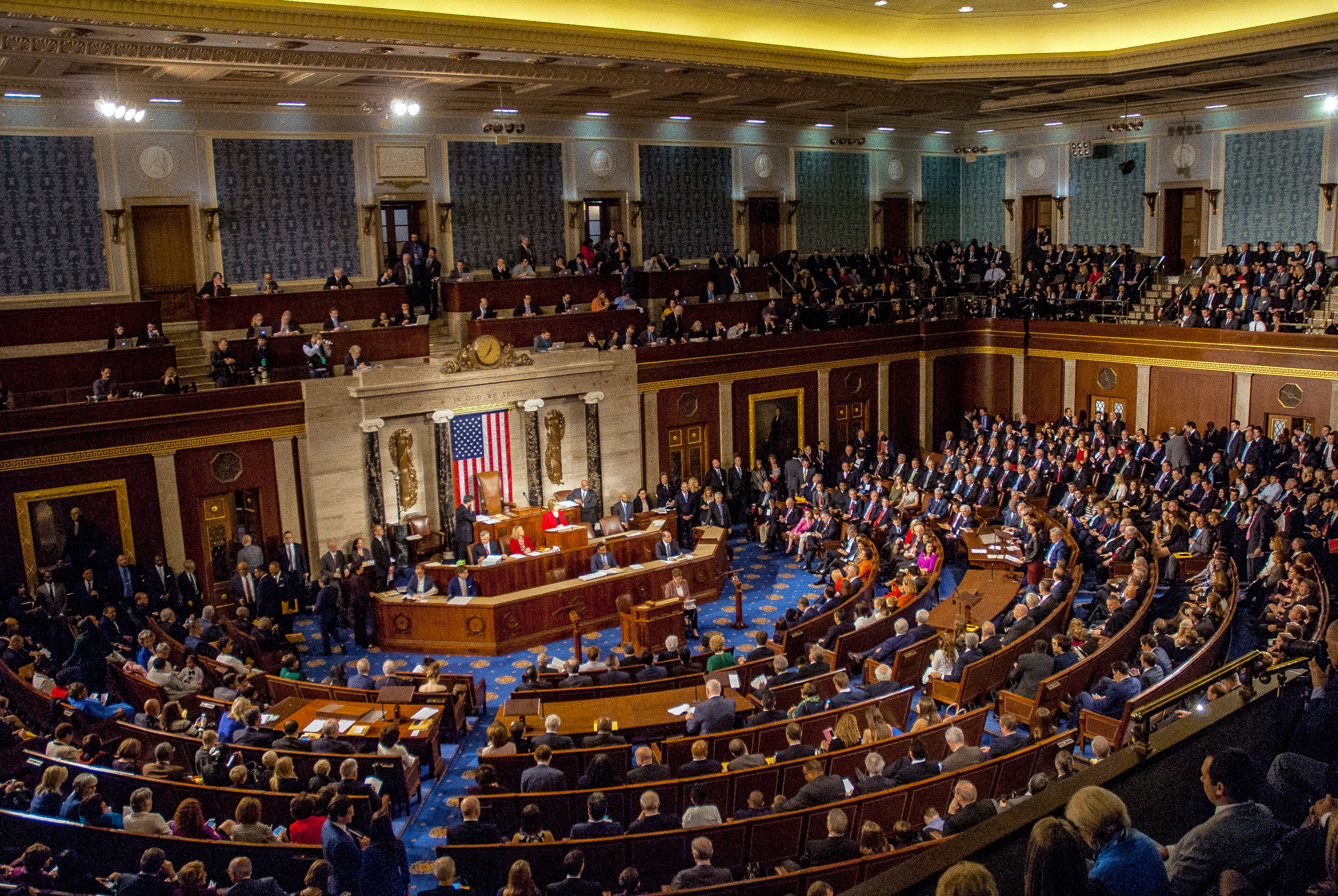

NAIFA Congressional Conference Participants Educate Lawmakers

By NAIFA on 5/15/24 2:02 PM

NAIFA’s May 20-21 Congressional Conference participants will fan out over Capitol Hill to educate lawmakers on key issues impacting NAIFA members and their clients. Several hundred participants from almost every state and Congressional District will also establish and grow the constituent-lawmaker relationships that are so key to favorable legislative outcomes.

Topics: Education Retirement Taxes Financial Literacy Congress Congressional Conference

4 min read

Final Fiduciary Rule Heads to Court

By NAIFA on 5/15/24 2:01 PM

On April 23, the Department of Labor (DOL) finalized its new fiduciary rule and its accompanying amendments to prohibited transaction exemptions (PTEs) 2020-02 and 84-24. The new rules would take effect September 23, but they have already triggered the first of what are likely to be multiple court challenges to them. Those court decisions could impact the effective date. And Congress is likely to vote on a Congressional Review Act (CRA) motion to block the rules, although even if a CRA motion passes both the House and Senate, President Biden will surely veto it.

Topics: Retirement 401(k) SEC Congress DOL Fiduciary

2 min read

Impending Major Tax Bill Raises Multiple, Difficult Issues

By NAIFA on 5/15/24 1:59 PM

There will be a major tax bill in 2025, as both Republicans and Democrats contend with the looming expiration of most of the current tax code’s individual and estate tax rules. Scheduled for expiration at the end of 2025 are income and capital gains tax rates for individuals as well as the current $12+ million exemption from the estate tax. Tax policy will play a key role in the debate, but so will revenue—the cost of extending the 2017 rules is astronomical. And lawmakers are already looking at other tax issues—like, for example, the corporate tax rate—that are not scheduled to expire but are intrinsic to both tax policy and revenue issues.

Topics: Taxes Debt Congress

2 min read

Ways & Means Questions Treasury Secretary Yellen on Biden Budget, Impending Tax Bill

By NAIFA on 5/15/24 1:55 PM

The House Ways & Means Committee held a hearing on April 30 with Treasury Secretary Janet Yellen as the sole witness. The hearing focused on the Biden budget tax proposals, and on the issues surrounding the scheduled expiration of the 2017 individual and estate tax rules.

Topics: Legislation & Regulations Taxes Congress

1 min read

Annuities in the Crosshairs

By NAIFA on 5/15/24 1:52 PM

Not only are fixed annuities now within the scope of the final fiduciary rule, but also a key tax writer is seeking information from the 12 biggest annuity writers about how annuities are sold. It appears that annuities are approaching being at the center of both Congressional and regulatory attention.

Topics: Legislation & Regulations SEC Congress Fiduciary Mass Mutual

2 min read

Education & the Workforce Has Hearing on Benefits for Independent Contractors

By NAIFA on 5/15/24 1:48 PM

The House Education & the Workforce’s Subcommittee on Workforce Protections held a hearing last month on how to allow states and companies to provide independent contractors with employer-provided benefits without causing them to be classified as employees. Subcommittee Chairman Rep. Kevin Kiley (R-CA) said at the hearing that he is working on legislation to achieve this result.

Topics: Legislation & Regulations Congress

1 min read

DOL Finalizes White-Collar Exemption to Overtime Rules

By NAIFA on 5/15/24 1:45 PM

The long-awaited final rule on the white-collar exception from the Fair Labor Standards Act’s (FLSA’s) overtime rules was released last month. The new rule significantly increases the salary threshold below which the white-collar exception does not apply and provides for automatic adjustments to the salary threshold every three years.

Topics: Legislation & Regulations Congress DOL

2 min read

Social Security/Medicare Trustees Issue Annual Report

By NAIFA on 5/15/24 1:37 PM

On May 6, the Social Security and Medicare trust fund trustees issued their annual report. The report predicts a financial crisis for the funds within 10 years, unless Congress intervenes before then.

.png?width=600&height=90&name=Support%20IFAPAC%20%20(600%20%C3%97%2090%20px).png)