The Department of Labor (DOL) has dropped its appeal of the court decision staying implementation of the agency’s fiduciary rule. This is a clear and important win for NAIFA. NAIFA along with four of its Texas chapters, the American Council of Life Insurance, and several other trade associations are plaintiffs in the lawsuit.

1 min read

DOL Drops Its Appeal of Overturned Fiduciary Rule

By NAIFA on 12/15/25 1:59 PM

Topics: Advocacy DOL Fiduciary

1 min read

Fiduciary Rule Effective Date Remains Stayed Pending Decision on Cases’ Merits

By NAIFA on 9/16/24 3:39 PM

Two federal district courts in Texas stayed (blocked) the new fiduciary rule’s September 23 effective date. Those stays remain in effect, pending the outcome of the courts’ decisions on the cases’ merits or whether the Department of Labor (DOL) decides to appeal the stays and is successful.

Topics: DOL Fiduciary

2 min read

Texas District Courts Stay Fiduciary Rule Effective Date

By NAIFA on 8/15/24 10:29 AM

Two federal district courts in Texas have blocked enforcement of the Department of Labor’s (DOL’s) fiduciary-only rule. The rule’s September 23 effective date was enjoined (blocked) by the Texas Eastern District Court on July 26, and then one day later stayed (stopped) by the Texas Northern District Court. NAIFA and several of its chapters are among the plaintiffs in the Northern District court case.

Topics: DOL Fiduciary

1 min read

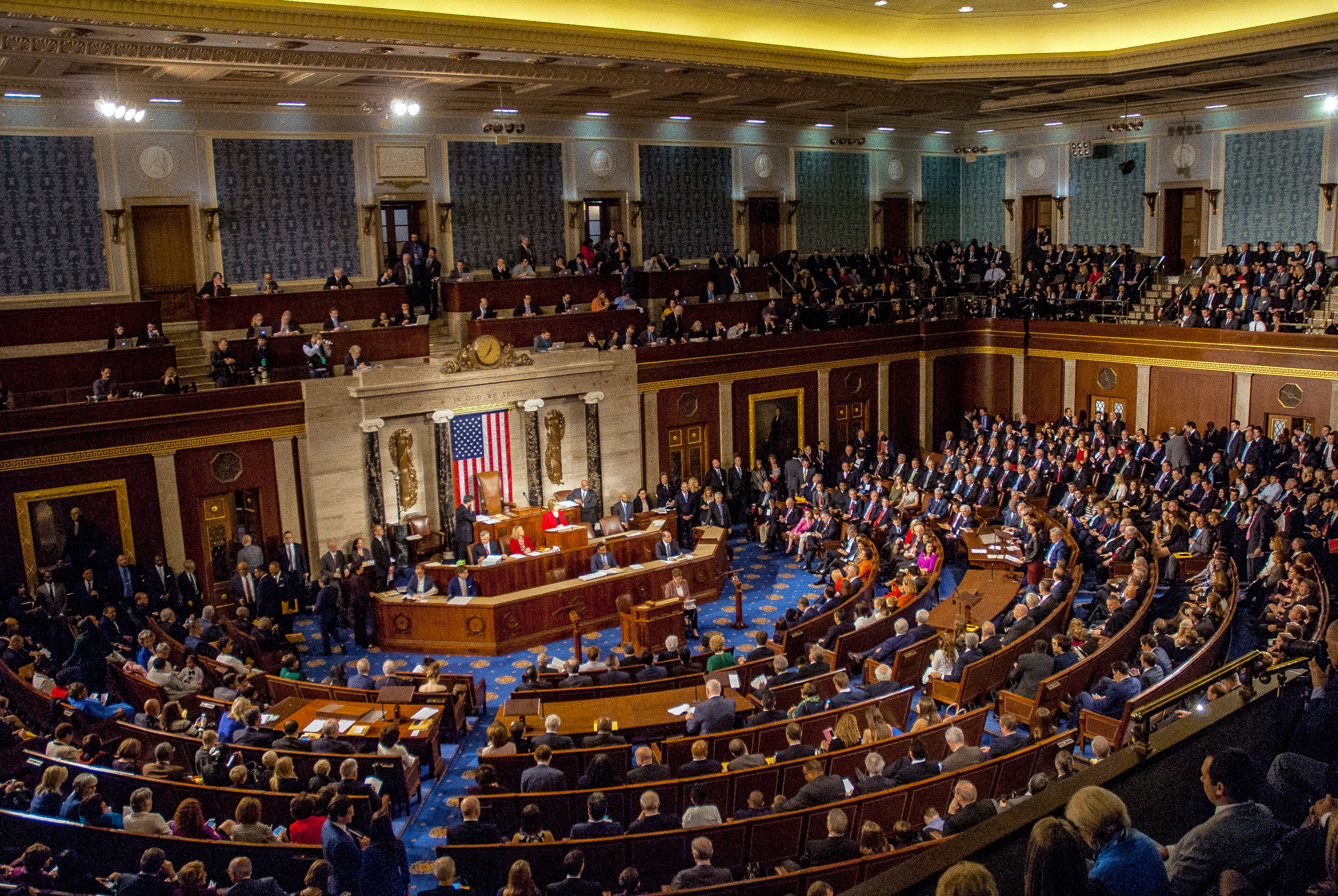

House Committee Approves, Sends to House Floor, Resolution to Block Fiduciary Rule

By NAIFA on 7/15/24 4:38 PM

On July 10, the House Education and Workforce Committee approved a Congressional Review Act (CRA) resolution to block the Department of Labor’s (DOL’s) new fiduciary-only rule. The CRA resolution, H.J.Res.142, would “disapprove the rule submitted by the Department of Labor relating to “Retirement Security by Rule: Definition of an Investment Advice Fiduciary (89 Fed. Reg. 32122 (April 25, 2024)), and such rule shall have no force or effect.”

Topics: Legislation & Regulations Congress DOL Fiduciary

2 min read

NAIFA, ACLI Sue to Overturn New Fiduciary Rule

By NAIFA on 6/14/24 2:45 PM

On May 24, a group of nine industry organizations, including NAIFA and the American Council of Life Insurers (ACLI), filed a lawsuit seeking to overturn the Department of Labor’s (DOL’s) newly finalized fiduciary rule. Joining NAIFA and ACLI in the lawsuit are NAIFA-Texas, NAIFA-Fort Worth, NAIFA-Dallas, NAIFA-Piney Woods of East Texas, the National Association of Fixed Annuities (NAFA), the Insured Retirement Institute (IRI), and Finseca.

Topics: SEC DOL Fiduciary NAIFA

1 min read

Legislation to Block Fiduciary Rule Introduced in both House and Senate

By NAIFA on 6/14/24 2:45 PM

Congressional Review Act (CRA) resolutions to block the Department of Labor’s (DOL’s) newly finalized fiduciary rule have been introduced in both the House and Senate. It appears the motion may pass, but President Biden is virtually certain to veto it if it does pass.

Topics: Congress DOL Fiduciary

1 min read

LIMRA Study Shows Pension Risk Transfers Skyrocket

By NAIFA on 6/14/24 2:37 PM

A study released on June 6 by the Life Insurance Marketing and Research Association (LIMRA) shows a 25 percent increase in pension risk transfer contracts in the first quarter of this year. A LIMRA statement discussing the study pointed to a record $14.6 billion in 146 contracts in companies shifting their lifetime pension obligations to annuities.

Topics: LIMRA Congress DOL Fiduciary

4 min read

Final Fiduciary Rule Heads to Court

By NAIFA on 5/15/24 2:01 PM

On April 23, the Department of Labor (DOL) finalized its new fiduciary rule and its accompanying amendments to prohibited transaction exemptions (PTEs) 2020-02 and 84-24. The new rules would take effect September 23, but they have already triggered the first of what are likely to be multiple court challenges to them. Those court decisions could impact the effective date. And Congress is likely to vote on a Congressional Review Act (CRA) motion to block the rules, although even if a CRA motion passes both the House and Senate, President Biden will surely veto it.

Topics: Retirement 401(k) SEC Congress DOL Fiduciary

1 min read

Annuities in the Crosshairs

By NAIFA on 5/15/24 1:52 PM

Not only are fixed annuities now within the scope of the final fiduciary rule, but also a key tax writer is seeking information from the 12 biggest annuity writers about how annuities are sold. It appears that annuities are approaching being at the center of both Congressional and regulatory attention.

Topics: Legislation & Regulations SEC Congress Fiduciary Mass Mutual

3 min read

FY 2024 Government Funding Complete without Fiduciary Rider

By NAIFA on 4/15/24 3:57 PM

In the wee morning hours of March 23—just two hours after the midnight March 22 deadline—Congress completed the fraught process of funding the federal government’s discretionary spending for fiscal year (FY) 2024—six months after FY 2024 began this past October 1. President Biden signed the measure into law the same day. Despite hard lobbying, the final funding package excluded a rider that would have stopped the Department of Labor’s (DOL) work on its fiduciary rule.

Topics: Legislation & Regulations Congress DOL Fiduciary

2 min read

NAIFA Meets with OIRA on DOL’s Proposed Fiduciary Rule; OIRA Returns Rule to DOL

By NAIFA on 4/15/24 3:44 PM

On April 10, NAIFA met with the White House’s Office of Information and Regulatory Affairs (OIRA) to express the association’s concerns about the Department of Labor’s (DOL’s) proposed fiduciary rule. NAIFA reiterated its long-standing opposition to the rule, citing its probable impact on the accessibility and affordability of professional investment advice for middle-American retirement savers. Late that afternoon, OIRA sent the proposed rule back to DOL for finalization, canceling at least two subsequent previously scheduled stakeholder meetings.

Topics: Legislation & Regulations Retirement Plans DOL Fiduciary

3 min read

Battle to Kill the Fiduciary-Only Rule Heats Up

By NAIFA on 1/16/24 3:33 PM

Repeating their testimony at a DOL hearing last month in comments submitted to DOL, industry advocates told a January 10 House hearing that the DOL’s fiduciary-only proposed regulations must be withdrawn. Fifty House members wrote to DOL demanding the rule’s withdrawal. DOL must sift through 19,000+ comments on the rule.

Topics: Legislation & Regulations Congress DOL NAIC Fiduciary

3 min read

Congress Returns to Difficult Times

By NAIFA on 1/16/24 3:25 PM

When the first session of the 118th Congress ended last month, lawmakers left undone controversial and pressing business that will make January a difficult month. Pending are government funding, international aid, and expiring law issues on which there is as yet little or no consensus. Caught in the crosshairs are a tax package with provisions of interest to NAIFA members, extension of the National Flood Insurance Program (NFIP), and proposals to defund regulatory initiatives like the fiduciary-only rule.

Topics: Legislation & Regulations Taxes Congress DOL SECURE 2.0 Fiduciary

4 min read

NAIFA’s Moore Comments on DOL’s Fiduciary-Only Proposal at NAIC Meeting

By NAIFA on 1/16/24 12:26 PM

At the NAIC’s Fall Meeting in Orlando, Florida (November 30 – December 3), NAIFA’s Policy Director Roger Moore testified against the Department of Labor’s proposed fiduciary-only rule during the Life and Annuities (A) Committee meeting, commenting that the rule will harm lower- and middle-income families. Moore was joined by representatives from coalition partners in expressing strong support for the NAIC’s efforts opposing DOL’s actions.

Topics: Legislation & Regulations Congress DOL NAIC Fiduciary

7 min read

DOL Proposes New Fiduciary Rule: Initial Reaction Is Intense

By NAIFA on 11/15/23 2:05 PM

On October 31, the Department of Labor (DOL) released its new proposed fiduciary rule (which they renamed the retirement security rule). The proposal triggered immediate and intense opposition from NAIFA and from most of the retirement savings community.

Topics: DOL Fiduciary

1 min read

EBSA Head Predicts Changes to Fiduciary Rule

By NAIFA on 8/14/23 3:52 PM

Employee Benefits Security Administration (EBSA) head Lisa Gomez is predicting changes to the Department of Labor’s (DOL’s) fiduciary rule due to “changes in the marketplace since 1975.” She noted, though, that EBSA is also considering the litigation that has overruled previous attempts by EBSA to change the fiduciary rule, especially in connection with advice on rollovers.

Topics: Legislation & Regulations Standard of Care & Consumer Protection DOL Fiduciary

2 min read

NCOIL Supports Resolution Opposing Fiduciary Rule Change

By NAIFA on 8/14/23 3:43 PM

On July 21, the National Conference of Insurance Legislators (NCOIL) adopted a NAIFA-backed resolution to oppose any new fiduciary rule from the U.S. Department of Labor (DOL). The decision came in part as a result of NAIFA testimony highlighting why no change to current fiduciary rules is necessary.

Topics: Standard of Care & Consumer Protection Interstate Advocacy DOL NCOIL Fiduciary

1 min read

DOL Appeals Florida Court Ruling that Overturns Fiduciary Rule Guidance

By NAIFA on 5/15/23 7:00 AM

On April 14, the U.S. Department of Labor (DOL) filed a notice of appeal to the 11th Circuit Court of Appeals on a Florida District Court ruling (American Securities Association v. United States Department of Labor) that struck down parts of the agency’s sub-regulatory guidance on the applicability of the fiduciary standard to advice on rolling over ERISA plan retirement funds into IRAs.

.png?width=600&height=90&name=Support%20IFAPAC%20%20(600%20%C3%97%2090%20px).png)