At the NAIC’s Fall Meeting in Orlando, Florida (November 30 – December 3), NAIFA’s Policy Director Roger Moore testified against the Department of Labor’s proposed fiduciary-only rule during the Life and Annuities (A) Committee meeting, commenting that the rule will harm lower- and middle-income families. Moore was joined by representatives from coalition partners in expressing strong support for the NAIC’s efforts opposing DOL’s actions.

At the NAIC’s Fall Meeting in Orlando, Florida (November 30 – December 3), NAIFA’s Policy Director Roger Moore testified against the Department of Labor’s proposed fiduciary-only rule during the Life and Annuities (A) Committee meeting, commenting that the rule will harm lower- and middle-income families. Moore was joined by representatives from coalition partners in expressing strong support for the NAIC’s efforts opposing DOL’s actions.

Additionally, as announced at the NAIC meeting, Moore will represent NAIFA on the National Insurance Producer Registry Board of Directors, where his position can enhance the organization’s ongoing advocacy efforts in support of new services and make it easier for members to comply with state-based producer regulations. Moore was also elected for a two-year term to represent NAIFA on the Interstate Insurance Product Regulation Commission’s Industry Advisory Committee.

At the meeting, the NAIC Committees discussed multiple topics of interest to NAIFA, most notably:

- DOL’s fiduciary-only rule;

- The Center for Medicare and Medicaid Services’ recent proposal altering payment structures for brokers and agents selling Medicare Advantage and Part D plans;

- The use of artificial intelligence by insurers;

- Consumer privacy and data protection; and

- Unfair trade practices

Life Insurance and Annuities

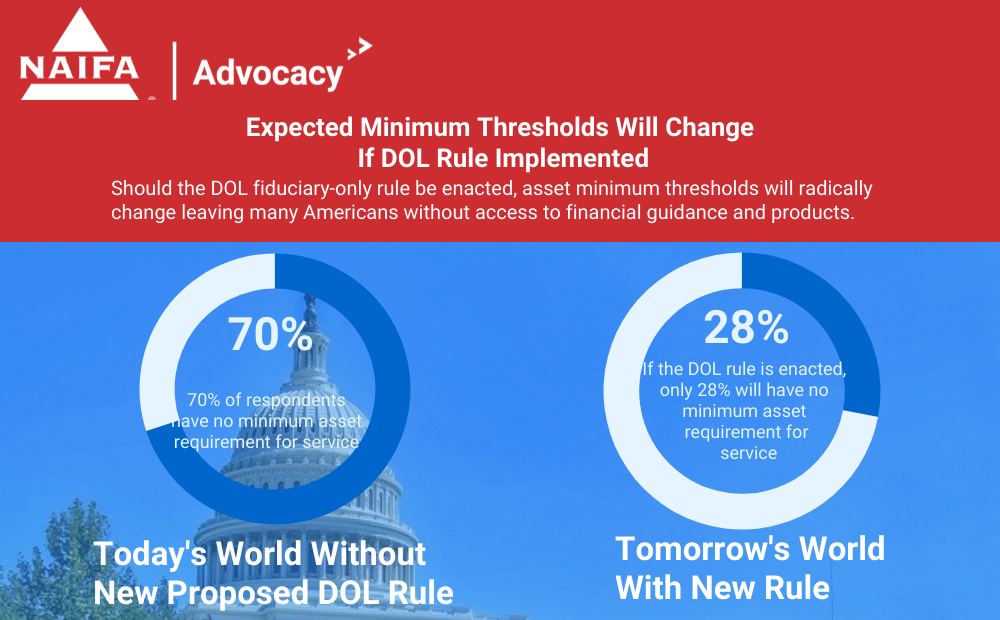

The Life Insurance and Annuities (A) Committee received an update on the DOL’s harmful and counterproductive fiduciary rule. After the proposal’s release, NAIC released a strongly worded statement opposing the rule, saying that it disregards state oversight and ignores the hard work of the 41 states that have worked diligently to enhance consumer protections through the adoption of the NAIC Suitability in Annuities Transactions Model Regulation (NAIC Model). Additional concerns were expressed by regulators at the meeting, who said the DOL has not met with commissioners and clearly does not understand the NAIC Model.

Additionally, the recent proposal from the North American Securities Administrators Administration (NASAA), which includes revisions to NASAA’s Model Rule on dishonest and unethical business practices of broker-dealers and agents, received notable mention. Regulators at the meeting requested that NAIC be more heavily engaged in NASAA’s rulemaking, acknowledging the industry’s concerns with the proposal and the opaque process by which is it being developed.

CMS Medicare Advantage/Part D Proposed Rulemaking

The Improper Marketing of Health Insurance (D) Working Group heard a presentation from CMS about the agency’s 2025 proposed rule. The rule, which has a comment period ending January 5, 2024, would change payment structures for agents and brokers for Medicare Advantage and Part D policies by:

- Implementing a single compensation rate for all plans;

- Revising the definition of compensation;

- Eliminating payments for administrative services; and

- Prohibiting certain contract terms.

Working Group participants requested that CMS consider exemptions and/or revisions to the proposed regulation that would mitigate its impact on the small agent community. Separately, commissioners expressed ongoing concerns with how Medicare Advantage plans are sold and continue to hear complaints from seniors about aggressive marketing and the narrowness of plan networks and coverage.

Artificial Intelligence

The Innovation, Cybersecurity, and Technology (H) Committee voted to adopt the “Model Bulletin on the Use of Artificial Intelligence Systems by Insurers.” Twenty-two states participated in the drafting process with the goal of establishing comprehensive regulatory standards to ensure the responsible deployment of AI in the insurance industry. The bulletin addresses problematic issues related to the use of AI systems, including potential inaccuracies, unfair bias leading to discrimination, and data vulnerabilities. While not a model law or regulation, the AI bulletin serves as a guiding document, fostering uniformity among state insurance regulators regarding expectations for insurance carriers deploying AI. The Committee is expected to continue focusing on the appropriate and responsible regulation of AI in 2024 and 2025.

Consumer Privacy and Data Protection

After moving full steam ahead for most of this year with the NAIC consumer privacy model, commissioners decided that NAIC will pause to think about its path forward by delaying the adoption of a new model or revising existing models until December 2024. The changing position followed comments from industry groups asking NAIC to consider modifying the existing privacy models rather than pursuing a wholesale rewrite. A new draft is expected to be released to commissioners and legislators in January, after which it will be opened for industry comments at the Spring meeting.

Unfair Trade Practices

To address concerns related to consumer Medicare Advantage lead generator complaints, regulators decided to add health lead generator oversight to the “Unfair Trade Practices Model Act.” The changes to the model were first adopted and recommended by the Improper Marketing of Health Insurance Working Group in Seattle in August. In Orlando, the Anti-Fraud Task Force adopted the model with several amendments, which were then adopted by the Market Regulation and Consumer Affairs (D) committee the following day. The amendments included those offered by the California Department of Insurance to reinstate certain record retention requirements. Several trade associations, including ACLI and AHIP, jointly suggested that the amendments further clarify that recordings should not be mandated but only permitted in states whose underlying laws permit it.

NARAB and Producer Licensing

NAIFA continues to prioritize our focus on implementing the NARAB board. During the NAIC Winter NIPR Board meeting, commissioners and board members discussed NARAB during the budget presentations and continued to plan for its implementation. In addition, there is speculation that NARAB board members could be appointed and confirmed by the end of the first quarter of 2024. The industry, including NAIFA, previously submitted recommendations for the business entity board members and will continue working with the White House Office of Personnel to ensure the appointment of the board.

NAIFA Staff Contact: Roger Moore – Policy Director – Government Relations, at rmoore@naifa.org.

.png?width=600&height=90&name=Support%20IFAPAC%20%20(600%20%C3%97%2090%20px).png)