H.R.1 as enacted into law extends the tax credit for employer-provided paid leave. Plus, the new law expands the tax credit by allowing employers to choose whether to take the deduction based on leave taken, or on the premiums paid for insurance that provides paid leave benefits.

1 min read

Employer Paid Leave Tax Credit Included in New Law

By NAIFA on 7/15/25 10:40 AM

Topics: Legislation & Regulations Taxes

1 min read

H.R.1 Would Create New Tax-Favored Savings Accounts for Children

By NAIFA on 7/15/25 10:38 AM

Included in H.R.1 as enacted into law are provisions that would create new tax-favored savings accounts (Trump accounts) for children. It also includes creation of a pilot program under which there would be a one-time government contribution to Trump accounts.

Topics: Legislation & Regulations Savings

1 min read

ABLE Account Rules Extended, Modified by New Law

By NAIFA on 7/15/25 10:35 AM

The new law extends and expands ABLE account rules. ABLE accounts are tax-advantaged savings accounts for people with disabilities. Generally, the ABLE accounts are subject to Roth treatment—i.e., contributions are made with after-tax money, but distributions (that comply with specific ABLE account rules) are tax-free.

Topics: Legislation & Regulations

1 min read

New Law Includes Student Loan, 529 Plan Changes

By NAIFA on 7/15/25 10:33 AM

As enacted into law, H.R.1 expands the ways 529 education savings plans can be used. For example, 529 plan funds can now be used for public or private (including religious) elementary and secondary school expenses. And certain accreditation programs (e.g., trade schools, certificate programs) will now also qualify for tax-free 529 plan payments. On student loans, the new law extends the exclusion from tax liability of employer-paid student loan payments and allows tax-free discharge of student loan debt in the case of death or disability.

Topics: Legislation & Regulations

1 min read

House Committee Approves Bills to Expand Small Business Access to Health Insurance

By NAIFA on 7/15/25 10:30 AM

On June 25, the House Education & the Workforce Committee approved two health insurance bills that supporters say will increase small business access to affordable health insurance coverage. Committee approval came on party-line votes.

Topics: Health Care Legislation & Regulations Small Business

3 min read

House Approves Reconciliation Bill

By NAIFA on 6/13/25 11:21 AM

On May 23, by a narrow 215 to 214 vote after an all-night debate, the House of Representatives passed the $6+ trillion reconciliation bill, H.R.1. The Congressional Budget Office (CBO) projects that the measure as passed by the House would, over 10 years, add $2.42 trillion to the federal deficit. H.R.1 contains a $3.8 trillion tax package. CBO also projected that Trump tariffs would reduce the deficit by $2.5 trillion over 10 years.

Topics: Legislation & Regulations Congress Tax Reform

2 min read

Senate Contemplates Changes to House-Passed Reconciliation Bill

By NAIFA on 6/13/25 11:19 AM

The Senate is now working on its version of reconciliation (tax) legislation, expecting to make multiple changes to H.R.1, the bill the House passed just before Memorial Day. Here are some of the issues that Republican Senators are considering.

Topics: Legislation & Regulations Congress Tax Reform

3 min read

H.R.1 Expands and Makes Permanent Section 199A

By NAIFA on 6/13/25 11:16 AM

The House-passed reconciliation bill, H.R.1 contains a provision increasing the Section 199A deduction for qualifying non-corporate business income from 20 percent to 23 percent There is no expiration date on the provision, which also contains modifications to eligibility for use of the deduction.

Topics: Legislation & Regulations Tax Reform

1 min read

Tax Package Increases Estate Tax Exemption

By NAIFA on 6/13/25 11:13 AM

H.R.1, the budget reconciliation bill approved by the House on May 23, includes a provision that permanently increases the estate tax exemption to $15 million ($30 million for married couples). The $15 million exemption amount is indexed for inflation with a base year of 2025.

Topics: Legislation & Regulations Estate Planning Tax Reform

1 min read

Reconciliation Bill Restricts Itemized Deduction Values for Wealthy

By NAIFA on 6/13/25 11:11 AM

A “tax-the-rich” provision in the House-passed reconciliation bill would reduce the value of itemized deductions for 37 percent taxpayers. The provision would replace current law’s Pease limitation on the value of itemized deductions.

Topics: Legislation & Regulations Tax Reform

1 min read

Health Savings Accounts Expanded in House-Passed Tax Package

By NAIFA on 6/13/25 11:09 AM

The House-passed tax package includes a number of enhancements to the rules governing health savings accounts (HSAs). These provisions are not subject to an expiration date—they would take effect in 2026.

Topics: Legislation & Regulations Health Savings Accounts

1 min read

House Bill Offers New Tax Break for Some Seniors, Enhanced Standard Deduction

By NAIFA on 6/13/25 11:08 AM

The House-passed tax bill provides a temporary additional deduction of $4,000 for those over age 65 who have less than $75,000 ($150,000 for married couples) in taxable income. It also temporarily expands the standard deduction by $2,000 (married)/$1,000 (single taxpayers).

Topics: Legislation & Regulations Tax Reform

1 min read

H.R.1 Would Create New Tax-Favored Savings Accounts for Children

By NAIFA on 6/13/25 11:06 AM

Included in H.R.1 are provisions that would create new tax-favored savings accounts, Trump Accounts, for children. It also includes creation of a pilot program under which there would be a one-time government contribution to Trump Accounts.

Topics: Legislation & Regulations

1 min read

House-Passed Reconciliation Bill Includes Bonus Depreciation for Five Years

By NAIFA on 6/13/25 11:04 AM

The House-passed budget reconciliation bill includes a temporary bonus depreciation provision that allows a 100 percent deduction (rather than several years of partial deductions to reflect amortization of the cost of the property) for qualified property acquired and placed in service by a business.

Topics: Legislation & Regulations Tax Reform

1 min read

Enhanced Deduction for Business Loan Interest Included in H.R.1

By NAIFA on 6/13/25 11:02 AM

H.R.1 modifies the rules for calculating the amount of interest paid on business loans. The result is for many businesses an increase in the amount of business loan interest that is deductible from taxable income.

Topics: Legislation & Regulations Tax Reform

1 min read

House Reconciliation Bill Makes Some Overtime Pay Income Tax-Free

By NAIFA on 6/13/25 11:00 AM

The House-passed reconciliation budget bill, H.R.1, contains a provision that would make certain overtime (OT) pay free from income tax, but not from payroll (Social Security/Medicare) taxes. This tax relief provision is limited both by income and by the Fair Labor Standards Act’s (FLSA’s) definition of qualified overtime hours.

Topics: Legislation & Regulations Taxes

1 min read

Key Senator Introduces Bill to Help ESOPs Contribute Shares to Plans

By NAIFA on 6/13/25 10:52 AM

On May 13, Sen. Bill Cassidy (R-LA), chair of the Senate Health, Education, Labor and Pensions (HELP) Committee, which has jurisdiction over ERISA issues, introduced legislation, S.1727, that would allow ESOPs to contribute company shares to plan participants without having to include the value of the shares in the ESOP’s or the employee’s contribution limits.

Topics: Legislation & Regulations Retirement Plans

3 min read

House Committees Begin Crafting Massive Reconciliation Bill

By NAIFA on 5/15/25 11:17 AM

During the week of April 29, House committees of jurisdiction began crafting their pieces of the $6 trillion+ reconciliation budget bill that Congress wants to enact by the end of this summer. The process is and will continue to be fraught as lawmakers make tough decisions, on which there is and will be much opposition, on how to cut spending and taxes for the upcoming 10 years.

Topics: Legislation & Regulations Taxes Congress

7 min read

Ways and Means Approves Huge Tax Reconciliation Title

By NAIFA on 5/15/25 11:14 AM

The House Ways and Means Committee approved its reconciliation title on May 14 on a party line vote after a 17-hour mark-up. The tax title of the reconciliation bill contains provisions that would permanently extend (i.e., eliminate an expiration date) a raft of tax rules that are set to expire at the end of this year. A few of these extension provisions also modify the expiring rules, including the Section 199A deduction. In addition, the title includes new tax cuts first proposed by President Trump as well as other tax cuts. Offsets are included to ensure that the cost of the title complies with the Committee’s reconciliation instructions. Significantly and in a major victory for NAIFA, the Committee did not attempt to raise revenue from the products and services NAIFA provides to assist American families in achieving financial security.

Topics: Legislation & Regulations Taxes

2 min read

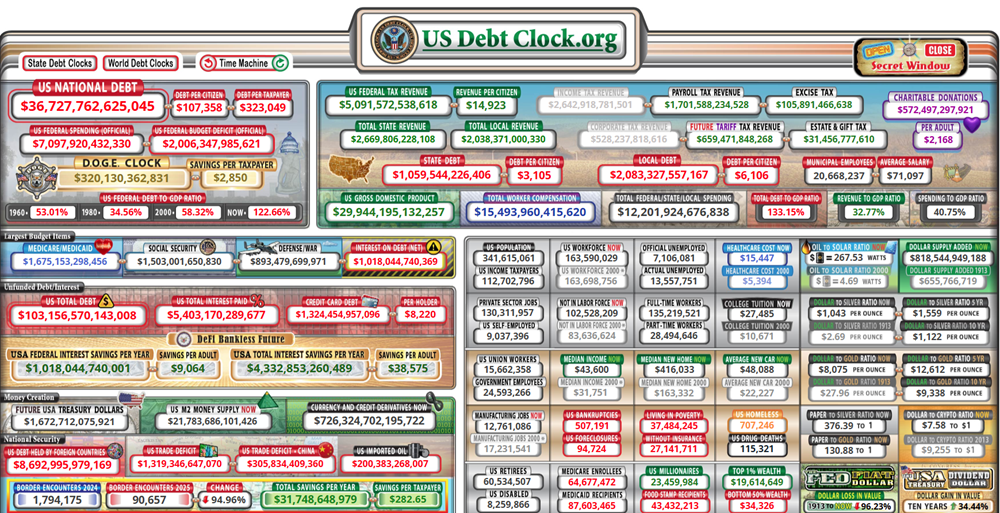

Debt Limit Sets “Real Deadline” for Reconciliation

By NAIFA on 5/15/25 11:06 AM

The emerging reconciliation bill includes a provision to raise the statutory debt limit—the amount beyond which Treasury may not borrow--to $4 trillion. The Senate version of the budget calls for a $5 trillion increase to the $37.2 trillion federal debt limit. The House budget authorizes a $4 trillion debt limit increase.

.png?width=600&height=90&name=Support%20IFAPAC%20%20(600%20%C3%97%2090%20px).png)