Legislation to create a new, tax-favored flexible savings account was introduced in both the House and Senate. The “Universal Savings Account (USA) Act” would qualify USA accounts for Roth treatment (after-tax contributions, tax-free earnings and withdrawals).

1 min read

Bicameral “Universal Savings Account” Bill Introduced

By NAIFA on 5/15/25 10:56 AM

Topics: Legislation & Regulations

2 min read

Worker Classification Bills Introduced in the House

By NAIFA on 5/15/25 10:49 AM

Rep. Kevin Kiley (R-CA) has introduced two worker classification bills. One would clarify what constitutes an independent contractor as compared to an employee. The other would create a safe harbor that would allow an employer to provide benefits to independent contractors without risking a worker’s classification as an employee.

Topics: Legislation & Regulations

2 min read

Bipartisan Federal Paid Family Leave Bill Introduced

By NAIFA on 5/15/25 10:46 AM

On April 30, a bipartisan bill to establish a federal paid family leave program was introduced by Reps. Stephanie Bice (R-OK) and Chrissy Houlahan (D-PA). The bill creates a three-year pilot grant program within the Department of Labor (DOL) aimed at encouraging states to create paid family leave programs using public-private partnerships.

Topics: Legislation & Regulations Paid Family Medical Leave

1 min read

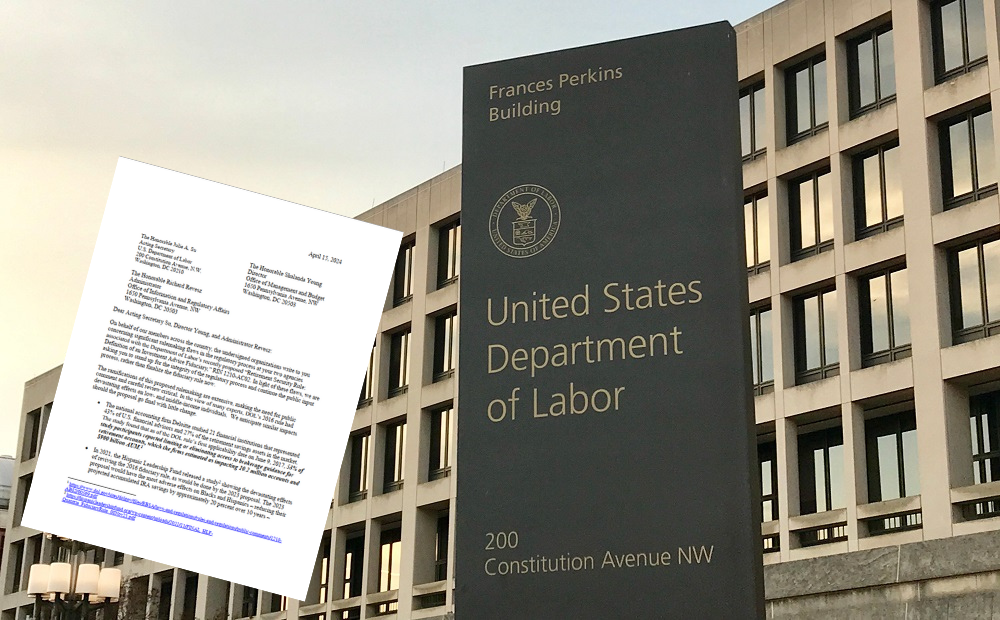

Court Grants Administration Request for Delay in Adjudicating Fiduciary Rule Challenge

By NAIFA on 5/15/25 10:37 AM

The Fifth Circuit Court of Appeals has granted the Trump Administration’s request for a 60-day delay in considering the fiduciary rule cases that are currently on appeal before that court. That puts the court’s consideration of the case on track to be considered in mid-June at the soonest.

The request for delay impacts the ACLI/NAIFA case challenging the Department of Labor (DOL) fiduciary rule. This is the second request for a 60-day delay that the court has granted.

Topics: Legislation & Regulations Standard of Care & Consumer Protection DOL

2 min read

BOI Rule Narrowed to Apply Only to Foreign Companies

By NAIFA on 4/15/25 9:11 AM

On March 26, the Financial Crimes Enforcement Network (FinCEN) issued an interim final rule (RIN 1506-AB49) narrowing the applicability of the beneficial ownership information (BOI) rule to foreign reporting companies.

Topics: Legislation & Regulations

2 min read

BOI Enforcement Back on Track

By NAIFA on 3/17/25 1:30 PM

The Financial Crimes Enforcement Network (FinCEN) announced that it is again going to enforce the beneficial ownership interest (BOI) rule that was enacted as part of the Corporate Transparency Act (CTA). But, FinCEN said on February 27 that it will not impose fines or penalties until after it finalizes new reporting rules that would narrow the BOI reporting rule to foreign reporting companies. The new reporting deadline is March 21, 2025.

Topics: Legislation & Regulations Federal Advocacy

1 min read

House Education & the Workforce Committee Examines Over-Regulation

By NAIFA on 3/17/25 11:59 AM

On Feb. 26, the House Education & the Workforce Committee held a hearing focused on over-regulation of business. Titled “Unleashing America’s Workforce and Strengthening Our Economy,” the hearing focused on the adverse impact of a slew of recent regulations, including overtime pay (the white-collar exemption) and worker classification.

Topics: Legislation & Regulations

2 min read

Lame Duck 118th Congress Extends Government Funding to March 14

By NAIFA on 1/14/25 1:59 PM

The last big-ticket item approved by the 118th Congress was enactment of a continuing resolution (CR), HR 10545, that keeps the government funded through March 14, 2025. The House and Senate approved the measure by wide margins. The House vote was 366 to 34, with one member voting “present.” The 366 aye votes included 170 Republicans and all Democrats except the one (Rep. Jasmine Crockett of Texas) who voted present. The Senate vote, coming just minutes after midnight December 20 deadline, was 85 to 11. President Biden signed it into law on December 21. Thus, the threatened partial government shutdown was averted, despite a few hours on a Saturday during which funding for the government technically ran out.

Topics: Legislation & Regulations Congress

1 min read

President Biden Signs Bills to Ease ACA Reporting Burdens

By NAIFA on 1/14/25 1:54 PM

On December 23, 2024, President Biden signed into law two pieces of legislation that will ease the burden on employers and insurance carriers that need to submit information to the IRS and employees on health care coverage. The Paperwork Burden Reduction Act (H.R. 3797) and the Employer Reporting Improvement Act (H.R. 3801) were championed by a bipartisan group of legislators eager to provide significant relief from paperwork burdens for small businesses.

Topics: Legislation & Regulations Small Business

2 min read

BOI Whipsaw: Enforcement Currently on Hold

By NAIFA on 1/14/25 1:51 PM

After a series of court decisions and reversal and then a reversal of the reversal, the rule (Beneficial Ownership Information, or BOI rule) requiring most businesses to report to FinCEN (the Financial Crimes Enforcement Network) on their ownership is currently on hold, pending a judicial opinion on whether the law containing the BOI rule is constitutional.

Topics: Legislation & Regulations Small Business

2 min read

Wyden Offers PPLI Legislation

By NAIFA on 1/14/25 1:27 PM

Just as the 118th Congress ended last month, then Senate Finance Committee chairman and now ranking member Sen. Ron Wyden (D-OR) offered a bill to contain private placement life insurance (PPLI). The bill died when the 118th Congress adjourned sine die on January 3, but Sen. Wyden is expected to reintroduce his legislation early this year.

Topics: Life Insurance & Annuities Legislation & Regulations Advanced Planning

2 min read

CMS Releases 2026 Medicare Advantage & Part D Proposed Rule

By NAIFA on 12/13/24 9:42 AM

CMS is proposing actions in the Medicare Advantage (MA) and Medicare Part D prescription drug programs to continue to strengthen protections and access to care for people with Medicare. The proposed rule aims to hold MA and Part D plans more accountable for delivering high-quality coverage so that people with Medicare are connected to the care they need when they need it.

Topics: Legislation & Regulations Medicare Medicare Part D

2 min read

Donald Trump Wins Presidency

By NAIFA on 11/22/24 10:53 AM

Donald Trump’s victory was declared when, at just about 5:30 a.m. on Wednesday, November 6, the media projected he had won swing state Wisconsin, taking him over the 270-vote electoral college count needed to win the presidency.

Topics: Legislation & Regulations Taxes Debt Congress Presidency Federal Deficit

3 min read

GOP Will Control the Senate in the 119th Congress

By NAIFA on 11/22/24 10:52 AM

Republicans will control the Senate in the incoming 119th Congress (2025-2026). The GOP’s undisputed win of 53 of the Senate’s 100 seats means Democrats have lost control of the upper chamber in the 119th Congress.

Topics: Legislation & Regulations Long-Term Care Insurance Taxes Debt Congress

2 min read

118th Lame Duck-Session Will Determine a Number of Key Issues

By NAIFA on 11/22/24 10:51 AM

A number of key issues remain to be addressed by the outgoing 118th Congress. They include the need to fund the government past the December 20 dates on which current funding authority expires. The government funding issues include extension of National Flood Insurance Program (NFIP) authority and funding.

Topics: Legislation & Regulations Congress DOL Federal Trade Commission Congressional Review Act

1 min read

Regulations Likely to Change under Trump Presidency

By NAIFA on 11/22/24 10:50 AM

Incoming President-Elect Donald Trump’s Administration is likely to roll back a plethora of regulations of concern to NAIFA members and their clients.

Topics: Legislation & Regulations Affordable Care Act CMS DOL SECURE 2.0 Federal Trade Commission

1 min read

Senate Democrats Introduce Bill to Subject Pass-Through Income to Payroll Tax

By NAIFA on 11/22/24 10:49 AM

Four Democratic Senators have introduced legislation that would subject pass-through (non-corporate) business income to payroll (Social Security/Medicare) taxes. Currently, many pass-through businesses (S corporations, partnerships, sole proprietorships) characterize some of their business income as dividends or other non-wage income and thus avoid having to include it in the payroll tax base.

Topics: Legislation & Regulations Taxes Congress

4 min read

Congress Punts Almost Everything to Lame Duck

By NAIFA on 10/15/24 10:57 AM

On September 26 President Biden signed into law the three-month funding bill that avoided a government shutdown on October 1. The continuing resolution (CR) extended fiscal year (FY) 2024 funding levels until December 20 and made few (none of them controversial) policy changes. So, the tough issues—e.g., FY 2025 funding levels, whether to block certain regulations (including the fiduciary rule)—were left to be resolved during the November-December lame duck session of the 118th Congress.

Topics: Legislation & Regulations Taxes Debt Congress SECURE 2.0

2 min read

Senate Finance Holds Hearing on 2025 Tax Issues

By NAIFA on 10/15/24 10:56 AM

On September 12, the Senate Finance Committee held a hearing to lay the groundwork for the 2025 tax bill effort to cut down on “tax avoidance.” The hearing highlighted proposals to improve tax equity in current law. It also focused considerable discussion on section 199A, the deduction for qualifying noncorporate business income.

Topics: Legislation & Regulations Taxes Congress

1 min read

ACA Premium Subsidies at Risk

By NAIFA on 10/15/24 10:55 AM

The premium tax subsidies that allow lower-income individuals to get Affordable Care Act (ACA) health insurance free or at reduced cost are scheduled to expire at the end of 2025. If the current subsidies do expire, millions of low-income individuals will face significant health insurance cost increases. Extension of the subsidies will be a key issue in the 2025 tax bill and/or during the November-December lame-duck session of the 118th Congress.

.png?width=600&height=90&name=Support%20IFAPAC%20%20(600%20%C3%97%2090%20px).png)