On December 23, 2024, President Biden signed into law two pieces of legislation that will ease the burden on employers and insurance carriers that need to submit information to the IRS and employees on health care coverage. The Paperwork Burden Reduction Act (H.R. 3797) and the Employer Reporting Improvement Act (H.R. 3801) were championed by a bipartisan group of legislators eager to provide significant relief from paperwork burdens for small businesses.

Paperwork Burden Reduction Act

Beginning with the 2024 Forms 1095, employers do not have to automatically provide the forms to individuals if they adequately notify individuals of their right to request a copy. This relief still requires additional guidance from the U.S. Department of the Treasury.

Employer Reporting Improvement Act

- Electronic delivery consents for Form 1095 remain in effect until revoked

- Relaxed use of name and DOB in lieu of SSN on Form 1095-C, Part III for 2024 Form 1095 reporting

- IRS Letter 226-J response due date extended to 90 days beginning in 2025

- Employer mandate penalties are subject to a six-year statute of limitations

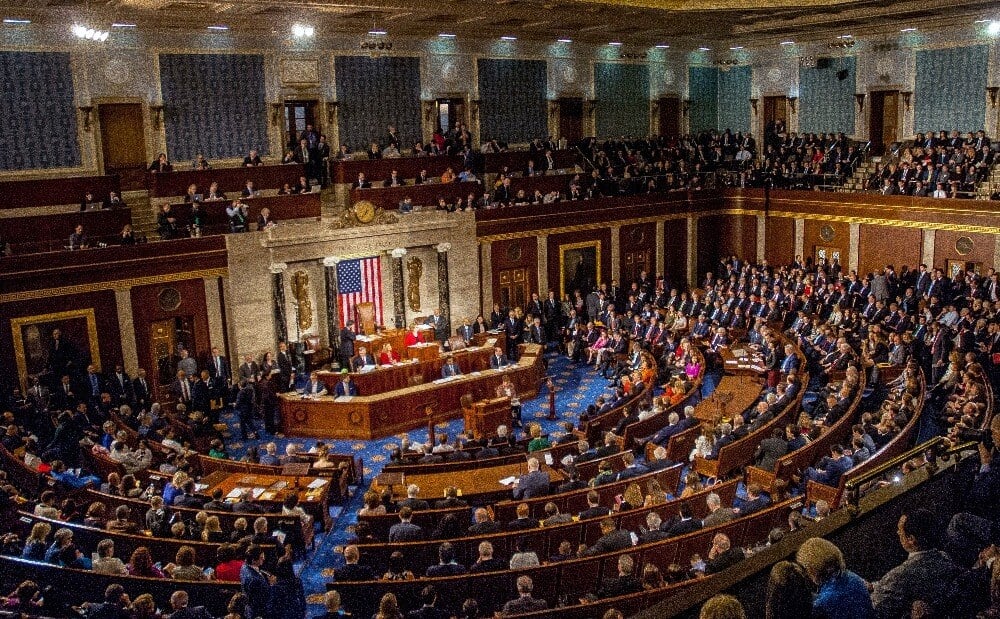

Prospects: The new 119th Congress may seek to further improve the cumbersome forms, and NAIFA will work with legislators and our employer coalition partners to explore opportunities.

NAIFA Staff Contacts: Diane Boyle – Senior Vice President – Government Relations, at dboyle@naifa.org; or Jayne Fitzgerald – Director – Government Relations, at jfitzgerald@naifa.org; or Mike Hedge – Senior Director – Government Relations, at mhedge@naifa.org.

.png?width=600&height=90&name=Support%20IFAPAC%20%20(600%20%C3%97%2090%20px).png)