STATE

Studies show students make better financial decisions as they enter the workforce including having less debt, being able to manage household finances more skillfully, making informed investments, and establishing healthy habits leading to a higher net worth. The latest FINRA Foundation National Capability Study reveals some troubling statistics:

- 66% of American adults cannot pass a basic financial literacy quiz.

- More than 40% lack retirement accounts.

- Fewer than 50% have emergency savings.

- Fewer than 30% have financial plans in place.

- Fewer than 20% use the continuing services of financial professionals.

NAIFA supports state requirements for high school students to pass a financial literacy test to graduate. Young people should feel empowered to discuss financial literacy, rather than afraid of their future finances as they enter the workforce.

NAIFA believes that the successes of providing high school students with financial literacy skills can be built upon to provide schools with additional tools to help these students build wealth. More commonly, young people are interested in roles of entrepreneurship, and NAIFA stands for empowering these entrepreneurs with a demand for early financial literacy education.

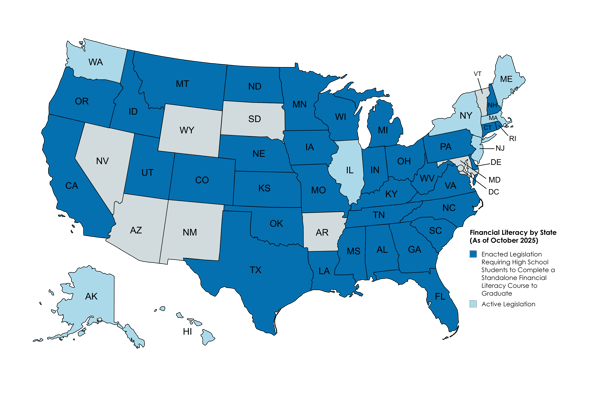

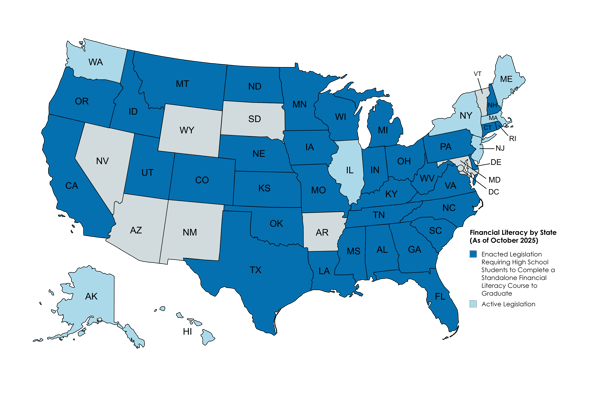

NAIFA chapters are actively promoting financial curriculum requirements in their states. Currently, 32 states have passed measures to require public high school students to take a one-credit personal finance course prior to graduation. Thirteen (13) of these have requirements in place, and 19 have begun the implementation process. As of October 2025, there are 8 states with active legislation to add a standalone semester-long personal finance course to high school graduation requirements.

FEDERAL

NAIFA strongly supports the Congressional Financial Literacy and Wealth Creation Caucus. The Caucus is committed to empowering Americans by giving them the tools they need to build wealth and achieve financial stability in their lives. The bipartisan Caucus is committed to empowering Americans by giving them the tools needed to build wealth and achieve financial stability in their lives. The Caucus raises awareness of the importance of financial literacy and aids to find ways to promote better financial management across the country.

When people understand finances, Americans are enabled to make responsible financial decisions, however, 66% of Americans cannot pass a basic financial literacy test. It is imperative that Americans are equipped with skills to make informed financial decisions.

Resources

- NAIFA's Advocacy in Action Blog