STATE

NAIFA supports high standards for the licensing of producers and state legislation and regulation that require prospective producers to successfully complete a producer licensing examination before they may sell, solicit, or negotiate insurance. Any obstacles, delays, or confusion that deter potential agents from obtaining a license, or an existing professional from renewing or modifying their current license are problems that NAIFA works diligently to overcome.

NAIFA is a proud board member of the National Insurance Producer Registry (NIPR). NIPR is a not‐for‐profit technology company that provides cost‐effective, streamlined, and uniform licensing data and compliance services for insurance professionals.

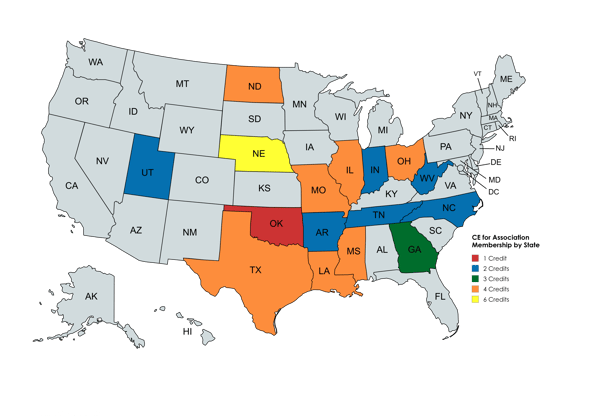

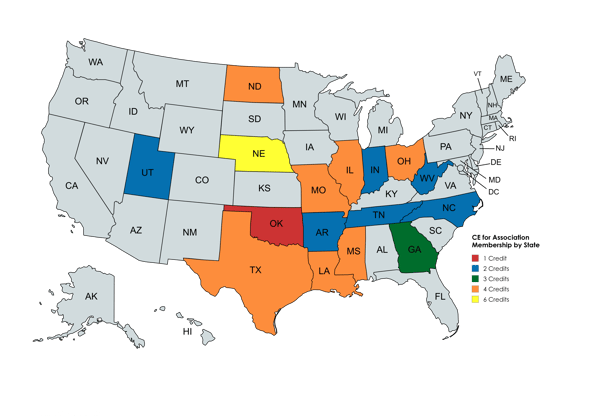

Continuing Education (CE) for Association Membership

NAIFA strongly supports legislation that would permit insurance producers to receive CE credit for their membership in a professional insurance association. Professional insurance associations, like NAIFA, promote high standards of ethical conduct among their members and provide educational programs and professional development opportunities to association members, further could encourage financial advisors to join professional insurance associations, thus benefiting consumers by providing access to qualified advisors.

NAIFA has developed the NAIFA Continuing Education Credit for Membership in a Professional Insurance Association Model Act for our members to share with their state legislatures. Under the NAIFA model, financial advisors and insurance agents are eligible to receive up to four hours of CE credits per reporting period for membership in a professional insurance association.

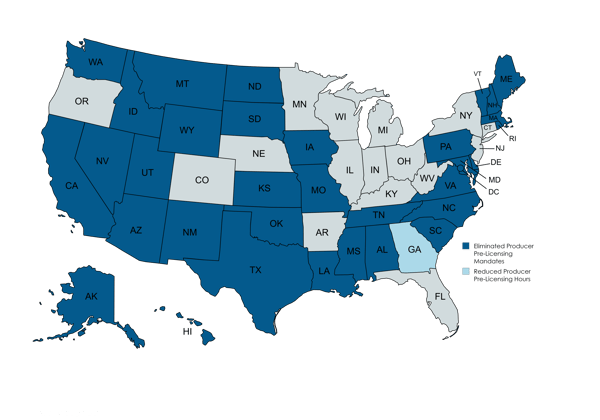

Producer Pre-Licensing Mandates

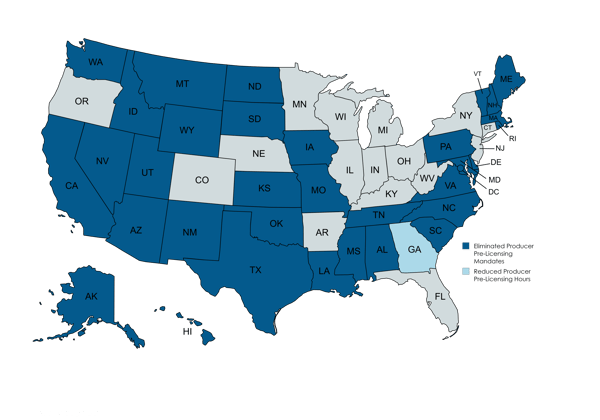

One of NAIFA’s top advocacy priorities among the states is to expand accessibility for prospective agents to join the profession. One of the big avenues to achieve this is through eliminating pre-licensing education mandates for prospective producers. Not to be confused with education taken after licensing - Continuing Education (CE).

There are 33 total states, plus the District of Columbia, that have done away with these mandates. Research shows that pass scores in states that do not have the mandates have not changed compared to the states that still have the mandates. Furthermore, states that do not have the mandates still find that candidates continue to take courses, buy materials, or otherwise prepare, but at their own pace and time. It expands recruitment efforts for the industry and offers additional flexibility, especially to those who have other obligations (have children, taking care of family, working another job, etc.) and are looking to sell insurance on a part-time basis.

NAIFA fully supports removing unnecessary barriers of entry, including pre-licensing education mandates, that prevent qualified professional candidates from entering, staying and thriving in the industry.

FEDERAL

NAIFA supports the creation of the National Association of Registered Agents and Brokers (NARAB) and urges the establishment of the NARAB board to ensure that consumers are protected and can continue working with agents they trust. NARAB is an organization with specific jurisdiction to oversee insurance producer non-resident licensing and continuing education standards on a national level. For NAIFA members, any producer (individual or agency) licensed in their home state can choose to apply to NARAB and submit to a federal criminal background check.

Resources