STATE

Suitability in Annuity Transactions Model

The updated National Association of Insurance Commissioners (NAIC) Annuity in Suitability Transactions Model #275 establishes the Best Interest Standard of Care, which requires a producer, or insurer where no producer is involved, to consider the consumer's needs and financial interests above their own. Forty-eight states (48) have adopted the updated model language, with New Jersey currently in the process of adoption. The District of Columbia has an active proposal as well.

The revised NAIC model aligns well with its federal counterpart, the SEC’s Regulation Best Interest. Together, these two initiatives will significantly enhance protections for consumers across the country who seek guaranteed lifetime income in retirement through annuities. Any proposal of this model that doesn’t specifically reference the words “best interest” would create a significant credibility problem and would give fuel to proponents of a fiduciary standard who claim that any such proposal really was nothing more than “warmed-over suitability. Further, the best interest standard of care aligns with a core component of NAIFA’s producer Code of Ethics.

Senior Financial Protection

NAIFA supports state legislation intended to protect seniors and other vulnerable adults from financial fraud and exploitation if it satisfies the following provisions:

- A voluntary, not mandatory, reporting process.

- Permit advisors to report suspected financial exploitation of a senior client to their firms, rather than directly to authorities.

- A legal “safe harbor” provision for advisors who report suspected financial exploitation.

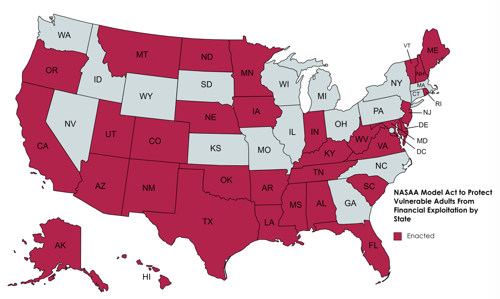

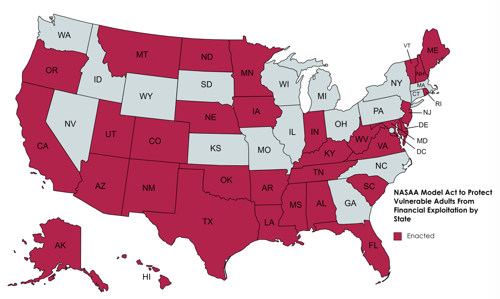

Several states have enacted or are considering model language from the National Association of State Securities Administrators (NASAA) that required financial advisers and their firms to report suspected financial exploitation of a senior client to state authorities. The NASAA model law, Protect Vulnerable Adults from Financial Exploitation Act, also permits firms to temporarily delay suspicious transactions to provide authorities time to investigate the possible fraudulent activity, and it provides advisors and firms with immunity from liability for taking steps to protect their clients' financial assets by following the provisions of the law.

FEDERAL

Fiduciary

NAIFA opposes all attempts to impose an expanded definition of fiduciary. Actions by the Department of Labor to adopt a fiduciary-only rule for financial professionals are unnecessary and will harm consumers’ access to retirement security for the American middle class. When the Department of Labor put forward its ill-conceived fiduciary regulation in 2016, NAIFA reacted with its formidable grassroots power and used judiciary mechanisms to defeat it.

Following the defeat of the DOL’s last push for a fiduciary-only standard, the Securities and Exchange Commission implemented the Regulation Best Interest standard, which requires advisors to work in their clients' best interests and significantly enhances consumer protections. Forty states have now adopted the National Association of Insurance Commissioners’ model for annuity transactions, which also puts annuity customers’ best interests first and provides further evidence of the changed landscape and lack of need for a fiduciary-only standard.

On October 31, 2023, the Department of Labor (DOL) released its new proposed fiduciary rule (which they renamed the retirement security rule). The proposal triggered immediate and intense opposition from NAIFA and from most of the retirement savings community.

The proposed rule, if finalized without modification, would impose a fiduciary duty on advisors who are giving advice, even if it is one-time only advice:

- to employer-sponsored plans,

- on rollovers from employer plans to IRAs, and

- on non-securities type annuities (e.g., fixed annuities).

The proposed rules would also apply to other tax-favored savings plans with funds that can be invested; e.g., health savings accounts and the various kinds of education savings accounts.

In conjunction with its issuance of the 2023 Proposed Rule, DOL also issued proposed amendments to the two PTEs for which investment advice fiduciaries may comply to enable them to receive such compensation going forward if the Rule is finalized – PTEs 2020-02 and 84-24 (together with the proposed “fiduciary” definition, the “2023 Proposed Rule.). Learn more about the most recent DOL Fiduciary Rule Proposal.

Resources

Recent Articles