Working in Clients' Best Interests

NAIFA members agree to abide by the NAIFA Code of Ethics, which requires them to work in the best interests of their clients. As an advocacy association, NAIFA supports public policy that furthers this aim without limiting consumer choice or creating barriers that could prevent all Americans from having access to needed financial products, services, and advice.

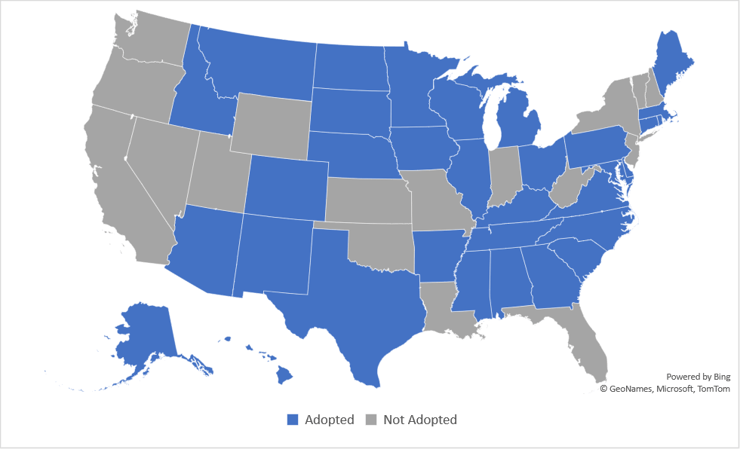

The National Association of Insurance Commissioners (NAIC) revised model regulation on annuity transactions together with the Securities and Exchange Commission’s (SEC) Regulation Best Interest (Reg BI) and the new PTE 2020-02 provide a robust framework that protects Americans planning and saving for the future and managing their retirement savings. NAIFA supports these new rules that provide protections while preserving access to products and guidance.