STATE

State lawmakers continue to consider legislation that would establish state-run individual retirement type savings programs for private sector workers and require certain employers to auto-enroll their employees in these plans. These plans would directly compete with existing private market programs that already offer consumers a robust variety of retirement options and could provide a disincentive for employers to offer.

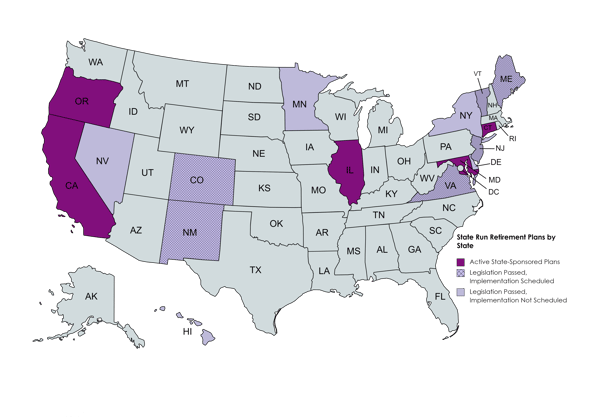

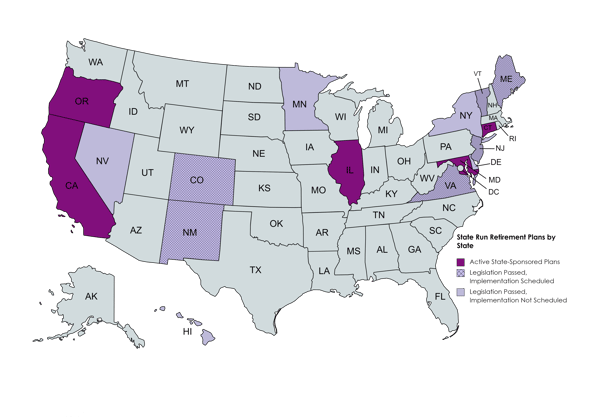

Nearly 40 states have considered legislation that would establish a state-run retirement plan. To date, California, Connecticut, Colorado, Illinois, Maryland, New Jersey, Oregon and Virginia are the only states that have enacted legislation establishing a state-run plan program.

NAIFA encourages lawmakers to focus on private sector solutions available to multiple employer plans, which are now more accessible for employers to adopt due to the recently enacted SECURE 2.0. Multiple employer plans will have all the benefits, features, and provisions of more traditional single-employer retirement plans but with significant relief to employers regarding cost, administrative responsibilities, and fiduciary duties.

NAIFA understands the importance of retirement security and encourages expanding retirement savings options and making it easier for Americans to plan and save for retirement. NAIFA appreciates that states are looking for solutions and we agree this area deserves our attention. However, NAIFA does not believe that a state-run auto-IRA program is the best solution for our members or American workers.

FEDERAL

NAIFA strongly supports SECURE 2.0 retirement planning legislation that simplifies the processes and incentives for employers to create and enroll employees in workplace retirement plans. The SECURE 2.0 legislation passed by the House makes positive strides towards helping a greater number of Americans prepare for retirement.

Among the provisions are:

- An automatic enrollment requirement for 401(k) and 403(b) plans

- A phased-in increase in the age when required minimum distributions (RMDs) begin (from current law age 72 to age 75 by 2033)

- An increase in catch-up contribution limits for people aged 62, 63 and 64, to $10,000, indexed.

- A rule requiring employers to include long-time part-time employees who have been with the company for two years (down from three) or more among those eligible to participate in retirement plans.

- The ability to count employer-paid student loan payments as plan contributions.

- Authority for 403(b) plans to participate in MEPs (and PEPs), and an enhanced start-up credit for plans that join a MEP or PEP

- Authority to plans to accept employee self-certification for hardship distributions.

Secure 2.0 makes it easier for plans to offer lifetime payment options by removing barriers to the use of annuities. Preparing for a secure retirement is a vital part of any financial plan and receiving a guaranteed lifetime income can be an important part of that plan for many consumers.

Resources