The hard-right wing of the Republican party in the House has written a letter to Speaker Johnson (R-LA) listing their demands for their support of early legislative initiatives this year. They include legislation to expand health savings accounts (HSAs), and “real” spending cuts “in place” ahead of approving a debt limit increase.

NAIFA

Recent posts by NAIFA

2 min read

Right-Wing House Republican Demands Color Early Agenda

By NAIFA on 1/14/25 1:30 PM

Topics: Congress

2 min read

Wyden Offers PPLI Legislation

By NAIFA on 1/14/25 1:27 PM

Just as the 118th Congress ended last month, then Senate Finance Committee chairman and now ranking member Sen. Ron Wyden (D-OR) offered a bill to contain private placement life insurance (PPLI). The bill died when the 118th Congress adjourned sine die on January 3, but Sen. Wyden is expected to reintroduce his legislation early this year.

Topics: Life Insurance & Annuities Legislation & Regulations Advanced Planning

1 min read

IRS Extends Deadline for SECURE 2.0 RMD Rules

By NAIFA on 1/14/25 1:23 PM

Last month the Internal Revenue Service (IRS) announced an extension, to January 1, 2026, for rules to accommodate the SECURE 2.0 required minimum distribution (RMD) rules. The December 18 announcement came in IRA Announcement 2025-2.

Topics: Retirement IRS SECURE 2.0

1 min read

DOL Appeals District Court Block of White-Collar Exemption OT Rule

By NAIFA on 1/14/25 1:20 PM

The Department of Labor (DOL) has appealed the November Eastern District of Texas district court ruling that overturned the agency’s updated white-collar exemption to the Fair Labor Standards Act’s (FLSA’s) overtime (OT) rules. However, the Trump Administration could reverse the decision to appeal to the Fifth Circuit Court of Appeals.

Topics: DOL

1 min read

Congress Announces New Members of Tax-Writing Committees

By NAIFA on 1/14/25 1:15 PM

Both Republicans and Democrats have named the members joining the House Ways & Means and Senate Finance Committees for the 119th Congress. These lawmakers will have particular influence over what goes in and what stays out of the massive tax bill Congress intends to enact this year.

Topics: Taxes Congress

1 min read

Congressional Republicans Want to Expand HSAs, AHPs

By NAIFA on 1/14/25 1:09 PM

Republicans in both the House and Senate are talking about expanding health savings accounts (HSAs) and association health plans (AHPs). There is a growing sense that these policies will help grow health coverage and reduce health insurance costs. Interest in HSAs and AHPs appear to be the emerging Republican answer to the Affordable Care Act (ACA).

Topics: Health Care Health Savings Accounts

2 min read

Retirement Savings, Death Benefits on Most Recent JCT Tax Expenditure List

By NAIFA on 1/14/25 1:06 PM

The Joint Committee on Tax’s (JCT’s) most recent “tax expenditure list” includes trillions in foregone federal revenue as a result of the tax rules governing retirement savings, life insurance death benefits and cash values, and employer provided health insurance.

Topics: Retirement Tax Reform

2 min read

Lame Duck 118th Congress Aims to Wind Up with Government Funding

By NAIFA on 12/13/24 11:14 AM

The outgoing 118th Congress must fund U.S. discretionary spending by December 20. Issues in play in that effort include extension of authority and funding for the National Flood Insurance Program (NFIP), delay of the Corporate Transparency Act’s (ACT’s) Beneficial Ownership Information (BOI) rule, and possibly technical corrections to SECURE retirement savings law.

Topics: Federal Advocacy Congress

3 min read

Republicans Will Control the 119th Congress; Face Substantial Challenges

By NAIFA on 12/13/24 11:09 AM

In 2025-2026, Republicans will control the White House (Trump/President), the Senate (53 to 47), and the House (220 to 215). But despite winning the trifecta, GOP lawmakers will confront significant challenges next year. They include a spiraling deficit that will make enactment of GOP priorities difficult, and deep divisions between ultra-conservative and more centrist Republicans.

Topics: Federal Advocacy Congress

2 min read

CTA BOI Reporting Requirement on Hold

By NAIFA on 12/13/24 11:03 AM

A Texas district court has issued a temporary nationwide injunction blocking enforcement of the Corporate Transparency Act’s (CTA) requirement (the Beneficial Ownership Information, or BOI rule) that forces U.S. businesses to report the names and identifying information of their beneficial owners. Legislation to delay the reporting requirement is pending before Congress.

Topics: Federal Advocacy

2 min read

Deficits Trigger Organized Spending Cut Initiative

By NAIFA on 12/13/24 10:57 AM

Federal deficits projected to grow to almost $2 trillion next year have triggered creation, by President-Elect Trump, of a Department of Government Efficiency (DOGE). DOGE’s goal is to cut federal spending by $2 trillion.

Topics: Federal Advocacy Federal Deficit

1 min read

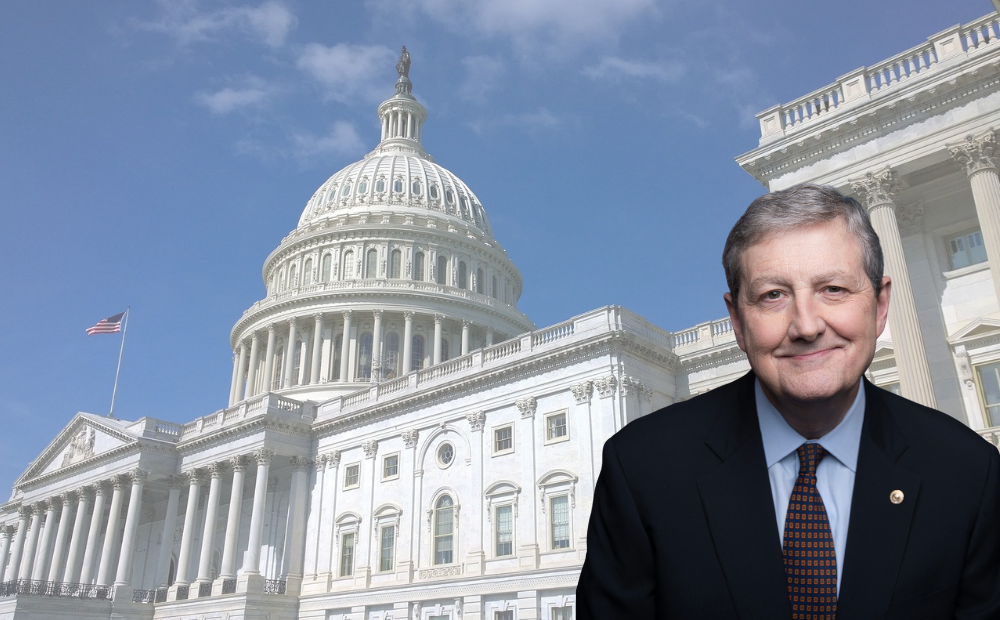

FSA Expansion Bill Introduced

By NAIFA on 12/13/24 10:51 AM

Sen. John Kennedy (R-LA) on December 3 introduced a bill to increase the amount a Flexible Spending Arrangement (FSA) owner can contribute to his/her FSA for dependent care expenses. While it is unlikely this bill will be enacted this year, its introduction tees up the issue for the incoming 119th Congress.

Topics: Federal Advocacy

2 min read

Federal District Court Strikes Down DOL’s New White Collar Exemption Rule

By NAIFA on 12/13/24 10:38 AM

On November 15, the federal District Court in the Eastern District of Texas struck down the Department of Labor’s (DOL’s) latest attempt to raise the salary threshold piece of the white-collar exemption to the Fair Labor Standards Act’s (FLSA’s) overtime (OT) pay rules. The court ruled that DOL exceeded its statutory authority in promulgating a rule that addressed only the salary threshold piece of the white-collar exemption from FLSA’s OT rules.

1 min read

Bessent Nominated to Head Treasury Department

By NAIFA on 12/13/24 10:32 AM

Billionaire hedge fund manager and investor Scott Bessent is President-Elect Trump’s choice to head the Treasury Department. He says tariffs will be his top priority.

Topics: Federal Advocacy

1 min read

Trump to Nominate Former Rep. Chavez-DeRemer to Head DOL

By NAIFA on 12/13/24 10:28 AM

President-Elect Trump has announced he will nominate former Rep. Lori Chavez-DeRemer (R-OR) to be Secretary of the Department of Labor (DOL). Rep. Chavez-DeRemer lost her bid for reelection last month. She is viewed as a pro-labor Republican, one of only a handful of GOP House members who cosponsored the labor-friendly PRO Act

Topics: DOL

1 min read

Paul Atkins Nominated to Chair SEC

By NAIFA on 12/13/24 10:24 AM

Former Securities and Exchange Commissioner (SEC) Paul Atkins will be nominated by President-Elect Trump to chair the SEC. Experienced at the SEC, Atkins served as one of the agency’s commissioners from 2002 to 2008 and worked as an SEC staffer during the 1990s.

Topics: SEC

1 min read

Robert F Kennedy Jr. Nominated to Lead HHS

By NAIFA on 12/13/24 10:21 AM

Robert F Kennedy Jr. is President-Elect Trump’s choice to be Secretary of the Department of Health and Human Services (HHS). A vaccines skeptic, Kennedy’s nomination is controversial, at least at this stage of the process.

Topics: Federal Advocacy

1 min read

Dr. Oz Is Trump’s Nominee for CMS

By NAIFA on 12/13/24 10:14 AM

Dr. Mehmet Oz, a tv personality who lost his bid for Pennsylvania’s Senate seat two years ago, is President-Elect Trump’s nominee as the head of the Centers for Medicare and Medicaid Services (CMS).

Topics: CMS

1 min read

Hassett Tapped to Head National Economic Council

By NAIFA on 12/13/24 10:10 AM

President-Elect Trump has chosen Kevin Hassett, an economist currently working as a fellow at the Hoover Institute at Stanford University, to head the National Economic Council (NEC). The NEC works closely with the Treasury Department as a hands-on policy-making team.

Topics: Federal Advocacy

2 min read

NAIFA’s Bianca Alonso Weiss Attends NCOIL Annual Fall Meeting

By NAIFA on 12/13/24 9:54 AM

NAIFA State Government Relations Manager, Bianca Alonso Weiss, attended NCOIL’s Annual Fall Meeting on November 21-23, where she had the opportunity to strengthen NAIFA’s relationships with state legislators and industry trade partners, as well as advocate for key priorities affecting NAIFA members. Several NCOIL sessions discussed topics of interest to NAIFA.

.png?width=600&height=90&name=Support%20IFAPAC%20%20(600%20%C3%97%2090%20px).png)