On March 10, the Senate voted to confirm former Rep. Lori Chavez-DeRemer (R-OR) to be Secretary of the Department of Labor (DOL). The 67 to 32 vote was bipartisan and included some GOP opposition as well as some Democratic support.

NAIFA

Recent posts by NAIFA

1 min read

Trump Nominates Insurance Executive to Head EBSA

By NAIFA on 3/17/25 11:49 AM

President Trump has nominated Daniel Aronowitz to lead the Department of Labor’s (DOL’s) Employee Benefits Security Administration (EBSA). Aronowitz is currently the president of ENCORE Fiduciary, an underwriter of insurance designed to protect employee benefits plans and trustees from fiduciary liability.

Topics: Employee Benefits

1 min read

Lawmakers Introduce Bicameral Legislation Targeting Agents and Brokers in the ACA Marketplace

By NAIFA on 3/17/25 11:43 AM

On March 12, Senate Finance Committee Ranking Member Ron Wyden (D-OR) along with Representatives Kathey Castor (D-FL) and Deborah Ross (D-NC) introduced the Insurance Fraud Accountability Act, which would impose civil and criminal penalties on agents and brokers engaging in misleading or fraudulent activities in the ACA marketplace, including enrolling individuals in plans without their consent and using deceptive marketing to target vulnerable groups.

Topics: Health Care

6 min read

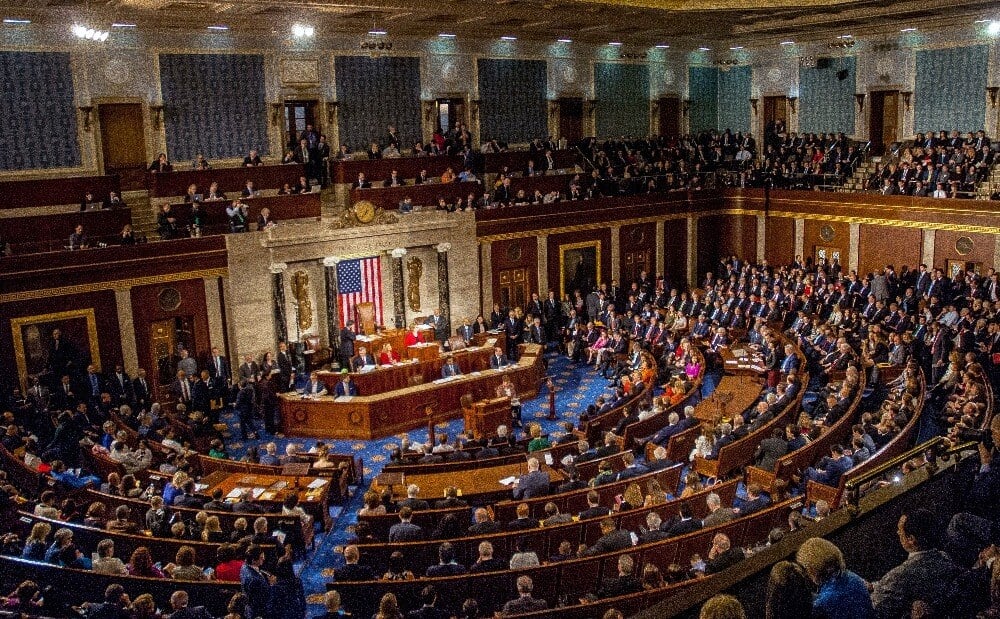

Congress Begins Work on GOP Agenda

By NAIFA on 2/17/25 9:34 AM

President Trump and the GOP-controlled Congress are officially in power, and have begun work on an aggressive, high-profile agenda covering among other issues spending cuts, taxes, and shrinking the federal government. Many—maybe most—of these issues could directly impact NAIFA members.

Topics: Congress

2 min read

Senators, House Members Introduce Legislation to Make Permanent Section 199A

By NAIFA on 2/17/25 9:28 AM

Legislation to make permanent the section 199A deduction for qualifying noncorporate business income has been introduced in both the House and Senate. The legislation is partisan—only Republicans cosponsored it in both chambers of Congress—but the number of cosponsors (35 in the Senate, including most of the Senate GOP’s leadership, and 152 in the House) demonstrates the strength of support for the measure.

Topics: Taxes Congress

1 min read

Key Tax Writer Introduces Bill to Extend Expiring Tax Rules Permanently

By NAIFA on 2/17/25 9:25 AM

On January 3, Rep. Vern Buchanan (R-FL), a senior member of the tax-writing Ways & Means Committee, introduced H.R.143, a bill that would make permanent expiring individual tax rates (including section 199A), the standard deduction, the estate tax personal exemption, and other individual tax provisions. The bill also specifically repeals the expiration date of section 199A, the deduction for qualifying noncorporate business income.

Topics: Taxes Congress

1 min read

President Trump Orders Regulations Freeze, Review

By NAIFA on 2/17/25 9:22 AM

In one of his first moves after his January 20 inauguration, President Trump ordered federal agencies to halt rulemaking until the new Administration can review all pending proposed regulations. He also ordered a review of regulations finalized late in the Biden Administration.

Topics: Federal Advocacy Insurance & Financial Advisor Regulation

1 min read

Tax Regs Again Subject to White House Review

By NAIFA on 2/17/25 9:19 AM

In a January 31 executive order (EO), President Trump once again made Treasury tax regulations subject to White House review. Office of Information and Regulatory Affairs (OIRA) review of tax regulations was not required until President Trump’s first term, from 2017 to 2021. But then-President Biden reversed that order, again exempting tax regulations from OIRA review. Now, per this latest Trump EO, IRA will again be reviewing proposed tax regulations.

Topics: Taxes

1 min read

House Republican Introduces Bill to Expand Section 199A, Repeal Estate Tax

By NAIFA on 2/17/25 9:16 AM

On January 3, Rep. Andy Biggs (R-AZ) introduced legislation that would repeal the limits on the kinds of businesses that are eligible for the section 199A deduction for qualifying noncorporate business income. The bill would also repeal the estate tax while retaining the step up in basis for assets passing to heirs after the decedent’s death.

Topics: Small Business Taxes Congress

1 min read

Bipartisan, Bicameral Bill Allows CIT Investment by 403(b)s

By NAIFA on 2/17/25 9:12 AM

Bipartisan legislation to allow 403(b) retirement savings plans to invest in collective investment trusts (CITs) has been introduced in both the House and Senate. The legislation would amend securities laws to allow for 403(b) CIT investments. Retirement law was amended to allow these CIT investments in SECURE 2.0, but efforts to expand the CIT investment authority to include securities laws fell short at the time.

Topics: Retirement Congress

1 min read

Bipartisan Senate Bill Would Increase Above-the-Line Charitable Deduction

By NAIFA on 2/17/25 9:09 AM

A bipartisan Senate bill, the “Charitable Act,” would reestablish an above-the-line charitable deduction. The deduction would allow taxpayers who do not itemize to deduct their charitable contributions up to an amount equal to up to one third of the standard deduction.

Topics: Taxes Congress

2 min read

Treasury Proposes Guidance on Auto Enrollment, Catch-Up Contribution Rules

By NAIFA on 2/17/25 9:06 AM

On January 10, the Treasury Department released new guidance on SECURE 2.0 automatic enrollment and catch-up contribution rules. The automatic enrollment guidance is in REG-100669-24. The catch-up contribution proposed regulation is REG 1545-BR11.

Topics: Retirement Planning SECURE 2.0

1 min read

IRS Issues Tax Guidance on State Paid Leave Program Benefits

By NAIFA on 2/17/25 8:58 AM

On January 22, the Internal Revenue Service (IRS) issued guidance on how employers should deal with the tax requirements of contributions and benefits paid under state paid and family leave programs. The guidance comes in Rev.Rul. 2025-4.

Topics: IRS

1 min read

Scott Bessent Confirmed as Treasury Secretary

By NAIFA on 2/17/25 8:56 AM

On January 27, the Senate voted to confirm the nomination of Scott Bessent as the 79th Secretary of the Treasury. The vote was 68 to 29. Sixteen Democrats joined with the Republicans to approve the nomination.

Topics: Federal Advocacy

1 min read

Congress Nearing Decisions on DOL, HHS Leadership Nominees

By NAIFA on 2/17/25 8:53 AM

On February 13, President Trump’s nominee to be Secretary of the Department of Health and Human Services (HHS), Robert F. Kennedy Jr., won approval from the Senate following approval by the Senate Finance Committee on a party-line 14 to 13 vote.

Topics: Congress White House

2 min read

Lame Duck 118th Congress Extends Government Funding to March 14

By NAIFA on 1/14/25 1:59 PM

The last big-ticket item approved by the 118th Congress was enactment of a continuing resolution (CR), HR 10545, that keeps the government funded through March 14, 2025. The House and Senate approved the measure by wide margins. The House vote was 366 to 34, with one member voting “present.” The 366 aye votes included 170 Republicans and all Democrats except the one (Rep. Jasmine Crockett of Texas) who voted present. The Senate vote, coming just minutes after midnight December 20 deadline, was 85 to 11. President Biden signed it into law on December 21. Thus, the threatened partial government shutdown was averted, despite a few hours on a Saturday during which funding for the government technically ran out.

Topics: Legislation & Regulations Congress

1 min read

President Biden Signs Bills to Ease ACA Reporting Burdens

By NAIFA on 1/14/25 1:54 PM

On December 23, 2024, President Biden signed into law two pieces of legislation that will ease the burden on employers and insurance carriers that need to submit information to the IRS and employees on health care coverage. The Paperwork Burden Reduction Act (H.R. 3797) and the Employer Reporting Improvement Act (H.R. 3801) were championed by a bipartisan group of legislators eager to provide significant relief from paperwork burdens for small businesses.

Topics: Legislation & Regulations Small Business

2 min read

BOI Whipsaw: Enforcement Currently on Hold

By NAIFA on 1/14/25 1:51 PM

After a series of court decisions and reversal and then a reversal of the reversal, the rule (Beneficial Ownership Information, or BOI rule) requiring most businesses to report to FinCEN (the Financial Crimes Enforcement Network) on their ownership is currently on hold, pending a judicial opinion on whether the law containing the BOI rule is constitutional.

Topics: Legislation & Regulations Small Business

7 min read

What to Expect from Congress in 2025

By NAIFA on 1/14/25 1:46 PM

The 119th Congress convened January 3. The GOP controls the House and the Senate, and Republican President-Elect Trump will be in the White House as of January 20. Republicans are still squabbling a bit about which priority issue to tackle first, but whatever the order, a massive tax bill, Fiscal Year (FY) 2025 government funding, FY 2026 appropriations to fund the government, the statutory debt limit, and nomination confirmations will dominate early in 2025. On the regulatory front, once cabinet secretaries (and other key agency leaders) are confirmed, expect action to roll back Democratic rulemaking in many issue areas.

Topics: Congress

1 min read

Johnson Elected House Speaker

By NAIFA on 1/14/25 1:33 PM

With only a little bit of drama, on January 3, House Republicans chose Rep. Michael Johnson (R-LA) to be Speaker of the House for the 119th Congress. Virtually all Speaker votes are purely partisan, and this one was no exception. So, with a 219 to 215 GOP-to-Democrat edge, Rep. Johnson needed 218 votes to become Speaker. The final vote was 218 to 215—one Republican (Kentucky’s Rep. Thomas Massie) voted for someone else.

.png?width=600&height=90&name=Support%20IFAPAC%20%20(600%20%C3%97%2090%20px).png)