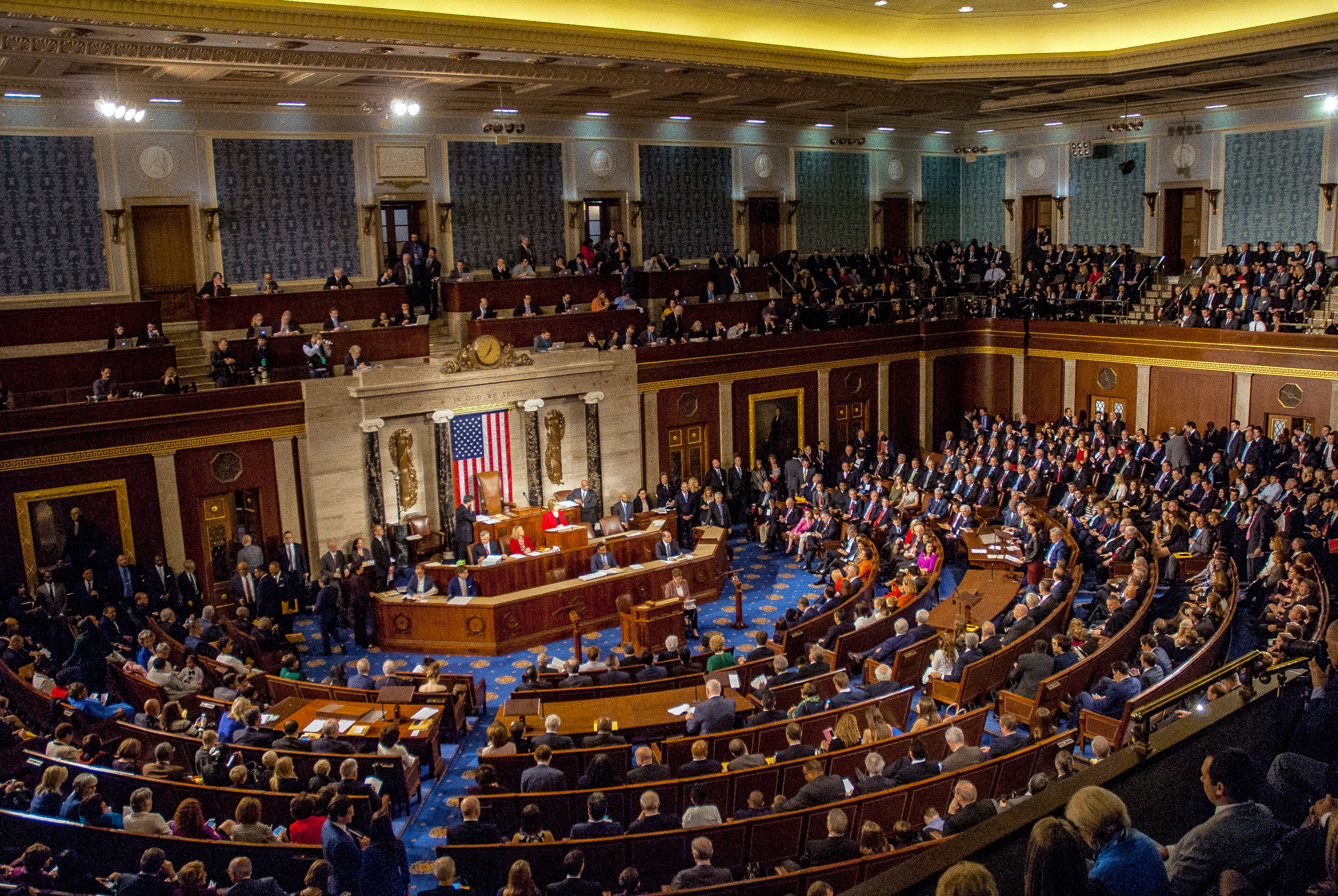

House Ways & Means Committee Republicans have formed ten issue-specific “tax teams” to work on what to include in the looming 2025 major tax bill. Senate Finance Committee Republicans will tackle these issues in six “working groups.” Both say they “may” include Democrats in their deliberations at some point, but for now, it is an all-GOP effort.

The 2025 tax bill will be massive—its cost could go as high as $4.6 trillion or even more. A great deal of the debate will focus on whether all or part of that cost will be offset. This issue will preoccupy Congress next year regardless of which party controls Congress and the White House.

A major tax bill in 2025 is viewed as absolutely necessary by virtually every lawmaker in both the House and Senate, regardless of party. Much of the current tax law applicable to individuals and estates is scheduled to expire at the end of 2025. Unless Congress acts prior to the end of 2025 to extend these rules, income and capital gains tax rates, the standard deduction, the exemption from the estate tax, and a raft of other individual and estate/gift tax rules would revert to the rules in place in 2016. And the section 199A deduction for qualifying non-corporate business income would expire. That would mean a substantial tax increase for virtually everyone, including the working and middle classes. No lawmaker, regardless of party and whether on the extreme left or extreme right, wants that result.

A key concern is section 199A, which was enacted in order to provide substantially similar tax relief to non-corporate businesses when the corporate rate was dropped to 21 percent in 2017. The 21 percent corporate rate does not expire, but many lawmakers—including some Republicans—think that because of deficit concerns the corporate rate should go up. If that were to happen, it would likely impact the structure of section 199A.

The tax debate is almost certainly going to expand beyond the expiring provisions of the Tax Cuts and Jobs Act (TCJA), the 2017 tax law. Many lawmakers will seek to include in the bill their priority tax proposals. In addition, deficit concerns are likely to result in proposals to raise taxes in new ways to offset at least some of the cost of extending at least some of the current tax rules, perhaps as modified.

Right now, Congress’s tax writers are focused on “education”—making sure they and their off-committee colleagues understand the tax policy, fiscal policy (i.e., impact on economic growth), and deficit considerations of the various issues that will be in play in the 2025 bill. Lobbying has already begun. These efforts include a late May letter to Congressional leaders and tax writers from almost 90 left-leaning and labor organizations calling for using the need to address the expiration of the TCJA to reduce the deficit (by raising taxes on individuals making more than $400,000/year and big corporations); modify TCJA provisions (including those, like the corporate tax rate, that do not expire) to “make the tax code more fair;” and to enact new rules that would create “greater and more inclusive economic growth by providing more financial security and opportunities for typical Americans, narrowing racial wealth gaps by boosting mobility, and disincentivizing economically harmful conduct by large corporations.”

Others—including, for example, Senate Finance Committee ranking member Sen. Mike Crapo (R-ID)—on the more conservative side of the issue say tax rules that promote economic growth should not need to be offset. However, one conservative think tank, American Compass, has just recently proposed a budget package (one of several) that would be a 60/40 mix of spending cuts and tax increases, arguing that the deficit problem is too severe to ignore and that the American people support raising taxes and cutting spending in this proportion to address the deficit. The group rails against the “anti-tax zealotry” of the current Republican party and suggests some tax increases are essential to this effort.

Prospects: Most Washington insiders believe that the tax bill that must be enacted before the end of next year is going to be the biggest issue facing Congress in 2025. What it will look like and how easily (or not) it will pass will depend a great deal on the outcome of the November elections. An all-Republican government (Presidency, House, and Senate) will craft a bill that is far different from one that would be put together by an all-Democratic government. And even more different would be a bill that would have to be passed by a divided government.

Most Washington insiders think an initial proposal will emerge either late in 2024 or early in 2025. It could take most or all of the year—with perhaps the effort spilling over into 2026—to actually pass what is sure to be a high-stakes, controversial, and complex measure.

NAIFA Staff Contacts: Diane Boyle – Senior Vice President – Government Relations, at dboyle@naifa.org; or Jayne Fitzgerald – Director – Government Relations, at jfitzgerald@naifa.org.

.png?width=600&height=90&name=Support%20IFAPAC%20%20(600%20%C3%97%2090%20px).png)