H.R.1, the budget reconciliation bill approved by the House on May 23, includes a provision that permanently increases the estate tax exemption to $15 million ($30 million for married couples). The $15 million exemption amount is indexed for inflation with a base year of 2025.

NAIFA

Recent posts by NAIFA

1 min read

Tax Package Increases Estate Tax Exemption

By NAIFA on 6/13/25 11:13 AM

Topics: Legislation & Regulations Estate Planning Tax Reform

1 min read

Reconciliation Bill Restricts Itemized Deduction Values for Wealthy

By NAIFA on 6/13/25 11:11 AM

A “tax-the-rich” provision in the House-passed reconciliation bill would reduce the value of itemized deductions for 37 percent taxpayers. The provision would replace current law’s Pease limitation on the value of itemized deductions.

Topics: Legislation & Regulations Tax Reform

1 min read

Health Savings Accounts Expanded in House-Passed Tax Package

By NAIFA on 6/13/25 11:09 AM

The House-passed tax package includes a number of enhancements to the rules governing health savings accounts (HSAs). These provisions are not subject to an expiration date—they would take effect in 2026.

Topics: Legislation & Regulations Health Savings Accounts

1 min read

House Bill Offers New Tax Break for Some Seniors, Enhanced Standard Deduction

By NAIFA on 6/13/25 11:08 AM

The House-passed tax bill provides a temporary additional deduction of $4,000 for those over age 65 who have less than $75,000 ($150,000 for married couples) in taxable income. It also temporarily expands the standard deduction by $2,000 (married)/$1,000 (single taxpayers).

Topics: Legislation & Regulations Tax Reform

1 min read

H.R.1 Would Create New Tax-Favored Savings Accounts for Children

By NAIFA on 6/13/25 11:06 AM

Included in H.R.1 are provisions that would create new tax-favored savings accounts, Trump Accounts, for children. It also includes creation of a pilot program under which there would be a one-time government contribution to Trump Accounts.

Topics: Legislation & Regulations

1 min read

House-Passed Reconciliation Bill Includes Bonus Depreciation for Five Years

By NAIFA on 6/13/25 11:04 AM

The House-passed budget reconciliation bill includes a temporary bonus depreciation provision that allows a 100 percent deduction (rather than several years of partial deductions to reflect amortization of the cost of the property) for qualified property acquired and placed in service by a business.

Topics: Legislation & Regulations Tax Reform

1 min read

Enhanced Deduction for Business Loan Interest Included in H.R.1

By NAIFA on 6/13/25 11:02 AM

H.R.1 modifies the rules for calculating the amount of interest paid on business loans. The result is for many businesses an increase in the amount of business loan interest that is deductible from taxable income.

Topics: Legislation & Regulations Tax Reform

1 min read

House Reconciliation Bill Makes Some Overtime Pay Income Tax-Free

By NAIFA on 6/13/25 11:00 AM

The House-passed reconciliation budget bill, H.R.1, contains a provision that would make certain overtime (OT) pay free from income tax, but not from payroll (Social Security/Medicare) taxes. This tax relief provision is limited both by income and by the Fair Labor Standards Act’s (FLSA’s) definition of qualified overtime hours.

Topics: Legislation & Regulations Taxes

1 min read

CHOICE Health Arrangements Included in House-Passed Reconciliation Bill

By NAIFA on 6/13/25 10:58 AM

The House-passed budget reconciliation bill includes a new two-year credit for employers that enroll their workers in a new health care program, CHOICE arrangements. The credit would be equal to $100 multiplied by the number of months for which each employee is enrolled in a CHOICE program in the first year, and $50 by the number of months each employee is enrolled in the program in the second year.

Topics: Health Care

1 min read

Reconciliation Bill Includes Enhanced Employer-Provided Paid Leave Credit

By NAIFA on 6/13/25 10:56 AM

The House-passed budget reconciliation bill includes a permanent extension of the tax credit available to employers offering qualified paid family and medical leave programs. It also modifies the tax credit to allow employers to claim the tax credit for the cost of private insurance that covers the cost of paid family and medical leave.

Topics: Paid Family Medical Leave

1 min read

DOL Rescinds 2022 Guidance on Crypto in Retirement Plans

By NAIFA on 6/13/25 10:54 AM

On May 28, the Department of Labor’s (DOL’s) Employee Benefits Security Administration (EBSA) announced it has rescinded its 2022 compliance guidance that discouraged retirement plan fiduciaries from including cryptocurrency options in retirement plan investment choices. The EBSA announcement specified that the agency is “neutral” on the issue of recommending inclusion of crypto in retirement plan investment options.

Topics: Retirement Plans DOL

1 min read

Key Senator Introduces Bill to Help ESOPs Contribute Shares to Plans

By NAIFA on 6/13/25 10:52 AM

On May 13, Sen. Bill Cassidy (R-LA), chair of the Senate Health, Education, Labor and Pensions (HELP) Committee, which has jurisdiction over ERISA issues, introduced legislation, S.1727, that would allow ESOPs to contribute company shares to plan participants without having to include the value of the shares in the ESOP’s or the employee’s contribution limits.

Topics: Legislation & Regulations Retirement Plans

1 min read

Senate HELP Advances Dhillon Nomination to Head PBGC

By NAIFA on 6/13/25 10:50 AM

On May 15, the Senate Health, Education, Labor and Pensions (HELP) Committee approved President Trump’s nominee, Janet Dhillon, to head the Pension Benefits Guaranty Corporation (PBGC) by a 12-11 vote. The Senate Finance Committee must also approve her nomination before it can go to the full Senate for a confirmation vote. The Finance Committee held a hearing on her nomination on June 3.

Topics: Federal Advocacy

Senate Approves Long Nomination as IRS Commissioner

By NAIFA on 6/13/25 10:48 AM

On June 12, the Senate approved President Trump’s nominee, former Missouri Congressman Billy Long, for Internal Revenue Service Commissioner on a partisan vote of 53-46. The Finance Committee on June 5 approved Long on a partisan 14-13 vote. The Committee held a hearing on his nomination on May 20. The nomination is for a 5-year term.

Topics: IRS

1 min read

Treasury Secretary Bessent Testifies Before Ways and Means

By NAIFA on 6/13/25 10:46 AM

Treasury Secretary Scott Bessent testified before the House Ways and Means Committee on June 11 in a highly partisan hearing focusing on OBBB tax cut distribution, IRS capabilities in light of Trump staff and budget cuts, budget deficits and trade policy. The hearing was called to discuss the Department’s “priorities”. Secretary Bessent testified that the IRS collected higher than expected receipts in April’s tax filings.

Topics: Congress

3 min read

House Committees Begin Crafting Massive Reconciliation Bill

By NAIFA on 5/15/25 11:17 AM

During the week of April 29, House committees of jurisdiction began crafting their pieces of the $6 trillion+ reconciliation budget bill that Congress wants to enact by the end of this summer. The process is and will continue to be fraught as lawmakers make tough decisions, on which there is and will be much opposition, on how to cut spending and taxes for the upcoming 10 years.

Topics: Legislation & Regulations Taxes Congress

7 min read

Ways and Means Approves Huge Tax Reconciliation Title

By NAIFA on 5/15/25 11:14 AM

The House Ways and Means Committee approved its reconciliation title on May 14 on a party line vote after a 17-hour mark-up. The tax title of the reconciliation bill contains provisions that would permanently extend (i.e., eliminate an expiration date) a raft of tax rules that are set to expire at the end of this year. A few of these extension provisions also modify the expiring rules, including the Section 199A deduction. In addition, the title includes new tax cuts first proposed by President Trump as well as other tax cuts. Offsets are included to ensure that the cost of the title complies with the Committee’s reconciliation instructions. Significantly and in a major victory for NAIFA, the Committee did not attempt to raise revenue from the products and services NAIFA provides to assist American families in achieving financial security.

Topics: Legislation & Regulations Taxes

2 min read

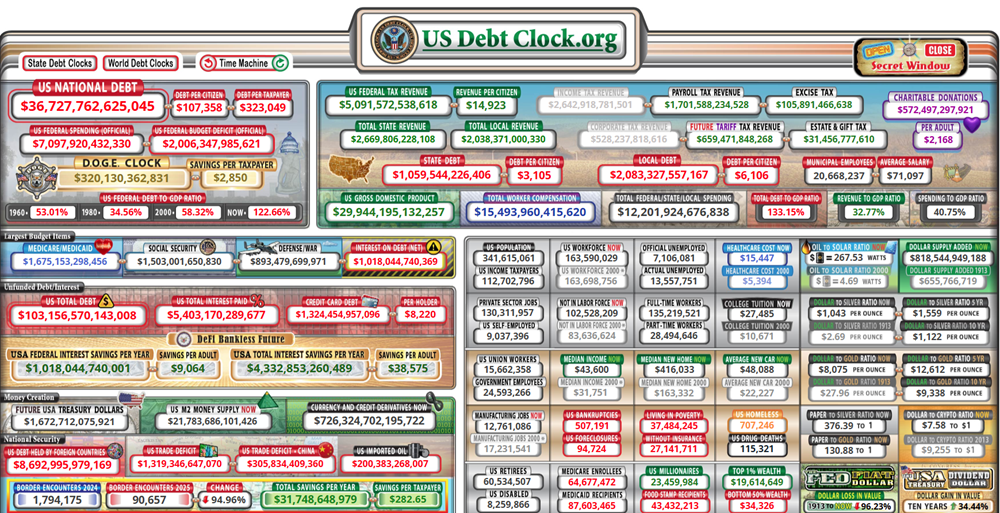

Debt Limit Sets “Real Deadline” for Reconciliation

By NAIFA on 5/15/25 11:06 AM

The emerging reconciliation bill includes a provision to raise the statutory debt limit—the amount beyond which Treasury may not borrow--to $4 trillion. The Senate version of the budget calls for a $5 trillion increase to the $37.2 trillion federal debt limit. The House budget authorizes a $4 trillion debt limit increase.

Topics: Legislation & Regulations Debt Congress

1 min read

House Committee Holds Hearing on ESG Rules in Retirement Plans

By NAIFA on 5/15/25 11:03 AM

On April 30, the House Education and the Workforce’s Subcommittee on Health, Employment, Labor, and Pensions (HELP) held a hearing on the impact of ESG rules on retirement plans. The hearing also focused on other security issues, like tariffs, Social Security, and the national debt.

Topics: Retirement Congress

1 min read

Bipartisan, Bicameral Federal Retirement Plan Legislation Introduced

By NAIFA on 5/15/25 10:59 AM

Legislation to create a federal retirement plan for workers whose employers do not offer a retirement plan was introduced last month in both the House and Senate. S.1526 was introduced by Sens. John Hickenlooper (D-CO) and Thom Tillis (R-SC). Reps. Lloyd Smucker (R-PA) and Terri Sewell (D-AL) introduced the companion bill, H.R.2696, in the House.

.png?width=600&height=90&name=Support%20IFAPAC%20%20(600%20%C3%97%2090%20px).png)