The outgoing 118th Congress must fund U.S. discretionary spending by December 20. Issues in play in that effort include extension of authority and funding for the National Flood Insurance Program (NFIP), delay of the Corporate Transparency Act’s (ACT’s) Beneficial Ownership Information (BOI) rule, and possibly technical corrections to SECURE retirement savings law.

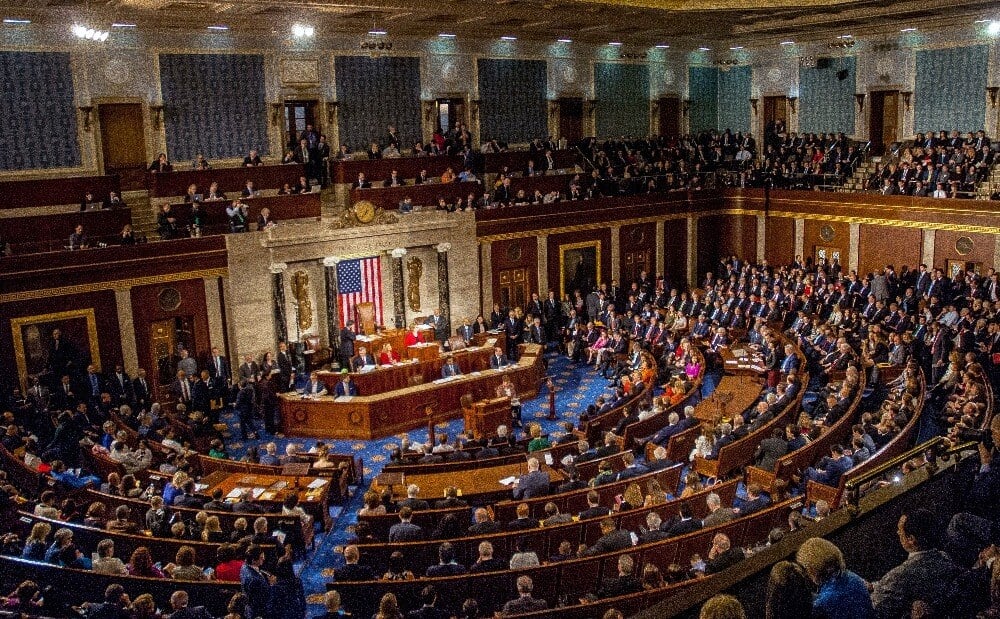

All votes this month in both the House and Senate will be taken by the outgoing 118th Congress. Democrats remain in control in the Senate and President Biden remains in the White House until the 118th Congress adjourns sine die at year-end. All-GOP control of the legislative process will not begin until the 119th Congress convenes in January 2025.

With less than two weeks to go before Christmas, lawmakers itching to get home for the holiday, and Republicans eager to take control over the legislative process in 2025, the likelihood is that Congress will enact a short-term continuing resolution (CR). The CR would continue government funding at fiscal year 2024 levels, with few policy changes, probably until mid-to-late March 2025.

Other issues that may be in play—and if they are to cross the legislative finish line, likely to be included in the CR—are an effort to further suspend or raise the federal borrowing cap (the debt limit), extension of the farm bill, and disaster aid (to help victims of Hurricanes Helene and Milton). The current statutory debt limit is suspended, and the suspension expires January 1. Treasury can take “extraordinary measures” (which are becoming commonplace as Congress continually confronts the nation’s borrowing limit) that will keep the government solvent for several weeks or months—likely until late spring/early summer. But because the debt limit cannot be breached, failure to suspend it or raise it after extraordinary measures are depleted means the U.S. would at least partially default on its obligations. Economists around the world say that would trigger catastrophic economic disaster.

The debt limit is always a fraught issue. Consequences for failure are extreme, and some lawmakers view the issue as leverage to get other priorities in place. Thus, there is a very real desire to address the issue and get it off the table to free the 119th Congress to work toward enactment of Trump/GOP priorities early in 2025.

Prospects: It is near-certain that one way or another the 118th Congress will enact a year-end government funding bill. That bill (a CR) is likely to include funding/authorization for the NFIP. It may or may not deal with the BOI effective date, SECURE retirement savings technical corrections, and/or the debt limit. We will keep you posted.

NAIFA Staff Contacts: Diane Boyle – Senior Vice President – Government Relations, at dboyle@naifa.org; or Jayne Fitzgerald – Director – Government Relations, at jfitzgerald@naifa.org; or Mike Hedge – Senior Director – Government Relations, at mhedge@naifa.org.

.png?width=600&height=90&name=Support%20IFAPAC%20%20(600%20%C3%97%2090%20px).png)