A Texas district court has issued a temporary nationwide injunction blocking enforcement of the Corporate Transparency Act’s (CTA) requirement (the Beneficial Ownership Information, or BOI rule) that forces U.S. businesses to report the names and identifying information of their beneficial owners. Legislation to delay the reporting requirement is pending before Congress.

On December 3, the federal District Court for the Eastern District of Texas issued the preliminary nationwide injunction to stop enforcement of the BOI rule. Under the BOI rule, any legal entity (with some exceptions) created in or registered to do business in the U.S. would have to report to the Treasury’s Financial Crimes Enforcement Network (FinCEN) the name and identifying information on the entity’s beneficial owners (those who directly or indirectly own 25 percent or more of the business). The BOI reports are due to FinCEN by January 1, 2025, and failure to comply with this reporting rule could trigger financial (and in some cases criminal) penalties. However, per the District Court nationwide injunction, those reports do not have to be filed, pending additional action by the courts.

The 23 exceptions to the CTA BOI rule include several that could help NAIFA members. For example, state-licensed insurance producers, SEC-registered investment advisors, and SEC-registered brokers and dealers are not subject to the BOI rule.

The district court ruling was appealed immediately (on December 5) to the Fifth Circuit Court of Appeals. The appeal calls for a stay of the injunction against enforcing the BOI rule. It is as yet unclear whether the Fifth Circuit will act on the appeal prior to the January 1 BOI effective date. It is also unclear at this point whether the Fifth Circuit will uphold the District Court’s preliminary injunction against enforcement of the BOI rule.

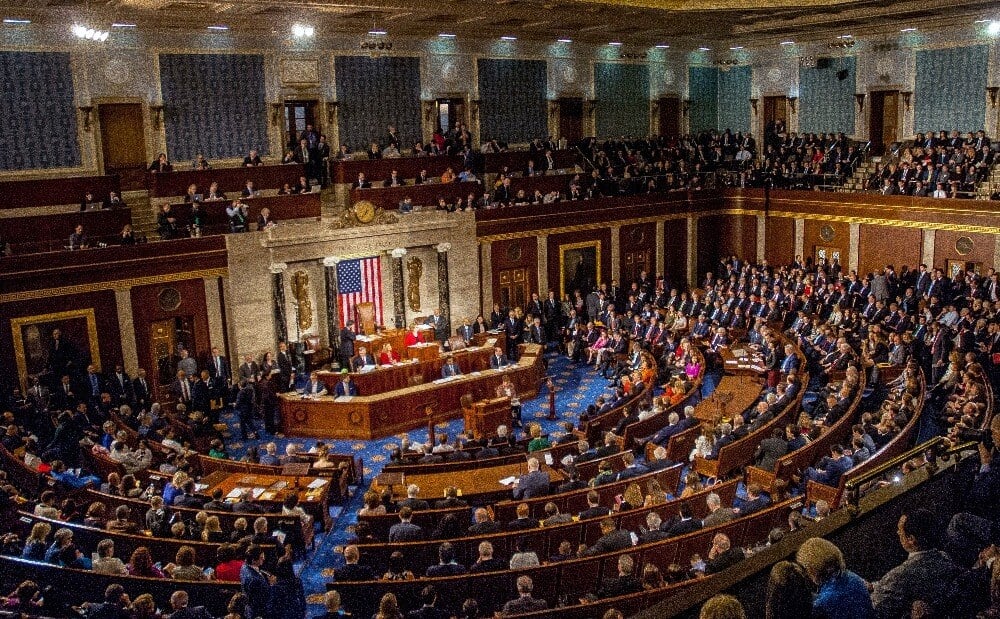

In Congress, there is a Republican-led effort to delay implementation of the BOI rule. The delay is part of ongoing negotiations between House and Senate lawmakers and may be included in the 118th Congress’ lame duck year-end government funding bill. Some Republican lawmakers are optimistic about the delay provision’s chances, but we will not know the outcome until the final year-end government funding bill is ready for House and Senate votes.

Prospects: Both Congress and the regulatory agencies support (on a bipartisan basis) the intent behind the BOI rule—to give FinCEN an additional tool in its fight against money-laundering. However, the rule’s impact on some 30 million U.S. businesses, most of whom are totally unprepared to deal with the rule despite Treasury and FinCEN educational efforts, makes a delay in its implementation possible, if not probable.

NAIFA Staff Contacts: Diane Boyle – Senior Vice President – Government Relations, at dboyle@naifa.org; or Jayne Fitzgerald – Director – Government Relations, at jfitzgerald@naifa.org.

.png?width=600&height=90&name=Support%20IFAPAC%20%20(600%20%C3%97%2090%20px).png)