On Wednesday November 12 President Trump signed into law a Senate-passed agreement that was approved by the House that reopened the federal government. The agreement guarantees a Senate vote by mid-December on extending the Affordable Care Act enhanced premium tax credits (PTCs), funds about 10 percent of the government for all of FY 2026, funds the remaining 90 percent of federal government discretionary activity at FY 2025 levels until January 30, reverses reductions in force (RIFs) done on or after October 1 and forbids further government layoffs through January 30. The National Flood Insurance Program (NFIP) is reauthorized until January 30, 2026, and is reauthorized retroactively to October 1, 2025.

2 min read

Federal Government Shutdown Ends

By NAIFA on 11/17/25 10:41 AM

Topics: Legislation & Regulations Federal Advocacy

1 min read

IRS Releases Guidance on Reporting Third-Party Transactions

By NAIFA on 11/17/25 9:50 AM

The Internal Revenue Service (IRS) has released guidance on how to report third-party transactions. The reporting thresholds increased via a provision in the spending/tax cuts law enacted this past July. The new transaction thresholds are 200 transactions in a year and/or transactions that exceed $20,000. The previous threshold was any transaction that exceeded $600.

Topics: Taxes Federal Advocacy IRS

1 min read

IRS Issues FAQs on ERTC Issues

By NAIFA on 11/17/25 9:48 AM

On October 22 the Internal Revenue Service (IRS) released guidance in the form of frequently-asked questions (FAQs) on the new Employee Retention Tax Credit (ERTC) compliance provisions. The new compliance provisions were enacted last summer in the tax/spending cuts reconciliation bill that was signed into law on July 4.

Topics: Taxes Federal Advocacy IRS

1 min read

Senate HELP Committee Approves ESOP Bills

By NAIFA on 8/15/25 9:55 AM

On July 30, the Senate Health, Education, Labor and Pensions (HELP) Committee approved two largely administrative ESOP bills. However, the committee’s chairman, Sen. Bill Cassidy (R-LA), withdrew from consideration his larger ESOP bill that would substantially increase the amount of employer stock that can be contributed to ESOP participants’ accounts.

Topics: Retirement Planning Legislation & Regulations Federal Advocacy

1 min read

Senate HELP Advances Dhillon Nomination to Head PBGC

By NAIFA on 6/13/25 10:50 AM

On May 15, the Senate Health, Education, Labor and Pensions (HELP) Committee approved President Trump’s nominee, Janet Dhillon, to head the Pension Benefits Guaranty Corporation (PBGC) by a 12-11 vote. The Senate Finance Committee must also approve her nomination before it can go to the full Senate for a confirmation vote. The Finance Committee held a hearing on her nomination on June 3.

Topics: Federal Advocacy

2 min read

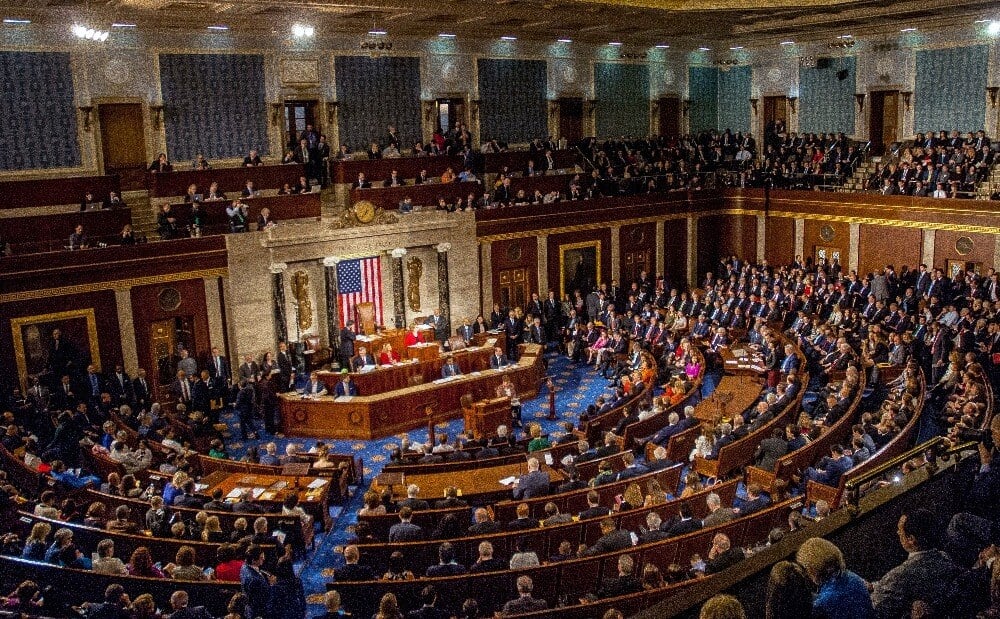

Congress Moves Forward on Massive Budget Bill

By NAIFA on 3/17/25 1:39 PM

The House and Senate have passed different Congressional Budget Resolutions (CBRs). Now, the two chambers must reconcile the differences to pass identical CBRs to unlock the budget process (reconciliation) that could bring deep mandatory and discretionary spending cuts, a huge tax package, and possibly an increase in the debt limit.

Topics: Federal Advocacy Congress

2 min read

BOI Enforcement Back on Track

By NAIFA on 3/17/25 1:30 PM

The Financial Crimes Enforcement Network (FinCEN) announced that it is again going to enforce the beneficial ownership interest (BOI) rule that was enacted as part of the Corporate Transparency Act (CTA). But, FinCEN said on February 27 that it will not impose fines or penalties until after it finalizes new reporting rules that would narrow the BOI reporting rule to foreign reporting companies. The new reporting deadline is March 21, 2025.

Topics: Legislation & Regulations Federal Advocacy

1 min read

HHS Secretary Limits Comments on Proposed Regulations

By NAIFA on 3/17/25 1:21 PM

On February 28, Department of Health and Human Services (HHS) Secretary Robert F. Kennedy Jr. announced the agency will no longer accept public comments on many of its rulemaking initiatives. This could impact rules important to NAIFA members, such as many Affordable Care Act (ACA) rules, including compensation for advisors on ACA insurance purchases.

Topics: Federal Advocacy

1 min read

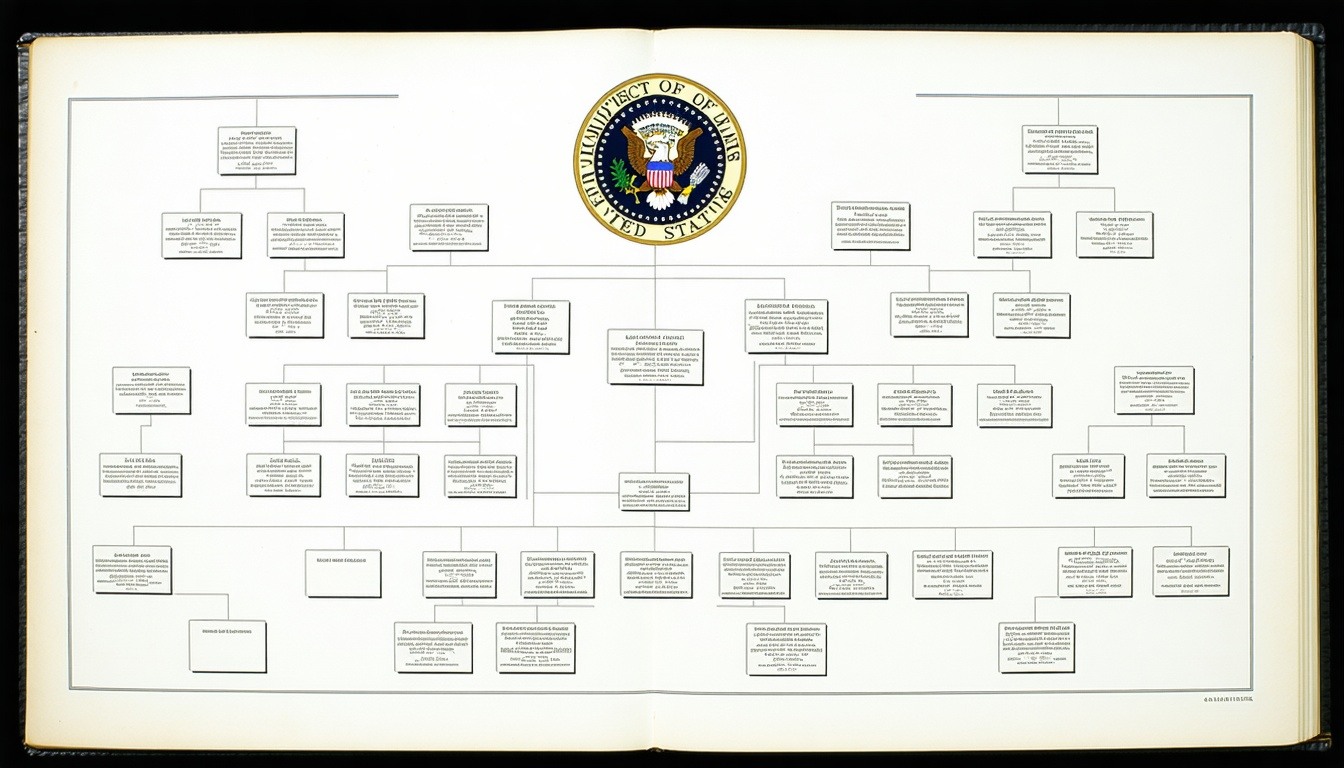

Trump Orders Reordering of Federal Bureaucracy

By NAIFA on 3/17/25 1:15 PM

Staffing cuts, federal agency and program relocation, and contract review (and potential cancellation) have started across the federal government. In conjunction with the Administration's “Department of Government Efficiency” (DOGE) (it is not a formal Cabinet department as it has not been established by law), all federal agencies have been ordered to put together a plan to reduce the federal workforce (starting with last month’s termination of thousands of probationary employees) by mid-March. The agencies must also draw up plans, by mid-April, to move agencies and programs out of Washington, DC to less expensive parts of the country. Agencies are also reviewing contracts they have with private sector service providers, with an eye to cancelling those that are not required by law or are otherwise not “mission critical.”

Topics: Federal Advocacy

1 min read

President Trump Orders Regulations Freeze, Review

By NAIFA on 2/17/25 9:22 AM

In one of his first moves after his January 20 inauguration, President Trump ordered federal agencies to halt rulemaking until the new Administration can review all pending proposed regulations. He also ordered a review of regulations finalized late in the Biden Administration.

Topics: Federal Advocacy Insurance & Financial Advisor Regulation

1 min read

Scott Bessent Confirmed as Treasury Secretary

By NAIFA on 2/17/25 8:56 AM

On January 27, the Senate voted to confirm the nomination of Scott Bessent as the 79th Secretary of the Treasury. The vote was 68 to 29. Sixteen Democrats joined with the Republicans to approve the nomination.

Topics: Federal Advocacy

2 min read

Lame Duck 118th Congress Aims to Wind Up with Government Funding

By NAIFA on 12/13/24 11:14 AM

The outgoing 118th Congress must fund U.S. discretionary spending by December 20. Issues in play in that effort include extension of authority and funding for the National Flood Insurance Program (NFIP), delay of the Corporate Transparency Act’s (ACT’s) Beneficial Ownership Information (BOI) rule, and possibly technical corrections to SECURE retirement savings law.

Topics: Federal Advocacy Congress

3 min read

Republicans Will Control the 119th Congress; Face Substantial Challenges

By NAIFA on 12/13/24 11:09 AM

In 2025-2026, Republicans will control the White House (Trump/President), the Senate (53 to 47), and the House (220 to 215). But despite winning the trifecta, GOP lawmakers will confront significant challenges next year. They include a spiraling deficit that will make enactment of GOP priorities difficult, and deep divisions between ultra-conservative and more centrist Republicans.

Topics: Federal Advocacy Congress

2 min read

CTA BOI Reporting Requirement on Hold

By NAIFA on 12/13/24 11:03 AM

A Texas district court has issued a temporary nationwide injunction blocking enforcement of the Corporate Transparency Act’s (CTA) requirement (the Beneficial Ownership Information, or BOI rule) that forces U.S. businesses to report the names and identifying information of their beneficial owners. Legislation to delay the reporting requirement is pending before Congress.

Topics: Federal Advocacy

2 min read

Deficits Trigger Organized Spending Cut Initiative

By NAIFA on 12/13/24 10:57 AM

Federal deficits projected to grow to almost $2 trillion next year have triggered creation, by President-Elect Trump, of a Department of Government Efficiency (DOGE). DOGE’s goal is to cut federal spending by $2 trillion.

Topics: Federal Advocacy Federal Deficit

1 min read

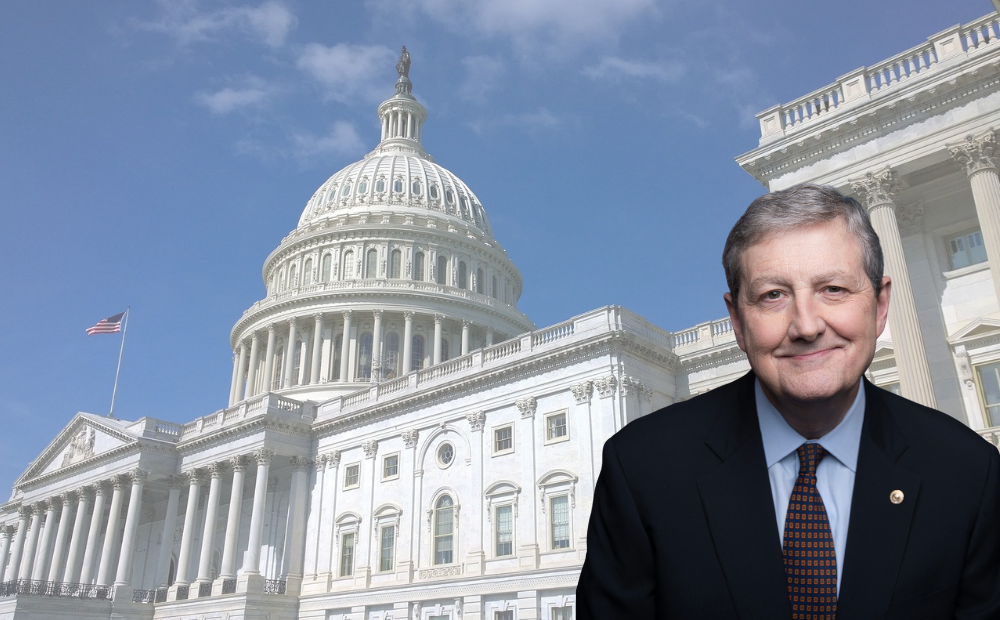

FSA Expansion Bill Introduced

By NAIFA on 12/13/24 10:51 AM

Sen. John Kennedy (R-LA) on December 3 introduced a bill to increase the amount a Flexible Spending Arrangement (FSA) owner can contribute to his/her FSA for dependent care expenses. While it is unlikely this bill will be enacted this year, its introduction tees up the issue for the incoming 119th Congress.

Topics: Federal Advocacy

1 min read

Bessent Nominated to Head Treasury Department

By NAIFA on 12/13/24 10:32 AM

Billionaire hedge fund manager and investor Scott Bessent is President-Elect Trump’s choice to head the Treasury Department. He says tariffs will be his top priority.

Topics: Federal Advocacy

1 min read

Robert F Kennedy Jr. Nominated to Lead HHS

By NAIFA on 12/13/24 10:21 AM

Robert F Kennedy Jr. is President-Elect Trump’s choice to be Secretary of the Department of Health and Human Services (HHS). A vaccines skeptic, Kennedy’s nomination is controversial, at least at this stage of the process.

Topics: Federal Advocacy

1 min read

Hassett Tapped to Head National Economic Council

By NAIFA on 12/13/24 10:10 AM

President-Elect Trump has chosen Kevin Hassett, an economist currently working as a fellow at the Hoover Institute at Stanford University, to head the National Economic Council (NEC). The NEC works closely with the Treasury Department as a hands-on policy-making team.

Topics: Federal Advocacy

3 min read

Biden State of the Union Speech Tees Up Huge Issues for 2024 and 2025

By NAIFA on 3/15/24 4:34 PM

President Biden’s March 7 State of the Union (SOTU) speech teed up a raft of issues important to NAIFA members and their clients. These are issues that will shape the pre-November election campaigns and the Congressional agenda for both 2024 and 2025.

.jpg)

.png?width=600&height=90&name=Support%20IFAPAC%20%20(600%20%C3%97%2090%20px).png)