A Texas judge has ruled against a challenge to Biden Administration environmental, social, and governance (ESG) rules that allow fiduciaries to consider ESG factors in selecting retirement plan investment choices. House action to roll back the rules is pending.

1 min read

ESG Rules Trigger Congressional, Judicial Attention

By NAIFA on 10/16/23 11:49 AM

Topics: Retirement Planning Retirement Legislation & Regulations Investing

1 min read

SEC Issues Proposed Rule on RILA Implementation

By NAIFA on 10/16/23 11:38 AM

On September 29, the U.S. Securities and Exchange Commission issued a proposed rule to implement the Registration for Index-Linked Annuities (RILA) Act, which directed the SEC to devise a new form for annuity issuers to use when filing registered index-linked annuities (RILAs). That legislation was enacted in December 2022 as part of the Consolidated Appropriations Act, 2023 which also included the Secure 2.0 Act.

Topics: Life Insurance & Annuities Legislation & Regulations SEC

2 min read

Roth Rule Catch-Up Contribution Notice Resolves Some Effective Date Issues

By NAIFA on 9/15/23 2:08 PM

In Notice 2023-62, the IRS and Treasury clarified that many catch-up contributions for 2024-2025 will not have to be Roth contributions for taxpayers earning $145,00/year or more.

Topics: Retirement Legislation & Regulations Federal Advocacy IRS SECURE 2.0

2 min read

EBSA Sends New Fiduciary Proposal to White House for Review

By NAIFA on 9/15/23 2:06 PM

On September 8, the Department of Labor’s (DOL’s) Employee Benefits Security Administration (EBSA) sent to the White House’s Office of Information and Regulatory Affairs (OIRA) a notice of proposed rulemaking (NPRM) on new fiduciary duty rules applicable to advisors on retirement savings. Details of what the agency is proposing are as yet unknown, but speculation suggests its focus is on insurance-related advice, and on rollovers from retirement plans to individual IRAs.

Topics: Retirement Legislation & Regulations Federal Advocacy DOL

3 min read

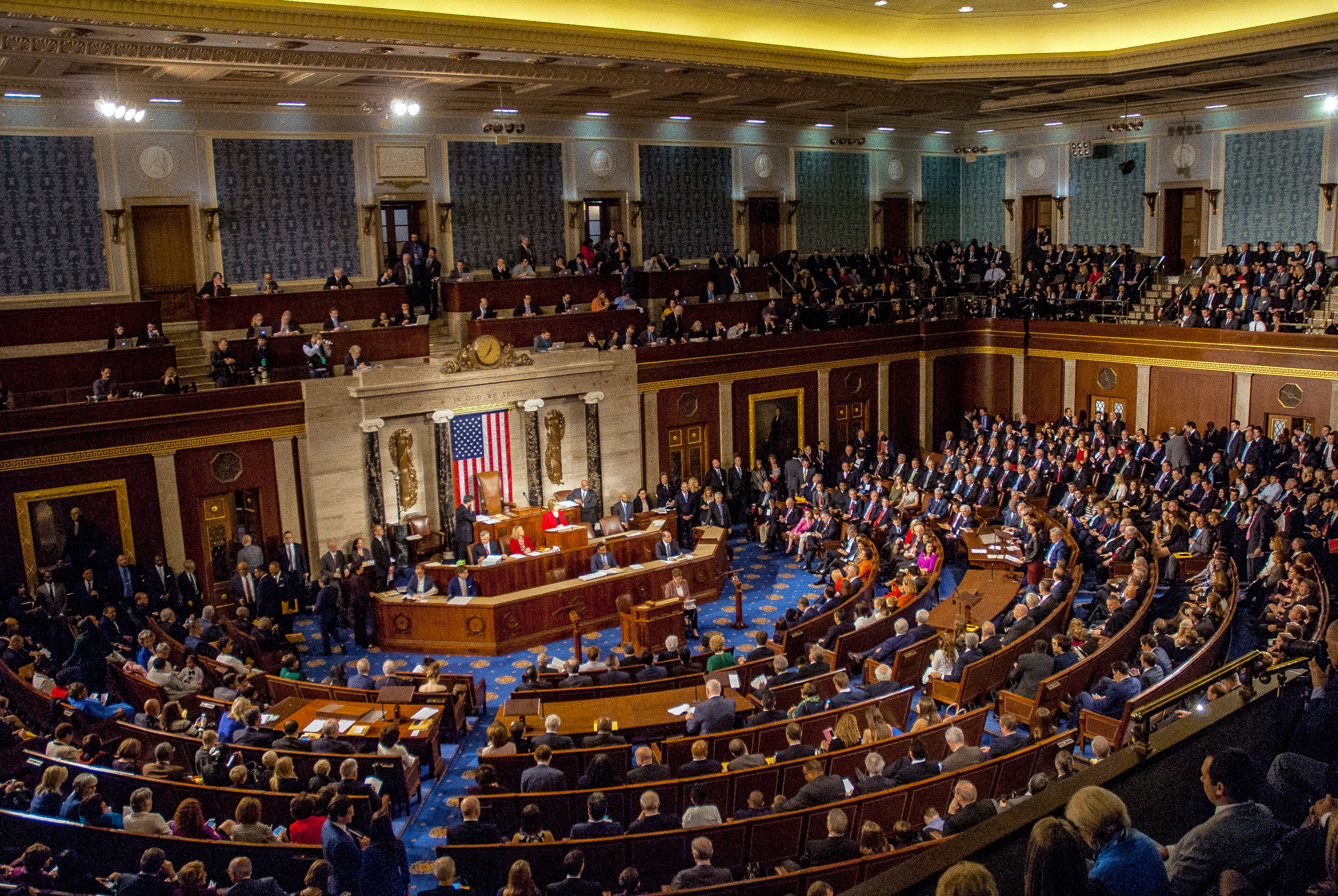

Congress Returns to a Brutal September

By NAIFA on 9/15/23 2:05 PM

Lawmakers returned to Washington after a six-week August recess with just two weeks in which to provide funding for the entirety of the discretionary spending available to the federal government. Other must-pass legislation, also due by October 1, further complicates September. And the politics are extremely difficult for all of this must-do legislation. A number of issues of concern to NAIFA could be caught up in what looks like will be a brutal month (or four).

Topics: Legislation & Regulations Federal Advocacy Congress SECURE 2.0

3 min read

NAIFA Submits Comments on Proposed STLD Health Insurance Regs

By NAIFA on 9/15/23 2:04 PM

On September 11, NAIFA submitted comments on the tri-agency (Departments of Health & Human Services (HHS), Labor (DOL) and Treasury) proposed regulations on short-term limited duration (STLD) health insurance, and on fixed payment (indemnity) health insurance.

Topics: Health Care Legislation & Regulations Federal Advocacy

2 min read

DOL Proposes New White-Collar Exemption Rule

By NAIFA on 9/15/23 2:03 PM

On August 30, the Department of Labor (DOL) released a new proposed regulation on the white-collar exception to the Fair Labor Standards Act’s (FLSA’s) overtime rules. Generally, DOL proposes that the salary threshold rise to $55,068/year (and suggests the number could go higher by the time the proposal is finalized), and that it be updated automatically every three years.

Topics: Legislation & Regulations Federal Advocacy DOL

2 min read

House Republicans Advance Anti-ESG Legislation

By NAIFA on 9/15/23 2:02 PM

Republicans on the House Financial Services Committee approved four anti- environmental/social/governance (ESG) bills this past July, and on September 5, GOP members of the House Education & the Workforce Committee introduced another four bills that would restrict the use of ESG factors in evaluating investments in a retirement savings plan.

Topics: Legislation & Regulations Federal Advocacy Congress

2 min read

Congress Tees Up September Appropriations Nightmare

By NAIFA on 8/14/23 3:57 PM

Congress left Washington on July 27 without enacting any fiscal year (FY) 2024 appropriations bills. Lawmakers did make some progress in both the House and Senate, but face having to do all 12 of the annual discretionary spending bills in less than three weeks in September. Expect deep cuts to the budgets of all the agencies, except the Veterans Administration (VA) and Defense, and potentially new taxes as well.

Topics: Legislation & Regulations Congress

1 min read

EBSA Head Predicts Changes to Fiduciary Rule

By NAIFA on 8/14/23 3:52 PM

Employee Benefits Security Administration (EBSA) head Lisa Gomez is predicting changes to the Department of Labor’s (DOL’s) fiduciary rule due to “changes in the marketplace since 1975.” She noted, though, that EBSA is also considering the litigation that has overruled previous attempts by EBSA to change the fiduciary rule, especially in connection with advice on rollovers.

Topics: Legislation & Regulations Standard of Care & Consumer Protection DOL Fiduciary

2 min read

Tri-Agency Proposed Reg Adversely Impact STLD, Indemnity Health Insurance

By NAIFA on 8/14/23 3:34 PM

On July 7, the Departments of Labor (DOL), Health and Human Services (HHS), and the Treasury (the “tri-agency” reg) released a proposed regulation that would significantly and adversely impact short-term limited duration (STLD) and fixed payment (e.g., indemnity) health insurance.

Topics: Health Care Legislation & Regulations Taxes DOL

2 min read

Effort to Delay Roth Catch-Up Contribution Rule Continues

By NAIFA on 8/14/23 3:28 PM

The Treasury Department has still not decided whether it will/can delay the effective date of the SECURE 2.0 rule that requires plan participants earning more than $145,000 to make their catch-up contributions on a Roth basis (i.e., after-tax contribution, tax-free withdrawals).

Topics: Retirement Planning Legislation & Regulations IRS Individual Retirement Accounts

2 min read

Bipartisan Senate Bill Would Allow Auto Enrollment Every Three Years

By NAIFA on 8/14/23 3:22 PM

A new Senate bill, S.2512, would permit employers to automatically enroll existing workers (who had initially opted out) into their employer-sponsored retirement plans every three years. The reenrollment would be subject to the worker’s ongoing ability to continue to opt out.

Topics: Retirement Planning Legislation & Regulations Congress

1 min read

Bill Introduced to Make Permanent the Noncorporate Business Income Deduction

By NAIFA on 8/14/23 3:15 PM

On July 27, Rep. Lloyd Smucker (R-PA), a key member of the tax-writing House Ways & Means Committee, introduced legislation to make permanent the 20 percent deduction for noncorporate business income. The bipartisan bill, H.R.4721, the Main Street Tax Certainty Act, has 99 cosponsors.

Topics: Legislation & Regulations Taxes Congress

1 min read

Bicameral Legislation to Raise the Federal Minimum Wage Introduced

By NAIFA on 8/14/23 3:09 PM

Key Democrats in the Senate and the House have introduced legislation to raise the federal minimum wage to $17/hour. The “Raise the Wage Act” was introduced in the Senate on July 25 by Senate Health, Education, Labor, and Pensions (HELP) Committee Chair Sen. Bernie Sanders (I-VT). Senate HELP has jurisdiction over minimum wage issues. The bill was introduced in the House by Education & the Workforce Committee ranking member Rep. Bobby Scott (D-VA). The Education & the Workforce Committee has jurisdiction over the bill in the House.

Topics: Legislation & Regulations Congress

1 min read

DOL Proposed Changes to White Collar Exemption to the OT Rule Moves Forward

By NAIFA on 8/14/23 2:46 PM

On July 12, the Department of Labor’s (DOL’s) Wage and Hour Division (WHD) sent to the White House (the Office of Management and Budget’s (OMB’s) Office of Information and Regulatory Affairs (OIRA)) for review its proposed changes to the white-collar exemption from overtime (OT) rules. This is the last step prior to finalizing a proposed regulation.

Topics: Legislation & Regulations DOL

1 min read

DOL Secretary’s Stalled Nomination Triggers Talk of Challenge

By NAIFA on 8/14/23 2:35 PM

The Government Accountability Office (GAO) is now investigating whether Acting Department of Labor (DOL) Secretary Julie Su has the legal authority to lead the agency. It is becoming increasingly clear that there are not yet the votes to confirm her as DOL Secretary. However, her nomination has not been withdrawn, nor is it scheduled for a Senate vote. Instead, the Administration is saying it has the authority to leave Su in place as Acting Secretary. This is triggering talk of a legal challenge to any actions taken by DOL during what some are calling Su’s illegal time as acting head of the agency.

Topics: Legislation & Regulations DOL

3 min read

Administration Proposes Regs on STLD Coverage, Fixed Payment Health Insurance, Medical Payment Products

By NAIFA on 7/14/23 9:00 AM

The Biden Administration has released proposed regulations on short-term limited duration (STLD) health insurance, and on indemnity health insurance that pays benefits based on a triggering illness/injury rather than on a specific service. The Administration also issued a request for information (RFI) on certain medical payment products.

Topics: Legislation & Regulations

1 min read

House Passes Bill to Streamline ACA Reporting

By NAIFA on 7/14/23 8:30 AM

On June 21, the House of Representatives approved legislation, H.R.3801, that would streamline the Affordable Care Act (ACA) required reporting. The Employer Reporting Improvement Act, sponsored by Reps. Adrian Smith (R-NE) and Mike Thompson (D-CA), passed by voice vote under suspension of the rules.

Topics: Health Care Legislation & Regulations Supported Legislation

1 min read

NLRB Issues New Worker Classification Test

By NAIFA on 7/14/23 8:00 AM

The National Labor Relations Board (NLRB) decided a case on June 13 that revives the agency’s worker classification standard from 2014; i.e., that entrepreneurial activity is but one of ten factors used to determine whether the employer controls the worker/work product, and therefore the worker should be classified as an employee. Prior to this new case, the standard, laid out in SuperShuttle DFW, Inc., made entrepreneurial activity a key factor through which other factors should be viewed.

.png?width=600&height=90&name=Support%20IFAPAC%20%20(600%20%C3%97%2090%20px).png)