On February 1, 2024, Representative Brad Finstad (R-MN) introduced the bipartisan Prove it Act in the U.S. House of Representatives. Senate Small Business and Entrepreneurship Committee Ranking Member Joni Ernst introduced the companion legislation last year. The Prove It Act aims to give small businesses a seat at the table during the regulatory process and aims to limit the regulatory burden on small businesses.

2 min read

U.S. House Introduces Prove it Act

By NAIFA on 2/15/24 10:07 AM

Topics: Legislation & Regulations Small Business Congress

2 min read

NAIFA Submits Comments to DOL on Fiduciary-Only Rule

By NAIFA on 1/16/24 3:48 PM

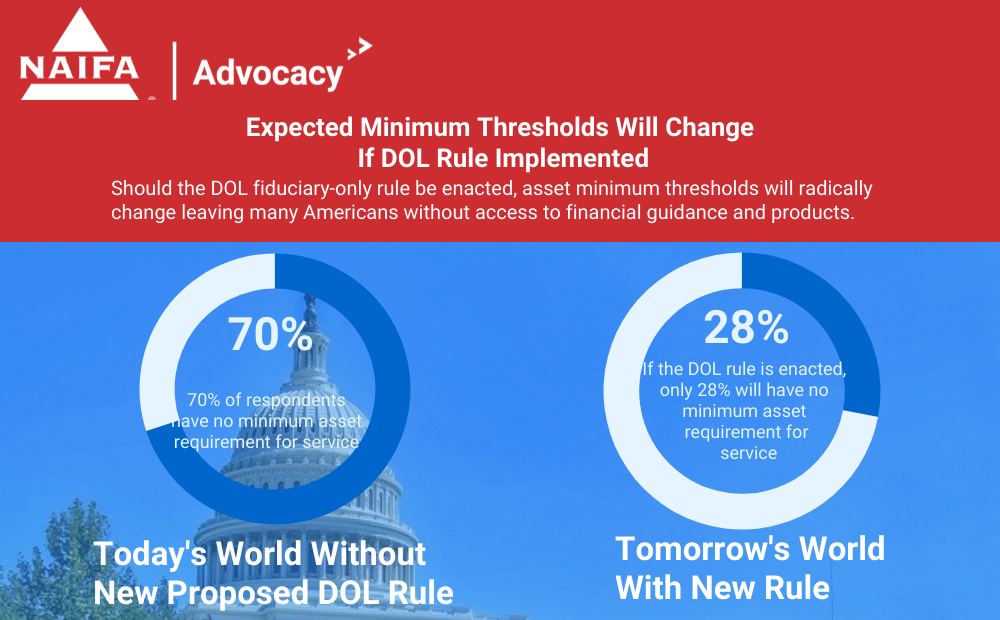

On January 2, NAIFA submitted comments to the Department of Labor (DOL) on its proposed fiduciary-only rule. The comments pointed out the harm the proposal would do to middle class retirement investors and to financial professionals who already put clients’ interests first. NAIFA recommended that the proposal be withdrawn.

Topics: Legislation & Regulations Standard of Care & Consumer Protection Federal Advocacy DOL

3 min read

Battle to Kill the Fiduciary-Only Rule Heats Up

By NAIFA on 1/16/24 3:33 PM

Repeating their testimony at a DOL hearing last month in comments submitted to DOL, industry advocates told a January 10 House hearing that the DOL’s fiduciary-only proposed regulations must be withdrawn. Fifty House members wrote to DOL demanding the rule’s withdrawal. DOL must sift through 19,000+ comments on the rule.

Topics: Legislation & Regulations Congress DOL NAIC Fiduciary

3 min read

DOL Releases New Final Rule on Worker Classification

By NAIFA on 1/16/24 3:28 PM

On January 9, the Department of Labor (DOL) released its new, final independent contractor classification regulation. It largely follows the proposed rule, imposing an economic reality based on the totality of the circumstances test to determine whether a worker is an employee or an independent contractor. It contains no industry or occupation exceptions or carve-outs. The rule is effective on March 11, 2024.

Topics: Legislation & Regulations Congress DOL

2 min read

NAIFA Voices Concern on Proposed Medicare Advantage and Part D Changes

By NAIFA on 1/16/24 3:27 PM

On January 5, President Tom Cothron submitted comments to the Centers for Medicare & Medicaid Services (CMS) on behalf of all NAIFA members to express concern over a proposed rule change regarding the Medicare Advantage and Medicare Part D programs.

Topics: Medicaid Legislation & Regulations Medicare CMS Compensation Regulation Congress

3 min read

Congress Returns to Difficult Times

By NAIFA on 1/16/24 3:25 PM

When the first session of the 118th Congress ended last month, lawmakers left undone controversial and pressing business that will make January a difficult month. Pending are government funding, international aid, and expiring law issues on which there is as yet little or no consensus. Caught in the crosshairs are a tax package with provisions of interest to NAIFA members, extension of the National Flood Insurance Program (NFIP), and proposals to defund regulatory initiatives like the fiduciary-only rule.

Topics: Legislation & Regulations Taxes Congress DOL SECURE 2.0 Fiduciary

6 min read

Government JCT Releases Latest Tax Expenditure Report

By NAIFA on 1/16/24 3:25 PM

Last month, Congress’ Joint Committee on Taxation (JCT) released its annual “tax expenditure report.” This is a list of many tax code rules that result in the government not collecting tax on what would otherwise be taxable income. Many of these rules directly benefit life and health insurance, retirement savings, employer-provided benefits, and general investments.

Topics: Retirement Legislation & Regulations Taxes Debt Insurance Congress

3 min read

ERTC Faces More Scrutiny

By NAIFA on 1/16/24 3:24 PM

Treasury and the Internal Revenue Service (IRS) have announced increased enforcement in connection with employee retention tax credit (ERTC) claims. The agencies are warning about more scrutiny as a result of what they call massive fraud in the pandemic-era tax rule. Now, some in Congress are pushing back, concerned that legitimate claims are not being paid as a result of this increased scrutiny. In addition, Congressional tax writers are looking at the ERTC as a possible source of offsetting revenue for the emerging tax bill (see story below).

Topics: Legislation & Regulations Taxes Congress IRS

3 min read

Congress to Consider Tax Legislation in 2024

By NAIFA on 1/16/24 3:23 PM

Currently there are two principal tracks for tax legislation in 2024. The first is an emerging $78 billion package aimed at providing a combination of business and individual tax relief in certain discreet areas. The second is a bigger picture bill that would address the fact that more than half the tax code is scheduled to expire at the end of 2025. Both have significant implications for NAIFA members and their clients.

Topics: Legislation & Regulations Taxes Congress

1 min read

DOL Proposes Rescission of Trump-Era Association Health Plan Regulation

By NAIFA on 1/16/24 3:22 PM

Last month, the Department of Labor (DOL) proposed rescission of the 2018 association health plan (AHP) regulations. AHPs are designed to allow small employers to band together to achieve cost-effective health insurance availability.

Topics: Legislation & Regulations DOL

1 min read

CMS Announces ACA Cost-Sharing Limits

By NAIFA on 1/16/24 3:22 PM

The Centers for Medicare and Medicaid Services (CMS) has announced new cost-sharing limits and required contribution percentages for the 2025 benefit year. For the 2025 calendar year, the self-only coverage annual limitation on cost-sharing is $9,200. It is $18,400 for other than self-only coverage.

Topics: Medicaid Legislation & Regulations Medicare Affordable Care Act CMS

1 min read

President Biden Renominates Julie Su to Head DOL

By NAIFA on 1/16/24 3:19 PM

On January 8, President Biden officially renominated Julie Sue as Secretary of Labor. Su failed to win the votes needed to confirm her last year, but Senate leadership pulled her nomination from the floor rather than allowing a vote against her. Su is currently serving as acting DOL Secretary.

Topics: Legislation & Regulations Congress DOL

4 min read

NAIFA’s Moore Comments on DOL’s Fiduciary-Only Proposal at NAIC Meeting

By NAIFA on 1/16/24 12:26 PM

At the NAIC’s Fall Meeting in Orlando, Florida (November 30 – December 3), NAIFA’s Policy Director Roger Moore testified against the Department of Labor’s proposed fiduciary-only rule during the Life and Annuities (A) Committee meeting, commenting that the rule will harm lower- and middle-income families. Moore was joined by representatives from coalition partners in expressing strong support for the NAIC’s efforts opposing DOL’s actions.

Topics: Legislation & Regulations Congress DOL NAIC Fiduciary

2 min read

NAIFA Testifies at DOL Fiduciary Rule Hearing

By NAIFA on 12/15/23 2:32 PM

NAIFA testified on the first day of the two-day (December 12-13) Department of Labor (DOL) fiduciary rule hearing. President Bryon Holz, who appeared with one of his clients, represented NAIFA, telling DOL of the harm its proposed rule would cause for middle-income retirement investors. NAIFA will also submit formal comments to the DOL ahead of the January 2 deadline for close of comments.

Topics: Legislation & Regulations Congress DOL NAIC

1 min read

NAIFA Leaders Ask Lawmakers to Oppose DOL’s Fiduciary, Independent Contractor Rules

By NAIFA on 12/15/23 2:26 PM

As part of NAIFA’s National Leadership Conference, 248 NAIFA leaders from around the country spent December 5 on Capitol Hill, asking lawmakers to support our efforts to kill the Department of Labor’s (DOL’s) proposed fiduciary rule and exempt financial advisors from its worker classification/independent contractor proposed rule.

Topics: Legislation & Regulations Congress DOL

3 min read

Government Shutdown Risk Shifts to Early Next Year

By NAIFA on 12/15/23 2:15 PM

On November 15, Congress enacted, and on November 17, President Biden signed into law a continuing resolution (CR) that extends current funding for the government’s discretionary spending until early in 2024. It was a two-part extension that was fraught with political peril. Renewed debate—and risk—will peak again right after the holidays.

Topics: Legislation & Regulations Congress DOL

2 min read

Ways & Means Approves Expanded HSA Bills

By NAIFA on 10/16/23 1:02 PM

On September 28, the House Ways & Means Committee approved legislation, HR 5687, that expands health savings account (HSA) rules to include an increase in the out-of-pocket costs associated with the HSA’s accompanying high deductible health plans (HDHPs). Those limits currently are $7,500 for self-only coverage, $15,000 for family coverage, and $1,000 in catch-up contribution authority. Under current law, HSA contribution limits are much lower--$3,850 for self-only HSAs and $7,750 for HSA owners with family coverage.

Topics: Legislation & Regulations Health Savings Accounts

2 min read

IRS Announces Moratorium on New ERTC Claims, Enhanced Program Scrutiny

By NAIFA on 10/16/23 12:37 PM

On September 14, the Internal Revenue Service (IRS) announced it had stopped processing all new coronavirus-era Employee Retention Tax Credit (ERTC) claims, and that claims submitted prior to September 14 will be subject to enhanced examination and considerable delay before payment of those claims it determines to be valid. The IRS actions are in light of reports of rampant fraud among those seeking to claim the ERTC.

Topics: Legislation & Regulations IRS

1 min read

DOL Sends Final Worker Classification Rule to White House for Review

By NAIFA on 10/16/23 12:27 PM

On September 28, the Department of Labor’s (DOL’s) Wage and Hour Division (WHD) sent to the White House’s Office of Management and Budget (OMB) for pre-release review (and authorization to release) its final new rules on worker classification.

Topics: Legislation & Regulations DOL

4 min read

Pending Regulations Impact NAIFA

By NAIFA on 10/16/23 12:19 PM

There is a slew of pending regulations on such issues as the fiduciary rule, retirement savings, and health insurance nearing release. Below is a summary of some of the ones that will have the most impact.

.png?width=600&height=90&name=Support%20IFAPAC%20%20(600%20%C3%97%2090%20px).png)