The Biden Administration has released proposed regulations on short-term limited duration (STLD) health insurance, and on indemnity health insurance that pays benefits based on a triggering illness/injury rather than on a specific service. The Administration also issued a request for information (RFI) on certain medical payment products.

STLD Coverage: On June 7, the Departments of Health and Human Services (HHS), Labor (DOL), and the Treasury released proposed regulations that roll back the Trump Administration’s rules on STDL health insurance. The Biden Administration proposed STDL rules largely revert to the rules in effect in 2014, during the Obama Administration. The Trump Administration had loosened those rules substantially.

Generally, the proposed new rule (RIN 1210-AC12) allows only three months of STLD coverage, with renewability for one month. The proposed rule would also impose strict disclosure and disclaimer requirements, so that purchasers are fully aware of the coverage they are getting (or, as some critics claim, what they are not getting). The Trump Administration rule, which these proposed regs would replace, allows STLD coverage for one year, renewable for up to three years.

STLD is not subject to Affordable Care Act (ACA) requirements such as minimum essential benefits, the mandate to cover preexisting conditions, and a prohibition against limited availability and premiums based on health status. It is generally significantly less expensive than the fuller coverage provided by ACA-compliant health insurance (whose premium costs, however, can be covered by income-based premium tax credits).

The proposed regulation was printed here. Comments are due 60 days after publication (September 11, 2023).

Indemnity Health Insurance: Another June 7 proposed rule (RIN:1545-BQ28) issued by the Internal Revenue Service (IRS) clarifies the rules applicable to health insurance that pays a fixed amount triggered by illness or injury, rather than for health services received by the insured. The proposed rule states that for such indemnity payments to be tax-free, they must be used to pay for qualified medical expenses. The proposed reg is posted here.

“The IRS is targeting fixed indemnity benefits and specified disease excepted benefits,” wrote the agency. “This insurance pays out a pre-determined amount to an employee on a regular basis if it is triggered by a diagnosis or sickness. The benefits are paid to the employee regardless of whether they incurred medical expenses.

“Although a benefit payment at the pre-determined level under that coverage may incidentally cover all or a portion of the cost of medical care stemming from the precipitating health-related event, it is typically not designed to do so and is paid without regard to the amount of the medical care expense incurred,” the IRS wrote.

The IRS said that it is aware these plans can be used to avoid paying income and employment taxes. Specifically, the proposed regulation states that indemnity insurance payments will not be excluded from a taxpayer’s gross income (under Internal Revenue Code Section 105) if the payments are made “without regard to the actual amount of medical expenses incurred.”

The effective date of the proposed regulation is the date of finalization, or January 1, 2024.

Medical Payment Products: Also on June 7, the Consumer Financial Protection Bureau (CFPB), HHS, and Treasury issued a request for information (RFI) on “potentially predatory practices in medical payment products” such as credit cards and installment loans. The agencies say they want to learn more about how prevalent these products are, and about whether “they can harm consumers with features such as exorbitant deferred interest fees.” Specifically, the RFI wants input on the payment product market, patient experiences with the products, billing issues, and healthcare provider incentives. Comments are due by mid-September (60 days after the July 12 publication of the RFI here.)

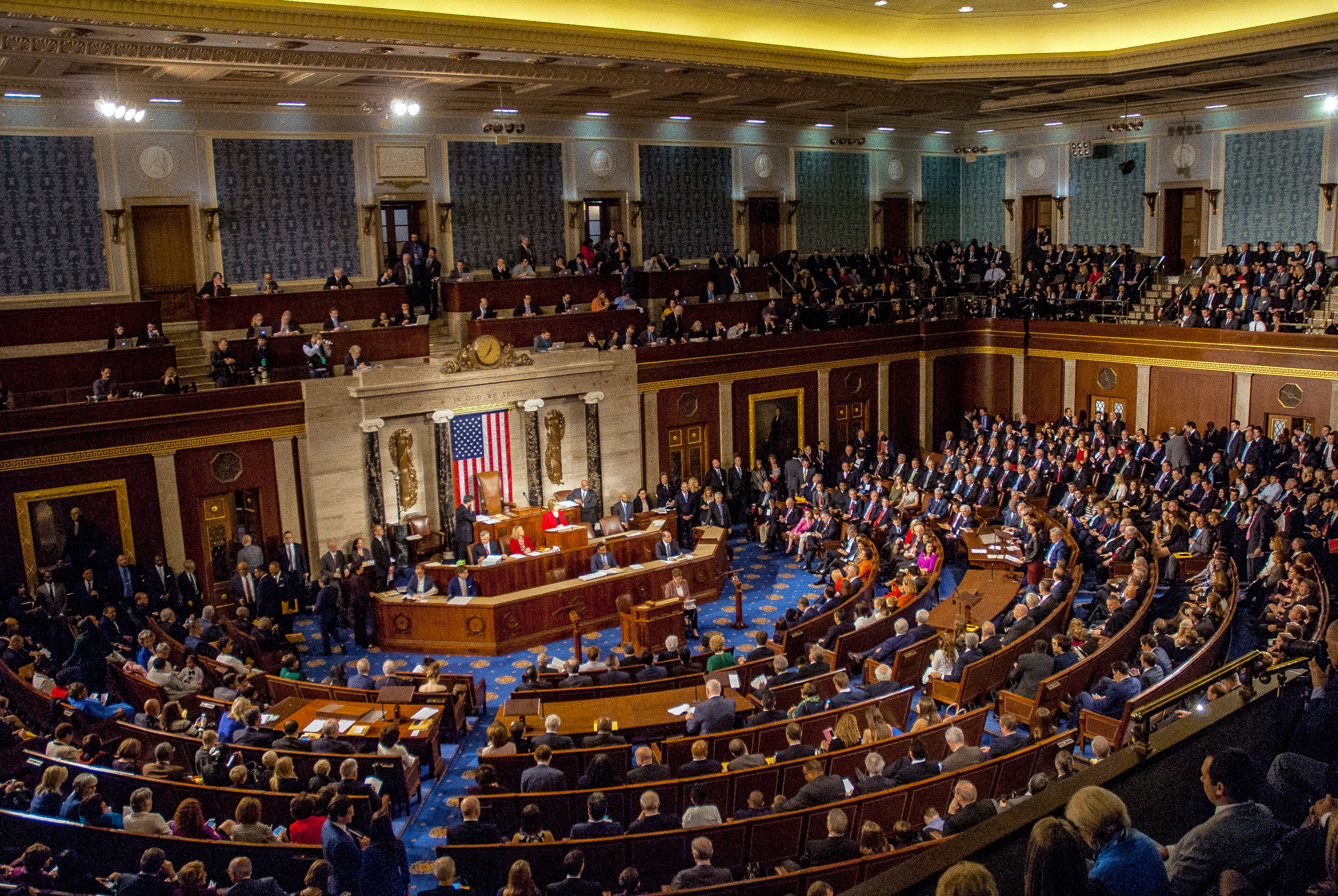

Prospects: Expect significant push-back from the private sector, and from Congressional Republicans on the STLD health insurance proposal. On the other hand, Democrats and various medical providers, patient advocates and consumer groups applauded the proposed STLD rule. The indemnity health insurance clarification does not appear to significantly change current regulations, which state that non-taxable indemnity health insurance payments must be used to reimburse a taxpayer for medical expenses. But early indications are that there will be opposition to this proposed reg as well. The RFI on medical payment products will likely trigger considerable debate, and possibly a new proposed regulation after the CFPB, HHS, and Treasury collect the information they are seeking.

NAIFA Staff Contacts: Diane Boyle – Senior Vice President – Government Relations, at dboyle@naifa.org; Jayne Fitzgerald – Director – Government Relations, at jfitzgerald@naifa.org; or Michael Hedge – Senior Director – Government Relations, at mhedge@naifa.org.

.png?width=600&height=90&name=Support%20IFAPAC%20%20(600%20%C3%97%2090%20px).png)