NAIFA CEO Kevin Mayeux, CAE, told the Biden Administration in a meeting that the Department of Labor’s (DOL’s) current efforts to revive a fiduciary-only regulation for financial professionals is unnecessary and likely to harm low- and middle-income consumers.

3 min read

NAIFA CEO Represents Advisors and Consumers in Meeting With Administration on DOL’s Fiduciary Proposal

By NAIFA on 10/10/23 11:18 AM

Topics: Press Release Federal Advocacy Annuity Best Interest DOL Regulation Best Interest White House Fiduciary

2 min read

Oklahoma Becomes 40th State to Adopt Enhanced Protections for Annuity Consumers

By NAIFA & ACLI on 8/16/23 10:37 AM

American Council of Life Insurers (ACLI) President and CEO Susan Neely and NAIFA-Oklahoma President Whitney Jessee issued the following joint statement on the best interest annuity rule adopted recently by the Oklahoma Insurance Department:

Topics: Press Release NAIC Model Regulation Annuity Best Interest Oklahoma

3 min read

Kansas Strengthens Protections for Annuity Consumers

By NAIFA & ACLI on 6/27/23 4:55 PM

WASHINGTON – American Council of Life Insurers (ACLI) President and CEO Susan Neely and National Association of Insurance and Financial Advisors (NAIFA)-Kansas Chapter President Brad Noller issued the following joint statement on the best interest annuity rule adopted recently by the Kansas Insurance Department:

Topics: Legislation & Regulations State Advocacy Annuity Best Interest Kansas

2 min read

NAIFA and ACLI Work Together to Get State Advocacy Wins

By NAIFA on 6/20/23 4:58 PM

NAIFA and the American Council of Life Insurers (ACLI) often work together to advocate for the industry, producers, and consumers in every part of the country. Their enduring cooperation and partnership take on great significance at the state level, where NAIFA is the only advocacy association of agents and advisors with a strong grassroots influence in all 50 state capitals.

Topics: State Advocacy Interstate Advocacy Advocacy Partnerships Annuity Best Interest NAIC

3 min read

New Oregon Law Strengthens Safeguards for Annuity Consumers

By NAIFA on 6/7/23 12:15 PM

American Council of Life Insurers (ACLI) President and CEO Susan Neely and National Association of Insurance and Financial Advisors NAIFA-Oregon President Kym Housley issued the following joint statement on legislation signed into law in Oregon that strengthens safeguards for annuity consumers:

Topics: Legislation & Regulations Press Release Annuity Best Interest Oregon Supported Legislation

1 min read

NAIFA's State Advocacy Is Influencing Consumer Protections for Annuity Transactions Around the Country

By NAIFA on 6/1/23 9:07 AM

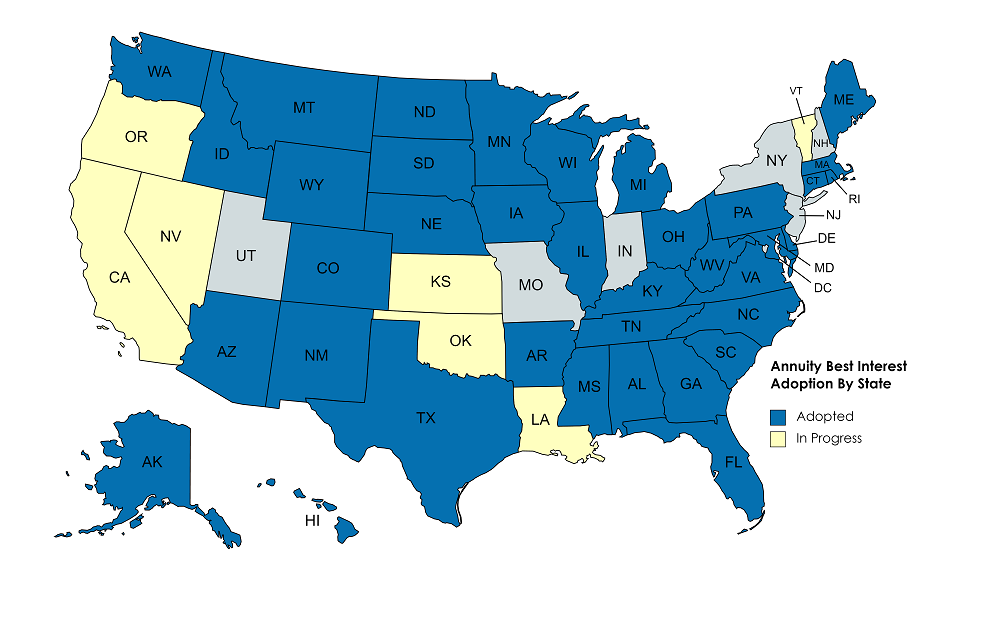

It's fitting on the first day of National Annuity Awareness Month for us to recognize the great work done by NAIFA leaders, members, and lobbyists in 37 states that have implemented the National Association of Insurance Commissioners (NAIC) model for annuity transactions. NAIFA chapters, along with our partners at ACLI, have worked with lawmakers and regulators in the states to get the measures enacted.

Topics: Life Insurance & Annuities Annuity Awareness Month Annuity Best Interest

2 min read

Florida Governor Signs Enhanced Protections For Annuity Consumers Into Law

By NAIFA & ACLI on 5/26/23 4:30 PM

ACLI President and CEO Susan Neely and NAIFA-Florida President Jeff Chernoff issued the following joint statement on legislation signed into law in Florida that strengthens protections for annuity consumers:

Topics: State Advocacy Interstate Advocacy Press Release Annuity Best Interest Florida

2 min read

New Law Enhances Protections for Washington State Annuity Consumers

By NAIFA & ACLI on 4/14/23 5:07 PM

American Council of Life Insurers (ACLI) President and CEO Susan Neely and NAIFA-Washington President Karl Kuntz issued the following joint statement on legislation signed into law in Washington that strengthens protections for annuity consumers:

“The new law sponsored by Representative Kristine Reeves, approved by the legislature, and signed by Governor Jay Inslee strengthens protections for consumers in Washington state seeking lifetime income through annuities.

Topics: Life Insurance & Annuities State Advocacy Interstate Advocacy Press Release NAIC Model Regulation Annuity Best Interest Washington

2 min read

Georgia Strengthens Protections for Annuity Consumers

By NAIFA & ACLI on 2/28/23 3:35 PM

American Council of Life Insurers (ACLI) President and CEO Susan Neely and National Association of Insurance and Financial Advisors (NAIFA)-Georgia President Joe Schreck issued the following joint statement on the best interest annuity rule adopted recently by Georgia’s Insurance Department:

“A new rule adopted by Georgia’s Insurance Department and Commissioner John King strengthens protections for Peach State consumers seeking lifetime income from annuities.

Topics: Life Insurance & Annuities Legislation & Regulations Press Release Georgia Annuity Best Interest NAIC

2 min read

Illinois Enhances Protections for Annuity Consumers

By NAIFA & ACLI on 2/24/23 4:10 PM

A new rule adopted recently by the Illinois Department of Insurance provides greater safeguards for consumers seeking lifetime income from annuities. Illinois is the 32nd state to adopt a measure that implements the “best interest of consumer enhancements” in the National Association of Insurance Commissioners (NAIC) Suitability in Annuity Transactions Model Regulation. The new laws and regulations also align with the SEC’s Regulation Best Interest.

.png)