NAIFA's Congressional Conference is an opportunity for financial professionals to learn to be the best grassroots advocates they can be and to stand united with fellow advisors, tell their stories directly to lawmakers, and help shape the policies that affect their practices, clients, and Main Street families across the country. Don't delay. The special early registration discount ends Tuesday, March 3. Also, if you are a first-time attendee (or would like to invite a first-time attendee), a limited number of travel stipends remain available for NAIFA members who have never attended a Congressional Conference.

1 min read

Register Now! The Congressional Conference Cost Goes Up on Tuesday.

By NAIFA on 2/27/26 5:15 PM

1 min read

Mayeux: Protection of Financial Professionals' Independence Is Crucial in New DOL Proposal

By NAIFA on 2/26/26 12:01 PM

The U.S. Department of Labor released its newly proposed independent contractor rule to determine whether workers are employees or independent contractors under the Fair Labor Standards Act (FLSA). The proposed rule, when finalized, will replace the 2024 federal rule on independent contractor classification.

NAIFA CEO Kevin Mayeux, CAE, issued the following statement:

“NAIFA is encouraged by the Department of Labor’s release of a new rule to replace the existing 2024 federal rule on independent contractor classification. The 2024 Rule fails to provide an analysis for distinguishing between independent contractors and employees under the FLSA that is sufficiently clear and leads to predictable outcomes. The 2024 Rule’s description of several economic reality factors could be viewed as setting a higher bar to find independent contractor status than required under the law. Among other harms, an analysis which is ambiguous or perceived as too restrictive of independent contracting can deter businesses from engaging with bona fide independent contractors or induce them to unnecessarily classify such individuals as employees.

Many financial advisors operate locally as small business owners, employing others on their staff, and serving the members of their communities. Reclassifying them as employees rather than independent contractors would have threated their ability to best serve their clients and to ensure that their small businesses can operate efficiently.

NAIFA is currently reviewing the proposed rule to determine the full impact on independent contractors and will remain diligent to ensure that NAIFA members are best positioned to maintain their independent business operations and to best serve their clients.

We have previously provided extensive comments and testimony to the DOL on the topic of preserving independent contractors’ rights and we now look forward to working with the department as it works to improve policies that support the independence of NAIFA members and the ability of consumers to receive professional financial guidance.”

2 min read

NAIFA's Gandy and Treasury Officials Discuss Trump Accounts and the Vital Role of Financial Professionals

By NAIFA on 2/25/26 1:59 PM

NAIFA President Christopher Gandy along with NAIFA’s Government Relations team met with Department of the Treasury staff on February 24 to discuss the implementation and rollout of “Trump Accounts,” the newly established tax-deferred investment accounts for children under age 18 created by legislation passed last year.

1 min read

NAIFA Welcomes Focus on Financial Security in President's State of the Union Address

By NAIFA on 2/25/26 7:59 AM

The National Association of Insurance and Financial Advisors (NAIFA) shares President Trump’s goal of helping more Americans achieve financial security and build stronger retirement savings.

2 min read

NAIFA: Financial Professionals Are Essential to the Success of Trump Accounts

By NAIFA on 2/20/26 9:16 AM

The National Association of Insurance and Financial Advisors (NAIFA) submitted formal comments to the Internal Revenue Service in response to Notice 2025-68 regarding the implementation of Section 530A Trump Accounts. Read NAIFA coverage in Investment News, 401kSpecialist and Advisor Magazine.

1 min read

NAIFA Releases State of Advocacy Report

By NAIFA on 2/18/26 1:58 PM

As the leading grassroots advocacy association for financial professionals on Capitol Hill and in ever state capital, NAIFA serves as the leading advocacy voice for insurance and financial professionals. Our newest publication, 2025-2026 State Of Advocacy: A Year of Achievement and What Lies Ahead, provides a deep dive into the advocacy work NAIFA has done and the policy issues we are currently facing. It is a good companion piece to another recent NAIFA publication, NAIFA Community: Members in Action, which provides profiles of several NAIFA members who have made a difference with their advocacy work.

1 min read

NAIFA Joins Coalition in Support of Strengthening the Regulatory Flexibility Act

By NAIFA on 2/12/26 3:14 PM

NAIFA joined a trade association coalition in sending a letter to U.S. House Majority Leader Steve Scalise (R-LA) urging Congress to pass legislation to strengthen the Regulatory Flexibility Act (RFA) to reduce the impact of burdensome regulations on small businesses.

2 min read

NAIFA Supports Policies to Promote Meaningful Financial Education and Security

By NAIFA on 2/6/26 4:15 PM

U.S. Treasury Secretary Scott Bessent delivered remarks at the Financial Literacy and Education Commission, which he chairs, stating his desire “to improve financial literacy and education for all Americans in partnership with private and non-profit sector partners.”

1 min read

Treasury Event Highlights Potential Benefits of Trump Accounts

By NAIFA on 1/28/26 3:49 PM

The U.S. Treasury Department today held a summit touting the so-called Trump accounts (section 530A accounts) enacted in H.R. 1, at which the President spoke about the benefits of the 4-year pilot program for babies born between 2025 and 2028 under which the government will seed each newborn's account with $1,000.

3 min read

Putting Medicare Beneficiaries First: NAIFA’s Recommendations to CMS

By Christopher Gandy, LACP on 1/26/26 3:15 PM

Medicare beneficiaries are facing an increasingly complex health insurance landscape. Each year brings new plan designs, regulatory changes, and market shifts that make informed decision-making more challenging, especially for older Americans navigating coverage options that directly affect their health, finances, and peace of mind.

1 min read

NAIFA Supports the Emergency Savings Enhancement Act

By NAIFA on 1/9/26 5:12 PM

NAIFA President Christopher Gandy, LACP, sent letters to Senators Todd Young (R-IN) and Cory Booker (D-NJ) and Representatives Glen Thompson (R-PA) and Eugene Vindman (D-VA) expressing the association's support for the bipartisan Emergency Savings Enhancement Act. The legislation would modernize Pension-Linked Emergency Savings Accounts (PLESAs), established by the Secure 2.0 Act and supported by NAIFA, to encourage more Americans to use these accounts and remove complex regulatory barriers.

1 min read

Get the Early Registration Rate for NAIFA's Congressional Conference

By NAIFA on 1/9/26 4:25 PM

The Congressional Conference is NAIFA's signature grassroots event, bringing financial advisors from all 50 states to Washington, D.C., is scheduled for May 18-19. NAIFA members who sign up before March 3 receive a $50 discount off the registration fee, so don't delay.

1 min read

NAIFA Joins Coalition Urging Phase-Out and Repeal of Tennessee’s Professional Privilege Tax

By NAIFA on 12/19/25 3:24 PM

NAIFA has joined a coalition of professional associations urging Tennessee policymakers to phase out and ultimately repeal the state’s Professional Privilege Tax (PPT). In a joint letter sent to Governor Bill Lee, the coalition called on state leaders to prioritize a phase-out of this outdated tax in the FY 2026–2027 budget, emphasizing that Tennessee should not fund government through a tax on the “privilege” of working. The PPT currently imposes a $400 annual tax on certain licensed professionals, including financial advisors, despite their significant contributions to the state’s economy .

1 min read

Ways & Means Spotlights NAIFA Webinar in Tax Law Press Release

By NAIFA on 12/19/25 9:45 AM

The House Ways & Means Committee issued a press release on tax reform measures for small businesses that highlights the recent NAIFA webinar, “The One Big Beautiful Bill: Several Big Beautiful(?) Tax Law Changes,” featuring Robert Kirkland, founding member of Kirkland Hochstetler law firm. The tax and spending bill known as the One Big Beautiful Bill (OBBB)” passed earlier this year stabilizes estate tax laws making legacy planning less challenging, Kirkland explained. InsuranceNewsNet magazine’s Advisor News also reported on the NAIFA webinar.

3 min read

The NAIFA-Supported INVEST Act Passes the House

By NAIFA on 12/11/25 3:30 PM

The bipartisan INVEST Act has passed the House of Representatives in a 302-123 vote. NAIFA supports the legislation to expand retirement-planning options for teachers, employees of nonprofit organizations, and others.

"NAIFA is pleased to see the House take bipartisan action to bolster the ability of more Americans to better prepare for retirement," said NAIFA CEO Kevin Mayeux, CAE. "The INVEST Act would give teachers, hospital workers, nonprofit employees, and others who have 403(b) plans access to expanded investment options, including annuity-linked products that provide guaranteed lifetime income. It would also take steps toward addressing elder financial exploitation and would remove unfair impediments that prevent expert investors who don't meet net-worth thresholds from taking advantage of some sophisticated investments."

Four sections of the bill are particularly noteworthy to financial professionals and their clients.

2 min read

NAIFA Advocacy Leadership Earns National Recognition Once Again

By Kevin Mayeux on 12/11/25 3:06 PM

On behalf of the entire NAIFA family, I am proud to congratulate Diane Boyle, Senior Vice President of Government Relations, for being named a Top Lobbyist for 2025 by The Hill. This recognition is one of the most respected acknowledgments in the advocacy community and reflects the consistent excellence of Diane’s work and her contributions to advancing NAIFA's mission to promote financial security for all Americans.

1 min read

NAIFA's Gandy Featured at NAIC Fall Meeting

By NAIFA on 12/10/25 2:07 PM

NAIFA President-Elect Christopher Gandy spoke before the Senior Issues (B) Task Force during the National Association of Insurance Commissioners’ 2025 Fall National Meeting in Hollywood, Fla. Gandy discussed hybrid life insurance policies with long-term care, extended care, and critical care riders, providing his perspective as an agent to the Task Force. Gandy provided insight on what he’s seeing in the market and offered suggestions to regulators to ensure the products remain accessible and easily understandable to consumers.

1 min read

NAIFA Supports Bill That Would Offer Retirement Plan Rollover Clarity and Annuity Options

By NAIFA on 12/4/25 11:49 AM

NAIFA supports the bipartisan Retirement Simplification and Clarity Act reintroduced by Reps. Jimmy Panetta (D-Calif.) and Darin LaHood (R-Ill.), which would require the IRS to rewrite documentation that employers must provide exiting employees who request distributions from their 401(k) plans. The new notice would use “clear, straightforward language” to explain various options for 401(k) distributions and rollovers along with their tax implications. The bill would also allow people aged 50 and over to roll over employer-sponsored 401(k) accounts into annuities.

1 min read

NAIFA-Supported Bill Would Expand Retirement Planning Options for Teachers and Employees of Non-Profits

By NAIFA on 12/3/25 4:16 PM

NAIFA CEO Kevin Mayeux, CAE, issued the following statement on the bipartisan INVEST Act:

2 min read

NAIFA Celebrates Advocacy Win in Court Decision on Fiduciary-Only Rule

By NAIFA on 12/3/25 3:42 PM

The Department of Labor’s fiduciary-only rule will not go into effect. NAIFA has strongly opposed the misguided regulation, which would have restricted consumer choice and access to retirement advice. NAIFA was similarly instrumental in defeating an earlier version of the rule in 2016.

2 min read

More states join calls for action on unfair trade practices in Medicare market

By NAIFA on 11/23/25 6:33 PM

Across the country, licensed financial professionals are stepping up on behalf of the seniors they serve and their efforts are making a difference. Following the regulatory alert issued by NAIFA, hundreds of advisors from all 50 states reached out to their state insurance regulators demanding action to curb carriers’ practices that undermine consumer choice and steer vulnerable Medicare beneficiaries into restricted or biased product lines.

2 min read

NAIFA’s Medicare Collective Stresses the Value of Agents in CMS Meeting

By NAIFA on 11/13/25 3:17 PM

Representatives of NAIFA’s Medicare Collective, an initiative of the Lifetime Healthcare Center, met with officials from the Centers for Medicare and Medicaid Services (CMS) to discuss the role of brokers and agents in providing vital guidance, services, and protections to consumers in the Medicare space. They presented the Collective’s plan to work with CMS and insurance carriers to ensure Medicare beneficiaries receive the best possible coverage and care in these challenging times. They also addressed rising concerns that the failure to adequately compensate agents for their work would harm consumers by leaving them vulnerable to misinformation or without competent, personalized assistance as they navigate complex coverage options, plans, and regulations.

2 min read

NAIFA Members Drive National Momentum to Protect Medicare Beneficiaries

By NAIFA on 11/3/25 4:12 PM

UPDATE: New Hampshire, Oklahoma, North Dakota, Montana, North Carolina, Mississippi, South Carolina and Colorado join Idaho and Delaware in addressing unfair trade practices.

In a powerful display of grassroots advocacy, hundreds of NAIFA members representing all 50 states have written to their state insurance commissioners urging immediate action against unfair trade practices harming Medicare beneficiaries and the licensed professionals who serve them. These letters, sent following NAIFA’s nationwide regulatory alert, underscore the profession’s determination to protect seniors during a particularly challenging enrollment period.

1 min read

NAIFA Recognizes Idaho Department of Insurance’s Commitment to Fairness and Consumer Choice

By NAIFA on 10/31/25 11:42 AM

The National Association of Insurance and Financial Advisors (NAIFA) acknowledges the recent actions taken by the Idaho Department of Insurance, which issued two cease and desist orders to address concerns in the Medicare Advantage marketplace. We appreciate the Department’s commitment to maintaining a fair, transparent, and competitive environment for both carriers and consumers and applaud Director Cameron’s leadership.

1 min read

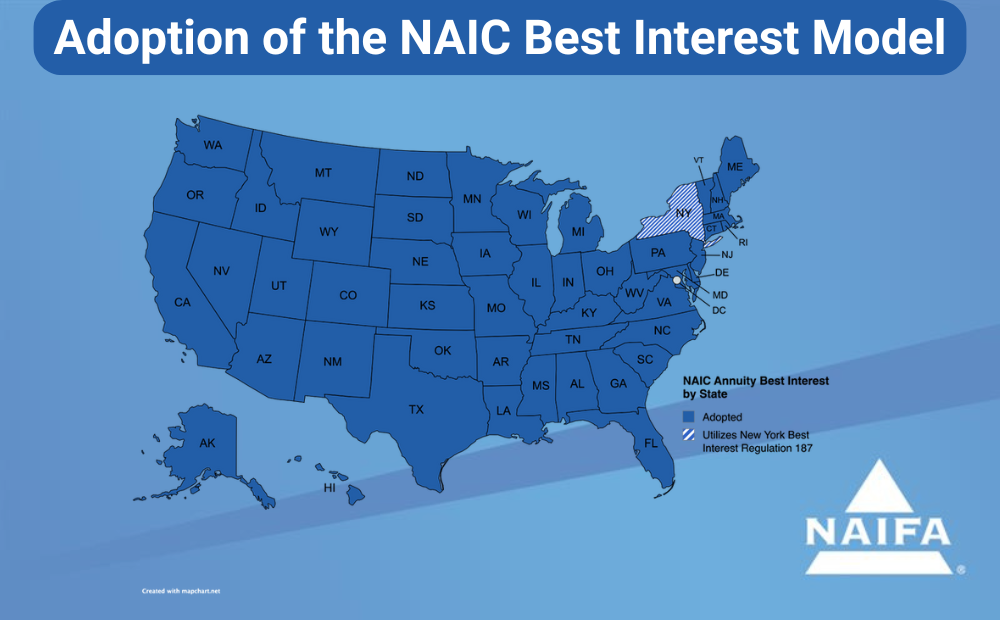

NAIFA Supports NAIC’s Updated Annuity Best Interest Draft

By NAIFA on 10/24/25 1:57 PM

NAIFA, alongside a coalition of industry partners, submitted a follow-up letter to the National Association of Insurance Commissioners (NAIC) expressing appreciation for the NAIC’s consideration of our prior comments and support for the continued refinement of the Annuity Best Interest guidance.

1 min read

NAIFA Calls for National Action on Unfair Trade Practices in Medicare Insurance Markets

By NAIFA on 10/20/25 3:31 PM

NAIFA President Doug Massey has called on state insurance regulators to take decisive action to protect consumers and insurance professionals from unfair trade practices in the Medicare marketplace. In a letter submitted to the National Association of Insurance Commissioners (NAIC), Massey praised Idaho Department of Insurance Director Dean Cameron for his leadership in issuing Bulletin No. 25-06, which condemns carrier practices that restrict consumer access and manipulate compensation structures for agents serving Medicare beneficiaries.

1 min read

California Eliminates Pre-Licensing Education Requirement for Insurance Producers

By NAIFA on 10/17/25 10:52 AM

Governor Gavin Newsom has signed AB 943 (sponsored by Assembly member Rodriguez) into law, making California the latest state to eliminate its insurance producer pre-licensing education requirement, a major win for the industry and aspiring professionals.

1 min read

Government Shutdown Complicates Federal Flood Insurance Program

By NAIFA on 10/5/25 9:21 AM

The federal government shutdown has created a great deal of confusion about the federal flood insurance program among insurance professionals and their clients who are homeowners or are in the process of purchasing homes. Advisors may face questions from frustrated clients, and not all of the answers are clear at this point. Policies issued under the federal program remain in force during the shutdown, but the processing and payment of claims may be delayed, according to media reports. Pending applications and renewals are frozen until the government funding impasse ends. Flood insurance requirements for federally backed loans are suspended during the shutdown, according to FEMA and banking regulators.

1 min read

NAIFA Supports Updated NAIC Annuity Best Interest Guidance and Suggests Additional Improvements

By NAIFA on 9/25/25 1:27 PM

The National Association of Insurance Commissioners (NAIC) has updated its draft of the Annuity Best Interest Regulatory Guidance and Considerations to reflect suggestions made by NAIFA and coalition partners. In a new letter to the NAIC, which NAIFA signed, the groups state their support for the updated guidance and suggest additional edits to to the draft.

1 min read

Financial professionals protect seniors amid Medicare’s growing complexity

By Kevin Mayeux on 9/23/25 4:09 PM

NAIFA CEO Kevin Mayeux, CAE, released the following statement in response to the Urban Institute report, “Challenges of Choice in Medicare: The Role of Agents and Brokers in a Public Program,” released today:

1 min read

Save the Date: NAIFA’s 2026 Congressional Conference

By NAIFA on 9/18/25 11:57 AM

Mark your calendar for May 18–19, 2026, when NAIFA members will gather in Washington, D.C., for a highly impactful grassroots advocacy event for financial professionals: the Congressional Conference. This signature event is central to NAIFA’s mission, uniting members from across the country to advocate for their businesses, clients, and the insurance and financial services industry.

4 min read

NAIFA Members Wrap Up Successful Summer of In-District Advocacy Across the States

By NAIFA on 9/16/25 9:26 AM

NAIFA members across the country during August and early September met face-to-face with lawmakers in their home districts to ensure the voices of Main Street Americans are represented in critical policy conversations. These in-district visits are a cornerstone of NAIFA’s grassroots advocacy, strengthening relationships with legislators while highlighting the essential role financial professionals play in helping families and businesses achieve financial security.

1 min read

NAIFA Looks to Work With DOL on Classification of Financial Services Independent Contractors

By NAIFA on 9/9/25 4:06 PM

NAIFA CEO Kevin Mayeux, CAE, issued the following statement on the Department of Labor’s announcement that it will rescind the federal rule on independent contractor classification:

2 min read

New HHS Guidance Expands Consumer Access to Catastrophic Health Plans

By NAIFA on 9/4/25 10:55 AM

New guidance from the U.S. Department of Health and Human Services (HHS) will expand consumer access to affordable catastrophic healthcare policies. NAIFA has long advocated for access to affordable catastrophic health plan options.

1 min read

NAIFA Urges CMS to Rethink Inactivity Log-outs on the Health Insurance Marketplace

By NAIFA on 9/4/25 9:51 AM

NAIFA has raised concerns over a new Centers for Medicare & Medicaid Services (CMS) policy to automatically log health care consumers out of their federally facilitated marketplace accounts after 30 minutes of inactivity. Proposed as a security measure, the time limit “could unintentionally harm consumer access to health insurance coverage and impede the ability of licensed professionals to effectively serve their clients,” NAIFA President Doug Massey wrote in a letter to policymakers.

1 min read

CMS Announces New Security Requirement for EDE Logins

By NAIFA on 8/29/25 5:29 PM

The Centers for Medicare & Medicaid Services (CMS) has implemented a new security procedure on Friday, August 29, that will require agents and brokers to reconnect their CMS Enterprise Portal Federally-facilitated Marketplace (FFM) account credentials after 30 minutes of inactivity.

1 min read

NAIFA Members Continue Grassroots Advocacy with In-District Meetings

By NAIFA on 8/15/25 12:35 PM

NAIFA members across the country are taking grassroots advocacy directly to home districts, meeting face-to-face to share the priorities of Main Street Americans and the financial professionals who serve them. Recent in-district meetings brought NAIFA members together with key lawmakers and their staff in South Carolina, California, Tennessee, and Montana.

1 min read

NAIFA-New Jersey Advocates for Professionals' Independent Contractor Status

By NAIFA on 8/7/25 5:40 PM

NAIFA-New Jersey Grassroots Involvement Chair Jill Van Nostrand asked the New Jersey Department of Labor and Workforce Development to withdraw a proposed rule that would risk misclassifying thousands of independent contractors in the state, including insurance producers and financial advisors, as employees under state labor law. In a comment letter she submitted on behalf of NAIFA-New Jersey, Van Nostrand wrote that the proposal ignores decades of legal precedent and places unnecessary burdens on highly regulated professionals who are already held to strict compliance standards.

1 min read

NAIFA President Massey Urges Congress to Protect the Role of Agents in Medicare Advantage Planning

By NAIFA on 7/28/25 4:00 PM

The Medicare system, including various Medicare Advantage and Medicare Part D plans, can be very confusing to beneficiaries and older Americans exploring their healthcare options. The guidance of experienced, licensed professionals is often indispensable. NAIFA President Doug Massey recently sent a letter to the chairmen and ranking members of the House Ways and Means Committee, Subcommittee on Health, and Subcommittee on Oversight outlining the role of the agent and suggesting ways Congress can strengthen consumer protections while preserving access to professional guidance.

3 min read

NAIFA Thought Leaders Participate in NCOIL Panel Discussion on LTCI

By Bianca Alonso Weiss on 7/25/25 3:00 PM

Two members of the NAIFA Lifetime Healthcare Center Legislative Working Group, Steve Cain (NAIFA-California) and Steve Schoonveld (NAIFA-Massachusetts), participated in a general session panel at the NCOIL Summer Meeting on trends and innovations in the long-term care insurance marketplace. They were joined by representatives from the American Council of Life Insurers (ACLI) and WA Cares for a dynamic discussion before insurance legislators and regulators from all over the country. The panel emphasized the urgency of planning ahead and highlighted the need for both public and private solutions. Programs like WA Cares offer a foundation, but private LTC insurance remains vital for greater choice and flexibility. With 70% of Americans likely to need LTC, early education, planning, and policy innovation are essential to reduce the financial and emotional burden on families and ensure aging with dignity.

1 min read

NAIFA Supports Proposal to Exempt the Insurance Business From CFPB Regulation

By NAIFA on 7/25/25 10:30 AM

The insurance business is effectively regulated at the state level, protecting consumers by taking into account local market conditions that impact the business. Laws that prevent federal regulations from straying into state-regulated insurance matters are important to avoid consumer confusion and prevent federal rules that could overlap or contradict state regulations. NAIFA supports legislation introduced by former NAIFA member Senator Tim Scott (R-SC) and Representative Bryan Steil (R-WI) that would amend the Consumer Financial Protection Act of 2010 to exempt the insurance business from regulations created by the Bureau of Consumer Financial Protection (CFPB).

1 min read

Master HR1 for Client Conversations

By NAIFA on 7/11/25 3:57 PM

The recently enacted HR 1 brings significant changes to tax policy, retirement planning, and financial strategies that clients rely on. As financial professionals, it’s essential to stay ahead of the curve - not just to understand the updates, but to explain them in ways that build trust and reinforce our value.

Join NAIFA for a timely and practical webinar designed to help you turn technical policy updates into meaningful client conversations.

6 min read

What Financial Professionals Need to Know About the Final Reconciliation Bill

By NAIFA on 7/3/25 1:06 PM

The newly finalized reconciliation bill delivers a sweeping set of tax provisions that will shape how financial professionals advise clients - individuals, families, and businesses - for years to come. From income tax and charitable giving to estate planning and business deductions, this legislation locks in key provisions of the Tax Cuts and Jobs Act (TCJA) while adding new tools across multiple areas of financial planning. NAIFA has identified 15 key takeaways that every financial professional should know. Download PDF.

1 min read

NAIFA-Supported Measures in the Senate Reconciliation Bill Favor Main Street Businesses

By NAIFA on 7/1/25 12:15 PM

NAIFA CEO Kevin Mayeux, CAE, issued the following statement upon Senate passage of its version of the tax and spending reconciliation bill:

“NAIFA is pleased that the Senate-passed reconciliation bill includes important measures that protect the financial security of American families and businesses. NAIFA members have strongly encouraged lawmakers to include permanent extensions of the 199A tax deduction for pass-through businesses and most of the individual tax rates and deductions that would have expired this year. We have also asked lawmakers to reject a cap on the corporate state and local tax (C-SALT) deduction and new taxes on insurers or insurance products. American consumers will benefit from the fact that the bill preserves the existing tax treatment of financial tools and imposes no new burdens that would prevent insurance and financial professionals from effectively serving the American public. NAIFA will continue to monitor the bill as it now returns to the House for final passage. Major changes that will impact our members or the financial security of the Main Street consumers they serve are unlikely.”

1 min read

NAIFA Supports Passage of Provisions in H.R. 1 that Support Main Street Businesses

By NAIFA on 6/29/25 11:05 AM

The National Association of Insurance and Financial Advisors (NAIFA) supports the budget reconciliation tax package and has signed onto two coalition letters (here and here) urging Congress to enact this important legislation. This tax package builds on the foundation laid by the Tax Cuts and Jobs Act and reflects a clear commitment to policies that enable Main Street businesses including insurance and financial professionals to thrive. It addresses long-standing tax concerns that impact the majority of small businesses and pass-through entities that form the backbone of local economies.

1 min read

NAIFA Asks the Senate to Avoid a Tax Hike for Millions of Small Businesses

By Kevin Mayeux on 6/26/25 11:23 AM

The Senate is preparing revisions to the massive budget and tax bill previously approved by the House with a goal of passing final legislation by July 4th. It is crucial to millions of Main Street businesses, many of which are owned or served by NAIFA members, that the final reconciliation bill makes the Section 199A deduction for pass-through businesses permanent and expands the deduction from 20 to 23%.

2 min read

NAIFA-NJ’s Dennis Cuccinelli Testifies on ABC Rule to Urge Protection of Advisor Independence

By NAIFA on 6/23/25 1:59 PM

NAIFA Trustee Dennis Cuccinelli of NAIFA-New Jersey testified before the New Jersey Department of Labor and Workforce Development to voice concerns over a proposed rule that would codify the ABC test for determining worker classification.

1 min read

CMS decision to adjust agent compensation is step in right direction

By NAIFA on 6/20/25 9:08 AM

"The Centers for Medicare & Medicaid Services' (CMS) decision to positively adjust agent compensation for 2026 is a meaningful step in the right direction," said NAIFA CEO Kevin Mayeux, CAE. "This adjustment reflects growing recognition of the critical role licensed insurance professionals play in guiding Medicare beneficiaries through a complex and often confusing system.

2 min read

NAIFA Denounces United Healthcare’s Decision to Cut Agent Commissions

By NAIFA on 6/17/25 12:41 PM

The National Association of Insurance and Financial Advisors (NAIFA) strongly objects to United Healthcare’s decision to cut agent commissions on more than 100 Medicare Advantage plans across over 20 states. This action undermines the value of professional guidance at a time when seniors need it most.

1 min read

Bipartisan FIREWALL Act will Advance Natural Disaster Preparedness

By NAIFA on 6/11/25 4:27 PM

NAIFA supports the bipartisan FIREWALL Act - Facilitating Increased Resilience, Environmental Weatherization and Lowered Liability - introduced by Senators Adam Schiff and Tim Sheehy. As natural disasters grow in frequency and severity, this legislation offers a proactive, fiscally responsible strategy to help protect American families and stabilize insurance markets.

1 min read

NAIFA-NJ Is Working to Protect the Independent Contractor Status of Financial Professionals

By NAIFA on 6/4/25 3:02 PM

A rule proposed by the New Jersey Department of Labor and Workforce Development (DOLWD) threatens the independent contractor status of many insurance agents and brokers and would improperly classify them as "employees" under state labor laws. Unfortunately, this would also impact consumers in the state, as the independence of licensed insurance and financial professionals allows them to effectively serve their clients by offering products and services from multiple insurance companies and financial institutions.

9 min read

NAIFA Breaks Down the House Tax and Budget Bill

By NAIFA on 5/29/25 11:42 AM

The House passed its version of the $6 trillion+ reconciliation bill (including a $3.8 trillion tax title), but we are still a long way from final action. Changes are expected in the Senate, and then more changes are likely as the House and Senate try to reconcile their two versions of the bill. Details are below. But first: a quick report on a highly successful NAIFA Congressional Conference last week.

1 min read

NAIFA's Mayeux Applauds CMS Efforts to Eliminate Waste and Promotes Consumer Access to Agents

By NAIFA on 5/28/25 10:39 AM

NAIFA CEO Kevin Mayeux, CAE, released the following statement in response to the Centers for Medicare & Medicaid Services (CMS) press release announcing an aggressive strategy to enhance and accelerate Medicare Advantage audits:

1 min read

NAIFA supports House budget reconciliation bill as ‘critical step forward’

By NAIFA on 5/21/25 5:01 PM

NAIFA endorses the House budget reconciliation bill for its provisions that assist families and businesses. Ensuring the long-term stability of favorable tax policies will give families and small businesses the predictability essential for smart financial planning, empowering them to make well-informed choices, invest wisely, and strengthen their financial futures.

2 min read

House Tax Title Includes NAIFA-Supported Provisions to Benefit Families and Businesses

By Kevin Mayeux on 5/12/25 5:24 PM

NAIFA is pleased the House Ways and Means Budget Reconciliation Title recognizes the need for American families and businesses to plan for their financial futures with access to knowledgeable professionals, affordable insurance products, and certainty in policy.

A stable tax system that continues to encourage Americans to plan and save for their future is more important than ever. Families are able to protect themselves through the current tax treatment of cash value life insurance, incentives to participate in individual and employer-sponsored retirement plans, savings vehicles for education and emergencies, paid leave, long-term care insurance, and disability insurance, and employer-provided health insurance. These measures reflect sound tax policy, established over decades, that gives Americans of all backgrounds the opportunity to attain a secure financial future.

NAIFA applauds the measure to permanently extend and increase the Section 199A deduction, which many of our members utilize to provide products and services that millions of Americans rely on to improve their financial security. The Section 199A deduction allows small- and medium-sized businesses, which are the backbone of the American economy, to remain competitive and to retain parity in corporate and passthrough income taxation. In addition:

1 min read

NAIFA Joins Business Community in Urging Congress to Preserve Key Tax Deduction

By NAIFA on 5/5/25 7:24 PM

NAIFA and a coalition of industry organizations has signed a joint letter to Congress urging lawmakers to protect a vital component of the federal tax code: the full deductibility of state and local business taxes known as the B-SALT (or C-SALT) deduction.

1 min read

DOL Drops Enforcement of Biden-Era Independent Contractor Rule as It Reviews the Measure

By NAIFA on 5/2/25 3:25 PM

The Department of Labor has announced that it will not enforce a 2024 rule for determining employee or independent contractor classification under the Fair Labor Standards Act. That rule, put in place by the Biden Administration, is now under review by the Department and also faces several federal lawsuits challenging its validity. NAIFA opposed the 2024 rule.

3 min read

Financial Professionals to Advocate for Their Businesses and Clients at NAIFA’s Congressional Conference

By NAIFA on 5/1/25 1:41 PM

NAIFA is hosting the 12th annual Congressional Conference May 19-20 in Washington, D.C. Day 1 of the event at the Westin DC Downtown will feature targeted advocacy training with briefings on legislative issues that affect financial professionals’ businesses, clients, and communities. Washington insiders at Congressional Conference will offer attendees best practices for conducting congressional meetings and tips for developing impactful long-term relationships with legislators.

1 min read

Life Insurance Industry Launches "We Put Life INTO America" Campaign

By NAIFA on 4/30/25 11:59 AM

The American Council of Life Insurers (ACLI) has launched a powerful new campaign spotlighting the life insurance industry's deep-rooted role in supporting American families and the nation’s economy. Titled “We Put Life Into America,” the campaign highlights the many ways life insurers strengthen the country, not only by providing financial protection but also by investing over $8 trillion into the economy and paying nearly $200 billion to policyholders and beneficiaries in 2023.

2 min read

New Jersey is 50th State to Adopt Best Interest Annuity Rule

By NAIFA on 4/21/25 12:59 PM

American Council of Life Insurers (ACLI) President and CEO David Chavern and National Association of Insurance and Financial Advisors (NAIFA) Trustee Dennis Cuccinelli made the following comment on the best interest annuity rule approved today by the New Jersey Department of Banking & Insurance:

2 min read

NAIFA Urges Congress to Protect Main Street Businesses From Harmful Tax Proposal

By NAIFA on 4/11/25 11:04 AM

Recent news reports indicate that some congressional Republicans may be amenable to a so-called "millionaire tax" that would raise the highest federal individual income tax rate to around 40%. NAIFA opposes this proposal due to the harm it would likely cause hundreds of thousands of pass-through corporations. Many owners of these small, often Main Street, businesses organized as S corporations, partnerships, and sole proprietorships would face large tax increases.

4 min read

NAIFA-Alabama Holds a Successful Legislative Day

By Sallie Bryant on 4/10/25 2:56 PM

Members of NAIFA-Alabama recently participated in the annual visit with our legislators. Before our visit at the State House, we spent the morning at the office of the Alabama Securities Commission. We heard from Securities Commission Director Amanda Senn and Alabama Department of Insurance Commissioner Mark Fowler. Director Senn talked about cryptocurrency fraud and both speakers discussed AI. Commissioner Fowler said that AI is top-of-mind of insurance commissioners around the country. He also spent some time discussing the duties of members of his staff. We were interested to hear there are 11 full-time investigators of insurance fraud, all of whom have arrest authority.

1 min read

Remote Notarization Law Would Benefit Consumers and Insurance and Financial Practices

By NAIFA on 4/8/25 12:40 PM

NAIFA has joined industry partners in urging congressional support for the SECURE Notarization Act, which would allow businesses and consumers to work remotely with notaries to execute critical documents. Often, signers must currently be in the physical presence of a notary to complete many transactions, including the signing of insurance and financial documents. These may include insurance claim forms, beneficiary request forms, change of ownership documents, affidavits, powers of attorney, living trusts, advance health care directives, and contracts, to name a few.

1 min read

NAIFA Supports Legislation to Ease the Financial Burden on Caregivers

By NAIFA on 4/7/25 4:53 PM

Family caregivers provide $600 billion in unpaid care each year, often impacting their own career opportunities or their families’ financial security. To help them cope with this burden, NAIFA strongly supports the bipartisan Credit for Caring Act, which would provide a $5,000 tax credit to offset out-of-pocket costs associated with home caregiving. These may include the cost of home modifications, health aides, adult daycare, medicines, transportation, and other support services.

2 min read

Promoting Insurance and Financial Products Is Good Policy

By NAIFA on 4/2/25 11:13 AM

Congress is looking to extend expiring provisions of the Tax Cuts and Jobs Act – which include reduced individual tax rates and a 20% deduction of qualified pass-through income for sole proprietorships, partnerships, and S-corporations – while at the same time creating new tax cuts President Donald Trump promised during his campaign. The Congressional Budget Office projects that extending the TCJA alone will cost around $4.6 trillion over 10 years. Lawmakers and the administration are looking to cover the cost by finding new sources of revenue and government spending cuts. We would be naïve to think the insurance and financial services industry will escape scrutiny.

Members of Congress need to understand that the products and services provided by insurance and financial professionals are part of the solution. Tax laws and other policies that encourage Americans to take control of their own financial well-being, plan for retirement, and mitigate life’s inevitable risks strengthen the economy and can reduce government spending. Insurance products and services also improve Americans’ quality of life by providing financial security and reducing financial worries. The results of two surveys, one by LIMRA and Life Happens and the other by ACLI, illustrate the points.

1 min read

U.S. Companies and Persons Exempted From BOI Reporting Requirements

By NAIFA on 3/25/25 1:22 PM

The U.S. Treasury Department's Financial Crimes Enforcement Network released an interim final rule that eliminates a beneficial ownership information (BOI) reporting requirement for U.S. businesses. The rule exempts domestic reporting companies and U.S. citizens and residents who are beneficial owners of foreign reporting companies.

1 min read

NAIFA Applauds CMS Decision to Protect Access to Medicare Agents for Consumers Affected by Disasters

By NAIFA on 3/21/25 5:02 PM

The Centers for Medicare & Medicaid Services (CMS) has withdrawn a memo issued during the previous administration that would have restricted how Medicare beneficiaries may enroll using a Special Election Period (SEP) when affected by a Government Entity-Declared Disaster or Other Emergency. Under the new direction, the process will not change and individuals will not be forced to enroll by calling Medicare directly.

1 min read

NAIFA-North Carolina Offers Alternative to State-Run Retirement Plan

By Fred Joyner on 3/21/25 4:55 PM

On Wed. March 12, 2025, NAIFA-NC provided testimony to the NC House Insurance Committee regarding House Bill 79, North Carolina Work and Save (a state-run retirement plan).

1 min read

NAIFA Video: The State of the Tax Bill

By NAIFA on 3/14/25 4:31 PM

Washington insiders and NAIFA consultants Danea Kehoe and Pat Raffaniello have recorded a new video outlining the congressional process of funding the federal government and providing an update on the state of federal tax legislation.

1 min read

NAIFA Advocates for Stability in Medicare Advantage and Part D Markets

By NAIFA on 3/6/25 3:03 PM

Medicare Advantage and Medicare Part D consumers rely on agents and brokers to help them understand and make informed decisions about these often complex products. Yet, ongoing instability in the marketplace and uncertainty about compensation for agents and brokers are making it difficult for professionals to give critical guidance to their clients.

NAIFA has joined NABIP, HAFA, the Big I, and the CIAB in asking Congress to address these challenges.

1 min read

NAIFA Seeks Tax Law to Support Main Street Employers

By NAIFA on 2/28/25 3:43 PM

Prior to passage of the House budget resolution, NAIFA joined a letter from a coalition of Main Street Employers to Speaker of the House Mike Johnson and House Minority Leader Hakeem Jeffries urging passage of the resolution to protect S corporations from untenable tax increases. The resolution was passed on February 26 and has been sent to the Senate, which has been working on a separate budget resolution.

1 min read

Small Business Reporting Requirements Under the CTA to Be Delayed and Reconsidered

By NAIFA on 2/28/25 3:14 PM

The Financial Crimes Enforcement Network (FinCEN) of the U.S. Treasury Department has announced that it will further delay enforcement of the Corporate Transparency Act (CTA). The CTA requires upwards of 32 million U.S. businesses to submit beneficial ownership information (BOI) reports to the U.S. Treasury Department, and Treasury had set a new deadline of March 21. A release by FinCEN said it will "not issue any fines or penalties or take any other enforcement actions against any companies based on any failure to file or update beneficial ownership information (BOI) reports."

1 min read

Federal Court Removes Pause on Corporate Reporting Act Requirements. NAIFA Supports Legislative Delay.

By NAIFA on 2/21/25 5:30 PM

The on-again, off-again Corporate Transparency Act (CTA), which requires upwards of 32 million U.S. businesses to submit beneficial ownership information (BOI) reports to the U.S. Treasury Department, is back on with a filing deadline of March 21. A February 18 U.S. District Court decision lifted an earlier injunction that had paused enforcement of the BOI reporting requirement. Generally, the legislation exempts securities brokers or dealers, licensed insurance producers, public accounting firms, and several other types of companies, but many of the business owner clients of NAIFA members are subject to the CTA.

2 min read

Texas Legislature Recognizes NAIFA-Texas Centennial

By NAIFA on 2/21/25 4:58 PM

Resolutions passed by the Texas House of Representatives (HR 215) and Senate (SR 76) celebrate the 100-year anniversary of NAIFA’s Texas chapter. The Senate resolution was sponsored by Senator Bryan Hughes and the House resolution by Representative Ryan Guillen.

1 min read

Never Been to the Congressional Conference? This Is Your Year!

By NAIFA on 2/7/25 4:04 PM

NAIFA members are the most potent grassroots advocacy force in the insurance and financial service industry. One thing could make us even more influential: Adding your voice. If you have never attended NAIFA's Congressional Conference, 2025 is a great time to give it a shot.

3 min read

Who’s Protecting Your Business? The Role of NAIFA Advocacy

By Kevin Mayeux on 2/6/25 12:38 PM

In today’s ever-changing regulatory landscape, financial professionals face a growing number of legislative and policy challenges that can directly impact their ability to serve clients and sustain their businesses. Many of these challenges come from well-intended but often misguided attempts to regulate the industry in ways that could limit consumer access to financial guidance, increase operational burdens, or even threaten advisors' ability to earn a living.

At NAIFA, our mission is clear: We are the voice of the financial professional in Washington, D.C., and in state capitals across the country. We are here to ensure that laws and regulations support—not hinder—your ability to provide the essential services that individuals, families, and businesses rely on every day.

Why Advocacy Matters

Without a strong, unified advocacy effort, financial professionals could face serious obstacles that disrupt their business models. Consider some of the critical battles NAIFA has fought on behalf of the industry:

1 min read

Grassroots Comes Alive at the 2025 NAIFA Congressional Conference

By NAIFA on 1/24/25 4:34 PM

Participate and make a difference! Come to Washington, D.C., May 19-20, for the 2025 Congressional Conference, NAIFA's signature advocacy event!

1 min read

Lawmakers Introduce the Main Street Tax Certainty Act

By NAIFA on 1/24/25 4:21 PM

Senator Steve Daines (R-MT), Majority Leader John Thune (R-SD), and 33 Republican Senators have introduced the Main Street Tax Certainty Act, a bill that would make the 20% pass-through business tax deduction permanent. Representative Lloyd Smucker (R-PA) has introduced companion legislation in the House, which is co-sponsored by 153 Representatives. The deduction is currently set to expire with many provisions of the Tax Cuts and Jobs Act at the end of this year.

1 min read

NAIFA Supports Legislation to Delay Business Paperwork Requirement

By NAIFA on 12/19/24 9:45 AM

Confusion over the status of the Corporate Transparency Act (CTA) is causing hardship for businesses across the country. The legislation, passed in 2021, requires an estimated 32.5 million businesses to file paperwork providing sensitive information about ownership with a division of the U.S. Department of Treasury by January 1, 2025. Under the law, companies that fail to comply would face fines of up to $590 per day. A federal court has issued a preliminary injunction that prevents the Treasury from enforcing the reporting requirements, but that decision is under appeal.

This issue is important to NAIFA because many NAIFA members are business owners or provide financial services for small business clients, even if the CTA does exempt securities brokers or dealers, licensed insurance producers, public accounting firms, and several other types of companies. NAIFA has joined a group of trade organizations supporting legislation that would delay enforcement of the reporting requirements by one year even if the court’s preliminary injunction is lifted. In a letter to Congressional leadership, NAIFA and the other organizations strongly urge lawmakers to include language delaying the CTA requirements in a continuing resolution (CR) that would fund the government into the new year. Doing so would remove a great deal of uncertainty for American businesses.

The larger funding CR is currently hung up in Congress due to disputes over issues unrelated to the CTA funding provision.

1 min read

NAIFA Is Tuned In to the Future of Medicare

By NAIFA on 12/10/24 4:22 PM

NAIFA CEO Kevin Mayeux sat down with Senior Director for Government Relations Michael Hedge to discuss some ways the incoming administration could change the regulatory landscape surrounding Medicare and how this could present opportunities for NAIFA to get involved. Insurance professionals are crucial to helping consumers navigate the complicated Medicare plans and NAIFA is dedicated to keeping agents involved and ensuring they are properly compensated.

2 min read

Top-Notch NAIFA Advocacy Efforts Earn Recognition

By Kevin Mayeux on 12/6/24 4:08 PM

On behalf of the entire NAIFA family, I am pleased to congratulate NAIFA’s Senior Vice President for Government Relations Diane Boyle, who has been recognized as a Top Association Lobbyist for 2024 by The Hill, a prestigious newspaper covering federal politics.

2 min read

NAIFA calls Medicare Advantage Organizations' compensation cuts to agents 'extremely detrimental' to beneficiaries

By NAIFA on 12/3/24 2:51 PM

NAIFA tells CMS that compensation cuts may ‘run afoul’ of existing federal regulations

2 min read

Talking About Taxes With NAIFA SVP Diane Boyle

By Kevin Mayeux on 11/21/24 10:28 AM

I recently sat down with NAIFA Senior Vice President for Government Relations Diane Boyle to discuss the election and its implications for the upcoming tax reform debate in the 119th Congress.

3 min read

New Rule Bolsters Protections for Nevada Annuity Consumers

By NAIFA on 11/19/24 10:55 AM

American Council of Life Insurers (ACLI) President and CEO David Chavern and National Association of Insurance and Financial Advisors (NAIFA)—Nevada Political Action Committee Chair Jarod Morgan issued the following joint statement on the best interest annuity rule approved recently by the Legislative Review Committee and supported by the Nevada Division of Insurance:

1 min read

NAIFA's Boyle Discusses LTC Policy Matters at OneAmerica Summit

By NAIFA on 11/13/24 5:09 PM

NAIFA Senior Vice President for Government Relations Diane Boyle participated in a legislative panel at OneAmerica's Long-Term Care Summit. The summit featured discussions by industry thought leaders focused on the future of long-term care, covering everything from industry trends and government and regulation considerations to consumer perspectives.

2 min read

Post-Election 2024: The Impact on Insurance and Financial Services

By NAIFA on 11/11/24 11:29 AM

Join us on Tuesday, December 3, 2024, at 3 pm Eastern as NAIFA’s Government Relations team unpacks the results of the 2024 general election and its implications for insurance agents and the broader financial services industry. With a new administration, shifts in the Senate and House, and changes across 11 gubernatorial offices and 85 state legislative chambers, this webinar will provide valuable insights on the challenges and opportunities that lie ahead.

3 min read

The Election Brings Big Changes. NAIFA's Advocacy Is Ready

By Kevin Mayeux on 11/6/24 11:31 AM

The campaigns are done, the voting is over, and the results are becoming clear. Donald Trump will return to the White House as the 47th President of the United States. Republicans will also control the Senate with at least 52 seats. Races determining which party controls the House of Representatives have yet to be decided (and may not be for some time).

2 min read

Decisions to Cut Commissions on Medicare Advantage Plans Are Bad for Consumers

By NAIFA on 11/1/24 3:58 PM

Here we go again! Two more insurance companies, Aetna and Anthem, have informed agents that they will no longer pay commissions on new enrollments to some Medicare Advantage plans. These announcements follow similar ones by insurers earlier this year. The most recent decisions are particularly jarring because they come in the middle of the Medicare Annual Enrollment Period, when many agents are deep into the planning process with clients.

2 min read

The Super Bowl of Tax Reform: Are You Ready to Take on What’s Next?

By Diane Boyle on 10/25/24 3:44 PM

2025 is gearing up to be a high-stakes year for tax reform. For financial professionals, it’s a lot like preparing for the Super Bowl. The clock is ticking as Congress pushes toward major tax legislation, driven by the impending expiration of individual tax cuts from the 2017 Tax Cuts and Jobs Act (TCJA). Extending TCJA could add an estimated $4.5 trillion to the federal deficit over 10 years. With such a high price tag, lawmakers are on a relentless hunt for revenue, putting every corner of the financial landscape—including insurance and financial services—under intense scrutiny.

1 min read

Americans need informed advice when choosing Medicare plans

By Kevin Mayeux on 10/21/24 2:03 PM

While MarketWatch columnist Brett Arends raises legitimate concerns about the complexities surrounding Medicare enrollment and the insurance brokers who assist beneficiaries (“The Medicare scandal hiding in plain sight,” Oct. 16), he unfairly paints a broad picture of financial professionals as profit-driven actors without considering the critical role brokers play helping consumers navigate the Medicare Advantage marketplace, which now accounts for more than half of all eligible Medicare beneficiaries. Agents and brokers educate consumers on how Medicare works, both broadly and in conjunction with other products such as Part D prescription drug plans, to simplify a complex decision-making process.

6 min read

LIAM Recap: State Proclamations

By NAIFA on 10/3/24 2:34 PM

Throughout September, NAIFA and our Life Happens community promoted Life Insurance Awareness Month (LIAM) to educate consumers about the importance of life insurance and empower financial professionals to reach wider communities with LIAM-themed resources and materials. As an important part of the LIAM campaign, NAIFA chapters worked alongside advocacy partner ACLI with elected officials to get proclamations or resolutions recognizing LIAM in at least 19 states.

1 min read

Preparing for 2025: Understanding Upcoming Tax Changes

By NAIFA on 10/3/24 9:43 AM

As we approach the sunset of key provisions in the Tax Cuts and Jobs Act (TCJA) set for 2025, taxpayers and businesses alike are bracing for significant changes. With the potential for major tax legislation on the horizon, now is the time to prepare.

2 min read

NAIFA Supports the Bipartisan ENABLE Act to Help Americans With Disabilities Achieve Financial Security

By NAIFA on 10/3/24 9:29 AM

More than 181,000 Americans living with disabilities have benefited from the Achieving a Better Life Experience (ABLE) program, which NAIFA has advocated for since it was first enacted in 2014. The program gives people with disabilities and their families access to tax-free savings accounts without affecting their eligibility for federal programs like Medicaid and Supplemental Security Income. Now that key provisions of the ABLE program are set to expire next year, NAIFA strongly supports the efforts of Senators Bob Casey (D-PA) and Eric Schmitt (R-MO) to extend them.

2 min read

Blanket Accusations Against Financial Professionals Need to Stop

By Kevin Mayeux on 9/27/24 9:22 AM

A message to NAIFA Members:

Throughout September, it has been truly inspiring to witness NAIFA members actively participating in Life Insurance Awareness Month by shining a much-needed spotlight on the tremendous value of life insurance. Your commitment to highlighting the importance of this product while educating millions of consumers on the broader issues of financial literacy helps ensure that Americans understand the many tools available to secure their financial futures.

2 min read

ACLI’s Neely Awarded NAIFA Defender of Financial Freedom Award

By NAIFA on 9/21/24 8:14 PM

The National Association of Insurance and Financial Advisors is pleased to present NAIFA’s Defender of Financial Freedom Award to Susan Neely, president and CEO of the American Council of Life Insurers (ACLI).

2 min read

New Rule in Louisiana Strengthens Protections for Annuity Consumers

By NAIFA on 9/20/24 5:25 PM

American Council of Life Insurers (ACLI) President and CEO Susan Neely and National Association of Insurance and Financial Advisors (NAIFA)—Louisiana Chapter President Blake Gillies issued the following joint statement on the best interest annuity rule adopted by the Louisiana Department of Insurance:

1 min read

Join us for the Q4 State of NAIFA Webinar

By NAIFA on 9/20/24 9:47 AM

NAIFA members are invited to the Q4 State of NAIFA webinar at 12 pm Eastern, October 16, 2024. Hear updates on NAIFA's advocacy efforts, professional development programs and other membership activities designed to enhance your professional growth.

1 min read

NAIFA letter to CMS offers solutions on consumer access to informed Medicare guidance

By NAIFA on 9/11/24 5:55 PM

In the letter, Mayeux said Medicare Part D plans “are sophisticated products that can be difficult for many Medicare beneficiaries to fully understand. NAIFA members spend a considerable amount of time each year, especially during the Annual Enrollment Period, matching beneficiaries to the prescription drug plan that best fits their specific needs.” Mayeux also makes the following points:

- Because Medicare can be much more complex than commercial insurance, many consumers need assistance throughout the year as they move through the various phases of coverage, cost determinations, and new prescriptions, all of which are services that agents provide on a continual basis.

- Eliminating agent compensation for these plans creates a risky precedent that may lead to consumers being left without personalized assistance as the agent cannot help with any issues that may arise.

- Without professional agent assistance, consumers will be confused and left to contact calls centers unfamiliar with their unique situations. Frustrated consumers are more likely to submit their complaints and concerns directly to Medicare, placing added stress on CMS’s ability to deal with calls and inquiries in a timely fashion.

Mayeux added that NAIFA plans to continue the conversation with the Centers for Medicare and Medicaid Services to communicate the impact this decision will have on protecting our most vulnerable citizens.

1 min read

NAIFA Offers Solutions to Protect Consumer Access to Informed Medicare Assistance

By Kevin Mayeux on 8/30/24 9:16 AM

National Association of Insurance and Financial Advisors (NAIFA) CEO Kevin Mayeux, CAE, issued the following statement on the decision by some health plans to cease new and renewal commissions for Medicare prescription drug (Part D) plans and terminating existing marketing service agreements:

1 min read

NAIFA's Lawsuit Aims to Protect Consumers and the Financial Professionals Who Serve Them

By Kevin Mayeux on 8/15/24 4:08 PM

The Wall Street Journal and Washington Post recently published articles casting a negative light on the lawsuit brought by NAIFA, ACLI, and others to stop the Department of Labor’s misguided fiduciary-only rule. These articles mischaracterize what we hope to achieve and largely ignore the arguments laid out in our court filings.

2 min read

NAIFA Seeks Volunteers to Be Nominated for Federal Advisory Councils

By NAIFA on 8/5/24 4:12 PM

We have an exciting opportunity for you to put your name forward as a nominee to serve on the Department of Labor’s ERISA Advisory Council or the Federal Reserve Board’s Insurance Policy Advisory Committee. Details for each are below. If nominated and selected, you will be able to provide critical input on the important role financial professionals and insurance producers play in securing Americans’ futures.

2 min read

A Win for NAIFA Is a Win for Insurance and Financial Professionals

By NAIFA on 8/2/24 9:07 AM

NAIFA along with the American Council of Life Insurers and other advocacy partners recently notched a major win in our lawsuit opposing the Department of Labor’s fiduciary-only rule. As we shared with you last week, the U.S. District Court for the Northern District of Texas granted a stay in the lawsuit that prevents the DOL rule from going into effect September 23.

3 min read

Missouri Enhances Protections for Annuity Consumers

By NAIFA & ACLI on 8/2/24 8:45 AM

American Council of Life Insurers (ACLI) President and CEO Susan Neely and NAIFA-Missouri President Craig Wright, MBA, CFP, ChFC, issued the following joint statement on the best interest annuity rule adopted today by the Missouri Department of Insurance:

1 min read

Update: Court Grants a Stay in NAIFA's Lawsuit Against the DOL

By NAIFA on 7/27/24 10:29 AM

The U.S. District Court for the Northern District of Texas has granted a request by NAIFA, ACLI, several NAIFA chapters, and other advocacy partners to stay the Department of Labor's fiduciary-only rule, stating that our case is "virtually certain to succeed on the merits." The action follows a similar stay issued Thursday by a different federal court in a similar case.

3 min read

Federal Court in Texas Halts the DOL's Fiduciary-Only Rule

By NAIFA on 7/26/24 4:15 PM

On July 25, 2024, a federal court in the Eastern District of Texas issued a stay barring the enforcement of the DOL fiduciary-only rule (and amendments to PTE 84-24) while the case in FACC v. DOL is pending. An appeal of the stay to the 5th Circuit is likely.

Meanwhile, NAIFA’s challenge to the fiduciary-only rule, brought with ACLI and other industry groups, is under review in the Northern District of Texas, where we seek a preliminary injunction and stay against enforcement of the fiduciary-only rule and amendments to PTE 84-24 and 2020-02.

4 min read

NAIFA-Texas Advocacy Standout John Ruckel to Receive NAIFA’s 2024 Terry Headley Award

By NAIFA on 7/22/24 4:00 AM

NAIFA is proud to announce that John M. Ruckel, LUTCF, a Financial Professional with MassMutual and owner of Ruckel Insurance and Financial Group in Nacogdoches, Texas, is the 2024 recipient of NAIFA’s Terry Headley Lifetime Defender Award.

NAIFA-CA celebrates passage of financial literacy bill

By NAIFA on 7/14/24 2:04 PM

Congratulations to NAIFA-California for its advocacy work that contributed to the California Legislature passing (and the Governor signing) AB 2927 by Assemblyman McCarty (D-Sacramento). The bill reflects years of efforts to require financial literacy be included in high school curriculum and required for graduation.

The recently agreed-to compromise was supported by NAIFA-California and resulted in the proposed November ballot initiative being pulled by its sponsor NGPF Mission 2030, an affiliate of Next Gen Personal Finance. The Governor and Legislative leaders praised the compromise and expressed their strong support of ensuring students are given the life tools necessary to make sound financial decisions at a young age. Students will begin to see the curriculum in the 2027-28 school year.

NAIFA-California’s advocacy win is NAIFA grassroots at its best.

1 min read

Two U.S. House Committees Act to Protect Retirement Savers from Labor Department’s Fiduciary-Only Regulation

By NAIFA on 7/11/24 10:10 AM

Washington, D.C.—The American Council of Life Insurers (ACLI), National Association of Insurance and Financial Advisors (NAIFA), Finseca, Insured Retirement Institute (IRI) and National Association for Fixed Annuities (NAFA) issued the following statement on legislation passed by the U.S. House Appropriations Committee and the Education and the Workforce Committee to protect retirement savers from the Labor Department’s fiduciary-only regulation:

“The actions taken by the U.S. House Appropriations Committee and the Education and the Workforce Committee send a clear message that the Labor Department’s fiduciary-only regulation does not align with Congress’s efforts to expand retirement security for all Americans through the increased availability of lifetime income options.

“In 2019 and 2022, Congress reaffirmed the importance of lifetime income when it passed legislation making it easier for employers to include annuities in workplace retirement plans. The fiduciary-only regulation is at odds with this progress. It restricts consumer access to professional financial guidance and options for protected lifetime income that annuities offer.

1 min read

Federal Court Blocks Medicare Advantage Compensation Rule That NAIFA Opposes

By NAIFA on 7/10/24 11:08 AM

The U.S. District Court for the Northern District of Texas has issued a stay preventing the Centers for Medicare and Medicaid Services (CMS) from implementing a new rule changing compensation rules for professionals providing products and services related to Medicare Advantage and Medicare Part D programs. NAIFA is not a party to the lawsuits, Americans for Beneficiary Choice et al. v. the U.S. Department of Health and Human Services et al. and The Council for Medicare Choice et al. v. HHS et al., but has been an outspoken critic of the rule since it was first proposed.

1 min read

NAIFA Supports Legislation Expanding Uses of 529 Plan Withdrawals

By NAIFA on 7/9/24 4:38 PM

So-called 529 plans are effective financial planning tools that help many families prepare for education-related costs. They allow tax-free withdrawals to pay “qualified education expenses.” Proposed legislation known as the “Education and Workforce Freedom Act,” which NAIFA supports, would significantly expand approved uses for 529 plan withdrawals and has been passed by the House Ways & Means Committee.

3 min read

U.S. House Appropriations Subcommittee Advances Legislation Blocking Funding for Fiduciary-Only Regulation

By NAIFA on 6/28/24 12:25 PM

Washington, D.C.—The American Council of Life Insurers (ACLI), National Association of Insurance and Financial Advisors (NAIFA), Finseca, Insured Retirement Institute (IRI) and National Association for Fixed Annuities (NAFA) issued the following statement on legislation advanced today by the U.S. House Appropriations Subcommittee on Labor, HHS, Education, and Related Agencies that would block funding for the Labor Department’s fiduciary-only regulation:

1 min read

Nine Years and Counting: NAIFA Continues to Urge the White House to Nominate NARAB Board Members

By NAIFA on 6/28/24 11:35 AM

It's been nine-and-a-half years since the National Association of Registered Agents & Brokers (NARAB) Reform Act was enacted, yet the NARAB Board of Directors has still not been established. The Obama administration submitted nominees but the Senate Banking Committee failed to act on the nominations. Since then, the Trump and Biden administrations have not submitted nominations to the Senate for approval.

2 min read

The NAIFA Advocacy Webinar, 'Tax Reform Priorities and Politics,' Is Available On Demand

By NAIFA on 6/14/24 4:44 PM

Major federal tax legislation is all but certain to be coming from Washington, D.C., in 2025. Many provisions from the 2017 Tax Cuts and Jobs Act (TCJA) are set to expire at the end of next year and Congress will need to address the situation. This NAIFA advocacy webinar, originally produced June 13 but now available on demand, gives you a better understanding of what is being dubbed the "Super Bowl of Tax" and provides insights into some of the proposals likely to shape the debate. It provides analysis of how the political landscape and upcoming election will shape the tax reform issue.

2 min read

NAIFA Joins Coalition to Advocate for Tax-Free Employer-Provided Health Care Coverage

By NAIFA on 6/11/24 3:22 PM

NAIFA has joined forces with 70 organizations, employers, unions, patient and disease advocacy groups, and other health care stakeholders to emphasize the importance of maintaining the tax-free status of employer-provided health care coverage. In a united front, these organizations reminded Congress of the critical role this coverage plays in ensuring the health and financial security of nearly 180 million Americans.

1 min read

Join us for the Q3 State of NAIFA Webinar

By NAIFA on 6/3/24 5:06 PM

NAIFA members are invited to the Q3 State of NAIFA webinar at 12 pm Eastern, June 27, 2024. Hear updates on NAIFA's advocacy efforts, professional development programs and other membership activities designed to enhance your professional growth.

2 min read

Insurance Associations File Legal Action Challenging U.S. Department of Labor’s Fiduciary-Only Regulation

By NAIFA on 5/24/24 4:21 PM

Nine insurance trade associations filed a lawsuit today against the U.S. Department of Labor (DOL) to overturn a regulation limiting consumers' choice of financial professional and their access to retirement products that deliver protected lifetime income.

The American Council of Life Insurers (ACLI), National Association of Insurance and Financial Advisors (NAIFA), NAIFA-Texas, NAIFA-Dallas, NAIFA-Fort Worth, NAIFA-POET, Finseca, Insured Retirement Institute (IRI), and National Association for Fixed Annuities (NAFA) issued the following comments on their challenge to the DOL's harmful intervention in the retirement savings marketplace and its one-size-fits-all fiduciary standard obligation on effectively every financial professional who sells retirement products:

3 min read

Financial Professionals to Advocate for Their Businesses and Clients at NAIFA’s Congressional Conference

By NAIFA on 5/16/24 10:07 AM

NAIFA is hosting the 11th annual Congressional Conference May 20-21 at the JW Marriott in Washington, D.C. The event will feature targeted advocacy training with briefings on legislative issues that affect members’ businesses, clients, and communities. Washington insiders will offer best practices for conducting Congressional meetings and tips for developing impactful long-term relationships with legislators.

1 min read

Mayeux Thanks Lawmakers for CRA Resolution Disapproving of the DOL’s Fiduciary-Only Rule

By NAIFA on 5/15/24 12:07 PM

NAIFA supports the newly introduced Congressional Review Act (CRA) resolution disapproving the DOL’s final fiduciary-only rule that will negatively impact and impose new costs on middle- and low-income savers, as well as financial services professionals. CEO Kevin Mayeux, CAE, sent letters personally thanking Representative Rick Allen and Senators Roger Marshall, Joe Manchin, Ted Budd, and Bill Cassidy for introducing the resolution in the House and Senate, respectively. ACLI, NAIFA, Finseca, IRI and NAFA also issued a joint release supporting the CRA review.

1 min read

NAIFA's Support for Senior Protection Legislation Recognized by Member of Congress

By NAIFA on 5/13/24 10:52 AM

NAIFA supports the bipartisan Empowering States to Protect Seniors Against Bad Actors Act, which would establish a grant program at the U.S. Securities and Exchange Commission to help states fund initiatives to protect consumers against financial scams. The grants would help states staff anti-scam enforcement offices, invest in technology, develop educational resources, and devise strategies specifically designed to protect seniors from financial exploitation and fraud.

1 min read

Please Take NAIFA’s Survey on the DOL Fiduciary-Only Rule

By NAIFA on 5/12/24 8:26 PM

An ongoing survey of NAIFA members will provide updated data to help NAIFA and our industry partners in future actions on the Department of Labor’s final fiduciary-only rule. The results will help us educate policymakers – and potentially the courts – on how the proposal will impact consumers and your business.

2 min read

NAIFA-Louisiana and Edward Jones Promote Financial Literacy Resolutions

By NAIFA on 5/2/24 12:49 PM

National Financial Literacy Month came to a close at the end of April 30, but educating consumers about the importance understanding their finances is a task NAIFA members can take to heart throughout the year. It's also has an important advocacy component. We are #NAIFAproud of members from NAIFA-Louisiana who worked in cooperation with Edward Jones and were instrumental in getting both the state House of Representatives and Senate to pass resolutions recognizing April as Financial Literacy Month in the state.

1 min read

How the DOL Fiduciary-Only Rule Will Impact Financial Professionals and Consumers

By NAIFA on 4/27/24 1:30 PM

A NAIFA Advocacy Webinar

May 2 | 2 pm eastern

The U.S. Department of Labor‘s final fiduciary-only rule will force the vast majority of financial professionals offering retirement planning services and products into a fee-for-service model, unless Congress or the courts intervene. It will deprive many consumers of the valuable option of working with professionals operating under alternative models, including those with commission-based compensation, that may better meet their needs.

1 min read

Don't Miss NAIFA's Congressional Conference

By NAIFA on 4/26/24 4:31 PM

May 20-21 | Washington, D.C.

Register Today!

NAIFA's Congressional Conference shines a spotlight on NAIFA's unmatched advocacy influence and provides financial professionals with another way to serve consumers' best interests. NAIFA members who meet with their members of Congress this May will not only be advocating for their own businesses but also for their colleagues, clients, and communities. Decisions made in Washington, D.C., affect the financial security of families and businesses nationwide that rely on NAIFA members for financial guidance.

1 min read

NAIFA Offers Analysis of FTC Non-Compete Rule

By NAIFA on 4/24/24 11:38 AM

The Federal Trade Commission voted 3-2 along partisan lines at an April 23 open Zoom meeting to approve its final Non-Compete Clause Rule which will ban most non-compete agreements.

The 570-page Final Rule becomes effective 120 days after it is published in the Federal Register unless a court issues an order staying that effective date while it considers challenges to the Final Rule. The Final Rule is expected to be published on April 25, 2024, and it would then become effective on August 23, 2024. Legal challenges are, however, expected to be filed immediately.

3 min read

NAIFA Responds to DOL Release of Fast-Tracked Fiduciary-Only Rule

By NAIFA on 4/23/24 1:40 PM

The Department of Labor and the White House have released a final fiduciary-only rule after an astonishingly brief regulatory and review process and in spite of grave concerns expressed by NAIFA, members of Congress, and other stakeholders. Unless Congress or the courts intervene, the rule will force the vast majority of financial professionals offering retirement planning services and products into a fee-for-service model. It will deprive consumers of the valuable option of working with professionals operating under alternative models that may better meet their needs.

1 min read

NAIFA-Arkansas Hosts State Lawmakers

By NAIFA on 4/18/24 4:26 PM

The NAIFA-Arkansas Board of Directors hosted a dinner with the state legislature's joint House and Senate Insurance & Commerce Committees. Attendees included highly influential elected officials whose decisions impact financial professionals and consumers throughout the state. At least two of the lawmakers are practicing financial professionals, who naturally understand the issues that go before the committees.

2 min read

A Flawed Regulatory Process on DOL Fiduciary-Only Rule Marginalized Public Input

By NAIFA on 4/15/24 3:24 PM

NAIFA continues efforts to discourage the Department of Labor and the administration from moving forward with its flawed fiduciary-only rule. In a letter to DOL Acting Secretary Julie A. Su, Office of Management and Budget (OMB) Director Shalanda Young, and Office of Information and Regulatory Affairs (ORIA) Administrator Richard Revesz, NAIFA and 10 other groups detailed problems with the rule's regulatory process and asked the administration to "stand up for the integrity of the regulatory process and continue the public input process, rather than finalize the fiduciary rule now."

5 min read

NAIFA Is Making Headlines on Efforts to Oppose the DOL's Misguided Rule

By NAIFA on 4/12/24 4:45 PM

NAIFA is speaking out on behalf of financial professional and, particularly, the consumers who would be harmed by the Department of Labor's latest effort to reduce choices for Americans preparing for retirement. The fiduciary-only proposal, which is largely a rehash of a rule struck down by a federal appeals court in 2018, would radically change the financial services industry and reduce the ability of low- and middle-income retirement savers to access products and services.

3 min read