NAIFA members are often at the forefront of efforts to improve Americans' financial literacy. From educating their clients to volunteering in local schools and their communities to promoting April as National Financial Literacy Month, NAIFA members are giving Americans intelligent insights into money matters. This even extends to their political advocacy.

2 min read

NAIFA Advocates for Financial Literacy

By NAIFA on 4/5/24 2:53 PM

Topics: State Advocacy Financial Literacy Federal Advocacy

2 min read

NAIFA's Gandy Tells Congress DOL Proposal Is Unnecessary

By NAIFA on 3/1/24 8:41 AM

NAIFA wholeheartedly supports a best interest standard for retirement investment professionals, but believes the Department of Labor's proposal to impose a fiduciary-only regulation goes too far, NAIFA Secretary Chris Gandy wrote in letter submitted to be part of the official record of a recent House Subcommittee on Health, Employment, Labor, & Pensions hearing entitled "Protecting American Savers and Retirees from DOL’s Regulatory Overreach.”

Topics: Federal Advocacy Congress DOL Supported Legislation

1 min read

NAIFA Reports on the State of Advocacy

By NAIFA on 2/23/24 2:33 PM

NAIFA is the leading advocacy voice for insurance and financial professionals at the federal and state levels. The association boasts members in every Congressional district and has a strong advocacy presence in every state capital. Last year, NAIFA tracked more than 490 state-level bills that had the potential to affect NAIFA members and the consumers they serve. NAIFA members or staff testified at more than 30 state-level hearings, providing real-world accounts of how policy proposals could benefit or harm the financial security of consumers.

Topics: State Advocacy Federal Advocacy

2 min read

NAIFA's Cothron: The SEC's Proposed Limits on Technology Will Harm Consumers

By NAIFA on 2/7/24 5:04 PM

Senators Ted Cruz and Bill Hagerty have introduced legislation, the Protecting Innovation in Investments Act, that would prevent the SEC from moving forward with a proposed rule that would deter technological innovation by financial services companies. The SEC's proposal would also stifle financial professionals' use of technology to benefit clients.

The Senators, in a release entitled "What They're Saying," quoted NAIFA President Tom Cothron, LUTCF, FSCP, on the importance of technology in the financial services industry and NAIFA's opposition to the SEC proposal.

Topics: Technology SEC Federal Advocacy Supported Legislation

1 min read

Senators Call Out NAIFA's Support for Bill to Protect Innovation in Investing

By NAIFA on 2/6/24 11:46 AM

NAIFA strongly supports newly introduced legislation, the Protecting Innovation in Investment Act sponsored by U.S. Senate Commerce Committee Ranking Member Ted Cruz (R-Texas) and U.S. Senator Bill Hagerty (R-Tenn.), that would foster the use of technology and innovation in the financial services industry to benefit consumers.

Topics: Technology Investing Federal Advocacy Supported Legislation

1 min read

Reasons Abound for the DOL to Withdraw Its Fiduciary-Only Proposal

By NAIFA on 1/26/24 1:26 PM

When it comes to preparing for retirement, having choices matters. Congress, in recent years, has passed landmark legislation encouraging Americans to invest in their futures and save for retirement while giving them greater flexibility and more planning options. Now more than ever Americans need retirement planning assistance.

Topics: Legislation & Regulations Standard of Care & Consumer Protection Federal Advocacy DOL

2 min read

New Study Agrees With NAIFA Survey Showing DOL Proposal Would Increase Costs

By NAIFA on 1/23/24 11:50 AM

NAIFA members in a recent survey overwhelmingly said that the Department of Labor’s fiduciary-only proposal for retirement planning services would increase the costs of serving clients. That sentiment is borne out on a macro level by a new Financial Services Institute study conducted by Oxford Economics, which found that the rule would cost financial services firms $2.7 billion in the first year with continuing annual costs of $2.5 billion. These figures are more than six times the upfront costs and nearly 11 times the ongoing costs estimated by the DOL.

Topics: Legislation & Regulations Standard of Care & Consumer Protection Federal Advocacy DOL

2 min read

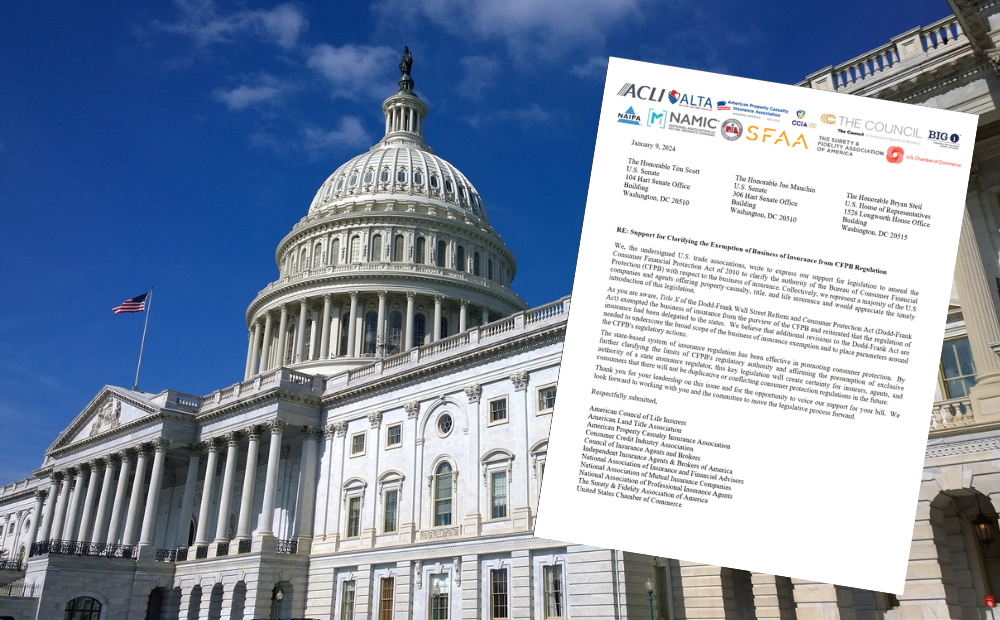

Press Release on Scott-Manchin Insurance Regulation Bill Cites NAIFA's Advocacy

By NAIFA on 1/17/24 8:21 AM

Senate Committee on Banking, Housing, and Urban Affairs Ranking Member Tim Scott (R-SC) cited NAIFA's support in a press release announcing legislation designed to protect the state-based regulatory regime of the insurance industry. The bill, known as the Business of Insurance Regulatory Reform Act, would clarify and reinforce sections of the Dodd-Frank Wall Street Reform and Consumer Protection Act to exclude "the business of insurance" from regulation by the federal Consumer Financial Protection Bureau. It would shore up federal laws that give state regulators exclusive authority to regulate insurance.

Topics: Legislation & Regulations Federal Advocacy Insurance & Financial Advisor Regulation

2 min read

NAIFA Seeks Legislation to Solidify the State-Based Regulation of Insurance

By NAIFA on 1/11/24 4:08 PM

State-based regulation of insurance has been a bedrock of the industry and effectively protects the interests of consumers. Federal law, including Title X of the Dodd-Frank Wall Street Reform and Consumer Protection Act, recognizes this fact and explicitly exempts the business of insurance from regulation by federal Bureau of Consumer Financial Protection (BCFP).

NAIFA and a coalition of groups representing a majority of the U.S. companies and agents offering property-casualty, title, and life insurance have asked Congress for additional legislation that would clarify provisions in Dodd-Frank and solidify the state-based system of insurance regulation.

Topics: Federal Advocacy Congress Insurance & Financial Advisor Regulation Supported Legislation

3 min read

NAIFA President and His Client Offer the DOL a Unique Perspective

By NAIFA on 12/12/23 12:04 PM

The Department of Labor thinks it knows what's best for Americans preparing for retirement. NAIFA President Bryon Holz, CLU, ChFC, LUTCF, CASL, LACP, and his long-time client Chuck Ross think the DOL is wrong and bring their real-life experience to the argument.

.png)

-1.png)

.png)