The U.S. Treasury Department today held a summit touting the so-called Trump accounts (section 530A accounts) enacted in H.R. 1, at which the President spoke about the benefits of the 4-year pilot program for babies born between 2025 and 2028 under which the government will seed each newborn's account with $1,000.

1 min read

Treasury Event Highlights Potential Benefits of Trump Accounts

By NAIFA on 1/28/26 3:49 PM

Topics: Federal Advocacy

3 min read

Putting Medicare Beneficiaries First: NAIFA’s Recommendations to CMS

By Christopher Gandy, LACP on 1/26/26 3:15 PM

Medicare beneficiaries are facing an increasingly complex health insurance landscape. Each year brings new plan designs, regulatory changes, and market shifts that make informed decision-making more challenging, especially for older Americans navigating coverage options that directly affect their health, finances, and peace of mind.

Topics: Medicare Press Release CMS medicare collective

1 min read

NAIFA Supports the Emergency Savings Enhancement Act

By NAIFA on 1/9/26 5:12 PM

NAIFA President Christopher Gandy, LACP, sent letters to Senators Todd Young (R-IN) and Cory Booker (D-NJ) and Representatives Glen Thompson (R-PA) and Eugene Vindman (D-VA) expressing the association's support for the bipartisan Emergency Savings Enhancement Act. The legislation would modernize Pension-Linked Emergency Savings Accounts (PLESAs), established by the Secure 2.0 Act and supported by NAIFA, to encourage more Americans to use these accounts and remove complex regulatory barriers.

Topics: Press Release Financial Security Supported Legislation

1 min read

Get the Early Registration Rate for NAIFA's Congressional Conference

By NAIFA on 1/9/26 4:25 PM

The Congressional Conference is NAIFA's signature grassroots event, bringing financial advisors from all 50 states to Washington, D.C., is scheduled for May 18-19. NAIFA members who sign up before March 3 receive a $50 discount off the registration fee, so don't delay.

Topics: Press Release Grassroots Congressional Conference

1 min read

NAIFA Joins Coalition Urging Phase-Out and Repeal of Tennessee’s Professional Privilege Tax

By NAIFA on 12/19/25 3:24 PM

NAIFA has joined a coalition of professional associations urging Tennessee policymakers to phase out and ultimately repeal the state’s Professional Privilege Tax (PPT). In a joint letter sent to Governor Bill Lee, the coalition called on state leaders to prioritize a phase-out of this outdated tax in the FY 2026–2027 budget, emphasizing that Tennessee should not fund government through a tax on the “privilege” of working. The PPT currently imposes a $400 annual tax on certain licensed professionals, including financial advisors, despite their significant contributions to the state’s economy .

Topics: Advocacy Press Release

1 min read

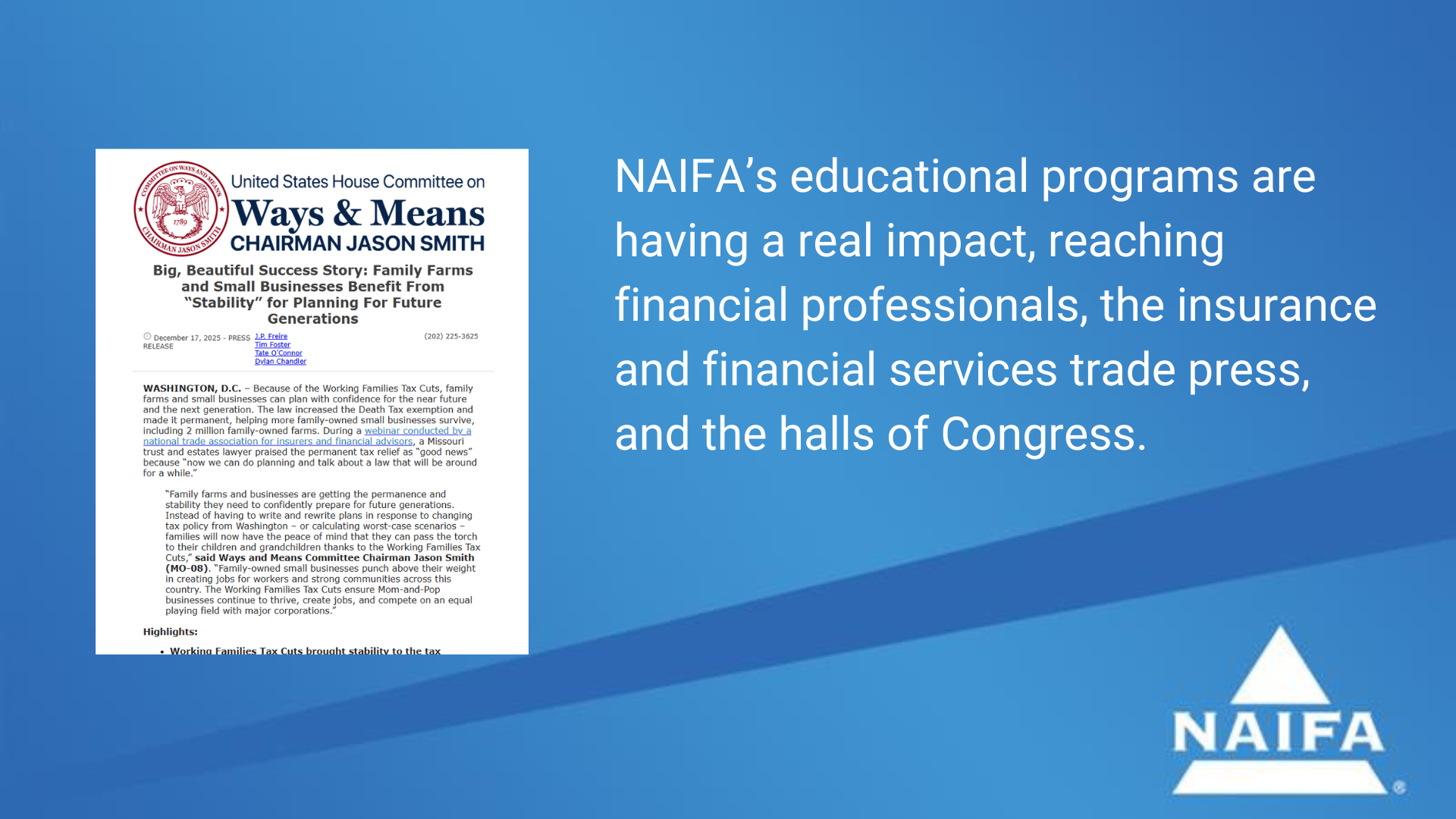

Ways & Means Spotlights NAIFA Webinar in Tax Law Press Release

By NAIFA on 12/19/25 9:45 AM

The House Ways & Means Committee issued a press release on tax reform measures for small businesses that highlights the recent NAIFA webinar, “The One Big Beautiful Bill: Several Big Beautiful(?) Tax Law Changes,” featuring Robert Kirkland, founding member of Kirkland Hochstetler law firm. The tax and spending bill known as the One Big Beautiful Bill (OBBB)” passed earlier this year stabilizes estate tax laws making legacy planning less challenging, Kirkland explained. InsuranceNewsNet magazine’s Advisor News also reported on the NAIFA webinar.

Topics: Estate Planning Webinar Press Release Congress Tax Reform

3 min read

The NAIFA-Supported INVEST Act Passes the House

By NAIFA on 12/11/25 3:30 PM

The bipartisan INVEST Act has passed the House of Representatives in a 302-123 vote. NAIFA supports the legislation to expand retirement-planning options for teachers, employees of nonprofit organizations, and others.

"NAIFA is pleased to see the House take bipartisan action to bolster the ability of more Americans to better prepare for retirement," said NAIFA CEO Kevin Mayeux, CAE. "The INVEST Act would give teachers, hospital workers, nonprofit employees, and others who have 403(b) plans access to expanded investment options, including annuity-linked products that provide guaranteed lifetime income. It would also take steps toward addressing elder financial exploitation and would remove unfair impediments that prevent expert investors who don't meet net-worth thresholds from taking advantage of some sophisticated investments."

Four sections of the bill are particularly noteworthy to financial professionals and their clients.

Topics: Retirement Planning Press Release Supported Legislation

2 min read

NAIFA Advocacy Leadership Earns National Recognition Once Again

By Kevin Mayeux on 12/11/25 3:06 PM

On behalf of the entire NAIFA family, I am proud to congratulate Diane Boyle, Senior Vice President of Government Relations, for being named a Top Lobbyist for 2025 by The Hill. This recognition is one of the most respected acknowledgments in the advocacy community and reflects the consistent excellence of Diane’s work and her contributions to advancing NAIFA's mission to promote financial security for all Americans.

Topics: #NAIFAProud Press Release

1 min read

NAIFA's Gandy Featured at NAIC Fall Meeting

By NAIFA on 12/10/25 2:07 PM

NAIFA President-Elect Christopher Gandy spoke before the Senior Issues (B) Task Force during the National Association of Insurance Commissioners’ 2025 Fall National Meeting in Hollywood, Fla. Gandy discussed hybrid life insurance policies with long-term care, extended care, and critical care riders, providing his perspective as an agent to the Task Force. Gandy provided insight on what he’s seeing in the market and offered suggestions to regulators to ensure the products remain accessible and easily understandable to consumers.

Topics: Interstate Advocacy Press Release NAIC

1 min read

NAIFA Supports Bill That Would Offer Retirement Plan Rollover Clarity and Annuity Options

By NAIFA on 12/4/25 11:49 AM

NAIFA supports the bipartisan Retirement Simplification and Clarity Act reintroduced by Reps. Jimmy Panetta (D-Calif.) and Darin LaHood (R-Ill.), which would require the IRS to rewrite documentation that employers must provide exiting employees who request distributions from their 401(k) plans. The new notice would use “clear, straightforward language” to explain various options for 401(k) distributions and rollovers along with their tax implications. The bill would also allow people aged 50 and over to roll over employer-sponsored 401(k) accounts into annuities.

.png)

%20(1).png)

.png)