The Congressional Conference is NAIFA's signature grassroots event, bringing financial advisors from all 50 states to Washington, D.C., is scheduled for May 18-19. NAIFA members who sign up before March 3 receive a $50 discount off the registration fee, so don't delay.

1 min read

Get the Early Registration Rate for NAIFA's Congressional Conference

By NAIFA on 1/9/26 4:25 PM

Topics: Press Release Grassroots Congressional Conference

1 min read

NAIFA Joins Coalition Urging Phase-Out and Repeal of Tennessee’s Professional Privilege Tax

By NAIFA on 12/19/25 3:24 PM

NAIFA has joined a coalition of professional associations urging Tennessee policymakers to phase out and ultimately repeal the state’s Professional Privilege Tax (PPT). In a joint letter sent to Governor Bill Lee, the coalition called on state leaders to prioritize a phase-out of this outdated tax in the FY 2026–2027 budget, emphasizing that Tennessee should not fund government through a tax on the “privilege” of working. The PPT currently imposes a $400 annual tax on certain licensed professionals, including financial advisors, despite their significant contributions to the state’s economy .

Topics: Advocacy Press Release

1 min read

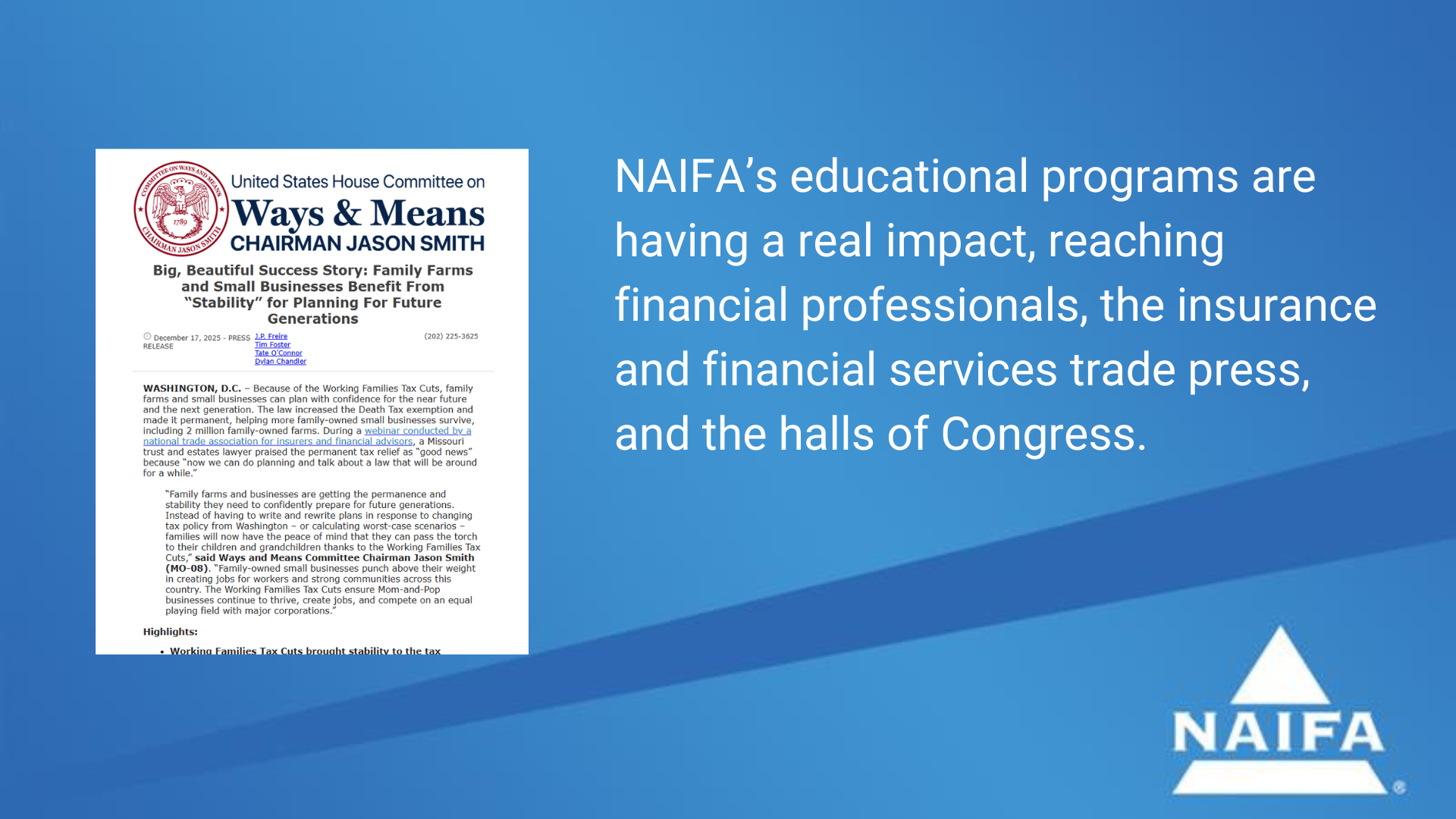

Ways & Means Spotlights NAIFA Webinar in Tax Law Press Release

By NAIFA on 12/19/25 9:45 AM

The House Ways & Means Committee issued a press release on tax reform measures for small businesses that highlights the recent NAIFA webinar, “The One Big Beautiful Bill: Several Big Beautiful(?) Tax Law Changes,” featuring Robert Kirkland, founding member of Kirkland Hochstetler law firm. The tax and spending bill known as the One Big Beautiful Bill (OBBB)” passed earlier this year stabilizes estate tax laws making legacy planning less challenging, Kirkland explained. InsuranceNewsNet magazine’s Advisor News also reported on the NAIFA webinar.

Topics: Estate Planning Webinar Press Release Congress Tax Reform

3 min read

The NAIFA-Supported INVEST Act Passes the House

By NAIFA on 12/11/25 3:30 PM

The bipartisan INVEST Act has passed the House of Representatives in a 302-123 vote. NAIFA supports the legislation to expand retirement-planning options for teachers, employees of nonprofit organizations, and others.

"NAIFA is pleased to see the House take bipartisan action to bolster the ability of more Americans to better prepare for retirement," said NAIFA CEO Kevin Mayeux, CAE. "The INVEST Act would give teachers, hospital workers, nonprofit employees, and others who have 403(b) plans access to expanded investment options, including annuity-linked products that provide guaranteed lifetime income. It would also take steps toward addressing elder financial exploitation and would remove unfair impediments that prevent expert investors who don't meet net-worth thresholds from taking advantage of some sophisticated investments."

Four sections of the bill are particularly noteworthy to financial professionals and their clients.

Topics: Retirement Planning Press Release Supported Legislation

2 min read

NAIFA Advocacy Leadership Earns National Recognition Once Again

By Kevin Mayeux on 12/11/25 3:06 PM

On behalf of the entire NAIFA family, I am proud to congratulate Diane Boyle, Senior Vice President of Government Relations, for being named a Top Lobbyist for 2025 by The Hill. This recognition is one of the most respected acknowledgments in the advocacy community and reflects the consistent excellence of Diane’s work and her contributions to advancing NAIFA's mission to promote financial security for all Americans.

Topics: #NAIFAProud Press Release

1 min read

NAIFA's Gandy Featured at NAIC Fall Meeting

By NAIFA on 12/10/25 2:07 PM

NAIFA President-Elect Christopher Gandy spoke before the Senior Issues (B) Task Force during the National Association of Insurance Commissioners’ 2025 Fall National Meeting in Hollywood, Fla. Gandy discussed hybrid life insurance policies with long-term care, extended care, and critical care riders, providing his perspective as an agent to the Task Force. Gandy provided insight on what he’s seeing in the market and offered suggestions to regulators to ensure the products remain accessible and easily understandable to consumers.

Topics: Interstate Advocacy Press Release NAIC

1 min read

NAIFA Supports Bill That Would Offer Retirement Plan Rollover Clarity and Annuity Options

By NAIFA on 12/4/25 11:49 AM

NAIFA supports the bipartisan Retirement Simplification and Clarity Act reintroduced by Reps. Jimmy Panetta (D-Calif.) and Darin LaHood (R-Ill.), which would require the IRS to rewrite documentation that employers must provide exiting employees who request distributions from their 401(k) plans. The new notice would use “clear, straightforward language” to explain various options for 401(k) distributions and rollovers along with their tax implications. The bill would also allow people aged 50 and over to roll over employer-sponsored 401(k) accounts into annuities.

Topics: Press Release Retirement Plans Supported Legislation

1 min read

NAIFA-Supported Bill Would Expand Retirement Planning Options for Teachers and Employees of Non-Profits

By NAIFA on 12/3/25 4:16 PM

NAIFA CEO Kevin Mayeux, CAE, issued the following statement on the bipartisan INVEST Act:

Topics: Retirement Planning Press Release Supported Legislation

2 min read

NAIFA Celebrates Advocacy Win in Court Decision on Fiduciary-Only Rule

By NAIFA on 12/3/25 3:42 PM

The Department of Labor’s fiduciary-only rule will not go into effect. NAIFA has strongly opposed the misguided regulation, which would have restricted consumer choice and access to retirement advice. NAIFA was similarly instrumental in defeating an earlier version of the rule in 2016.

Topics: Legislation & Regulations Press Release DOL Fiduciary

2 min read

More states join calls for action on unfair trade practices in Medicare market

By NAIFA on 11/23/25 6:33 PM

Across the country, licensed financial professionals are stepping up on behalf of the seniors they serve and their efforts are making a difference. Following the regulatory alert issued by NAIFA, hundreds of advisors from all 50 states reached out to their state insurance regulators demanding action to curb carriers’ practices that undermine consumer choice and steer vulnerable Medicare beneficiaries into restricted or biased product lines.

%20(1).png)

.png)