An April 3 Department of Labor (DOL) Field Assistance Bulletin (FAB 2025-02) provides guidance on the annual funding notice requirements applicable to defined benefit (DB) plans. The Bulletin also provides updated model notices for single-employer and multiemployer DB pension plans.

NAIFA

Recent posts by NAIFA

1 min read

DOL Issues Guidance on Annual Funding Notice Requirements

By NAIFA on 4/15/25 8:12 AM

Topics: DOL

2 min read

CMS Proposes Rule Shortening ACA Open Enrollment, Modifying Premium Subsidies

By NAIFA on 4/15/25 8:09 AM

On March 10, the Centers for Medicare and Medicaid Services (CMS) issued a proposed new rule, CMS-9884-P/RIN 0938-AV61, that would, among other things, shorten the Affordable Care Act (ACA) enrollment period by a month and reduce ACA subsidies by $5/month until those claiming the subsidies confirm information about their income. Under the new rule, the enrollment period would end on December 15 rather than January 15.

Topics: Health Care

1 min read

Democrats Introduce Minimum Wage Hike Bill

By NAIFA on 4/15/25 8:07 AM

Key Democrats in the House and Senate have introduced legislation to phase in a federal minimum wage increase to $17/hour. The five-year phase-in would hike the federal minimum wage, which is currently $7.25/hour, to $17/hour by 2030. The bill would also index the minimum wage for inflation, and would phase out the subminimum wage for youth, tipped and disabled workers. It would be the first federal minimum wage increase since 2009.

Topics: Practice Management

2 min read

States Reacting to Potential Cuts to Medicaid, ACA Premium Subsidy Rollback

By NAIFA on 4/15/25 8:04 AM

As Congress grapples with whether and how to cut Medicaid and also whether to allow current ACA premium tax credit levels to revert to 2016 levels, States are looking at ways to fill the gap.

Topics: Health Care Medicaid

1 min read

Senate Confirms Atkins to Head SEC

By NAIFA on 4/15/25 8:00 AM

On April 9, the Senate confirmed Paul Atkins to lead the Securities and Exchange Commission (SEC). The vote was 52 to 44.

Topics: SEC

1 min read

Sonderling Confirmed as Number Two at DOL

By NAIFA on 4/15/25 7:57 AM

On March 12, the Senate confirmed Keith Sonderling as deputy secretary of labor, the number two job at the Department of Labor (DOL). The vote was 53 to 46.

Topics: DOL

1 min read

Senate Confirms Dr. Oz as Head CMS

By NAIFA on 4/15/25 7:55 AM

On April 3, the Senate confirmed President Trump’s nominee to head the Centers for Medicare and Medicaid Services (CMS), Dr. Mehmet Oz. The party-line vote was 53 to 45.

Topics: Medicaid Medicare

2 min read

NAIFA’s Roger Moore Attends NAIC Spring National Meeting

By NAIFA on 4/15/25 7:52 AM

NAIFA’s Policy Director Roger Moore attended NAIC’s Spring 2025 National Meeting on March 23-26, where he had the opportunity to strengthen NAIFA’s relationships with state regulators and industry trade partners as well as advocate for key priorities affecting NAIFA’s members. Before regulators convened for the meeting, they announced their 2025 federal legislative and regulatory priorities, which include 1) preserving and respecting states’ primary role as insurance regulators by eliminating the Federal Insurance Office (FIO); 2) ensuring natural catastrophe resilience; 3) promoting and preserving state flexibility to manage their health insurance markets; 4) providing consistent funding for crucial programs; and 5) producing guidance for key issues, including Section 1557 nondiscrimination rules, copay accumulator rules, and mental health parity grants.

Topics: Interstate Advocacy NAIC

2 min read

Congress Funds the Government Through September 30, 2025

By NAIFA on 3/17/25 1:43 PM

On March 14, Congress enacted a continuing resolution (CR) to fund the government’s discretionary spending through September 30, 2025, the end of the current fiscal year.

Enactment of the law prevented a government shut-down that, absent this measure, would have kicked in at midnight March 15.

Topics: Congress

2 min read

Congress Moves Forward on Massive Budget Bill

By NAIFA on 3/17/25 1:39 PM

The House and Senate have passed different Congressional Budget Resolutions (CBRs). Now, the two chambers must reconcile the differences to pass identical CBRs to unlock the budget process (reconciliation) that could bring deep mandatory and discretionary spending cuts, a huge tax package, and possibly an increase in the debt limit.

Topics: Federal Advocacy Congress

1 min read

NAIFA Calls for Extension of Tax Rules Important to Small Business

By NAIFA on 3/17/25 1:34 PM

NAIFA, in conjunction with a coalition of pass-through business employers, has weighed in with Congressional leadership on the importance of extending expiring tax rules important to pass-through (S corps, partnership, sole proprietorship) businesses.

On February 24, the Main Street Employers Coalition sent a letter to Speaker of the House Rep. Mike Johnson (R-LA) and Democratic Leader Rep. Hakeem Jeffries (D-NY) urging Congress “to act quickly to prevent a massive tax hike on Main Street businesses.”

Topics: Small Business

2 min read

BOI Enforcement Back on Track

By NAIFA on 3/17/25 1:30 PM

The Financial Crimes Enforcement Network (FinCEN) announced that it is again going to enforce the beneficial ownership interest (BOI) rule that was enacted as part of the Corporate Transparency Act (CTA). But, FinCEN said on February 27 that it will not impose fines or penalties until after it finalizes new reporting rules that would narrow the BOI reporting rule to foreign reporting companies. The new reporting deadline is March 21, 2025.

Topics: Legislation & Regulations Federal Advocacy

1 min read

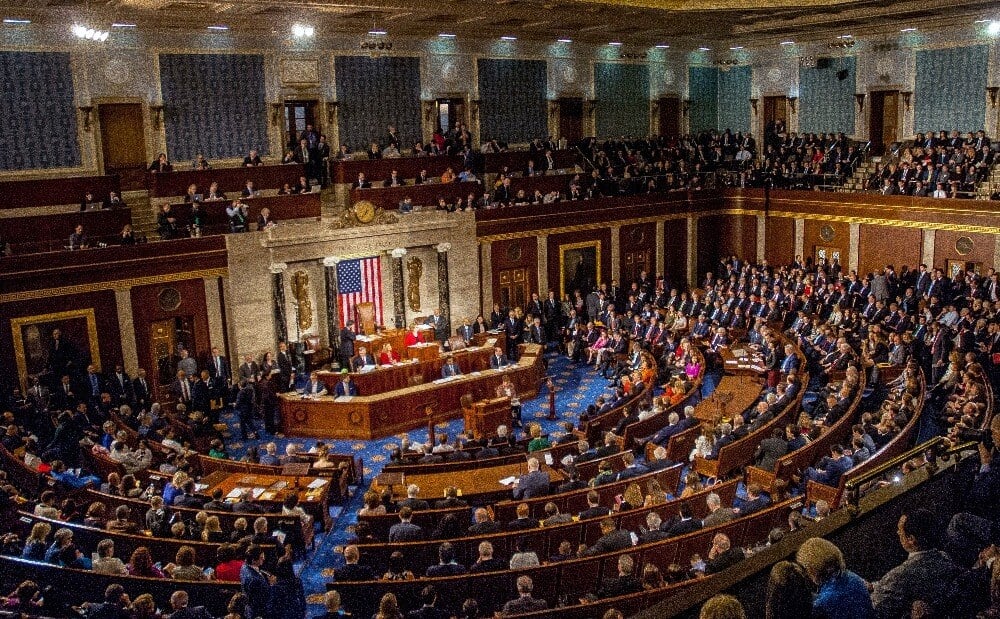

Trump Calls for Tax Cuts in Address to Joint Session of Congress

By NAIFA on 3/17/25 1:23 PM

President Trump’s March 4 address to a joint session of Congress included a call for tax cuts along with most of his other campaign promises and priorities. The speech (technically not a State of the Union speech due to its occurrence at the beginning of his term) was well-received by President Trump’s GOP base, but characterized as divisive by those who do not support him.

Topics: Tax Reform

1 min read

HHS Secretary Limits Comments on Proposed Regulations

By NAIFA on 3/17/25 1:21 PM

On February 28, Department of Health and Human Services (HHS) Secretary Robert F. Kennedy Jr. announced the agency will no longer accept public comments on many of its rulemaking initiatives. This could impact rules important to NAIFA members, such as many Affordable Care Act (ACA) rules, including compensation for advisors on ACA insurance purchases.

Topics: Federal Advocacy

1 min read

Trump Orders Reordering of Federal Bureaucracy

By NAIFA on 3/17/25 1:15 PM

Staffing cuts, federal agency and program relocation, and contract review (and potential cancellation) have started across the federal government. In conjunction with the Administration's “Department of Government Efficiency” (DOGE) (it is not a formal Cabinet department as it has not been established by law), all federal agencies have been ordered to put together a plan to reduce the federal workforce (starting with last month’s termination of thousands of probationary employees) by mid-March. The agencies must also draw up plans, by mid-April, to move agencies and programs out of Washington, DC to less expensive parts of the country. Agencies are also reviewing contracts they have with private sector service providers, with an eye to cancelling those that are not required by law or are otherwise not “mission critical.”

Topics: Federal Advocacy

1 min read

House, Senate Democrats Introduce Social Security Expansion Bill

By NAIFA on 3/17/25 1:09 PM

On Feb. 27, House and Senate Democrats introduced the Social Security Expansion Act, a bill that would increase Social Security (SS) benefits by $2,400/year, fully fund the program for 75 years, and apply the SS payroll tax to all income above $250,000/year.

Topics: Social Security

1 min read

Lawmakers Introduce Bicameral Bipartisan Bill to Extend ABLE Account Tax Rules

By NAIFA on 3/17/25 1:02 PM

On Feb. 19, bipartisan bicameral legislation was introduced that would make permanent several provisions of tax-favored ABLE accounts. The bill’s sponsors say that ABLE accounts help people with disabilities save for their future and ease the burden on those who support them.

Topics: Financial Planning

1 min read

NLRB Acting GC Rescinds Memos on Non-Compete Agreements

By NAIFA on 3/17/25 12:54 PM

On Feb. 14, the National Labor Relations Board’s (NLRB’s) Acting General Counsel, William Cowen, rescinded two general counsel (GC) memos opining that virtually all non-compete and stay-or-pay agreements would violate the National Labor Relations Act (NLRA). This action does not resolve all the non-compete agreement issues currently in play, but it does signal a shift in NLRB thinking on the issues.

Topics: National Labor Relations Board

1 min read

House Education & the Workforce Committee Examines Over-Regulation

By NAIFA on 3/17/25 11:59 AM

On Feb. 26, the House Education & the Workforce Committee held a hearing focused on over-regulation of business. Titled “Unleashing America’s Workforce and Strengthening Our Economy,” the hearing focused on the adverse impact of a slew of recent regulations, including overtime pay (the white-collar exemption) and worker classification.

Topics: Legislation & Regulations

1 min read

Senate HELP Grills Sonderling During His Confirmation Hearing

By NAIFA on 3/17/25 11:56 AM

Senators closely questioned Department of Labor (DOL) Deputy Secretary nominee Keith Sonderling during his February 27 confirmation hearing before the Senate’s Health, Education, Labor and Pensions (HELP) Committee. Sonderling has been nominated to serve in the number 2 spot at DOL. He vowed to undertake a wholesale review of every DOL enforcement division, and to make sure that DOL has the resources it needs to carry out its mission.

.jpg)

.png?width=600&height=90&name=Support%20IFAPAC%20%20(600%20%C3%97%2090%20px).png)