The House passed its version of the $6 trillion+ reconciliation bill (including a $3.8 trillion tax title), but we are still a long way from final action. Changes are expected in the Senate, and then more changes are likely as the House and Senate try to reconcile their two versions of the bill. Details are below. But first: a quick report on a highly successful NAIFA Congressional Conference last week.

9 min read

NAIFA Breaks Down the House Tax and Budget Bill

By NAIFA on 5/29/25 11:42 AM

Topics: Legislation & Regulations Taxes Federal Deficit

1 min read

NAIFA supports House budget reconciliation bill as ‘critical step forward’

By NAIFA on 5/21/25 5:01 PM

NAIFA endorses the House budget reconciliation bill for its provisions that assist families and businesses. Ensuring the long-term stability of favorable tax policies will give families and small businesses the predictability essential for smart financial planning, empowering them to make well-informed choices, invest wisely, and strengthen their financial futures.

Topics: Advocacy Taxes

2 min read

House Tax Title Includes NAIFA-Supported Provisions to Benefit Families and Businesses

By Kevin Mayeux on 5/12/25 5:24 PM

NAIFA is pleased the House Ways and Means Budget Reconciliation Title recognizes the need for American families and businesses to plan for their financial futures with access to knowledgeable professionals, affordable insurance products, and certainty in policy.

A stable tax system that continues to encourage Americans to plan and save for their future is more important than ever. Families are able to protect themselves through the current tax treatment of cash value life insurance, incentives to participate in individual and employer-sponsored retirement plans, savings vehicles for education and emergencies, paid leave, long-term care insurance, and disability insurance, and employer-provided health insurance. These measures reflect sound tax policy, established over decades, that gives Americans of all backgrounds the opportunity to attain a secure financial future.

NAIFA applauds the measure to permanently extend and increase the Section 199A deduction, which many of our members utilize to provide products and services that millions of Americans rely on to improve their financial security. The Section 199A deduction allows small- and medium-sized businesses, which are the backbone of the American economy, to remain competitive and to retain parity in corporate and passthrough income taxation. In addition:

Topics: Taxes Press Release Supported Legislation NAIFA CEO Executive Summary

2 min read

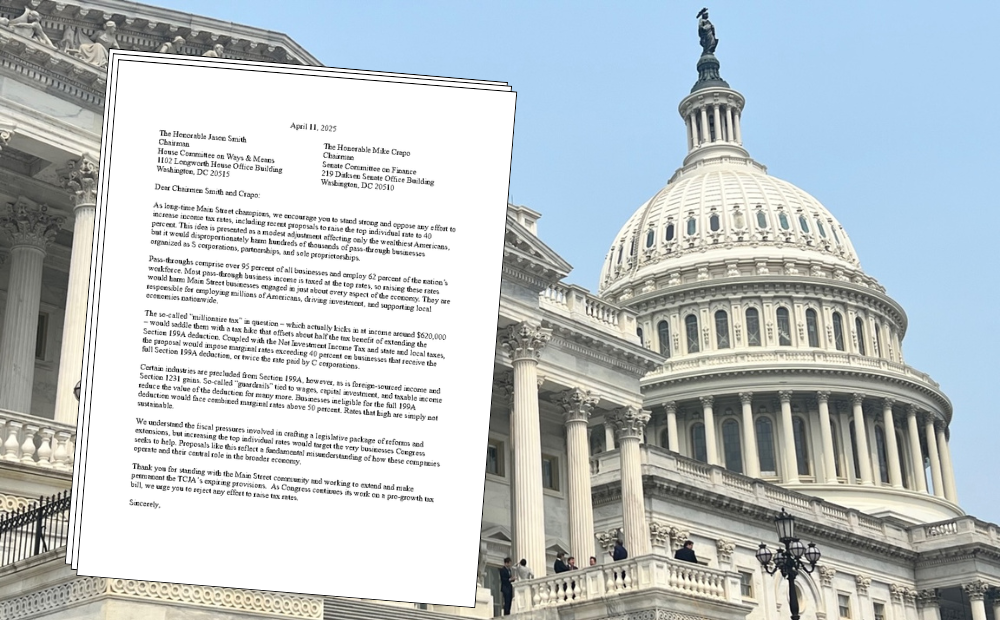

NAIFA Urges Congress to Protect Main Street Businesses From Harmful Tax Proposal

By NAIFA on 4/11/25 11:04 AM

Recent news reports indicate that some congressional Republicans may be amenable to a so-called "millionaire tax" that would raise the highest federal individual income tax rate to around 40%. NAIFA opposes this proposal due to the harm it would likely cause hundreds of thousands of pass-through corporations. Many owners of these small, often Main Street, businesses organized as S corporations, partnerships, and sole proprietorships would face large tax increases.

Topics: Small Business Taxes Congress

2 min read

Promoting Insurance and Financial Products Is Good Policy

By NAIFA on 4/2/25 11:13 AM

Congress is looking to extend expiring provisions of the Tax Cuts and Jobs Act – which include reduced individual tax rates and a 20% deduction of qualified pass-through income for sole proprietorships, partnerships, and S-corporations – while at the same time creating new tax cuts President Donald Trump promised during his campaign. The Congressional Budget Office projects that extending the TCJA alone will cost around $4.6 trillion over 10 years. Lawmakers and the administration are looking to cover the cost by finding new sources of revenue and government spending cuts. We would be naïve to think the insurance and financial services industry will escape scrutiny.

Members of Congress need to understand that the products and services provided by insurance and financial professionals are part of the solution. Tax laws and other policies that encourage Americans to take control of their own financial well-being, plan for retirement, and mitigate life’s inevitable risks strengthen the economy and can reduce government spending. Insurance products and services also improve Americans’ quality of life by providing financial security and reducing financial worries. The results of two surveys, one by LIMRA and Life Happens and the other by ACLI, illustrate the points.

Topics: Life Insurance & Annuities Legislation & Regulations Taxes Federal Advocacy

1 min read

NAIFA Video: The State of the Tax Bill

By NAIFA on 3/14/25 4:31 PM

Washington insiders and NAIFA consultants Danea Kehoe and Pat Raffaniello have recorded a new video outlining the congressional process of funding the federal government and providing an update on the state of federal tax legislation.

Topics: Legislation & Regulations Taxes Congress

1 min read

NAIFA Seeks Tax Law to Support Main Street Employers

By NAIFA on 2/28/25 3:43 PM

Prior to passage of the House budget resolution, NAIFA joined a letter from a coalition of Main Street Employers to Speaker of the House Mike Johnson and House Minority Leader Hakeem Jeffries urging passage of the resolution to protect S corporations from untenable tax increases. The resolution was passed on February 26 and has been sent to the Senate, which has been working on a separate budget resolution.

Topics: Small Business Taxes Supported Legislation

2 min read

NAIFA Seeks Middle Ground on STDLI Health Policies

By NAIFA on 9/12/23 5:25 PM

Short-term limited duration insurance (STLDI) is very important to many American families and individuals looking to fill gaps in their health insurance coverage and unable to access the individual health insurance marketplace. A current proposal by the administration would reduce the maximum allowable STLDI coverage period from 12 months to three months with a possible one-month renewal. People would be able to purchase a new STLDI policy from a different carrier, but would not be allowed to "stack" a new policy from the same carrier on an expiring policy.

Topics: Health Care Legislation & Regulations Taxes DOL Insurance & Financial Advisor Regulation

1 min read

NAIFA Supports Tax Certainty for Main Street

By NAIFA on 5/18/23 4:40 PM

An important tax deduction for many individual- and family-owned businesses – Section 199A of the Tax Cuts and Jobs Act – is set to expire in just two years. NAIFA strongly supports legislation sponsored by Senator Steve Daines (R-MT) that would make permanent the 20% deduction for pass-through businesses.

.png)