NAIFA Director of Government Relations Mike Hedge recently spoke with David Duford of Duford Insurance Group about the potential implications of the PRO Act for insurance and financial professionals. Hedge discusses how the PRO Act could disrupt the business relationships between producers and companies and harm the ability of agents and advisors to serve consumers. He also talks about the work NAIFA is doing to head off provisions of the PRO Act that would “revolutionize the industry for the wrong reasons.” The interview is featured on Duford’s popular YouTube channel.

1 min read

NAIFA's Hedge Explains Potential Impacts of the PRO Act

By NAIFA on 3/18/21 8:45 AM

Topics: Federal Advocacy PRO Act Congress Insurance & Financial Advisor Regulation Producer Employment

2 min read

Idaho Enacts Enhanced Protections for Annuity Consumers

By Julie Harrison on 3/17/21 2:15 PM

Idaho Governor Brad Little has signed a NAIFA-promoted best interest bill into law. The bill, HR 79, is based on the National Association of Insurance Commissioners (NAIC) Suitability in Annuity Transaction Model Regulation.

Topics: State Advocacy Standard of Care & Consumer Protection Grassroots Annuity Best Interest Idaho Insurance & Financial Advisor Regulation

1 min read

NAIFA-MT Promotes Favorable Auto Insurance Ratemaking Bill

By Julie Harrison on 3/17/21 1:58 PM

The Montana State Legislature is considering a bill that would end the state’s practice of treating all people, regardless of gender, the same by insurance companies when setting rates and product offerings.

Topics: State Advocacy Grassroots Montana Underwriting & Risk Classification

1 min read

NAIFA-MN Testifies Against Problematic Paid Family Medical Leave Bill

By Julie Harrison on 3/15/21 2:45 PM

NAIFA-MN opposes a bill that would create a state-wide paid and family medical leave insurance program in Minnesota, HF 1200, which is under consideration in the state House.

Topics: State Advocacy Grassroots Minnesota Paid Family Medical Leave

1 min read

NAIFA-ME Connects Producers and Lawmakers at Virtual Legislative Breakfast

By NAIFA on 3/12/21 9:12 AM

NAIFA-Maine’s virtual Legislative Breakfast on March 9 featured video conference meetings connecting NAIFA members with state lawmakers whose policy decision impact the businesses of insurance and financial professionals as well as the consumers they serve. Legislators in attendance included:

Topics: State Advocacy Grassroots Legislative Day Maine

1 min read

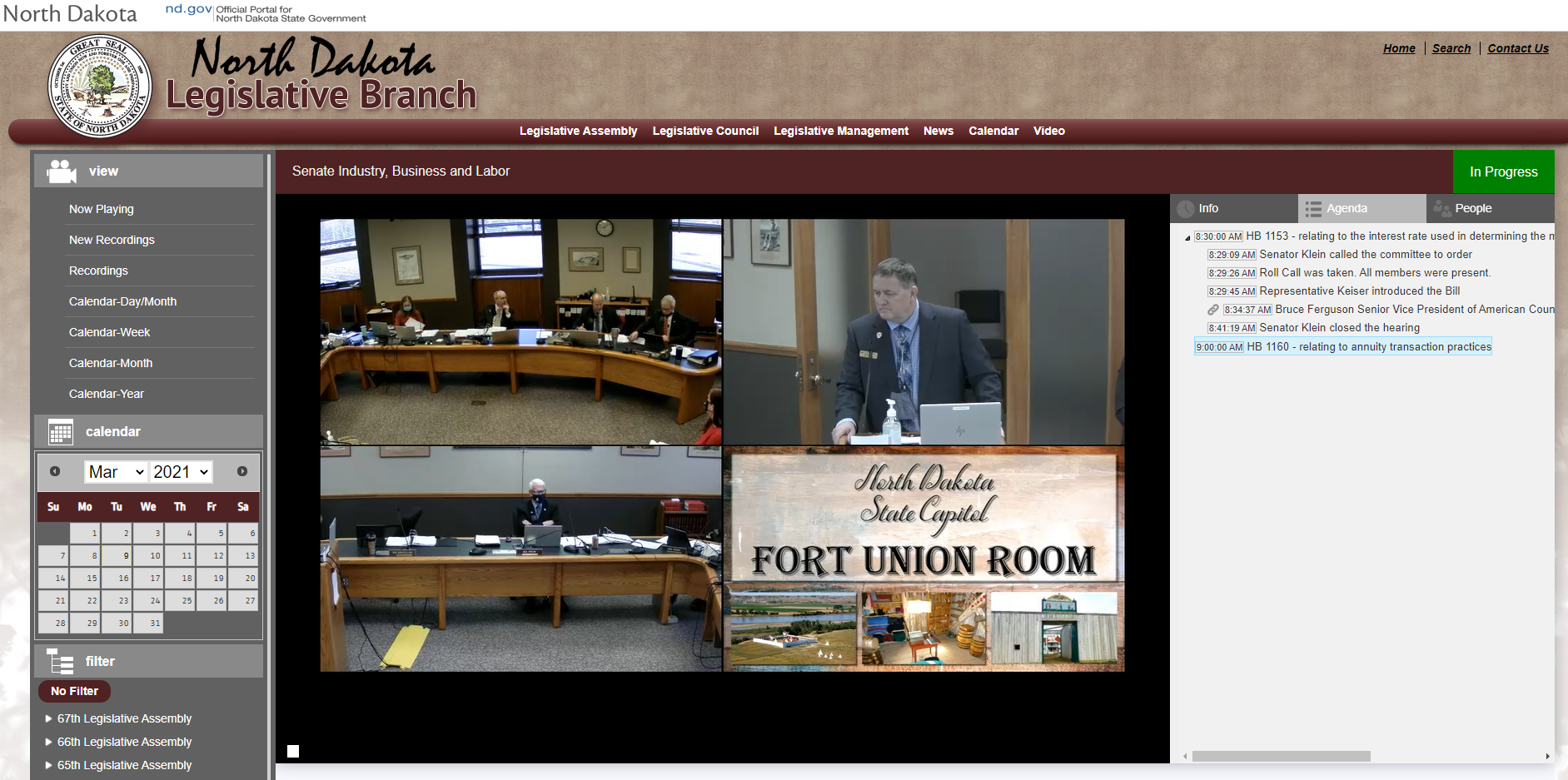

NAIFA-ND Tells Lawmakers Their Clients Come First

By Julie Harrison on 3/9/21 3:35 PM

NAIFA-ND President Lyle Kraft testified at the State Senate Industry, Business and Labor Committee on March 9, on the importance of passing an important new best interest standard.

Topics: State Advocacy Standard of Care & Consumer Protection Grassroots Annuity Best Interest North Dakota Insurance & Financial Advisor Regulation

2 min read

As the House Passes the PRO Act, NAIFA Continues to Work for Changes

By NAIFA on 3/9/21 1:52 PM

The House of Representatives passed the Protecting the Right to Organize (PRO) Act (H.R. 842), a sweeping piece of labor legislation. Among its provisions, the PRO Act as passed by the House would reclassify many insurance and financial professionals as “employees” rather than “independent contractors” under federal labor law. NAIFA argues that such a reclassification will disrupt insurance and financial services business models and limit consumer access to diverse offerings of products, services, and advice.

Topics: Federal Advocacy PRO Act Congress Insurance & Financial Advisor Regulation Producer Employment

1 min read

NAIFA CEO Kevin Mayeux Signs Letter Seeking PRO Act Changes

By NAIFA on 3/4/21 4:12 PM

NAIFA CEO Kevin Mayeux and the CEOs of 13 other insurance and financial services trade associations sent a letter to House Speaker Nancy Pelosi and Minority Leader Kevin McCarthy urging Congress to address concerns with the Protecting the Right to Organize (PRO) Act (H.R. 842).

Topics: Federal Advocacy PRO Act Congress Insurance & Financial Advisor Regulation Producer Employment

1 min read

NAIFA-TX Holds Successful Virtual Day at the Capitol Advocacy Event

By NAIFA on 3/3/21 5:02 PM

NAIFA’s Texas chapter (NAIFA-TX) held a successful legislative event last week, with several dozen participants. The annual Day at the Capitol was planned as a hybrid event, with both in-person and virtual attendees. However, the lingering effects of recent winter storms required NAIFA-TX to quickly shift to an all-virtual event.

Topics: State Advocacy Grassroots Legislative Day Texas

1 min read

NAIFA-Wisconsin to Hold Virtual Day on the Hill Political Advocacy Programs

By NAIFA on 3/3/21 4:13 PM

The Wisconsin chapter of the National Association of Insurance and Financial Advisors (NAIFA-WI) will present its annual Day on the Hill advocacy programming March 8 and 10. The virtual event will highlight the importance of political advocacy for insurance financial advisors. Decisions by state lawmakers and regulators have tremendous impacts on the businesses of NAIFA members as well as the Main Street consumers and small businesses they serve.