NAIFA encourages all insurance and financial professionals to vote in local, state, and federal elections and to encourage others to follow their example. Approximately 63 million Americans who are eligible are not even registered to vote. Encouraging your colleagues, team, and clients to register is a great first step and a way to show your dedication to participating in the democratic process.

1 min read

Connect With Clients While You Help NAIFA Get Out the Vote

By NAIFA on 9/8/23 2:45 PM

Topics: Advocacy Get Out the Vote

1 min read

NAIFA-CT Advocates for Main Street Americans in Hartford

By NAIFA on 6/27/23 5:22 PM

NAIFA is the only association for insurance and financial professionals with a strong political advocacy presence in Washington, D.C., and every state capital.

Last month, NAIFA members in Connecticut amplified NAIFA's advocacy message in Hartford. NAIFA-Connecticut's Legislative Day created great momentum heading into the Congressional Conference, May 22-23, in Washington, D.C.

Topics: Advocacy Connecticut Legislative Day

1 min read

House Passes Bill to Lower Administrative Burdens on Small Businesses

By Mike Hedge on 6/26/23 3:31 PM

On June 22, The United States House of Representatives passed the NAIFA-supported Employer Reporting Improvement Act (H.R. 3801), which provides employers flexibility about what personal information they have to provide on behalf of their employees and their families. Additionally, it extends the appeal window for any potential violation and establishes a statute of limitations so small businesses operating with limited resources can continue their work with less of a burden.

Topics: Advocacy Legislation & Regulations Supported Legislation

2 min read

NAIFA-NC Adds 10 New IFAPAC Contributors

By NAIFA on 4/21/23 8:58 AM

Last month, NAIFA-NC signed up 10 new contributors to NAIFA's political action committee, IFAPAC, in one day. Congratulations to these individuals who joined the ranks of NAIFA members working together to advocate for the individuals, families, and small businesses that make up Main Street USA, and a special thank you to NAIFA-NC IFAPAC Chair Elie Aharon, LACP, LUTCF.

Topics: Advocacy IFAPAC

1 min read

NAIFA-CO Meets With Lawmakers in Denver to Advocate for Main Street USA

By NAIFA on 2/16/23 10:02 AM

NAIFA-CO leaders and members came together February 15 to meet with lawmakers on the chapter's annual Legislative Day. Members shared their insights with legislators and officials, including Securities Commissioner Tung Chan and Insurance Commissioner Michael Conway. Central among the topics discussed was HB23-1174, which would create guaranteed replacement cost coverage in homeowner's insurance, and its implications for Coloradoans.

Topics: Advocacy Legislation & Regulations State Advocacy Legislative Day

1 min read

NAIFA Asks IRS to Make the Temporary Remote Notarization Rule Permanent

By Michael Hedge, NAIFA's Director of Government Relations on 12/7/22 2:50 PM

On November 30, 2022, NAIFA joined with the U.S. Chamber of Commerce and other industry partners in a letter asking the Internal Revenue Service (IRS) to make permanent the temporary relief from the physical presence requirement for spousal consent that the IRS has provided. As reflected in the attached letter, plans have been using this relief for nearly two years, and NAIFA believes that its use and effectiveness warrant that it be made permanent. If the IRS feels it cannot make this relief permanent before it expires after December 31, 2022, NAIFA urged the IRS to provide at least an additional 12-month extension while the IRS either provides permanent relief on its own or through notice and comment. By doing so, the IRS will avoid disrupting a valued tool many have come to rely on.

Topics: Advocacy Legislation & Regulations Federal Advocacy IRS

1 min read

NAIFA Advises NLRB on Proposed Joint-Employer Rule

By Michael Hedge, NAIFA's Director of Government Relations on 12/7/22 1:45 PM

On December 5, 2022, NAIFA filed comments on the National Labor Relations Board’s (NLRB) proposed rule that would expand the joint-employer definition under the National Labor Relations Act. The rule would extend liability to employers that have indirect and reserved control over one or more employees’ essential terms and conditions of employment.

Topics: Advocacy Legislation & Regulations Federal Advocacy Opposed Legislation

3 min read

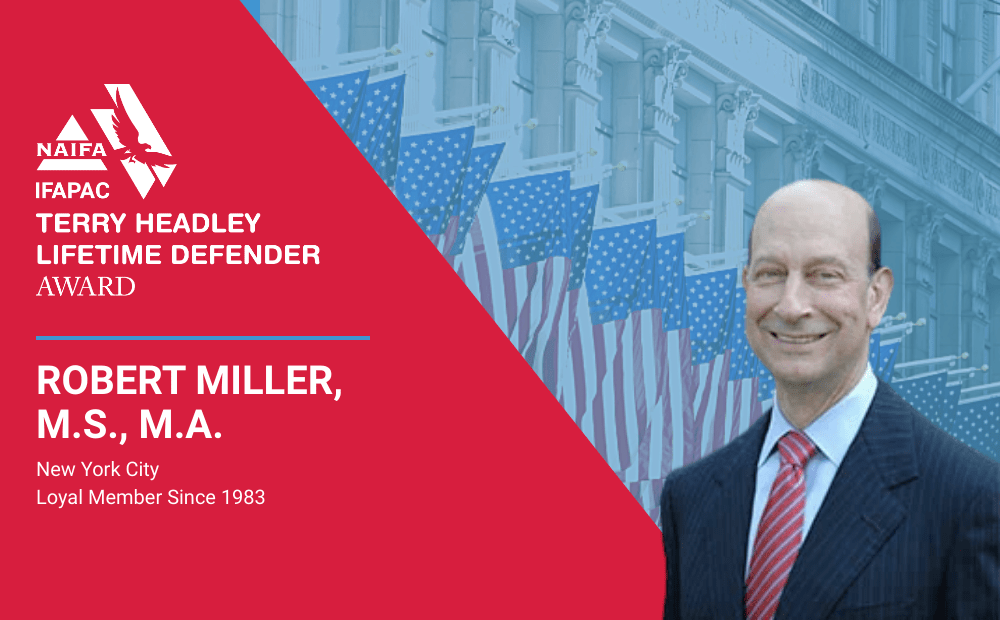

Robert A. Miller to Receive NAIFA’s Terry Headley Lifetime Defender Award

By NAIFA on 10/18/22 10:00 AM

NAIFA is proud to announce that Robert A. Miller, M.S., M.A., Partner at Miller-Pomerantz Insurance and Financial Services in New York City, is the recipient of NAIFA’s Terry Headley Lifetime Defender Award.

Miller, a loyal member since 1983, was NAIFA’s national President for the 2011-2012 term. He had previously served as President of the NAIFA-New York state chapter and NAIFA-New York City. He was elected to the NAIFA Board of Trustees in 2005 and has served as trustee liaison to the CEO Outreach Program, the Young Advisor Team, and the Corporate Partnerships Program. He also served as chair of the NAIFA Governance Committee and was a member of the NAIFA Finance Committee.

Topics: Advocacy Awards Press Release IFAPAC

1 min read

NAIFA Partners With BIPAC to Support Employee Voter Registration Week

By NAIFA on 9/27/22 5:32 PM

NAIFA is excited to partner with BIPAC to support Employee Voter Registration Week.