NAIFA's New Jersey chapter (NAIFA-NJ) has been hard at work on the advocacy front and has recent wins to show for its efforts.

2 min read

NAIFA-NJ Celebrates Legislative Victories

By Bianca Alonso Weiss on 1/27/22 9:19 AM

Topics: State Advocacy Standard of Care & Consumer Protection New Jersey Grassroots Insurance & Financial Advisor Regulation Fiduciary

2 min read

Broker Compensation Disclosure Requirements

By Michael Hedge, NAIFA's Director of Government Relations on 12/27/21 4:39 PM

Beginning on December 27, 2021, brokers and consultants will be held to new compensation transparency obligations under the Consolidated Appropriations Act (CAA). The CAA is a spending and coronavirus relief package that was signed into law on December 27, 2020 and expands ERISA’s existing disclosure requirements. It broadened the definition of a “covered plan” to include group health plans (previously it only included retirement plans).

Topics: Federal Advocacy Compensation Regulation DOL Insurance & Financial Advisor Regulation

2 min read

FINRA Includes NAIFA Recommendations in New Maintaining Qualifications Program

By NAIFA on 11/29/21 9:45 AM

NAIFA Senior Vice President for Government Relations Diane Boyle on June 22 submitted comments to FINRA in response to Regulatory Notice 21-17, Supporting Diversity & Inclusion in the Broker-Dealer Industry. Among several recommendations, NAIFA requested the U5 filing time limit be extended from two years to five years. Given the subject matter difficulty and extensive time commitment to earning FINRA Series Registrations, the extension would allow for a broader group of advisors to maintain their credentials despite taking leaves from the industry.

Topics: Diversity Federal Advocacy FINRA Insurance & Financial Advisor Regulation Producer Licensing & CE

1 min read

New Rule in Mississippi Offers Stronger Protections to Annuity Consumers

By American Council of Life Insurers on 11/23/21 6:01 PM

American Council of Life Insurers (ACLI) President and CEO Susan Neely and George B. Pickett, J.D. CLU, AEP, LACP, of the NAIFA Government Relations Committee, issued the following joint statement on the best interest annuity rule adopted recently by the Mississippi Insurance Department:

“Retirement savers seeking lifetime income from annuities should work with financial professionals who act in consumers’ best interest. The rule adopted by the Mississippi Insurance Department makes certain that they will.

Topics: State Advocacy Standard of Care & Consumer Protection Annuity Best Interest Mississippi Insurance & Financial Advisor Regulation

2 min read

New Rule Enhances Protections for Kentucky Annuity Consumers

By American Council of Life Insurers on 11/17/21 4:14 PM

American Council of Life Insurers (ACLI) President and CEO Susan Neely, National Association of Insurance and Financial Advisors (NAIFA) CEO Kevin Mayeux and NAIFA-Kentucky Immediate Past President Brian Wilson issued the following joint statement on the annuity best interest rule recently adopted by the Kentucky Department of Insurance:

Topics: State Advocacy Standard of Care & Consumer Protection Annuity Best Interest Kentucky Insurance & Financial Advisor Regulation

1 min read

SEC Chair Gensler Says He Is Committed to Reg BI

By NAIFA on 10/11/21 9:18 AM

NAIFA strongly supports the Securities and Exchange Commission’s (SEC's) Regulation Best Interest (REG BI) to protect investors and preserve the ability of financial advisors to serve the needs of Main Street USA consumers. The rule is in harmony with the National Association of Insurance Commissioners’ (NAIC's) revised Annuity Suitability Model, which requires producers to work in the best interests of consumers during annuity transactions, providing enhanced investor protections at the federal and state levels and discouraging a mishmash of confusing and potentially contradictory laws and regulations.

Topics: Standard of Care & Consumer Protection SEC Federal Advocacy Insurance & Financial Advisor Regulation Regulation Best Interest

2 min read

NAIFA Article on NAIC Model Featured in NCOIL Publication

By NAIFA on 10/5/21 3:25 PM

The monthly newsletter of the National Council of Insurance Legislators (NCOIL) features a front-page article contributed by NAIFA State Chapters Director Julie Harrison on the best interest standard incorporated into the National Association of Insurance Commissioners (NAIC) Suitability in Annuity Transaction Model Regulation.

Topics: Standard of Care & Consumer Protection Interstate Advocacy Annuity Best Interest Insurance & Financial Advisor Regulation NAIC NCOIL

1 min read

CMS Plan Year 2022 Registration and Training is Live for Returning Agents and Brokers

By NAIFA Government Relations Team on 8/30/21 5:24 PM

Today, the Centers for Medicare and Medicaid Services (CMS) announced that registration and training for Plan Year 2022 is now available for returning agents/brokers who completed training and registration for Plan Year 2021. Registration and full training for new agents and brokers will be made available later this year.

Topics: Federal Advocacy CMS Insurance & Financial Advisor Regulation Producer Sales & Marketing

Take the 2021 NAIFA Workforce Survey

By NAIFA on 8/29/21 10:15 PM

NAIFA members are our association's advocacy strength. We are influential with lawmakers at state and federal levels because we have members from every congressional district in the United States who serve Main Street Americans. Policymakers want to hear NAIFA members' stories and respect our expertise because we represent the communities, families, and small businesses important to elected officials.

Topics: Federal Advocacy Insurance & Financial Advisor Regulation Producer Employment

1 min read

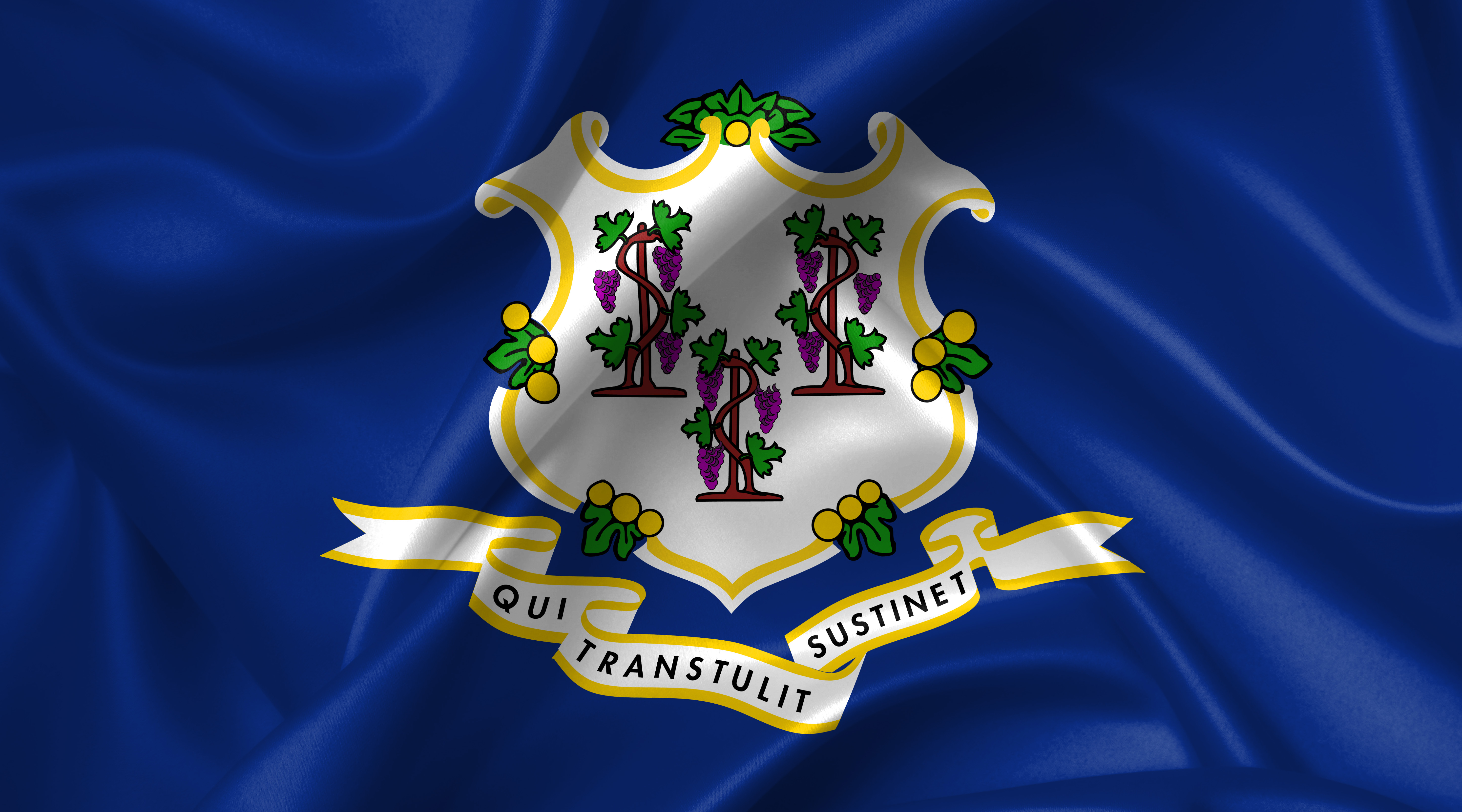

Connecticut Is the 16th State to Adopt the NAIC's Best Interest Model

By NAIFA on 8/18/21 4:46 PM

Connecticut has become the 16th state to adopt consumer-protection regulations or legislation based on the National Association of Insurance Commissioners’ (NAIC’s) Suitability in Annuity Transactions Model. The NAIC model requires financial professionals to work in the best interests of their clients during annuities transactions and aligns with the federal Securities and Exchange Commission’s Regulation Best Interest. It also preserves the ability of consumers to work with agents and advisors offering a variety of successful business models and avoids restrictions that would likely make it impossible for financial professionals to work with Main Street investors and retirement savers.