NAIFA, alongside a coalition of industry partners, submitted a follow-up letter to the National Association of Insurance Commissioners (NAIC) expressing appreciation for the NAIC’s consideration of our prior comments and support for the continued refinement of the Annuity Best Interest guidance.

1 min read

NAIFA Supports NAIC’s Updated Annuity Best Interest Draft

By NAIFA on 10/24/25 1:57 PM

Topics: Press Release Annuity Best Interest

1 min read

NAIFA Calls for National Action on Unfair Trade Practices in Medicare Insurance Markets

By NAIFA on 10/20/25 3:31 PM

NAIFA President Doug Massey has called on state insurance regulators to take decisive action to protect consumers and insurance professionals from unfair trade practices in the Medicare marketplace. In a letter submitted to the National Association of Insurance Commissioners (NAIC), Massey praised Idaho Department of Insurance Director Dean Cameron for his leadership in issuing Bulletin No. 25-06, which condemns carrier practices that restrict consumer access and manipulate compensation structures for agents serving Medicare beneficiaries.

Topics: Medicare Press Release

1 min read

California Eliminates Pre-Licensing Education Requirement for Insurance Producers

By NAIFA on 10/17/25 10:52 AM

Governor Gavin Newsom has signed AB 943 (sponsored by Assembly member Rodriguez) into law, making California the latest state to eliminate its insurance producer pre-licensing education requirement, a major win for the industry and aspiring professionals.

Topics: Advocacy Press Release

1 min read

Government Shutdown Complicates Federal Flood Insurance Program

By NAIFA on 10/5/25 9:21 AM

The federal government shutdown has created a great deal of confusion about the federal flood insurance program among insurance professionals and their clients who are homeowners or are in the process of purchasing homes. Advisors may face questions from frustrated clients, and not all of the answers are clear at this point. Policies issued under the federal program remain in force during the shutdown, but the processing and payment of claims may be delayed, according to media reports. Pending applications and renewals are frozen until the government funding impasse ends. Flood insurance requirements for federally backed loans are suspended during the shutdown, according to FEMA and banking regulators.

Topics: Property & Casualty Insurance Press Release Federal Advocacy

1 min read

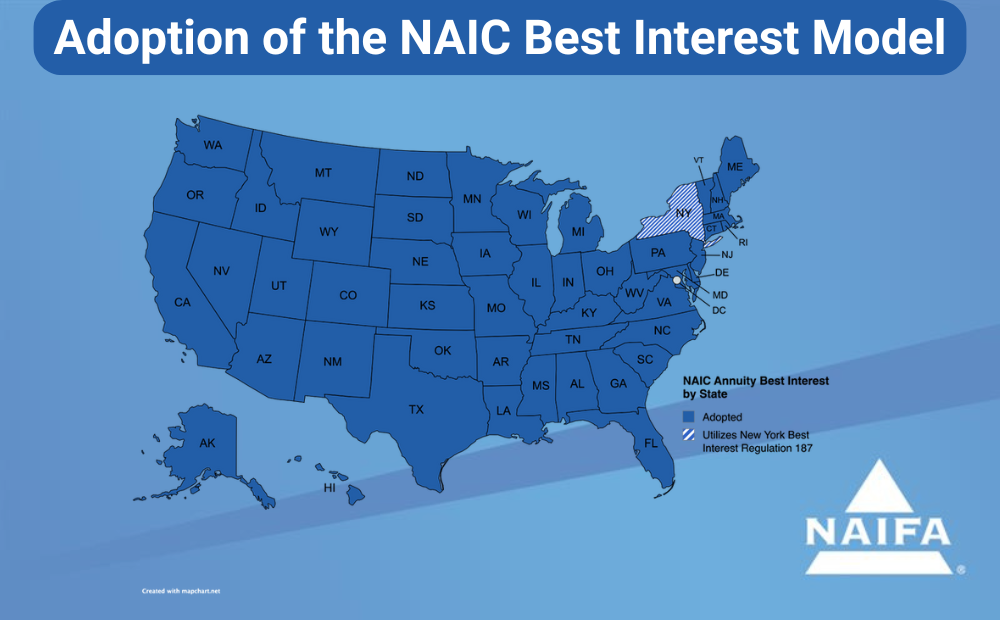

NAIFA Supports Updated NAIC Annuity Best Interest Guidance and Suggests Additional Improvements

By NAIFA on 9/25/25 1:27 PM

The National Association of Insurance Commissioners (NAIC) has updated its draft of the Annuity Best Interest Regulatory Guidance and Considerations to reflect suggestions made by NAIFA and coalition partners. In a new letter to the NAIC, which NAIFA signed, the groups state their support for the updated guidance and suggest additional edits to to the draft.

Topics: Press Release NAIC Model Regulation Annuity Best Interest NAIC

1 min read

Financial professionals protect seniors amid Medicare’s growing complexity

By Kevin Mayeux on 9/23/25 4:09 PM

NAIFA CEO Kevin Mayeux, CAE, released the following statement in response to the Urban Institute report, “Challenges of Choice in Medicare: The Role of Agents and Brokers in a Public Program,” released today:

Topics: Medicare Press Release

1 min read

Save the Date: NAIFA’s 2026 Congressional Conference

By NAIFA on 9/18/25 11:57 AM

Mark your calendar for May 18–19, 2026, when NAIFA members will gather in Washington, D.C., for a highly impactful grassroots advocacy event for financial professionals: the Congressional Conference. This signature event is central to NAIFA’s mission, uniting members from across the country to advocate for their businesses, clients, and the insurance and financial services industry.

Topics: Advocacy Press Release

4 min read

NAIFA Members Wrap Up Successful Summer of In-District Advocacy Across the States

By NAIFA on 9/16/25 9:26 AM

NAIFA members across the country during August and early September met face-to-face with lawmakers in their home districts to ensure the voices of Main Street Americans are represented in critical policy conversations. These in-district visits are a cornerstone of NAIFA’s grassroots advocacy, strengthening relationships with legislators while highlighting the essential role financial professionals play in helping families and businesses achieve financial security.

Topics: Advocacy Press Release

1 min read

NAIFA Looks to Work With DOL on Classification of Financial Services Independent Contractors

By NAIFA on 9/9/25 4:06 PM

NAIFA CEO Kevin Mayeux, CAE, issued the following statement on the Department of Labor’s announcement that it will rescind the federal rule on independent contractor classification:

Topics: Press Release DOL Insurance & Financial Advisor Regulation

2 min read

New HHS Guidance Expands Consumer Access to Catastrophic Health Plans

By NAIFA on 9/4/25 10:55 AM

New guidance from the U.S. Department of Health and Human Services (HHS) will expand consumer access to affordable catastrophic healthcare policies. NAIFA has long advocated for access to affordable catastrophic health plan options.

.png)

.jpg)

.png)