The National Association of Insurance Commissioners (NAIC) has updated its draft of the Annuity Best Interest Regulatory Guidance and Considerations to reflect suggestions made by NAIFA and coalition partners. In a new letter to the NAIC, which NAIFA signed, the groups state their support for the updated guidance and suggest additional edits to to the draft.

The suggested edits would add clarity about insurers' obligations under the NAIC's model regulation, align the guidance document with language used in the model, and improve the guidance document's readability. They would improve the draft document by ensuring that its guidance is accurate and more easily understood. NAIFA strongly supports the draft guidance and, as state in the letter to the NAIC, believes it "will be extremely helpful for regulators, companies, and ultimately consumers."

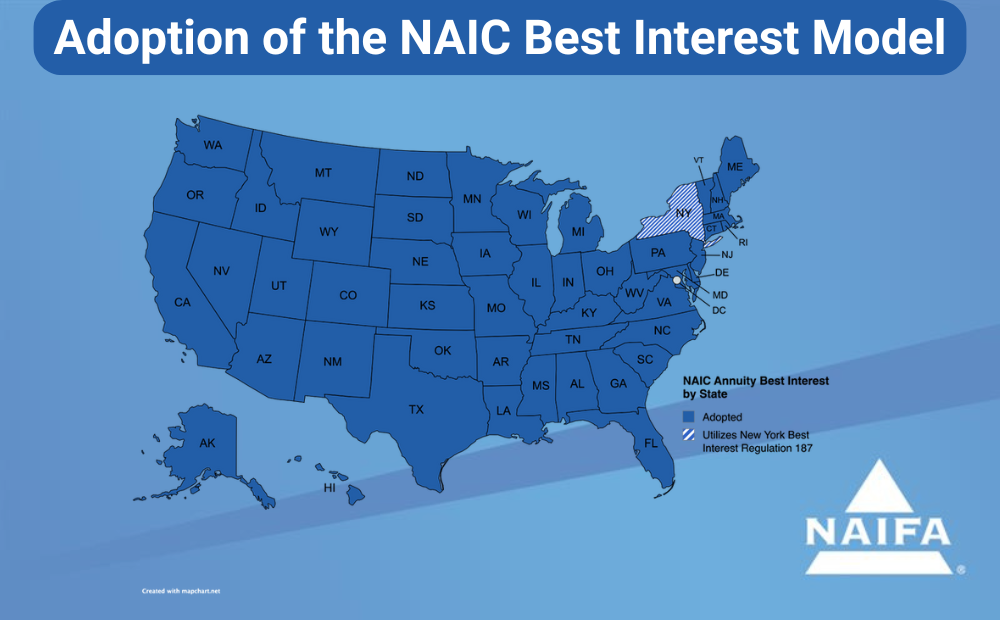

Forty-nine states have adopted the NAIC model (New York has a separate best-interest standard for annuity transactions) and NAIFA's state chapters have been at the forefront of advocacy efforts urging its acceptance. NAIFA works with organizations like the NAIC to ensure that model regulations protect the availability and accessibility of financial products and services and serve the best interests of consumers. NAIFA will continue to work with the NAIC as it finalizes the Annuity Best Interest Regulatory Guidance document.