Republican Senators are growing increasingly reluctant to vote any time soon on the House-passed bill that would, among other things, allow for more generous business equipment depreciation and business loan interest deductibility. The bill would need 60 votes, and therefore at least ten Republicans, to pass the Senate. However, some key GOP Senators are demanding changes, while others urge waiting until next year when they think they will be in a stronger position.

The ranking member of the Finance Committee, Sen. Mike Crapo (R-ID), is demanding changes before he withdraws his opposition to a vote on the bill. He says those changes are necessary to win the support of a majority of his GOP colleagues. Senate Republican Leader Sen. Mitch McConnell (R-KY) is urging the Senate GOP Caucus to unify in support of Sen. Crapo. So, too, are the two leading candidates for the job of Republican Leader after Sen. McConnell steps down at year-end. These two, Sens. John Cornyn (R-TX) and John Thune (R-SD), are both members of the tax-writing Senate Finance Committee. The three have considerable influence with most Republican Senators.

On April 9, Sen. Josh Hawley (R-MO) floated a potential deal that, if accepted, could result in a Senate vote on the tax bill. Sen. Hawley is proposing attaching a bill to reauthorize a radiation compensation program. That bill has already passed the Senate with 69 votes. Sen. Hawley says he is talking to his GOP colleagues to determine whether this deal will garner the necessary 60+ votes to pass it.

The bill is being heavily lobbied by supporters from the business community as well as by family advocates, who badly want the bill’s expanded child tax credit. But so far, that lobbying, intense though it is and by interests who are usually very influential with lawmakers, has not moved Senate Republicans to agree to a quick vote on the bill unless they get a chance to amend it.

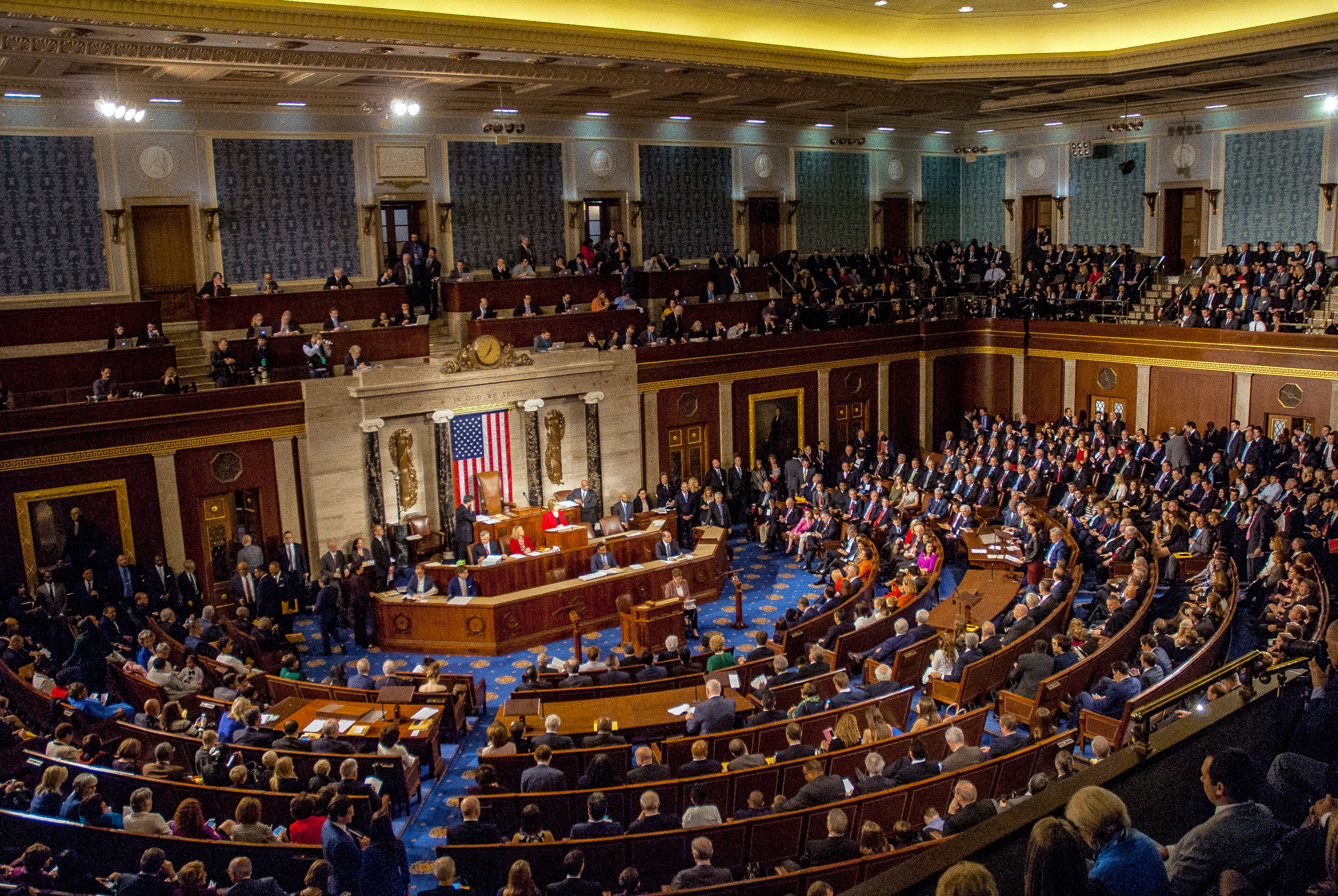

The House of Representatives passed the tax bill, H.R.7024, on January 31 by an overwhelmingly bipartisan 357 to 70 vote. But Congress’ preoccupation with the need to fund the federal government’s discretionary spending slowed progress on the bill in the Senate, where it had won some early public support from both Republicans and Democrats. In the two months since Republican opposition has hardened. It is now looking less likely that the Senate will vote on the bill any time soon, and maybe not even at all this year.

Prospects: Senate Majority Leader Sen. Chuck Schumer (D-NY) is currently deciding whether to bring the tax bill to the floor for a vote despite Republican objections. He said on April 9 that there are not currently 60 votes to pass the bill and so he cannot bring it to the floor. Right now, it looks more likely than not—unless the Sen. Hawley proposal turns out to be acceptable—that the provisions of H.R.7024 will be debated in the context of next year’s major tax bill rather than this year when passage could give Democrats a win—something Republicans are loath to do this close to the November elections.

NAIFA Staff Contact: Jayne Fitzgerald – Director – Government Relations, at jfitzgerald@naifa.org.

.png?width=600&height=90&name=Support%20IFAPAC%20%20(600%20%C3%97%2090%20px).png)