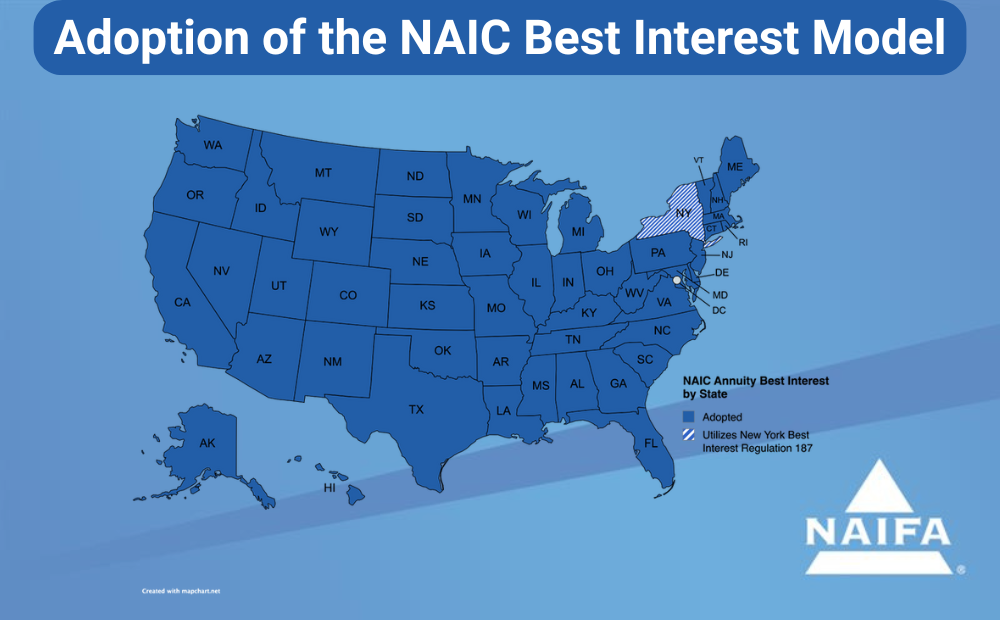

UPDATE: New Hampshire, Oklahoma, North Dakota, Montana, North Carolina, Mississippi, South Carolina and Colorado join Idaho and Delaware in addressing unfair trade practices.

In a powerful display of grassroots advocacy, hundreds of NAIFA members representing all 50 states have written to their state insurance commissioners urging immediate action against unfair trade practices harming Medicare beneficiaries and the licensed professionals who serve them. These letters, sent following NAIFA’s nationwide regulatory alert, underscore the profession’s determination to protect seniors during a particularly challenging enrollment period.

.png)

.jpg)

.png)