NAIFA has joined a coalition of professional associations urging Tennessee policymakers to phase out and ultimately repeal the state’s Professional Privilege Tax (PPT). In a joint letter sent to Governor Bill Lee, the coalition called on state leaders to prioritize a phase-out of this outdated tax in the FY 2026–2027 budget, emphasizing that Tennessee should not fund government through a tax on the “privilege” of working. The PPT currently imposes a $400 annual tax on certain licensed professionals, including financial advisors, despite their significant contributions to the state’s economy .

NAIFA

Recent posts by NAIFA

1 min read

NAIFA Joins Coalition Urging Phase-Out and Repeal of Tennessee’s Professional Privilege Tax

By NAIFA on 12/19/25 3:24 PM

Topics: Advocacy Press Release

1 min read

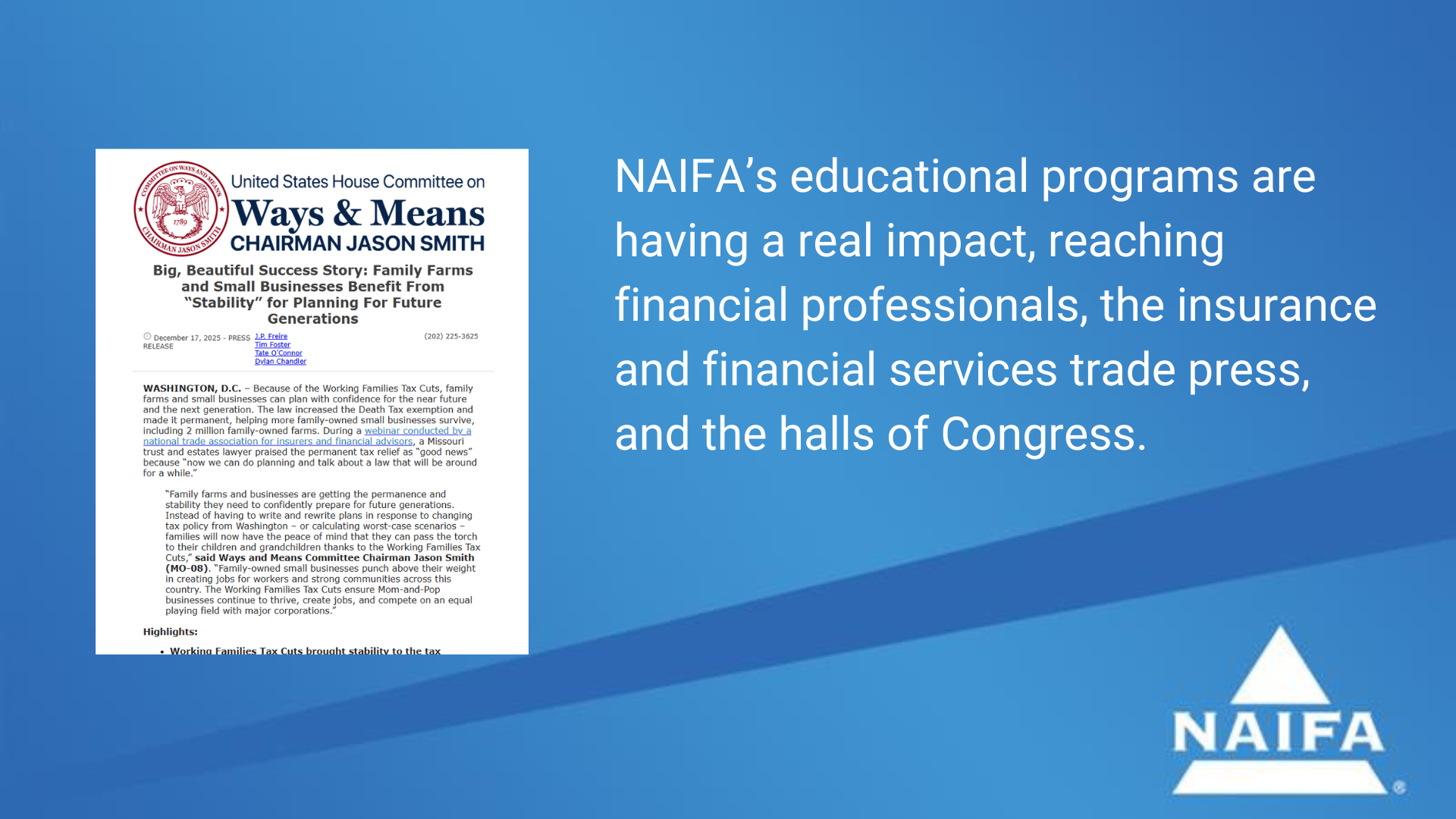

Ways & Means Spotlights NAIFA Webinar in Tax Law Press Release

By NAIFA on 12/19/25 9:45 AM

The House Ways & Means Committee issued a press release on tax reform measures for small businesses that highlights the recent NAIFA webinar, “The One Big Beautiful Bill: Several Big Beautiful(?) Tax Law Changes,” featuring Robert Kirkland, founding member of Kirkland Hochstetler law firm. The tax and spending bill known as the One Big Beautiful Bill (OBBB)” passed earlier this year stabilizes estate tax laws making legacy planning less challenging, Kirkland explained. InsuranceNewsNet magazine’s Advisor News also reported on the NAIFA webinar.

Topics: Estate Planning Webinar Press Release Congress Tax Reform

3 min read

The NAIFA-Supported INVEST Act Passes the House

By NAIFA on 12/11/25 3:30 PM

The bipartisan INVEST Act has passed the House of Representatives in a 302-123 vote. NAIFA supports the legislation to expand retirement-planning options for teachers, employees of nonprofit organizations, and others.

"NAIFA is pleased to see the House take bipartisan action to bolster the ability of more Americans to better prepare for retirement," said NAIFA CEO Kevin Mayeux, CAE. "The INVEST Act would give teachers, hospital workers, nonprofit employees, and others who have 403(b) plans access to expanded investment options, including annuity-linked products that provide guaranteed lifetime income. It would also take steps toward addressing elder financial exploitation and would remove unfair impediments that prevent expert investors who don't meet net-worth thresholds from taking advantage of some sophisticated investments."

Four sections of the bill are particularly noteworthy to financial professionals and their clients.

Topics: Retirement Planning Press Release Supported Legislation

1 min read

NAIFA's Gandy Featured at NAIC Fall Meeting

By NAIFA on 12/10/25 2:07 PM

NAIFA President-Elect Christopher Gandy spoke before the Senior Issues (B) Task Force during the National Association of Insurance Commissioners’ 2025 Fall National Meeting in Hollywood, Fla. Gandy discussed hybrid life insurance policies with long-term care, extended care, and critical care riders, providing his perspective as an agent to the Task Force. Gandy provided insight on what he’s seeing in the market and offered suggestions to regulators to ensure the products remain accessible and easily understandable to consumers.

Topics: Interstate Advocacy Press Release NAIC

1 min read

NAIFA Supports Bill That Would Offer Retirement Plan Rollover Clarity and Annuity Options

By NAIFA on 12/4/25 11:49 AM

NAIFA supports the bipartisan Retirement Simplification and Clarity Act reintroduced by Reps. Jimmy Panetta (D-Calif.) and Darin LaHood (R-Ill.), which would require the IRS to rewrite documentation that employers must provide exiting employees who request distributions from their 401(k) plans. The new notice would use “clear, straightforward language” to explain various options for 401(k) distributions and rollovers along with their tax implications. The bill would also allow people aged 50 and over to roll over employer-sponsored 401(k) accounts into annuities.

Topics: Press Release Retirement Plans Supported Legislation

1 min read

NAIFA-Supported Bill Would Expand Retirement Planning Options for Teachers and Employees of Non-Profits

By NAIFA on 12/3/25 4:16 PM

NAIFA CEO Kevin Mayeux, CAE, issued the following statement on the bipartisan INVEST Act:

Topics: Retirement Planning Press Release Supported Legislation

2 min read

NAIFA Celebrates Advocacy Win in Court Decision on Fiduciary-Only Rule

By NAIFA on 12/3/25 3:42 PM

The Department of Labor’s fiduciary-only rule will not go into effect. NAIFA has strongly opposed the misguided regulation, which would have restricted consumer choice and access to retirement advice. NAIFA was similarly instrumental in defeating an earlier version of the rule in 2016.

Topics: Legislation & Regulations Press Release DOL Fiduciary

2 min read

More states join calls for action on unfair trade practices in Medicare market

By NAIFA on 11/23/25 6:33 PM

Across the country, licensed financial professionals are stepping up on behalf of the seniors they serve and their efforts are making a difference. Following the regulatory alert issued by NAIFA, hundreds of advisors from all 50 states reached out to their state insurance regulators demanding action to curb carriers’ practices that undermine consumer choice and steer vulnerable Medicare beneficiaries into restricted or biased product lines.

Topics: Medicare Press Release

2 min read

NAIFA’s Medicare Collective Stresses the Value of Agents in CMS Meeting

By NAIFA on 11/13/25 3:17 PM

Representatives of NAIFA’s Medicare Collective, an initiative of the Lifetime Healthcare Center, met with officials from the Centers for Medicare and Medicaid Services (CMS) to discuss the role of brokers and agents in providing vital guidance, services, and protections to consumers in the Medicare space. They presented the Collective’s plan to work with CMS and insurance carriers to ensure Medicare beneficiaries receive the best possible coverage and care in these challenging times. They also addressed rising concerns that the failure to adequately compensate agents for their work would harm consumers by leaving them vulnerable to misinformation or without competent, personalized assistance as they navigate complex coverage options, plans, and regulations.

Topics: Medicare Press Release Medicare Part D

2 min read

NAIFA Members Drive National Momentum to Protect Medicare Beneficiaries

By NAIFA on 11/3/25 4:12 PM

UPDATE: New Hampshire, Oklahoma, North Dakota, Montana, North Carolina, Mississippi, South Carolina and Colorado join Idaho and Delaware in addressing unfair trade practices.

In a powerful display of grassroots advocacy, hundreds of NAIFA members representing all 50 states have written to their state insurance commissioners urging immediate action against unfair trade practices harming Medicare beneficiaries and the licensed professionals who serve them. These letters, sent following NAIFA’s nationwide regulatory alert, underscore the profession’s determination to protect seniors during a particularly challenging enrollment period.

%20(1).png)

.png)