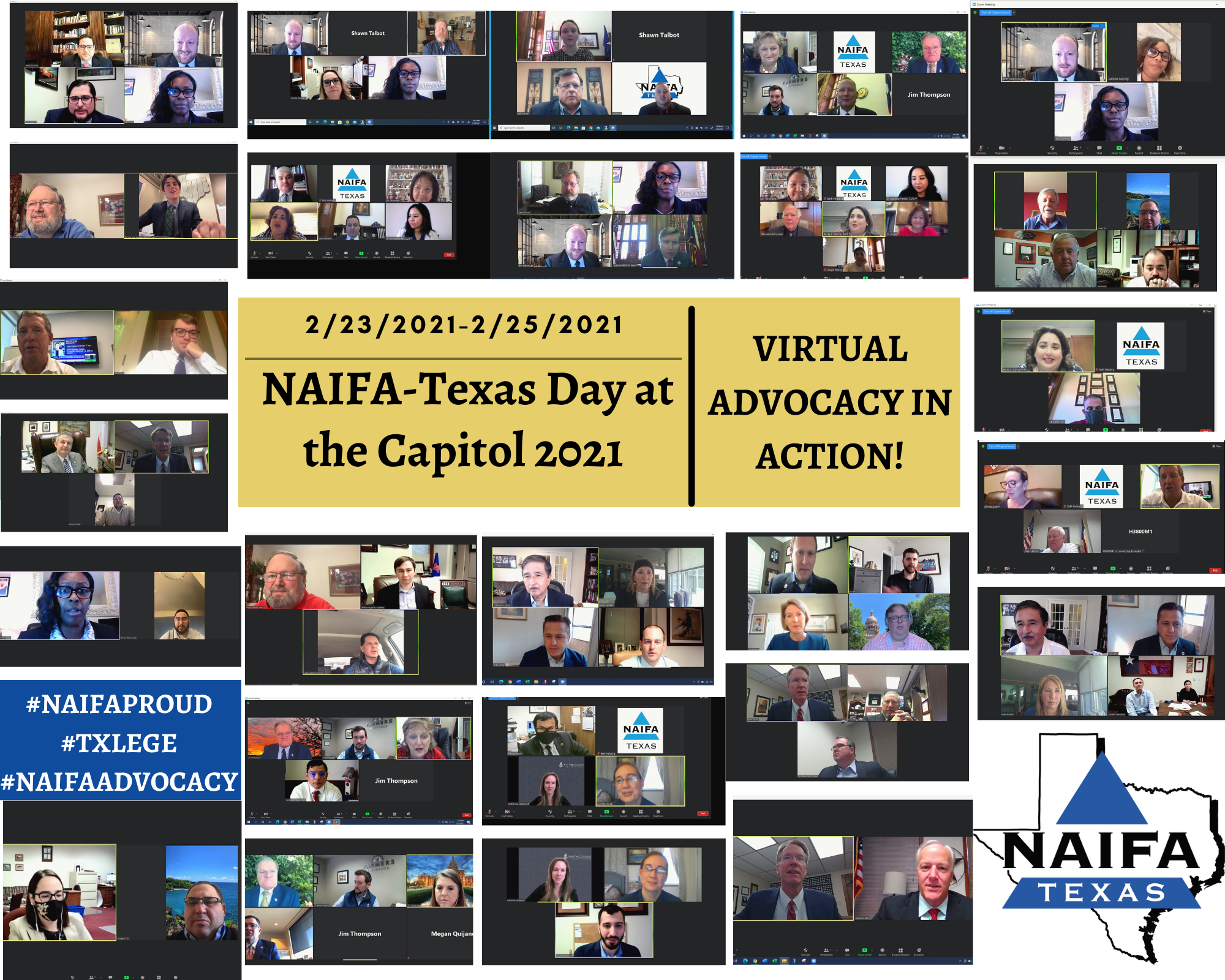

NAIFA’s Texas chapter (NAIFA-TX) held a successful legislative event last week, with several dozen participants. The annual Day at the Capitol was planned as a hybrid event, with both in-person and virtual attendees. However, the lingering effects of recent winter storms required NAIFA-TX to quickly shift to an all-virtual event.

NAIFA

Recent posts by NAIFA

1 min read

NAIFA-TX Holds Successful Virtual Day at the Capitol Advocacy Event

By NAIFA on 3/3/21 5:02 PM

Topics: State Advocacy Grassroots Legislative Day Texas

1 min read

NAIFA-Wisconsin to Hold Virtual Day on the Hill Political Advocacy Programs

By NAIFA on 3/3/21 4:13 PM

The Wisconsin chapter of the National Association of Insurance and Financial Advisors (NAIFA-WI) will present its annual Day on the Hill advocacy programming March 8 and 10. The virtual event will highlight the importance of political advocacy for insurance financial advisors. Decisions by state lawmakers and regulators have tremendous impacts on the businesses of NAIFA members as well as the Main Street consumers and small businesses they serve.

Topics: State Advocacy Wisconsin Grassroots Legislative Day

1 min read

NAIFA-FL Holds a Virtual Legislative Day

By NAIFA on 2/24/21 9:33 AM

NAIFA-Florida’s Virtual Legislative Day on the Hill was February 23. Approximately 80 participants joined the event and received legislative and regulatory updates as well as advocacy training from NAIFA-FL President Craig Duncan and state lobbyist Tim Meenan of Meenan P.A. Other speakers included Florida Insurance Commissioner David Altmaier.

Topics: Legislation & Regulations State Advocacy Grassroots Florida

2 min read

The White House Issues Guidance on the Latest Round of PPP Funding

By NAIFA on 2/22/21 10:31 AM

The White House has released a fact sheet clarifying some aspects of the latest round of Paycheck Protection Program (PPP) funding that opened a month ago. The PPP provides loans to small businesses, including NAIFA members and their clients, impacted by the COVID-19 pandemic. The low-interest loans may be forgiven if the businesses that receive them meet certain conditions.

Topics: COVID-19 Federal Advocacy

1 min read

DOL Confirms PTE on Retirement Advice Will Go Into Effect Feb. 15

By NAIFA on 2/12/21 4:50 PM

The Biden Administration has confirmed that the Department of Labor (DOL) will move forward with a prohibited transaction exemption (PTE) for financial professionals who provide retirement plan advice. DOL previously announced the new PTE on December 15 during the Trump Administration. It goes into effect February 15.

Topics: Standard of Care & Consumer Protection Federal Advocacy DOL Insurance & Financial Advisor Regulation

1 min read

NAIFA-WA Urges LTC Bill Changes to Protect Employees With Private Coverage

By NAIFA on 2/12/21 2:45 PM

NAIFA-WA is urging changes to a long-term services bill, HB 1323, to protect employees who have purchased long-term care coverage.

Topics: Long-Term Care State Advocacy Washington

1 min read

NAIFA-Idaho Testifies at Hearing on Annuity Best Interest Legislation

By NAIFA on 2/11/21 6:14 PM

NAIFA-Idaho member EmmaLee Robinson testified before a hearing of the Idaho Legislature on the Annuity Consumer Protections Act (HB 79) and encouraged lawmakers to adopt legislation based on the National Association of Insurance Commissioners’ updated Suitability in Annuity Transactions Model. The NAIC model requires financial professionals to work in the best interests of consumers on annuity transactions.

Topics: State Advocacy Standard of Care & Consumer Protection Grassroots Annuity Best Interest Idaho Insurance & Financial Advisor Regulation

1 min read

Ohio Finalizes Annuities Best Interest Rule Based on the NAIC Model

By NAIFA on 2/10/21 5:05 PM

The Ohio Department of Insurance has finalized a rule based on the National Association of Insurance Commissioners’ updated Suitability in Annuity Transactions Model that requires financial professionals to work in the best interests of consumers on annuity transactions. The new rule goes into effect in Ohio on Feb. 14.

Topics: State Advocacy Standard of Care & Consumer Protection Grassroots Annuity Best Interest Insurance & Financial Advisor Regulation Ohio

2 min read

NAIFA Urges Oklahoma Senate to Reject State-run Retirement Plan

By NAIFA on 2/9/21 3:15 PM

NAIFA strongly supports efforts to encourage and incentivize workers’ participation in employer-provided retirement plans available on the private market. Private-sector plans offered by employers provide many design features that help workers plan for secure retirements. A qualified financial professional, such as a NAIFA member, can help workers with individual retirement-planning solutions and assist employers in establishing workplace plans.

Topics: Retirement Planning State-Facilitated Retirement Plans State Advocacy Grassroots Oklahoma

1 min read

Delaware Joins the Growing List of States Adopting the NAIC Annuity Model

By NAIFA on 2/8/21 3:34 PM

The Delaware Department of Insurance has published a final regulation based on the National Association of Insurance Commissioners’ updated Suitability in Annuity Transactions Model that requires financial professionals to work in the best interests of consumers on annuity transactions.