California has not at this time established a publicly funded state-run long-term care insurance program or set deadlines for employees in the state to opt out. The state established a Task Force to study the possibility of such a program and make recommendations, and that study is ongoing. The California Department of Insurance has issued a revised Frequently Asked Questions Document to clear up some common misconceptions. Among topics covered by the FAQ are:

1 min read

California Insurance Department FAQ Aims to Clear Up Confusion About LTCi Program Study

By NAIFA on 8/18/23 3:03 PM

Topics: Long-Term Care Insurance State Advocacy Limited & Extended Care Planning Center California

1 min read

Happy Birthday to IFAPAC

By NAIFA on 8/18/23 8:54 AM

On August 18, 1966, NAIFA formed the Insurance and Financial Advisors Political Action Committee (IFAPAC) as a nonprofit, nonpartisan organization. Then known as LUPAC, it was created "to engage in voter registration and get-out-the-vote campaigns, compile voting records of individual members of Congress, and implement nonpartisan courses designed to stimulate citizen involvement in politics," according to NAIFA's magazine at the time. The PAC also solicited "contributions to aid selected Congressional candidates," the publication said.

Topics: State Advocacy Federal Advocacy IFAPAC

2 min read

Oklahoma Becomes 40th State to Adopt Enhanced Protections for Annuity Consumers

By NAIFA & ACLI on 8/16/23 10:37 AM

American Council of Life Insurers (ACLI) President and CEO Susan Neely and NAIFA-Oklahoma President Whitney Jessee issued the following joint statement on the best interest annuity rule adopted recently by the Oklahoma Insurance Department:

Topics: Press Release NAIC Model Regulation Annuity Best Interest Oklahoma

1 min read

Take Me Out to the Advocacy Opportunity

By NAIFA on 8/11/23 3:54 PM

When we think of the In-District Meetings NAIFA promotes each August, we usually think of get-togethers at district offices with federal lawmakers or their staff. But really, they can take all shapes and forms.

Topics: State Advocacy Financial Literacy

2 min read

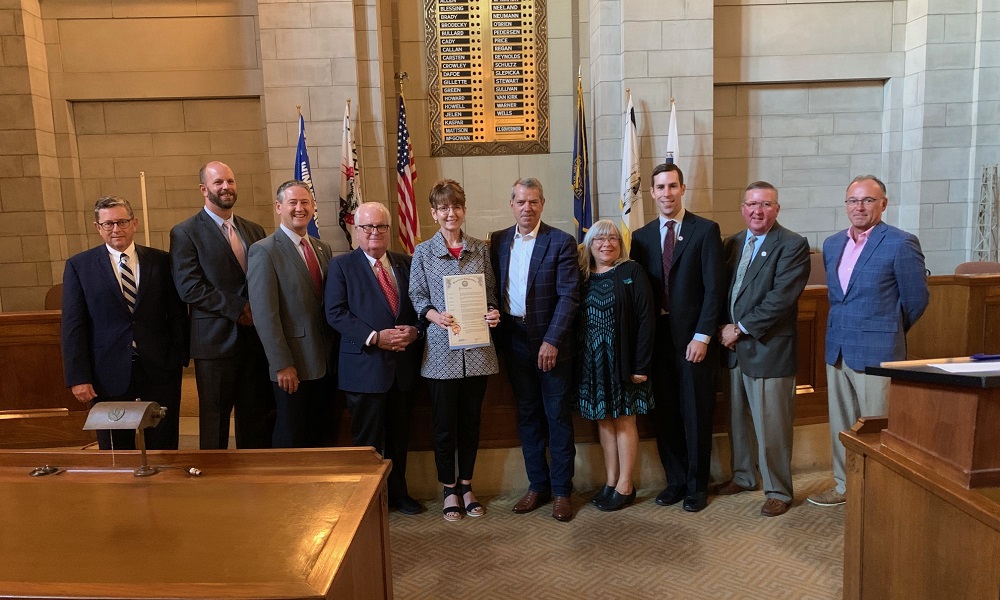

NAIFA-NE Promotes Life Insurance Awareness With Governor Pillen

By NAIFA on 8/8/23 9:07 AM

NAIFA's Nebraska chapter has been a strong advocate for the life insurance industry, working with state officials to proclaim September Life Insurance Awareness Month (LIAM) in the state. Their efforts were successful and several members of the association were on hand at the ceremony when Governor Jim Pillen issued the proclamation.

Topics: Life Insurance & Annuities Life Insurance Awareness Month State Advocacy Nebraska

3 min read

NAIFA-Utah Members Make a Lasting Impression with Members of Congress

By Mark Anderson on 8/4/23 2:59 PM

“I alone cannot change the world, but I can cast a stone across the waters to create many ripples.”

- Mother Teresa.

On August 3rd, NAIFA-Utah held its annual Legislative Engagement Day in Salt Lake. The fact that we were able to count on all four of our U.S. Congressional representatives to participate made for a successful and informative meeting. Dori Phillips, our NAIFA-Utah VP of Advocacy and our Grassroots Chair representative, did a superb job of coordinating schedules so that each could address us. While their broad message focused on the state of the nation, each had a unique approach and shared stories of their own path and experience in working with financial professionals.

Topics: Federal Advocacy Grassroots Utah

2 min read

NAIFA Members’ Powerful Grassroots Message for Financial Security Hits Home

By NAIFA on 8/1/23 1:50 PM

Congress has begun its August recess, and members of the National Association of Insurance and Financial Advisors (NAIFA) are capitalizing on lawmakers’ annual working session in their home districts by meeting with their Representatives and Senators to strengthen grassroots relationships and discuss issues important to financial professionals and their clients.

Topics: Press Release Grassroots Congress

2 min read

NCOIL Adopts NAIFA-Backed Resolution Opposing Potential Fiduciary Rulemaking by the DOL

By NAIFA Government Relations Team on 7/21/23 5:49 PM

This afternoon, the National Conference of Insurance Legislators (NCOIL) adopted a NAIFA-backed resolution that opposes potential fiduciary rulemaking by the Department of Labor (DOL).

Topics: NAIC Model Regulation DOL NCOIL Regulation Best Interest Fiduciary

1 min read

NAIFA Supports the Main Street Tax Certainty Act

By NAIFA on 7/19/23 4:37 PM

NAIFA recently signed onto a letter supporting Congressman Lloyd Smucker's (R-PA, 11th District) newly introduced bill that would make the Section 199A deduction permanent. The bill had over 80 co-sponsors from both aisles and received unanimous support from the 25 Republicans on the Ways & Means Committee. The bill is similar to S.1706 introduced by Senator Steve Daines (R-MT) making the support for minimizing tax hikes bipartisan and bicameral.

Topics: Legislation & Regulations Small Business Supported Legislation

3 min read

Biden Administration Published Proposed Rule to Roll Back Short-Term Health Insurance Plans

By Michael Hedge, NAIFA's Director of Government Relations on 7/10/23 10:28 AM

On July 7, the Biden Administration published a proposed rule to roll back President Trump’s expansion of short-term health insurance plans. The Office of Management & Budget previously announced its approval of the proposed rule on “short‐term limited duration insurance” health plans (STLDI).

.png)

.png)