On March 26, NAIFA joined industry partners in a letter to Congressional leadership urging support for the inclusion of the Securing and Enabling Commerce Using Remote and Electronic Notarization Act (SECURE Notarization Act), in the legislative package from Congress intended to address the economic fallout from COVID-19. The bipartisan legislation (S. 5355, H.R. 6364) was introduced by Sens. Cramer (R-ND) and Warner (D-VA), and Reps. Reschenthaler (R-PA) and Dean (D-PA).

1 min read

NAIFA and Industry Partners Urge Congress to Support SECURE Notarization Act

By NAIFA Government Relations Team on 3/27/20 2:41 PM

Topics: Federal Advocacy Congress Insurance & Financial Advisor Regulation Supported Legislation Remote Notarization Producer Sales & Marketing

1 min read

Financial Services Committee Explores Creation of Federal Backstop Program for Pandemic Insurance

By NAIFA on 3/24/20 7:45 AM

House Financial Services Committee Chairwoman Maxine Waters (D-CA) is considering potential legislation which would create a Pandemic Risk Insurance Program similar to that of the program created by the Terrorism Risk Insurance Act (TRIA). Chairwoman Waters’s proposal would be to create a temporary program that would provide a federal backstop for pandemic risk. This model would be very similar to the federal backstop that exists for terrorism risk through TRIA, but would deal with the Coronavirus pandemic instead.

Topics: COVID-19 Congress

2 min read

Lawmakers Respond Positively to NAIFA's COVID-19 Constituent Help

By NAIFA on 3/20/20 4:59 PM

The National Association of Insurance and Financial Advisors (NAIFA) has a long history of working with lawmakers on the state and federal levels. Recent outreach to Congressional offices, state insurance commissioners, and state legislators offering assistance to lawmakers with constituents’ financial concerns has resulted in sincere appreciation.

Topics: COVID-19 Federal Advocacy Congress

2 min read

NAIFA Urges Congress to Help Employers and Workers Cope With COVID-19 Impacts

By NAIFA on 3/20/20 10:26 AM

The COVID-19 outbreak is disrupting the lives of families and the operations of businesses across the country. The impact on the economy and financial implications for Americans will certainly be substantial. At times like this, NAIFA’s advocacy influence and role as the voice of insurance and financial professionals is more important than ever. We are working on behalf of our members, the entire agent-advisor community, and Main Street USA consumers to help Congress find ways to lessen the impact of the outbreak.

Topics: COVID-19 Federal Advocacy Congress

1 min read

NAIFA Works with Congress on COVID-19 Policies to Protect Main Street USA

By NAIFA Government Relations Team on 3/19/20 9:26 AM

While the volatile stock market remains a concern, there is a recognition that the most acute impact of COVID-19 is being felt on Main Streets around the country. NAIFA continues our work with lawmakers on crisis-related proposals to ensure the interests of NAIFA members and their Main Street clients are considered. Lawmakers are moving quickly on policies to address the coronavirus pandemic. Congress has enacted two legislative packages, and a third legislative response is underway (also see State Capitols Respond to COVID-19).

Topics: COVID-19 Federal Advocacy Congress

1 min read

State Capitols respond to COVID-19

By NAIFA Government Relations Team on 3/17/20 4:30 PM

In light of the recent coronavirus (COVID-19) outbreak during the peak of states' legislative sessions, some state capitols have made the difficult decision to shutdown and many others are considering following suit. As a result of these closures, and because legislatures will most likely be prioritizing health and economic issues resulting from COVID-19 upon reconvening, many bills important to NAIFA members are likely to fall by the wayside.

Topics: State Advocacy COVID-19 Congress

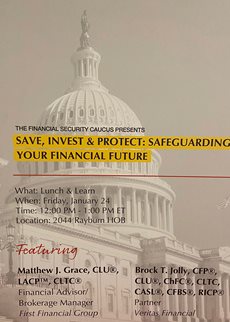

NAIFA Leaders Present Educational Session For Congressional Financial Security Caucus

By NAIFA on 1/24/20 10:21 AM

NAIFA Treasurer Brock Jolly and NAIFA-Greater Washington Advocacy Chair Matthew Grace are featured speakers at a lunch and learn to members of Congress and staff entitled: “Save, Invest & Protect: Safeguarding Your Financial Future.”

Topics: Retirement Planning Member Spotlight Congress

1 min read

Klobuchar Raises Americans' Need For LTCI In Debate

By NAIFA on 1/16/20 2:33 PM

Topics: Long-Term Care Federal Advocacy Congress Promoting Financial Security

2 min read

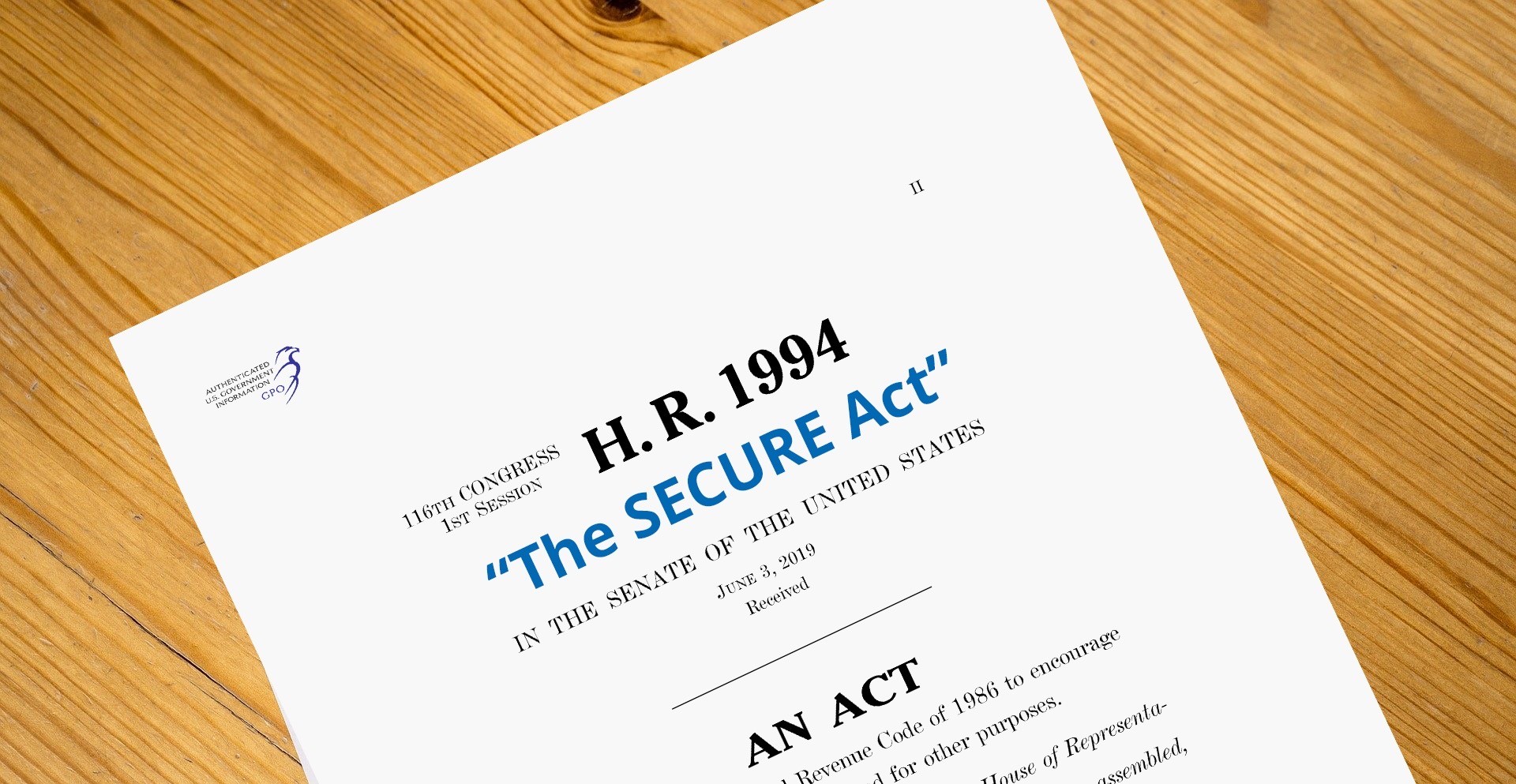

Congress Enacts The SECURE Act As Part Of Year-End Spending Bill

By NAIFA Government Relations Team on 12/19/19 1:54 PM

The U.S. Senate today passed the Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019 as part of the fiscal 2020 spending bill, which the House passed on Tuesday. The SECURE Act will make it easier for small businesses to offer employee retirement plans. It will also give retirement savers greater flexibility to participate in plans and choose investment options and will encourage adequate savings amounts. The American Council of Life Insurers (ACLI) estimates that SECURE will result in 700,000 additional American workers saving for retirement.