Bradford Campbell, a partner with the law firm Faegre, Drinker, Biddle & Reath, testified today on behalf of NAIFA and several other industry organizations at the U.S. Department of Labor’s Administrative Hearing on the Proposed Class Exemption Regulation “Improving Investment Advice for Workers & Retirees.”

1 min read

Industry Groups Testify at Hearing on DOL Proposal

By NAIFA on 9/3/20 6:11 PM

Topics: Standard of Care & Consumer Protection Federal Advocacy DOL Fiduciary

3 min read

NAIFA Webinar: COVID-19 Executive Actions in August

By NAIFA on 8/28/20 10:39 AM

Topics: COVID-19 Federal Advocacy White House

1 min read

New DOL Rule Provides Important Guidance on How to Illustrate Monthly Lifetime Income

By NAIFA on 8/19/20 4:44 PM

The Department of Labor’s (DOL’s) Employee Benefits Security Administration (EBSA) issued an interim final rule providing the important information employers need to comply with the new requirement that they give retirement plan participants annual illustrations of the monthly lifetime income they would receive from their retirement plan account balances.

Topics: Federal Advocacy DOL Insurance & Financial Advisor Regulation Producer Sales & Marketing

1 min read

The SEC’s CAT Database Brings Data Security Concerns

By NAIFA on 8/13/20 1:28 PM

The Securities and Exchange Commission (SEC) in June began requiring broker-dealers to submit detailed information on securities trades to the SEC’s Consolidated Audit Trail (CAT) database. A similar requirement for options trades went into effect in July. The purpose of the CAT is to allow SEC regulators to identify and analyze irregularities and threats to the securities markets.

Topics: SEC Federal Advocacy Privacy Data Security

1 min read

Federal LTC Task Force Includes NAIFA Recommendations in Report

By NAIFA on 8/11/20 12:02 PM

The U.S. Treasury Department has released a report from the Federal Interagency Task Force on Long-Term Care Insurance recommending government actions to foster innovation in long-term care (LTC) product design, improve the efficiency and relevance of LTC product regulation and promote financial literacy on LTC matters.

Topics: Long-Term Care Federal Advocacy

2 min read

NAIFA Sees DOL Proposal as a Step in the Right Direction, But Offers Improvements

By NAIFA on 8/11/20 10:29 AM

NAIFA President Cammie Scott submitted a comment letter on behalf of NAIFA that generally supports the Department of Labor’s proposed class exemption for investment advice fiduciaries under ERISA and the Internal Revenue Code and makes several suggestions to improve the proposal.

Topics: Standard of Care & Consumer Protection Federal Advocacy DOL Insurance & Financial Advisor Regulation Fiduciary

1 min read

ALI Survey Finds Growing Concern Among Workers Planning for Retirement

By NAIFA on 7/29/20 1:26 PM

A new survey by the Alliance for Lifetime Income (ALI) finds that 70% of older working Americans with at least $100,000 in assets are more pessimistic about their retirement plans because of the COVID-19 pandemic. One-in-five of these workers, or approximately 3.2 million Americans, now plans to retire later than they had anticipated. ALI notes that the number would likely be much higher had the survey also included older workers with less than $100,000 in assets.

Topics: Retirement Planning Federal Advocacy Advocacy Resources

5 min read

Pandemic, PPP and Policy

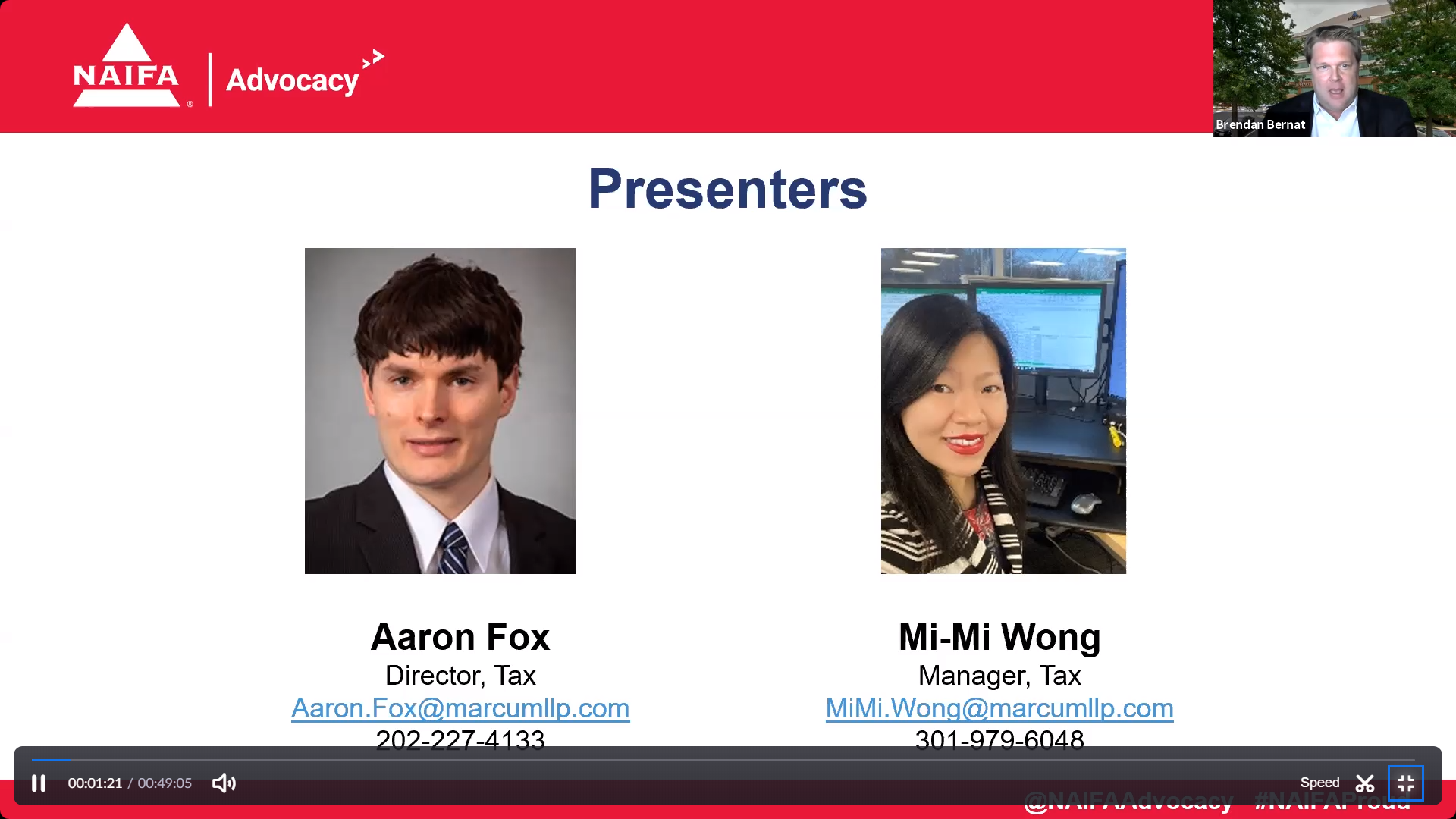

By NAIFA on 7/24/20 4:52 PM

This special NAIFA webinar provided Paycheck Protection Program updates and information on COVID-19 amendments to the Family Medica Leave Act that insurance and financial professionals need to know. NAIFA members may view the webinar on-demand. If you are not a NAIFA member, please join.

Topics: COVID-19 Federal Advocacy

1 min read

IRS Provides Flexibility on RMD Rollovers for 2020

By NAIFA on 7/24/20 4:43 PM

The CARES Act, signed into law in late March, waives the 2020 required minimum distribution (RMD) for IRAs and defined contribution plans, like 401(k)s and 403(b)s. This provides owners of these products flexibility and prevents them from having to draw down their plans while facing COVID-19-related market volatility.

Topics: Retirement Planning Federal Advocacy IRS

2 min read

Expert Panel to Provide New Insights on the Paycheck Protection Program to NAIFA Members

By NAIFA on 7/17/20 3:58 PM

The federal Paycheck Protection Program (PPP) has provided more than $517 billion in COVID-19 relief loans to nearly 5 million employers across the United States. Nearly 170,000 loans have gone to companies in the finance and insurance sector, while many more have gone to small businesses served by NAIFA members and other financial professionals. As of July 7, more than $130 billion remained in PPP funding, according to the Small Business Administration.